Briefly: in our opinion, full (200% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Yesterday’s session was quite volatile, just as one might have expected it to be. It was the interest rate decision day in the US and the first of this week’s monetary authorities’ comments. It was volatile, but it did not result in any meaningful changes in gold or mining stocks. The only thing that was really affected was – once again – silver. Its strength was clear and since we saw it for yet another day in a row, it’s obvious that it means something. Is silver on a verge of a massive rally?

We just received an e-mail in our inbox with a title that claims so, but is it really the case? Absolutely not. Precisely, yes, it’s possible just as anything is in the market and one can’t rule out silver at $50 by the end of June, but one also can’t rule out silver at $5 by the end of June. Both outcomes are extremely unlikely, though.

The point is that the above is not the correct question for one to be asking. The correct question is “what is likely to happen?” and – even better – “what is the profitable thing to do in the light of the risk to reward ratio and all the indications that we get at this time?”

We’ve been providing the answer to the above question in the past several days and since the signal that we saw yesterday was yet another repeat of the same thing (silver’s outperformance for both: gold and mining stocks), today’s answer will not be different. Silver’s temporary outperformance is a sign of an upcoming decline.

But silver keeps on rallying!

Yes, it does, and it did the same many times before and got people excited just as many times. There is something about silver that when it rallies, it makes investors and traders extremely excited. The problem is that the extreme emotions accompany price extremes – in this case tops. Those, who follow the emotions overall tend to lose money and those who tend to stay strong and even act in the opposite to what their emotions suggest them to do, tend to profit – if not immediately, then eventually and on average.

Don’t get us wrong – emotions are necessary and inherent part of life (the stoic masters would argue that the last few centuries put excessive weigh on one’s emotionality, but it doesn’t seem to be a good place to elaborate on that), but when it comes to investing and trading, they are not making things easier, but more difficult.

But my trading position is underwater!

Unless one enters a position right at the extreme (in case of the short positions right at the top), it’s likely to be the case that the position becomes temporarily unprofitable – that’s quite natural. If the reasoning behind the trade was correct, it’s likely that it’s just a matter of time before the position becomes profitable. The key thing is to make sure that this initial temporarily state is not too unprofitable. This can be done in either of two ways and we encourage both of them.

The first one is diversification between trading gold, silver, and mining stocks – not just one part of the sector. At times, silver will provide greatest profits, at other times mining stocks and sometimes it will be gold that steals the show. On the downside, when the market goes the wrong way, it could be the case that only one of the parts of the trading position becomes unprofitable, while the rest is still rather ok. In the current case, silver moved in the unfavorable direction, but the analogous moves in gold and mining stocks are small. By diversifying, the chance for having the entire position affected is significantly lowered.

The second way is keeping the sizes of the positions reasonable. Yes, we currently view an extra-large position as justified from the risk to reward point of view, but still it doesn’t mean betting the entire farm on a single trade. We explained this in detail in our research report on speculation in general and in the analysis of one’s precious metals portfolio in general, and we provided a simple simulation in the article that discusses the basics of using our service.

We can only tell you what we think about the market based on more than a decade of experience and while applying our greatest care, but you will not get great results if the position sizes are too big. It’s even possible to lose capital in the long run despite having high efficiency of trades (70%+ of correct market calls) if the position is too big – you can see it in details (there’s a chart featuring this phenomenon) in this report.

The bottom line is that if the position is underwater then it’s neither normal nor excessive. If both: diversification and money management techniques are applied, then the latter should not be the case. If it is and the position is diversified, then the current position size might be too big.

We greatly care about your investment and trading success and we do everything in our power to contribute to it, but we can’t do it on our own –we can only analyze the market, prepare materials, describe benefits of applying diversification and so on. But, ultimately, it is you, who makes the decisions and enters the trades. Consequently, it is very important that you help us to help you, by applying these money management techniques – without your help, we will not be able to provide you with the results that you’ll be happy with in the long run.

Having said the above, let’s take a look at the charts

.

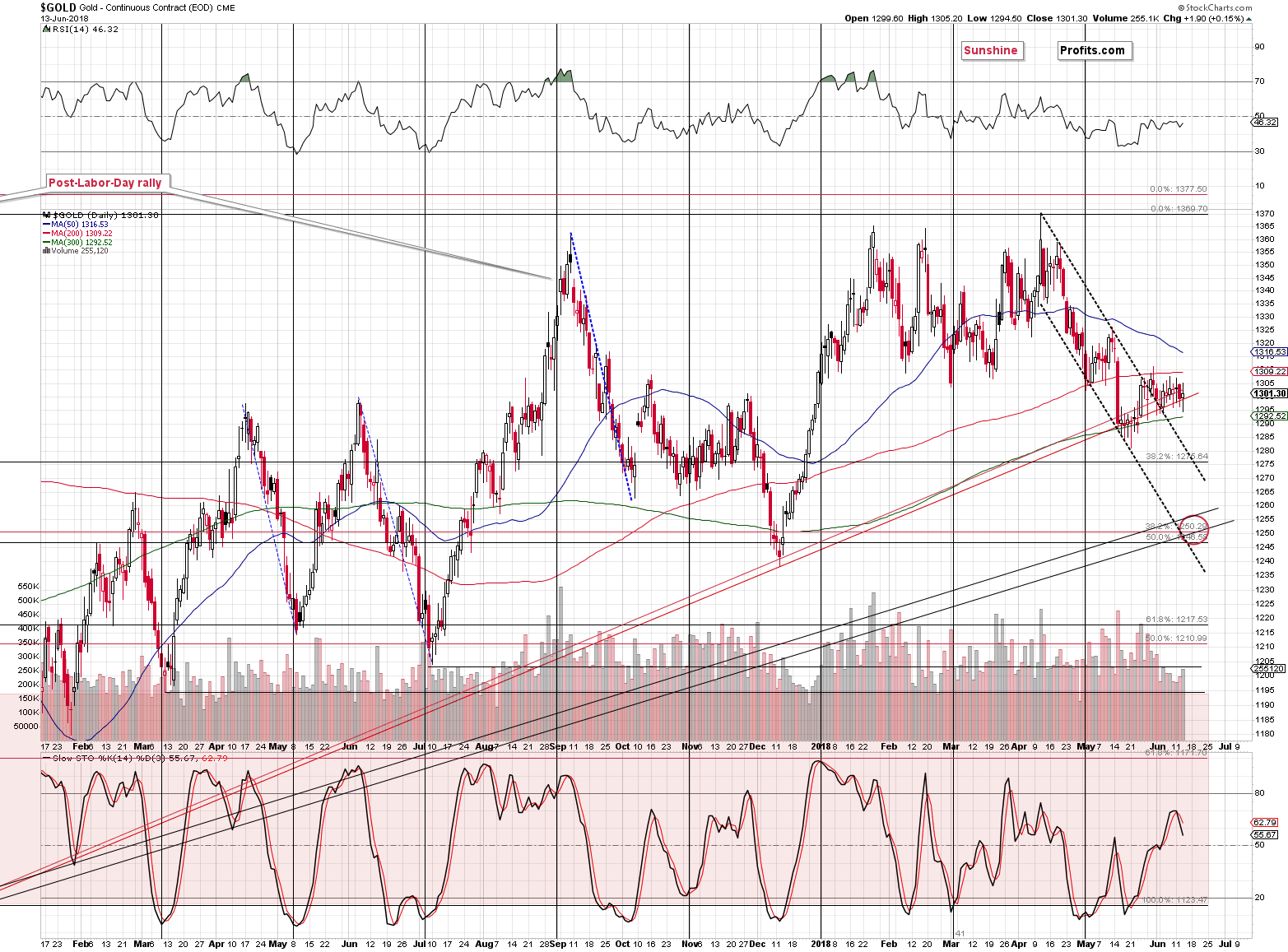

As we discussed above, gold and mining stocks were rather unchanged, which seems to reflect the lack of major surprises from the Fed. As a reminder, markets don’t move on the facts but on changing expectations (after filtering it through sentiment). The flagship example was when Bernanke cut rates by 0.75 in 2008 and the stock market fall after this decision. Why would that ever happen? Because investors expected even bigger cuts. So, whatever was said and done yesterday (interest rate hike and mentioning of two additional ones), didn’t seem to surprise precious metals investors and traders.

If it was the case, for instance, that most other markets reacted in a strong way, but PMs didn’t, we could still infer something from that. This wasn’t the case. The general stock market and the USD Index were both down, but these moves were barely noticeable.

Gold is up to about $1,308 in today’s pre-market trading, which is well in line with this month’s trading range. Nothing special is going on despite the intraday volatility. We warned about the latter due to this week’s monetary meetings, so you are most likely not surprised by these price swings.

Silver’s performance may appear surprising, though.

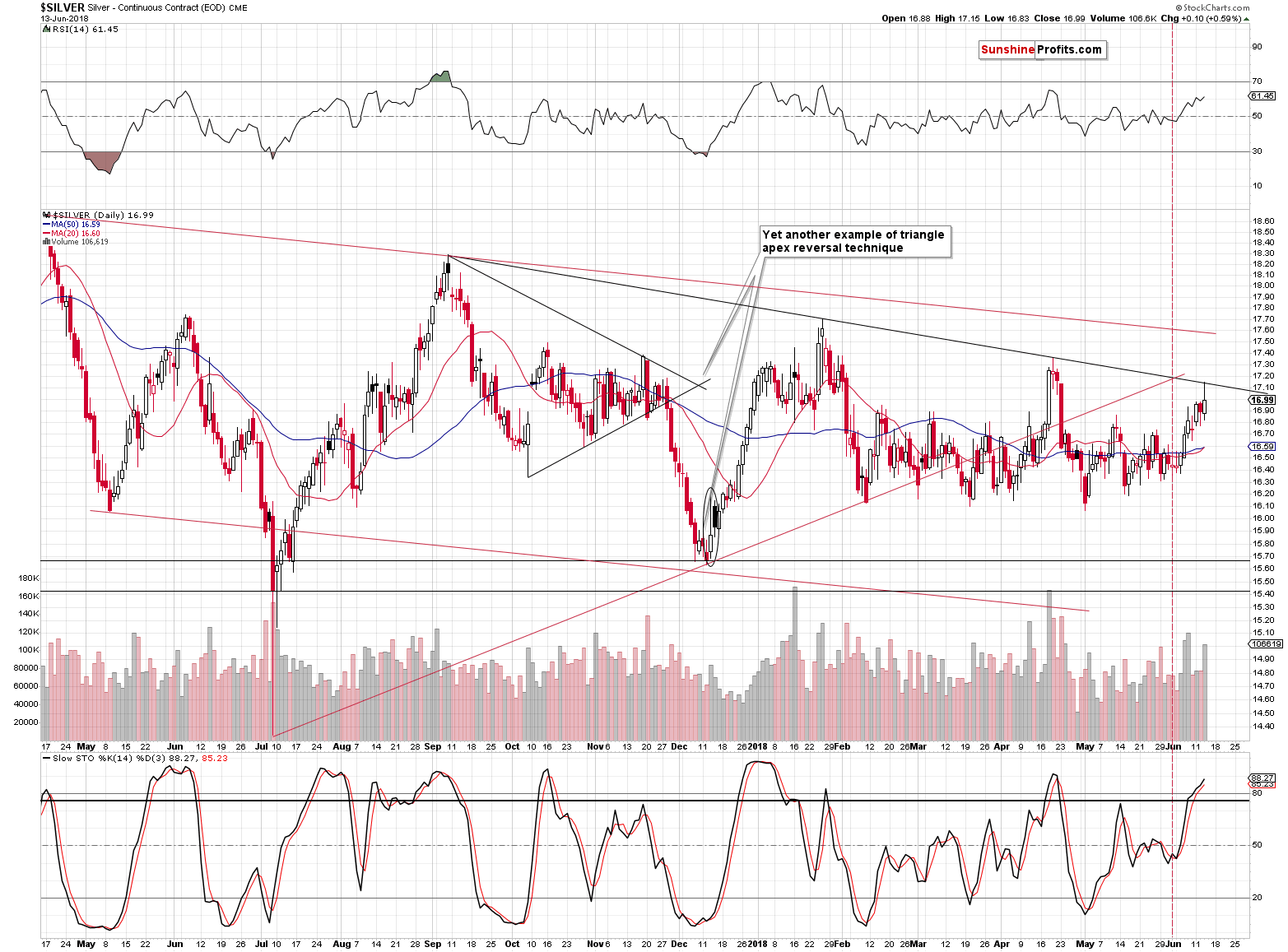

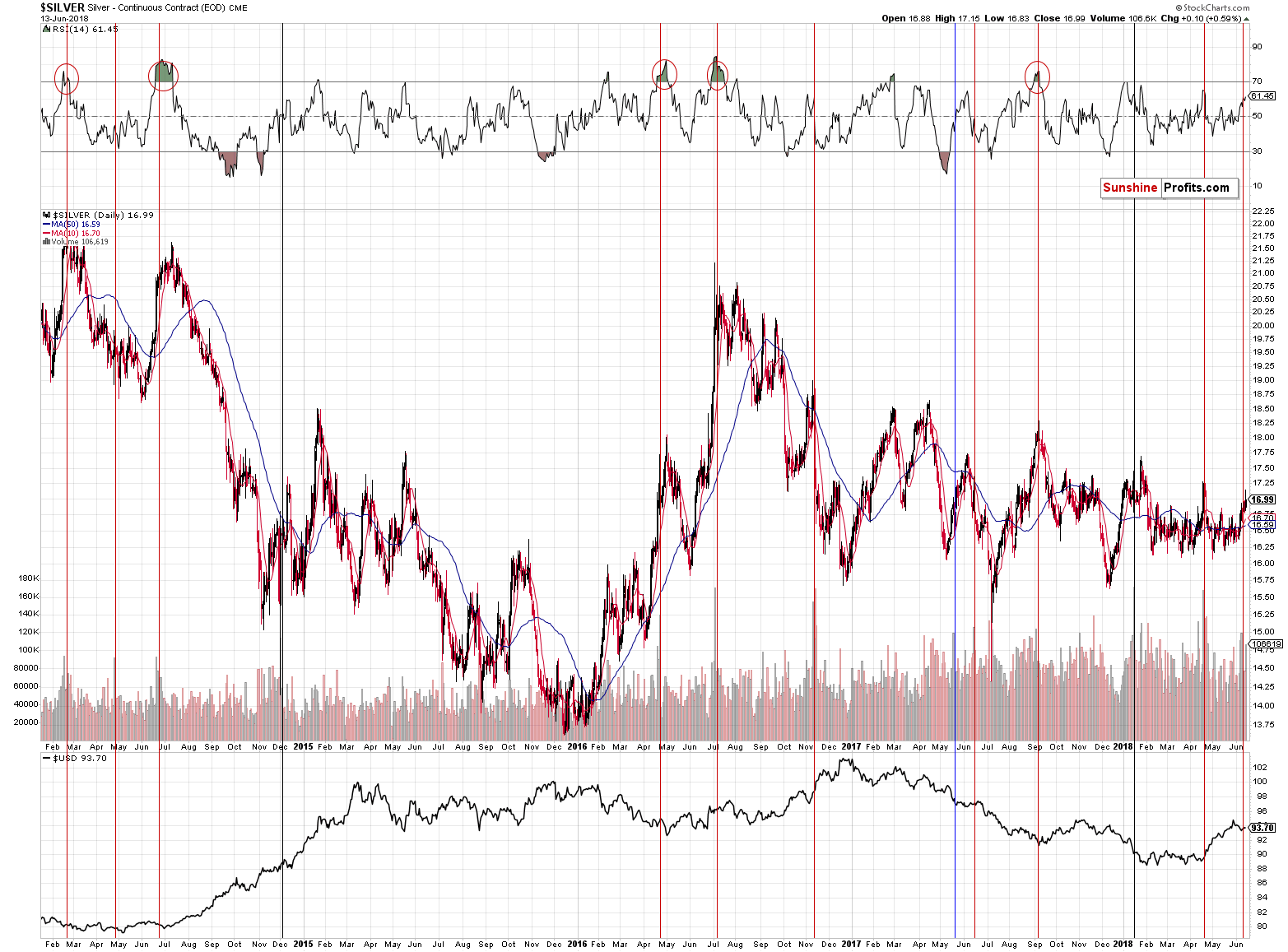

Silver Rally and Resistance

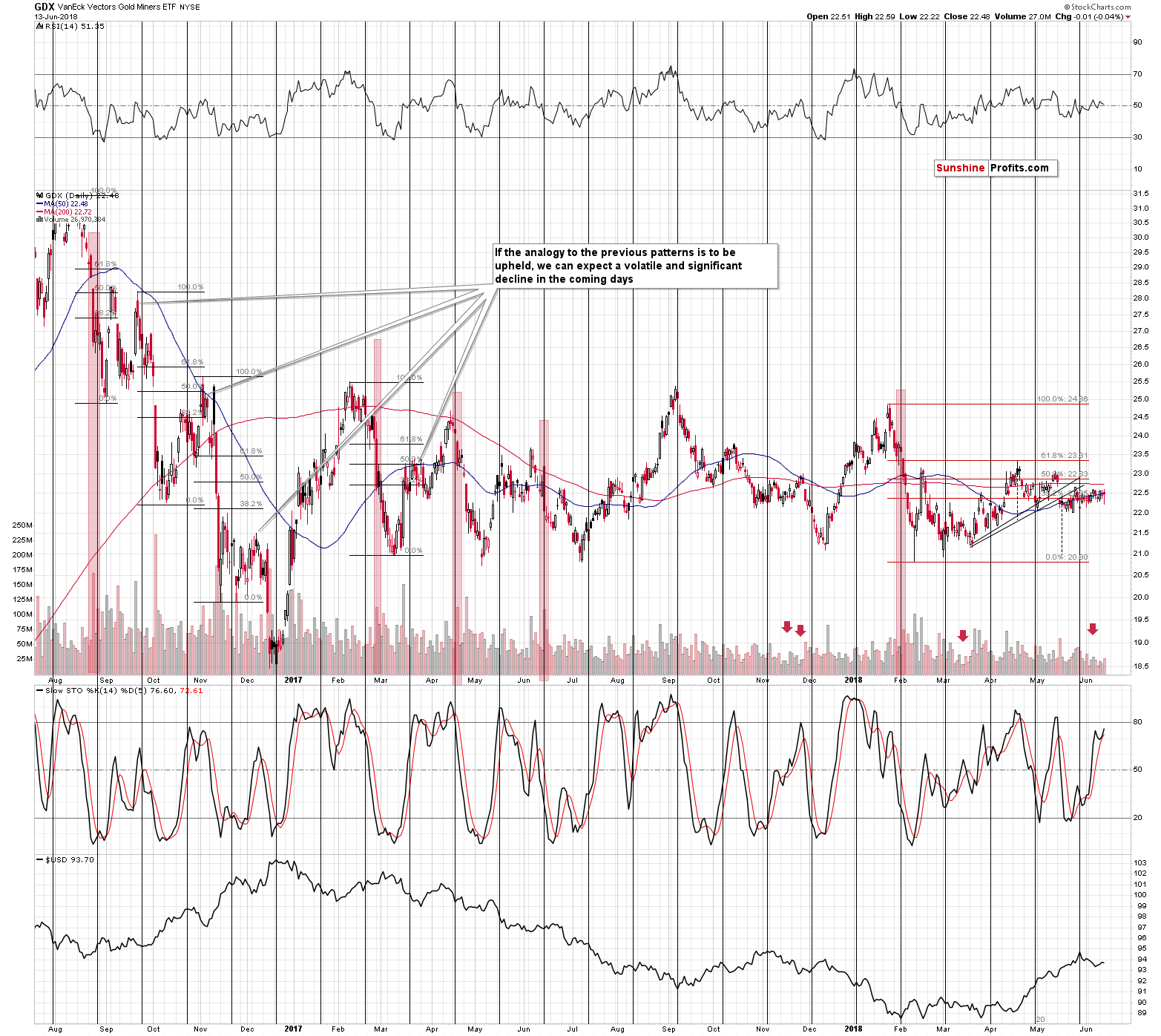

Silver moved higher once again and this time it reached its declining, medium-term resistance line. Does this mean that the rally is over? It could, but let’s keep in mind that silver is known for fake breakouts, so a move above this line could also be seen. In fact, today’s pre-market rally took silver several cents above yesterday’s high, which fits the above. At this point it’s imperative to keep in mind that silver breakouts – if they are not accompanied by bullish confirmations from gold and miners – are almost certainly fakeouts and excellent opportunities to enter short positions. We already have such positions, so the above doesn’t apply, but the key takeaway is that it’s not a bullish thing.

Also, let’s keep in mind that the very bearish implications of silver’s recent upswing on big volume remain in place and so do our comments on the above chart:

In 9 out of 12 recent cases, big volume during daily rallies meant excellent shorting opportunities (marked with red). In 2 cases it was unclear whether it was an opportunity to go short or long (marked with black), but in both cases entering a short position at that time and keeping it for about 3 weeks would have been profitable. In the remaining case that we marked with blue, silver moved higher but only for 2 weeks – it declined then and if one simply kept the short position intact, for a few more weeks, they would have made sizable gains.

Overall, the implications of a volume spike during a daily rally are clearly bearish.

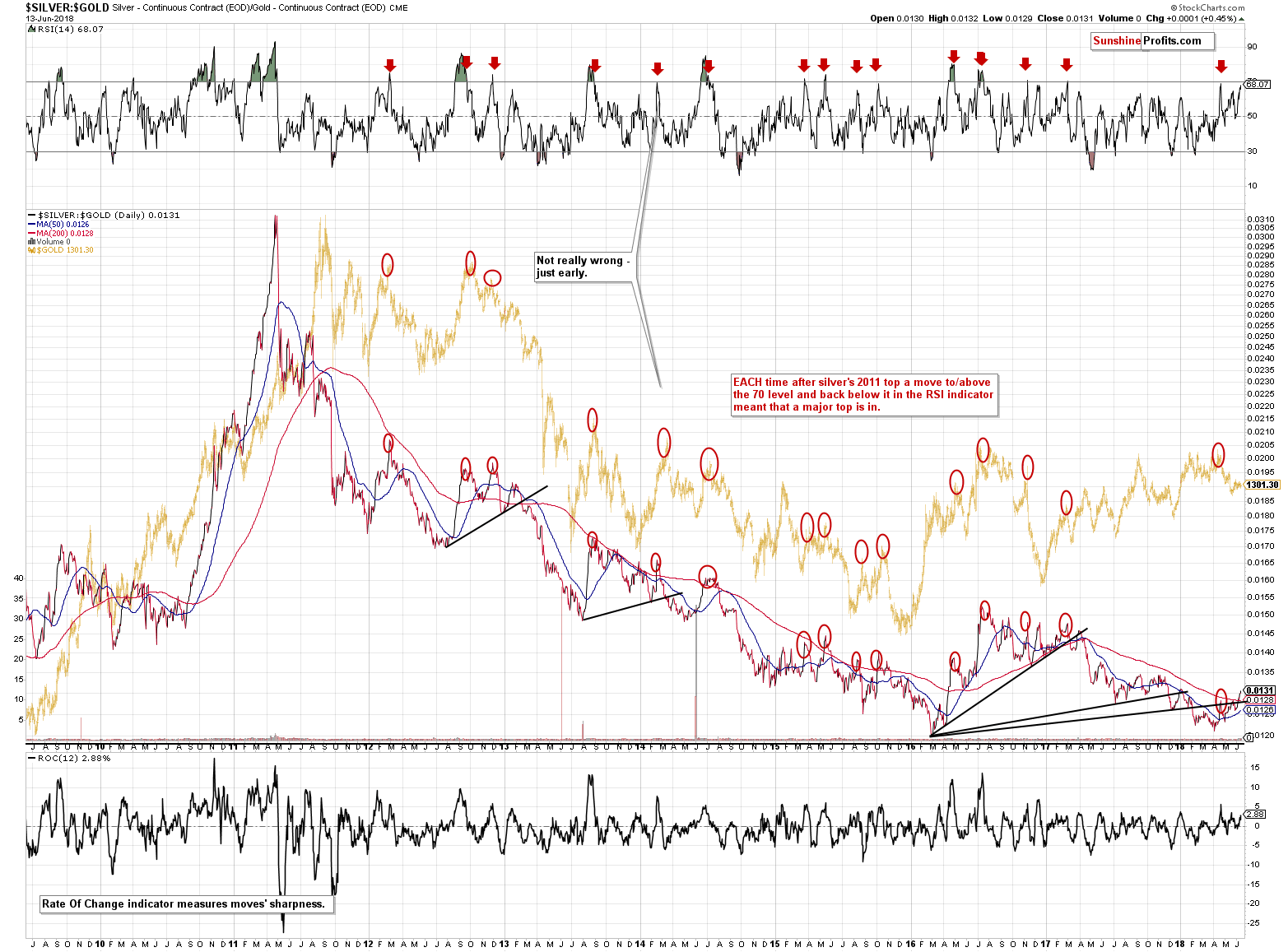

Silver to Gold Ratio

On Tuesday, we commented on the silver to gold ratio in the following way:

The only thing that we would like to update you on is the silver to gold ratio. Precisely, the RSI indicator that’s based on it. It moved very close to the level of 70, and this level is something that should make silver bulls consider changing their outlook to at least neutral.

The thing is that practically each time that the RSI based on the silver to gold ratio moved above 70 and then back below it meant that the top is in. In many cases (for instance earlier this year), the RSI didn’t even have to move to 70 – its proximity was enough to have bearish implications going forward.

In the April 23rd, 2018 Gold & Silver Trading Alert, we wrote that the short positions were definitely (we had 200% exposure, just like we currently do) justified, while the above RSI was a bit above 69. It turned out that it was the day when the decline accelerated. This may or may not be the case this time because of all the fundamental stuff that’s going on this week (Fed, ECB, BoJ meetings), but the decline is likely to follow shortly anyway.

Based on yesterday’s price action in gold and silver, the RSI moved above 68. While it’s not yet a crystal-clear sell sign, it’s extremely close to the level at which it was in late April, when the decline really started (accelerated). The implications are bearish.

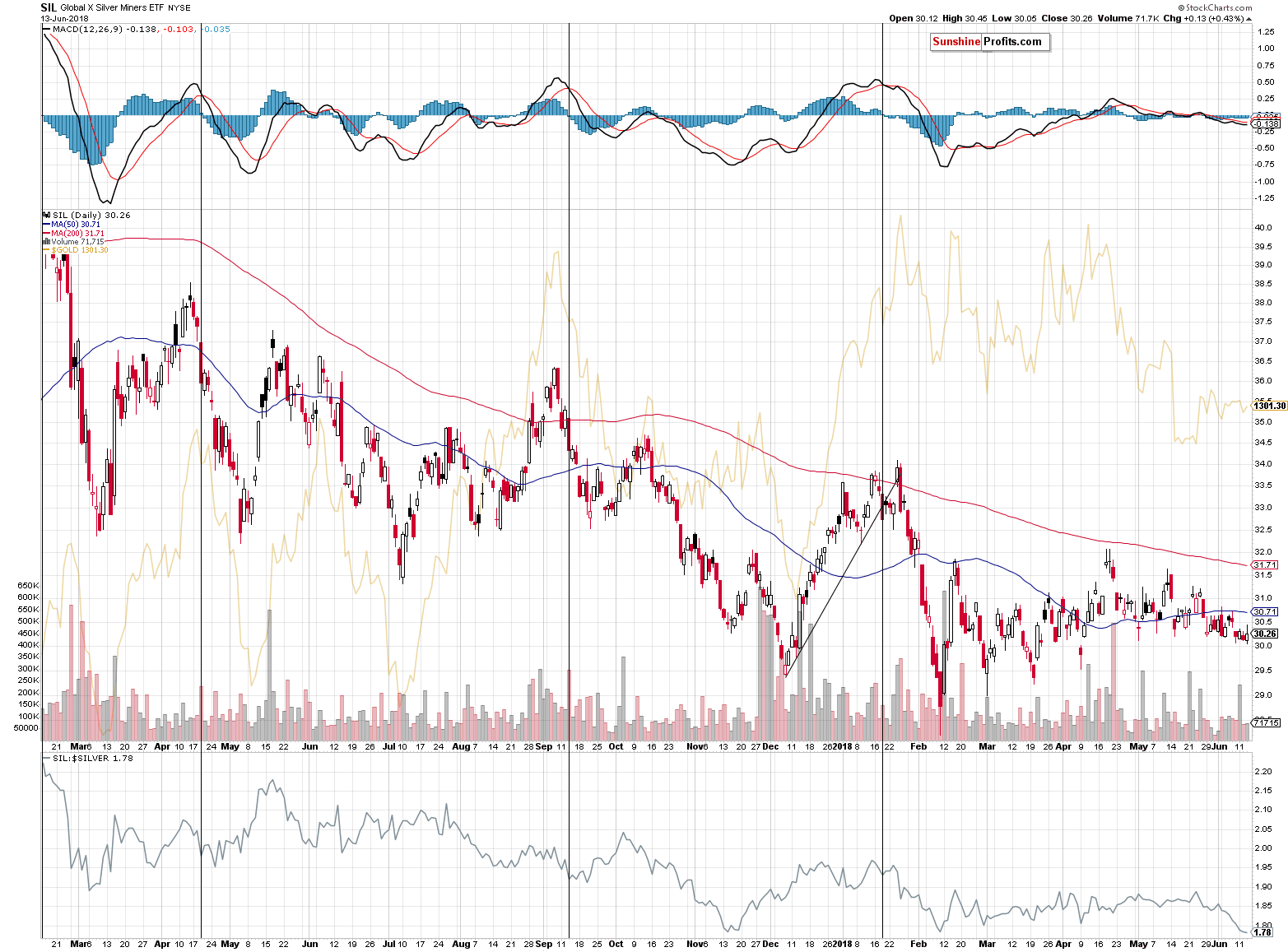

Silver Stocks’ Underperformance

Despite silver’s rally yesterday, the performance of silver stocks once again was very weak. It did move higher, but the size of the move is nothing like the size of silver’s rally. Just as we explained yesterday, since the mining stocks often lead metals and are showing relative strength or weakness as a sign of what’s to come, one should currently be expecting a turnaround in silver rather than in the miners.

Of course, if the financial system was destroyed, WWIII broke out etc., then gold and silver would soar, but nothing like that is likely to happen shortly and the above technical rule for the precious metals is likely to apply.

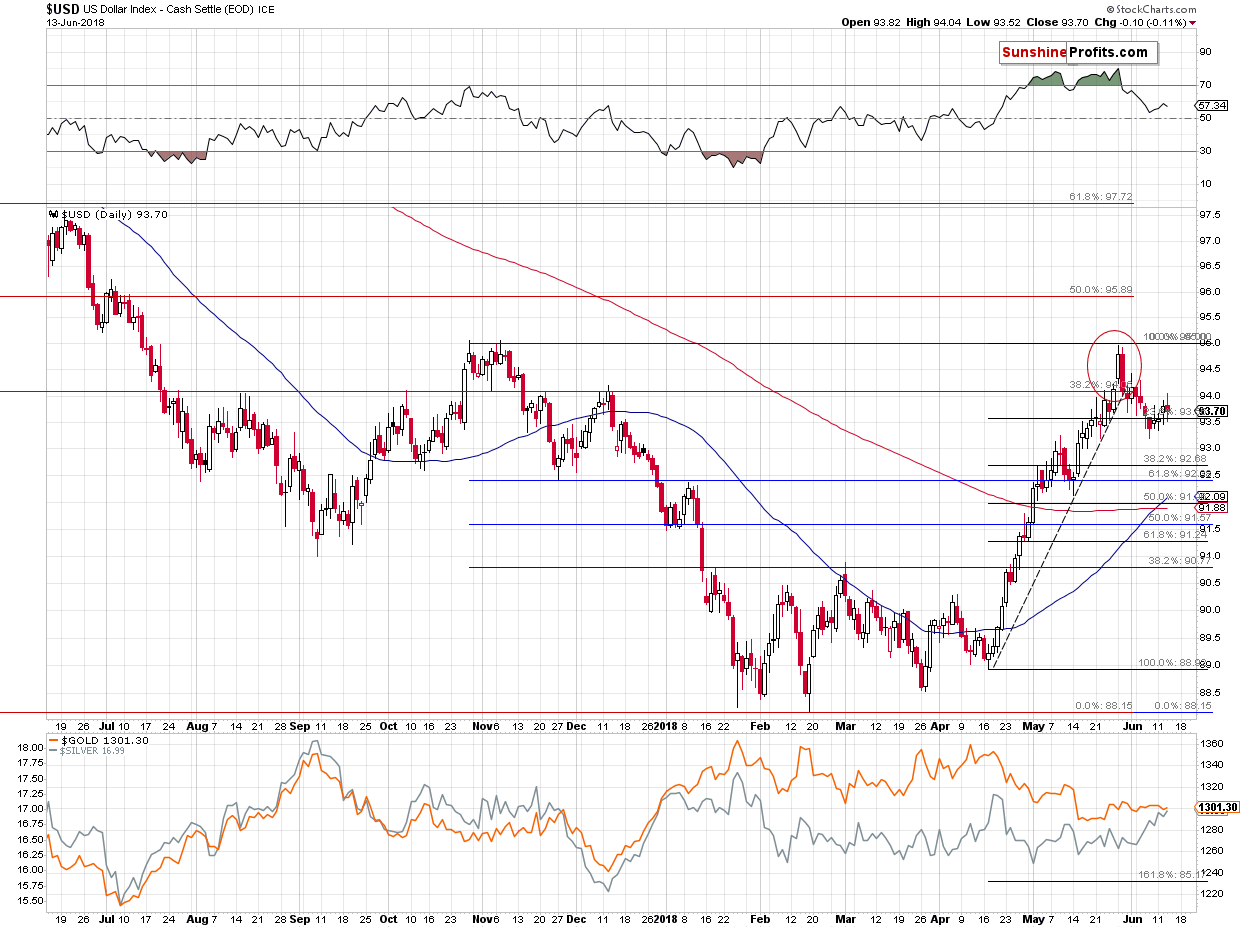

Forex Update

As far as the situation in the currency markets is concerned, we can say that it’s developing in tune with the technical patterns and with our expectations. However, at the same time, the risk that would be associated with having an open forex position right now – at the hottest time right after monetary authorities’ meetings – seems too big.

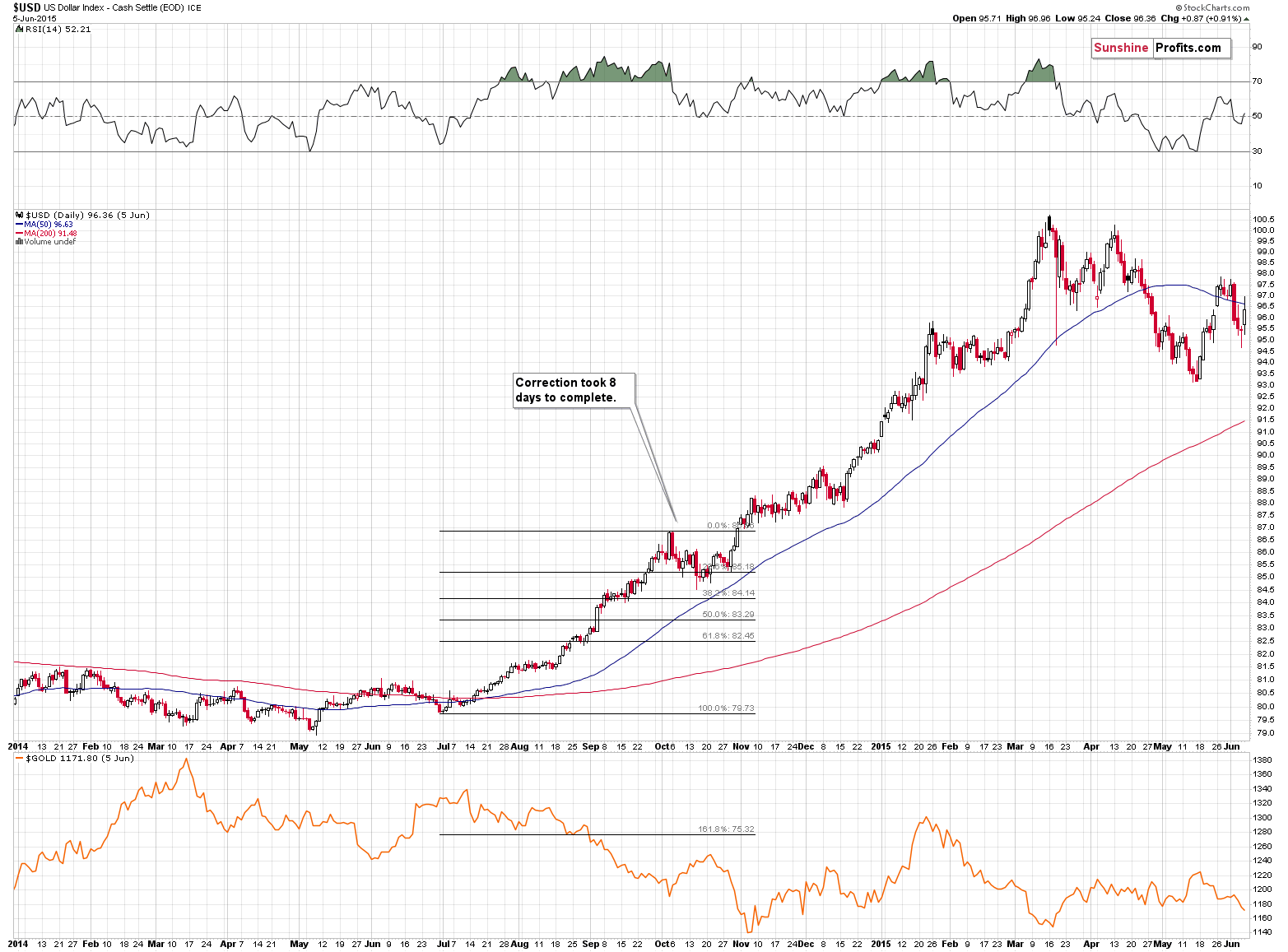

We previously wrote that the correction in the USD Index was most likely ending and that we could see some sideways trading this week before the rally really continues. The above was based on the analogy to the 2014 rally and on this week’s hot nature due to incoming news from monetary authorities. Once all is said and done and the dust settles, the markets are likely to resume their trends. This means another move higher in case of the USD Index.

Please note that in October 2014, the final bottom was followed by a few days of higher USD prices and then another move lower, almost to the previous low. Only after that did the USD index soar and PMs plunged. It seems that we are seeing something similar this time.

The USD Index didn’t move much lower yesterday, but it did decline below 93.3 in today’s pre-market trading before rallying higher. This seems to perfectly fit the above analogy and it would imply that today is the topping day for the precious metals sector. It also probably means that the next big move in the EUR/USD has just begun as in the case of this currency pair, we’ve had news from both central banks and the uncertainty is now lower.

The situation is not as clear for the Japanese yen yet, but it will soon be (after tomorrow’s BoJ press conference), so for now we think that opening a speculative short position only in the EUR/USD pair is justified from the risk to reward point of view. The stop-loss level for this position is 1.186 and the initial target price is 1.1203.

Summary

Summing up, the rally that we’re seeing in silver seems to be very bullish, but looking at it from a broader perspective and checking how similar situations played out in the past provides us with exactly the opposite implications. It’s easy to follow one’s emotions on the market, but the opposite is usually profitable. In this case, it seems that the precious metals market is not starting a rally, but a decline and just because silver’s outperformance was profound this time, doesn’t make it any less bearish. Conversely, it suggests that the move lower that follows will be just as profound.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,251; stop-loss: $1,382; initial target price for the DGLD ETN: $48.88; stop-loss for the DGLD ETN $37.48

- Silver: initial target price: $15.73; stop-loss: $18.06; initial target price for the DSLV ETN: $27.58; stop-loss for the DSLV ETN $19.17

- Mining stocks (price levels for the GDX ETF): initial target price: $21.03; stop-loss: $23.54; initial target price for the DUST ETF: $28.88; stop-loss for the DUST ETF $21.16

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – but if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $30.62; stop-loss: $36.14

- JDST ETF: initial target price: $59.68 stop-loss: $40.86

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

We love Italy. As many other tourists, we have been of course in Tuscany to hold up the Leaning Tower of Pisa. It’s great country, but its economy wobbles, not to mention dysfunctional and populist politics. Will the Leaning Tower of Italy fall, sinking the whole EU and boosting gold? We invite you to read our today’s article about the political and economical situation in Italy and find out what does it all imply for the gold market.

Will Italy Sink the EU and Boost Gold?

It was all about the FOMC Rate Decision release on Wednesday, and stocks' initial reaction to that news was slightly negative. The broad stock market extended its short-term consolidation along the resistance level. Will the uptrend continue or is this some topping pattern ahead of downward reversal? There are still two possible medium-term scenarios.

Topping Pattern or Just Pause Before Going Higher?

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold hits 2-week high on dollar weakness, weak China data, trade worries

J.P. Morgan Remains Bullish On Gold But Downgrades Price Forecasts

Top 10 Gold-Producing Countries

=====

In other news:

U.S. retail sales surge in May; weekly jobless claims fall

Euro tumbles as ECB vows to keep rate down

Draghi Ends ECB Bond-Buying Era Saying Economy Can Beat Risks

The euro could be nearing a crisis – can it be saved?

Saudis Say Deal to Gradually Boost OPEC Output `Inevitable'

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts