Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

In yesterday’s (May 19) regular Gold & Silver Trading Alert, I focused on the reversals that we saw across the precious metals market. During yesterday’s exceptionally interesting session, things got even more interesting – and “reversally” – but each of the main parts of the precious metals market was interesting and “reversally” in a different manner.

Each Reversal Goes Its Own Way

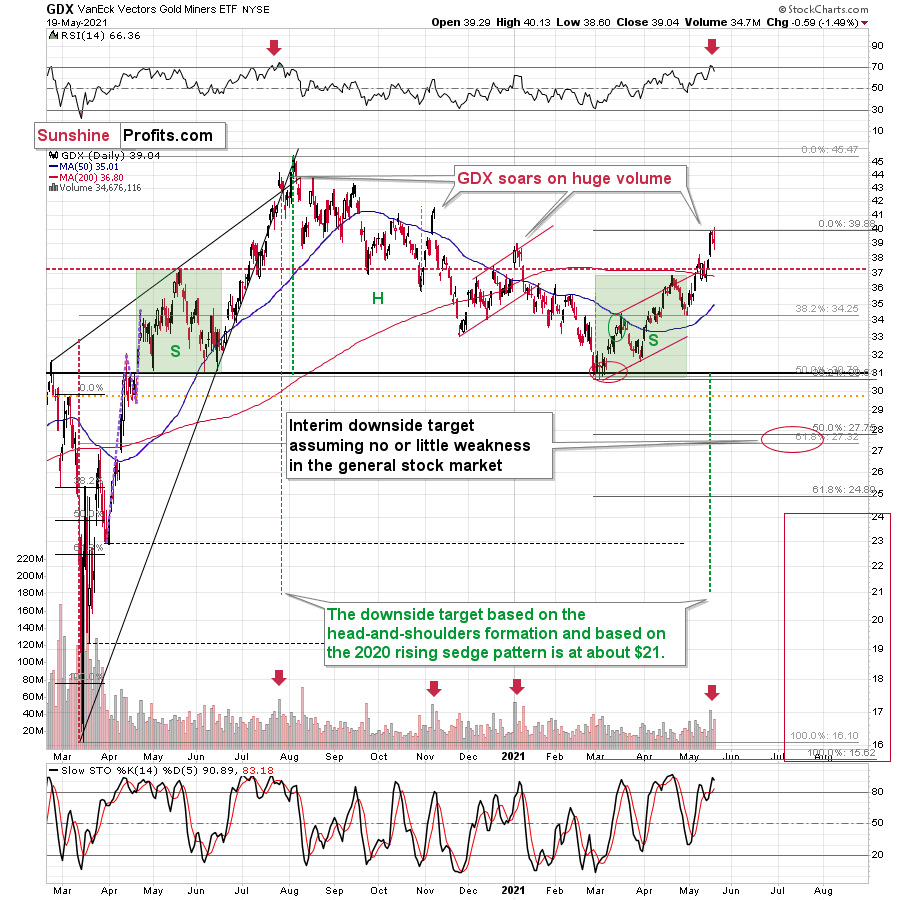

Gold miners reversed in a classically bearish way.

The GDX ETF first tried to rally to new highs, then it failed to hold them, and it ultimately ended the day 1.49% lower. This reversal took place on big volume, which makes it even more bearish.

Since this was the confirmation of the bearish indications that we saw previously: RSI above 70, rally on huge volume, the situation is now particularly bearish, not only in the medium term but also in the short term.

Silver reversed in a different manner.

The white metal didn’t move to new highs yesterday. Conversely, it moved sharply lower, and then it recovered only part of its intraday decline. The true reversal had happened a day earlier – on Tuesday – and what we saw yesterday was just its consequence. It’s quite often the case that the tops and bottoms in the precious metals market take place more or less (!) simultaneously, but not necessarily exactly on the same day. Consequently, what we saw this week is quite normal.

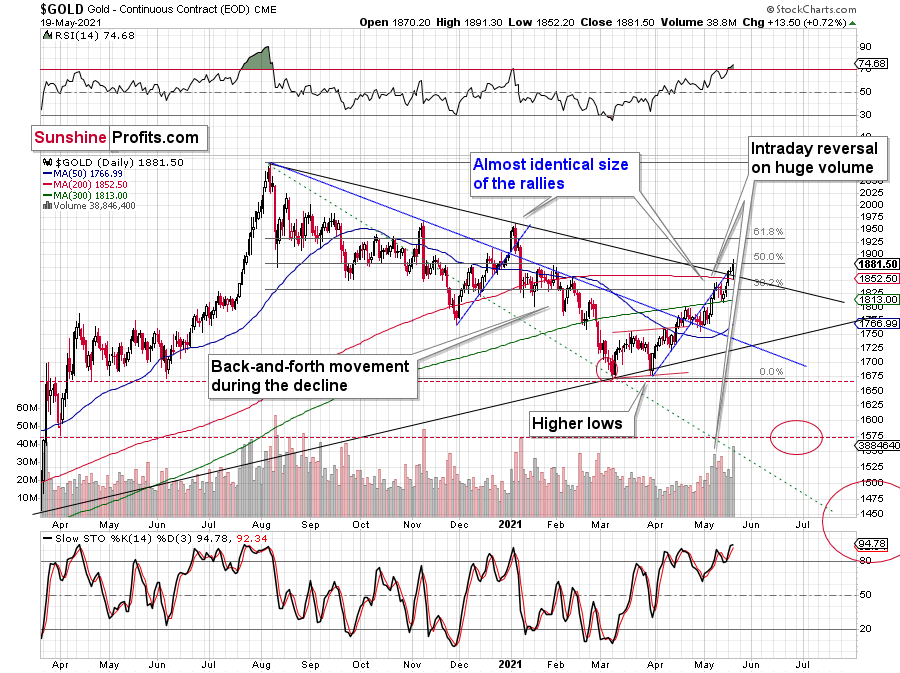

Gold, however, reversed after rallying, but it still managed to close the day higher.

It moved a bit lower in today’s pre-market trading, and overall, it’s just $7 higher than it was at the end of Tuesday’s session. This might seem positive given that gold managed to move slightly above its declining medium-term resistance lines. However, this move was not confirmed yet, and if we consider what happened recently, it seems that big declines are much more likely in the near future than big rallies.

Why? The Fed is attempting to control the long-term rates, and we just saw a short-term exodus from the cryptocurrency market. Theoretically, capital should be flowing into gold as a safe-haven / inflation-hedge asset, and it should be soaring. But it’s not. It did move higher recently, but compared to what “should have” happened given the importance of the above-mentioned developments, the reaction is barely noticeable.

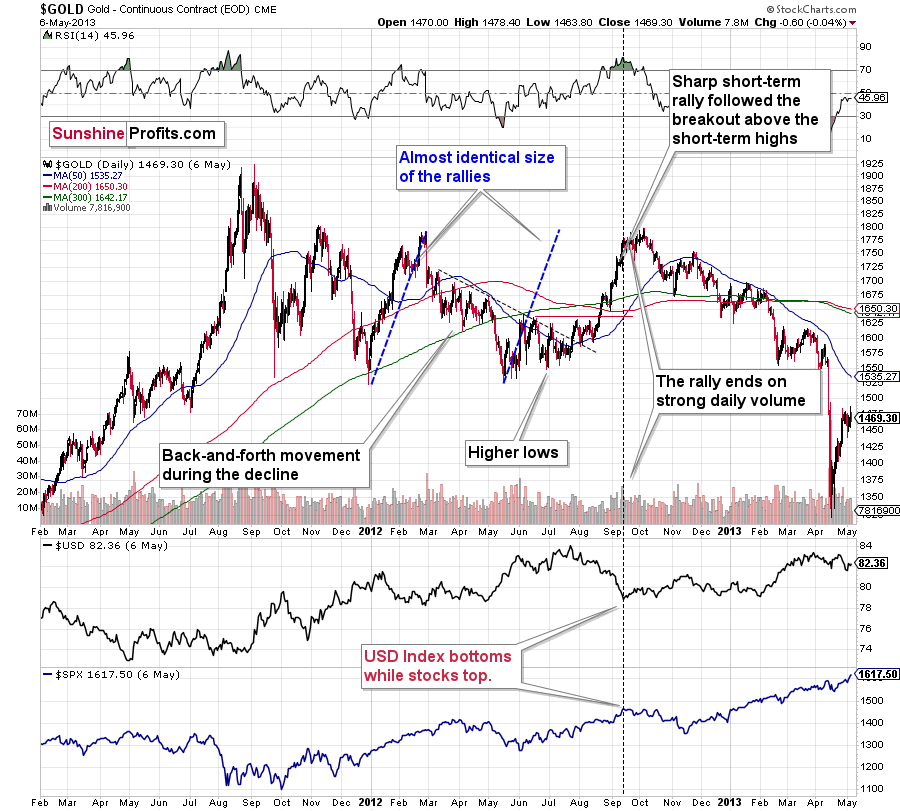

Instead, gold seems to be insisting on repeating – to some extent – its 2012 performance, and – to some extent – its 2008 performance. Either way, it seems that gold is about to slide.

The reversal in gold took place after gold moved very close to its mid-January highs and the 50% Fibonacci retracement based on the August 2020 – March 2021 decline.

The sizes of the current rally (taking the second March bottom as the starting point) and the rally that ended at the beginning of this year are practically identical at the moment.

Just as the rallies from early 2012 and late 2012 (marked with blue) were almost identical, the same could happen now.

The March 2021 low formed well below the previous low, but as far as other things are concerned, the current situation is similar to what happened in 2012.

The relatively broad bottom with higher lows is what preceded both final short-term rallies – the current one, and the 2012 one. Their shape as well as the shape of the decline that preceded these broad bottoms is very similar. In both cases, the preceding decline had some back-and-forth trading in its middle, and the final rally picked up pace after breaking above the initial short-term high.

Interestingly, the 2012 rally had ended in huge volume, which is exactly what we saw on May 19. To be 100% precise, the 2012 rally didn’t end then, but it was when over 95% of the rally was over. Gold moved very insignificantly higher since that time. Most importantly, though, it was the “dollars to the upside, hundreds of dollars to the downside” situation. And it seems that we are in this kind of situation right now once again.

Interestingly, back in 2013 gold started its gargantuan (…) slide from about $1,800 and it is not far (from the long-term point of view) from this level also today.

Moreover, let’s keep in mind that the RSI indicator just topped slightly above 70, which is what tends to happen when gold tops. The upside seems very limited. In fact, it seems that the top in gold might already be in.

The lower part of the above chart shows how the USD Index and the general stock market performed when gold ended its late-2012 rally and was starting its epic decline. In short, that was when the USD Index bottomed, and when the general stock market topped. I don’t want to get into too many USD-related short-term details, as I did that on Tuesday, but let’s take a closer look at the short-term developments on the stock market.

Stock Market

In short, the situation doesn’t look pretty. To explain, I wrote the following on May 11:

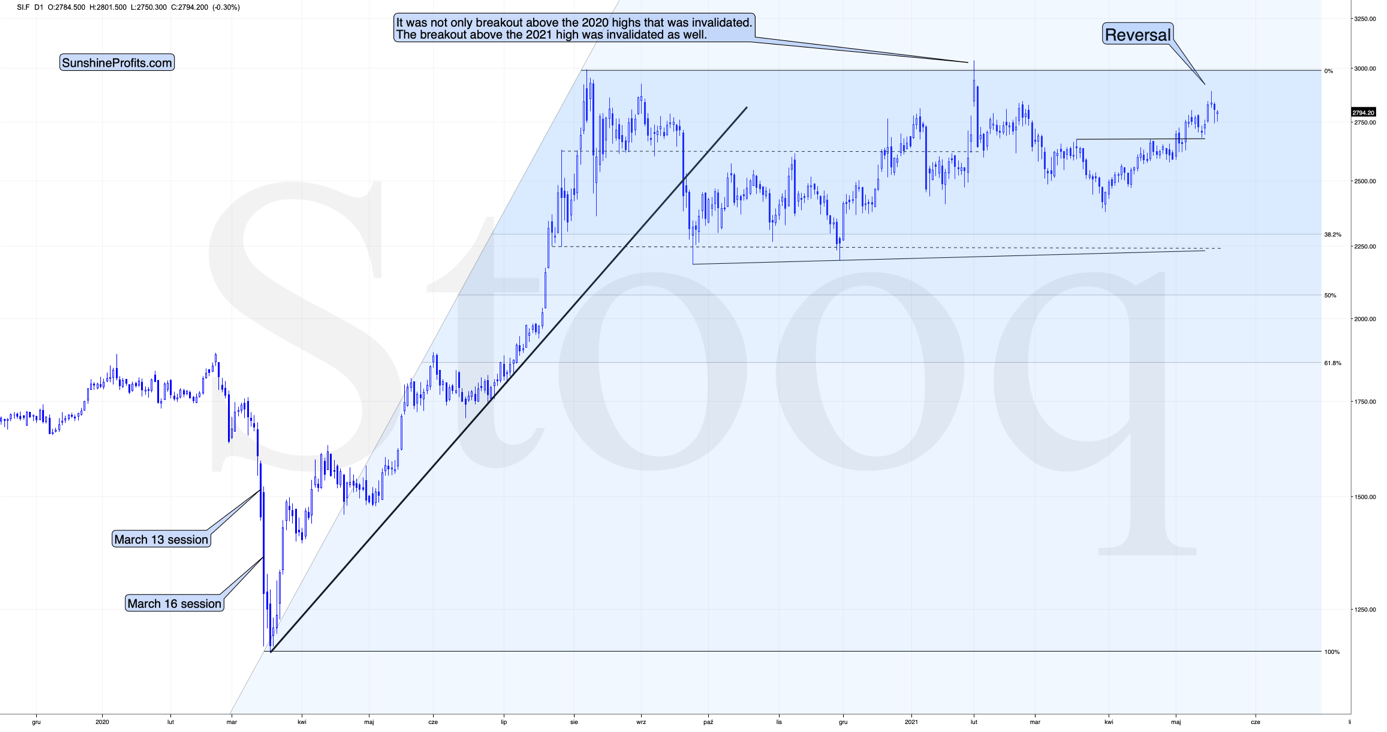

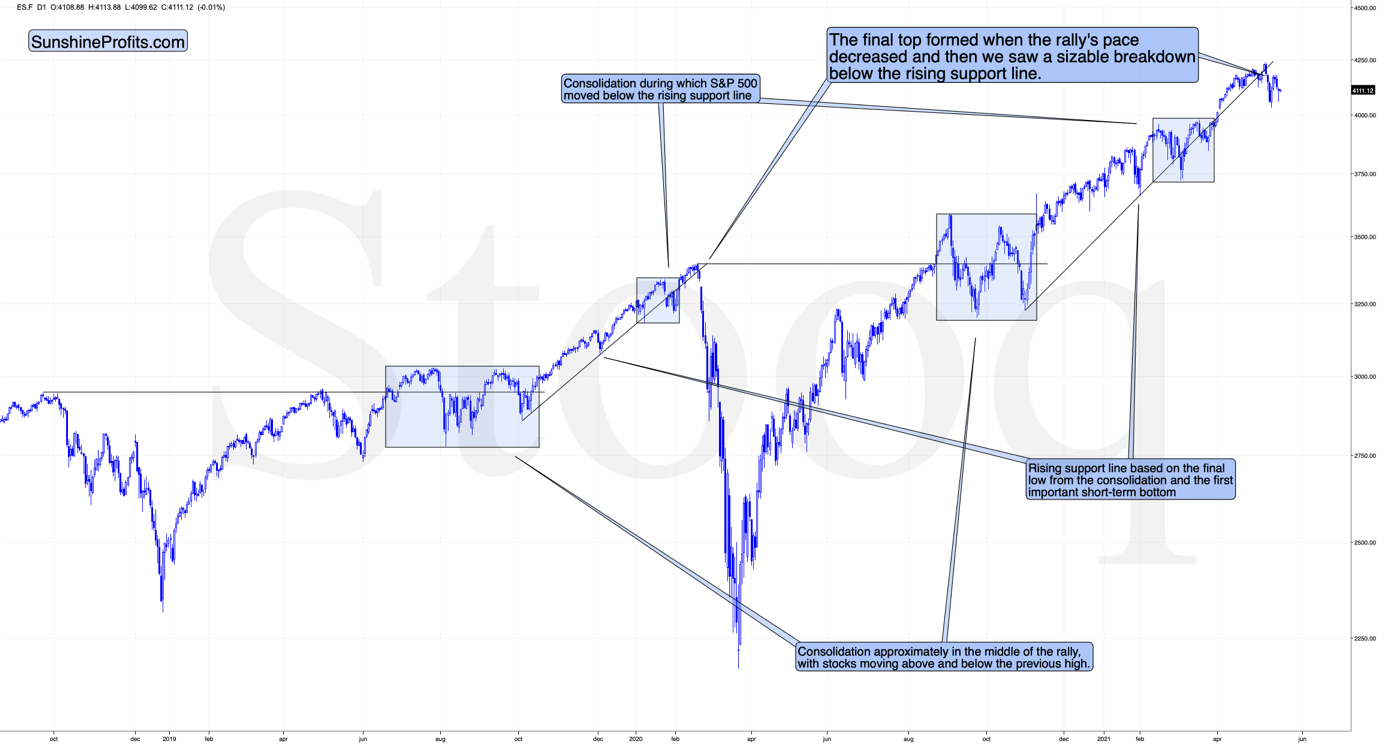

The markets are self-similar (which is another way of saying that they have a fractal nature), which generally means that while the history tends to rhyme, it also tends to rhyme in similar shapes of alike or various sizes.

For example, the rally from 2018–2020 seems very similar to the rally from 2020 to the present. Both rallies started after a sharp decline, and the first notable correction took the form of back-and-forth trading around the previous high. I marked those situations with big rectangles.

Then the rally continued with relatively small week-to-week volatility. I created rising support lines based on the final low of the broad short-term consolidation and the first notable short-term bottom.

This line was broken, and some back-and-forth trading followed, but it was only about half of the previous correction in terms of price and time.

Then, we saw a sharp rally that then leveled off. And that was the top. The thing that confirmed the top was the visible breakdown below the rising support line right after stocks invalidated a tiny breakout to new highs. That’s what happened in February 2020, and that’s what happened this month.

“Time is more important than price; when the time comes, the price will reverse”. Both rallies took an almost identical amount of time: 60 weeks vs. 59 weeks.

Stocks moved a bit higher recently, but the most recent price move was once again to the downside. It seems that the initial slide was not just another correction in the bull market. This is the first time when the S&P 500 was unable to get back above its rising support line after temporarily breaking below it. Instead, we saw an attempt to rally, and now we see another slide lower.

This is bearish for gold, silver, and mining stocks – in particular for the last two.

The USD Index

As you can see in the above chart, the USD Index rallied after reaching its horizontal support provided by the previous important low – the low that was formed after a fake breakdown below the neck level of a supposedly bearish head-and-shoulders pattern. The USDX is not only at similar price levels; it’s also right after a supposedly bearish breakdown below. The reversal could be just around the corner, or we might have already seen it, given yesterday’s invalidation of the breakdown.

It seems that the USD Index is ready to move higher, just like in 2016.

Having said that, let’s take a look at the markets from a more fundamental point of view.

Suddenly, Not so Sure

With cryptocurrencies taking a bath on May 19, I warned previously that the most speculative corners of the financial markets have become increasingly unhinged. Case in point: with IPOs and SPACs already being sent to slaughter, Bitcoin (and the entire realm of cryptocurrencies) was the latest narrative-driven asset to suffer a severe swoon. And while the fundamental merits of Bitcoin are certainly up for debate, when an asset increases by more than 6x in six months, it’s certainly not a function of fundamentals.

Please see below:

More importantly, though, with fear once again gripping Wall Street, the USD Index suddenly became a prized possession. And with the liquidly-induced mania slowly running dry, the probability of a sharp upswing only increases as we approach the second half of 2021.

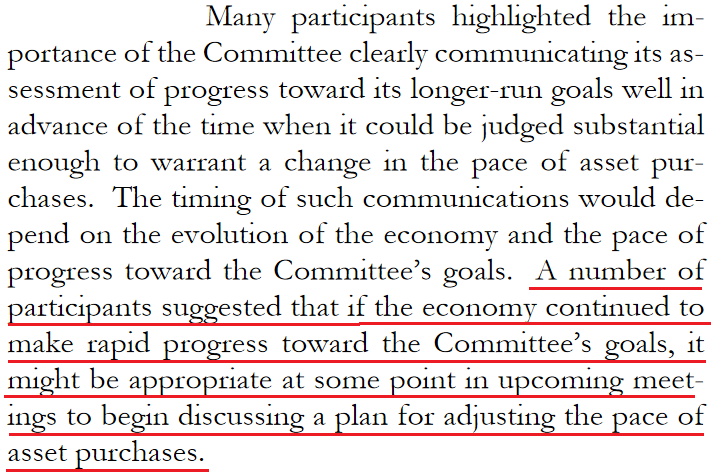

To explain, I’ve warned on several occasions that the U.S. Federal Reserve (FED) is likely next in line to taper its asset purchases. And while the daily deluge of FED speakers say that “it’s too early” to slow down their bond purchases, behind closed doors they’re singing a different tune. Case in point: with the FOMC releasing its latest minutes on May 19, notice the sudden change in tone?

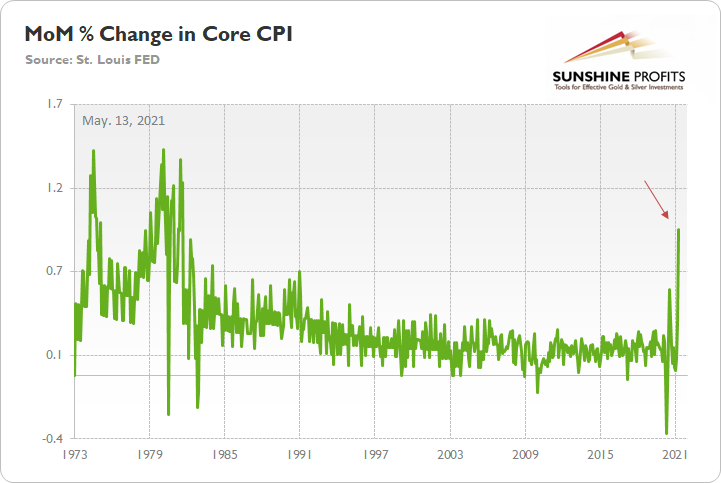

Moreover, the phrase “a number of participants suggested” is extremely important. Not only does it signal a material shift in the FED’s disposition, but it’s important to remember that the discussion covered the “meeting held on April 27–28, 2021.” Thus, while FED officials have been denying the prospect publicly, they’ve been keenly aware of the rising risks for weeks. On top of that, the statement was made before the core Consumer Price Index (CPI) surged by 0.92% month-over-month (MoM) on May 12 – establishing the largest MoM percentage increase since September 1981. And because it was a MoM reading, Jerome Powell, Chairman of the FED, can’t cry foul over “base effects.”

Please see below:

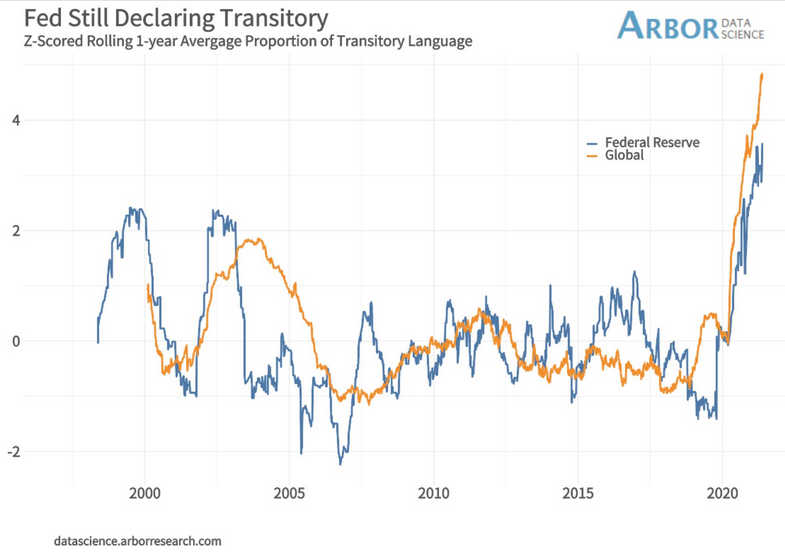

As further evidence of how private conversations contradict the public message, notice how the word “transitory” (regarding inflation) has been parroted by not only the FED but by global central banks around the world?

To explain, the blue line above tracks FED officials’ pontification on the word transitory, while the orange line above tracks global central-bank officials’ identical messaging. If you analyze the right side of the chart, you can see that their use of transitory certainly isn’t transitory.

However, while I’ve noted on several occasions that the FED’s gambit is merely a confidence game, data from J.P. Morgan signals that the central bank remains materially behind the inflation curve.

Please see below:

To explain, the blue line above tracks the FED’s index of inflation expectations, while the orange line above tracks businesses’ expectations of future inflation. If you analyze the right side of the chart, you can see that companies are reporting pricing pressures at an extremely abnormal rate.

Services’ Upcoming Chase

On top of that, with large populations still subject to some form of coronavirus-related restrictions, services have been the main casualty. And with inflation surging at a time when pubs, restaurants and entertainment venues are largely offline, what’s likely to occur once restrictions are lifted?

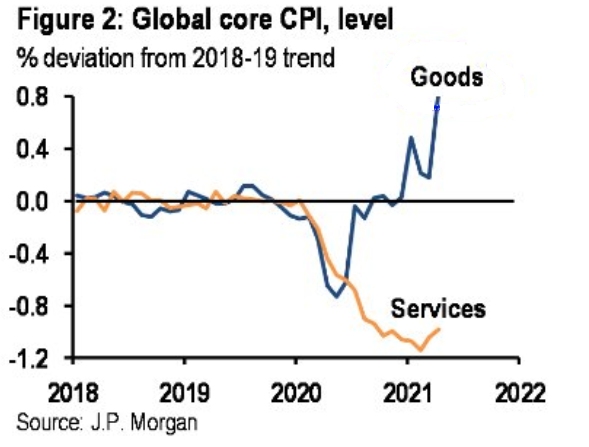

To explain, the blue line above tracks the global core CPI for goods’ percentage deviation from its 2018-2019 trend, while the orange line above tracks the global core CPI for services’ percentage deviation from its 2018-2019 trend. If you analyze the right side of the chart, you can see that the orange line has begun to move higher. Thus, with sizzling CPI prints occurring with services still stuck in the basement, imagine the temperature once they join the party.

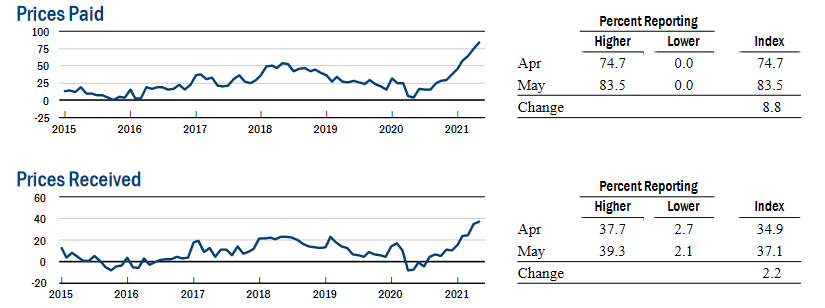

To that point, with goods inflation showing no signs of slowing down, the New York FED’s Empire State Manufacturing Survey (released on May 17) revealed that “Both price indexes reached record highs: the prices paid index rose nine points to 83.5, and the prices received index rose two points to 37.1.”

Please see below:

The bottom line?

If the FED is forced to taper, the USD Index and the U.S. 10-Year Treasury yield will likely be the main beneficiaries. And with that, the PMs will probably be the odd men out. Moreover, with the EUR/USD – which accounts for roughly 58% of the movement of the USD Index – suffering a crisis of confidence on May 19, the currency pair is far from out of the woods.

ECB and the EUR/USD Pair

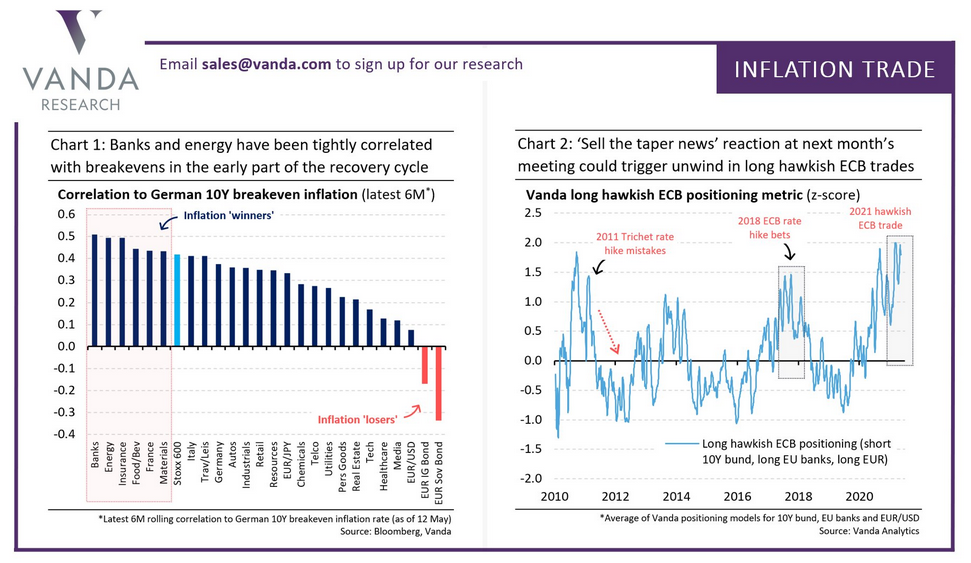

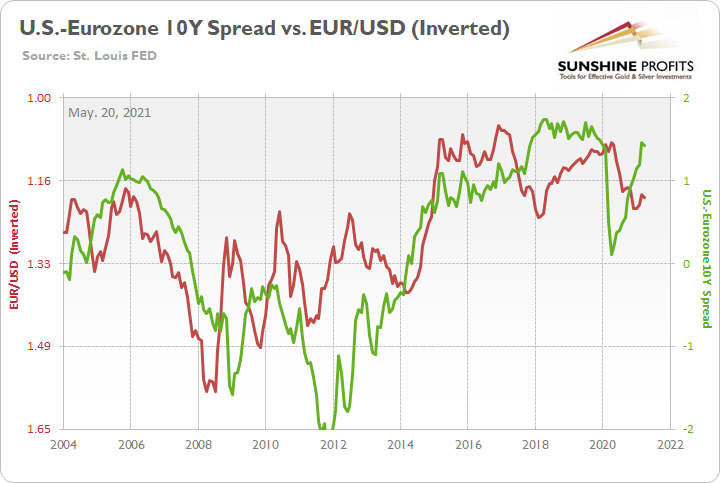

Case in point: with optimism abound, European banks, energy stocks and breakeven inflation rates have helped boost the EUR/USD. And while investors are extrapolating the cyclical strength as grounds for the European Central Bank (ECB) to reduce its bond-buying program in June, haven’t we seen this movie before?

To explain, if you analyze the chart on the right, you can see that hawkish ECB positioning implies being long Eurozone banks, short Eurozone bonds and long the EUR/USD. However, if you analyze the peaks in the light blue line, you can see that prior bets on ECB tightening have ended in extreme disappointment. For example, when the ECB hiked rates twice in 2011, Portuguese sovereign debt was downgraded to junk, and less than a year later, Greece was forced to restructure its debt in order to remain in the European Union. Likewise, it didn’t take long for all of the cyclical bets to unwind and for the EUR/USD to plunge. Second, after foolish optimism sent cyclicals soaring in 2018, the bets unraveled, and once again, the EUR/USD plunged. Thus, is this time really different?

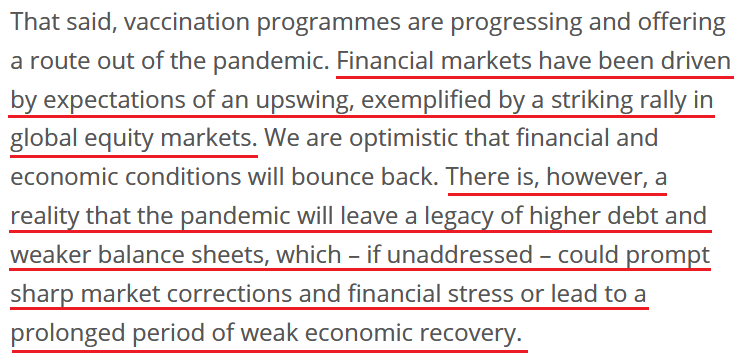

To that point, the ECB released its latest Financial Stability Review (FSR) on May 19. And with ECB Vice President Luis de Guindos saying that “a vast number of firms – particularly those in the services, leisure and travel sectors – still cannot operate normally, and the economy is still reliant upon policy support to prevent widespread unemployment, corporate insolvencies and economic contraction,” is the ECB likely to taper in June?

He added:

Therefore, if the ECB worries about “a legacy of higher debt and weaker balance sheets, which – if unaddressed – could prompt sharp market corrections and financial stress,” does reducing liquidity and/or raising interest rates seem like a solution to the problem?

Furthermore, with the FSR citing that “corporate solvency challenges could weigh on sovereigns, households and creditors” and projecting a material rise in bankruptcies, again, does reducing liquidity and/or raising interest rates seem like a solution to the problem?

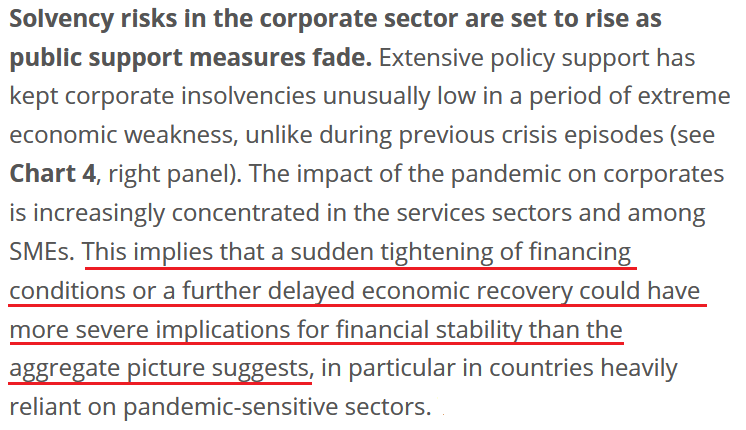

For a visual representation, please see below:

To explain, not only have European corporations’ debt-to-equity (D/E) ratios surged since the beginning of the pandemic (the orange line on the chart on the left) but corporate bankruptcies are expected to surge through the end of 2022 (the dashed blue line on the chart on the right). Thus, while FED officials are quietly talking about tightening, ECB officials are quietly moving in the opposite direction.

10-Year Treasury Lurking in the Background

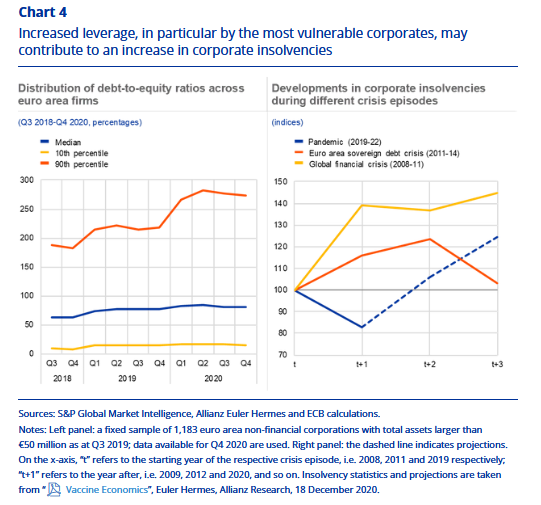

Speaking of quiet, amid the cryptocurrency chaos and the FED’s rather weak implementation of Operation Twist 3.0, the U.S. 10-Year Treasury yield jumped by 2.44% on May 19. And with the U.S.-Eurozone 10-year yield differential an ominous sign for the EUR/USD, a continued rise in the Treasury benchmark implies a significant re-rating of the currency pair.

Please see below:

To explain, the green line above tracks the spread between the U.S. 10-Year Treasury yield and the benchmark Eurozone 10-year yield, while the red line above tracks the inverted EUR/USD. For context, inverted means that the latter’s scale is flipped upside down and that a rising red line represents a falling EUR/USD, while a falling red line represents a rising EUR/USD.

If you analyze the relationship, you can see that when the U.S. 10-Year Treasury yield outperforms the benchmark Eurozone 10-year yield (depicted by the green line rising), the EUR/USD often suffers (depicted by the red line rising). Moreover, if you analyze the right side of the chart, you can see that both are currently rising in tandem. Despite the U.S. 10-Year Treasury yield’s drastic outperformance, the EUR/USD is attempting to buck the trend. However, with the U.S. 10-Year Treasury yield continuing to outrun its European counterpart, and a reconnection with the green line already implying the EUR/USD of roughly 1.10, it’s only a matter of time before reality sets in.

In conclusion, the greenback got its groove back on May 19, and the macroeconomic environment signals further appreciation ahead. Moreover, with the PMs benefitting from ample liquidity and a dovish FED, the FOMC’s latest minutes signal that the second half of 2021 won’t be as sanguine as the first. Furthermore, with Bitcoin’s roller coaster highlighting the double-edged sword that is a record-breaking margin debt (remember, U.S. margin debt is at an all-time high), when forced liquidations erupt, they will tend to be fast and furious. The bottom line? With the PMs attempting to shine while the liquidity lights are being dimmed, their recent sparkle is likely to fade over the next few months. Moreover, if the stock market leads the next move lower, their journey will be all the more painful.

Overview of the Upcoming Part of the Decline

- It seems likely to me that the current corrective upswing is very close to being over, given gold’s similarity to what happened in 2012, USD’s similarity to 2016 and the situation in the general stock market.

- After miners slide once again in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver (this could take another 1-2 weeks to materialize). I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,450 - $1,500 and the entire decline (from above $1,700 to about $1,475) would be likely to take place within 1-12 weeks, and I would expect silver to fall hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments, in my view. This might happen with gold close to $1,475, but it’s too early to say with certainty at this time. In other words, the entire decline could take between 1 and 12 weeks, with silver declines occurring particularly fast in the final 1-2 weeks.

- If gold declines even below $1,500 (say, to ~$1350 or so), then it could take another 10 weeks or so for it to bottom, but this is not what I view as a very likely outcome.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops. If the general stock market puts the final top in the first half of May (which seems quite likely given NASDAQ’s top in late April), then we might expect the precious metals sector to bottom sometime in August.

- The above is based on the information available today, and it might change in the following days/weeks.

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, even though it doesn’t seem to be the case based on this month’s price change in gold, it seems that the yellow metal’s days are numbered. This is based not only on the excessively oversold USD Index and its 2016 self-similar pattern but also on what’s happening in the stock market, silver’s recent outperformance and price levels reached throughout the precious metals sector. From the long-term point of view, the current situation seems similar to what we saw in the second half of 2012, while from the short-term point of view it seems similar to what we saw at the beginning of 2021. While the very near term remains unclear (today’s pre-market reversal might have been the final top, but there’s no certainty there), the outlook for the next several months remains very bearish.

After the sell-off (that takes gold to about $1,350 - $1,500), we expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $24.12; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $39.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $94.87; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,512.

Gold futures upside profit-take exit price: $1,512.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief