Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

The most interesting thing that we saw on the markets yesterday took place in mining stocks. Miners moved slightly higher, and they ended the session in the green. If their preceding weak performance relative to gold was bearish, then surely this was bullish, right? Not necessarily. The history rhymes after all, and sometimes the rhymes are very specific. What do I mean by that? As always, I mean that context is king. And this time, the king says “watch out”.

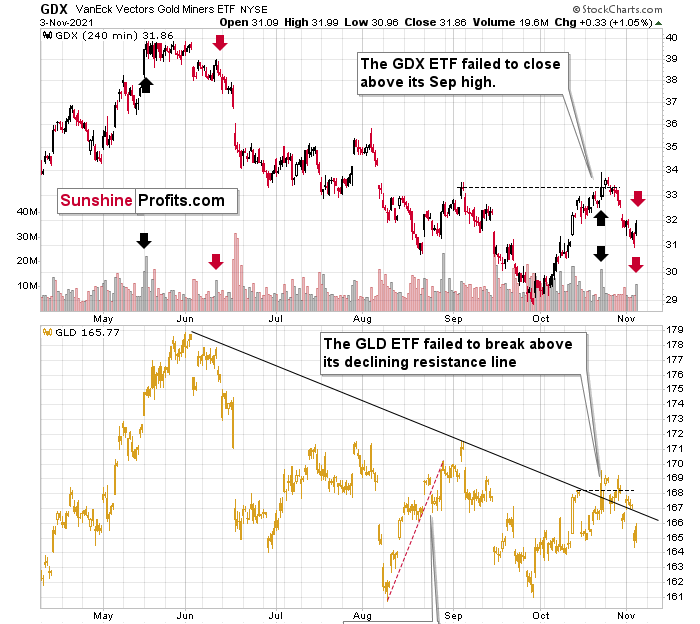

The above 4-hour GDX ETF chart allows us to see what happened in the first and second half of each session. In short, we saw the upswing – on quite strong volume – in the final part of the day. Was it truly a game-changer?

The context here is provided by the preceding decline and the rally that preceded the decline. The last time we saw something similar was in May and June. The similarity is not just in price movement, but also in terms of volume.

In both cases (in late October and in mid-May), the GDX topped on strong volume, then it moved back-and-forth for a few days, after which it declined again. However, before the decline accelerated and the GDX plunged, we first saw a small counter-trend (and fake!) sign of strength that materialized on relatively strong volume.

I marked the first (topping) volume spike with black arrows, and the final counter-trend (fake) rallies and their volume spikes with red arrows.

Did the history rhyme? That seems quite likely. And if so, the implications are not bullish, but bearish.

Also, since the rally and broad top in mid-2021 took longer to form than what we saw in October, we might also wait less for the decline’s continuation in this case than we did in June. In other words, bigger declines could be days, not weeks away. You will find additional explanations that I included in today’s video analysis of the above chart.

There’s no need to ask what the direct trigger could be for this kind of movement, because of two facts:

- A trigger is not needed for the market to move (in particular, for a market to decline). The moves can take place based on emotional reasons only.

- The trigger is likely to come from a rallying USD Index, anyway.

I know that I’ve been repeating myself for weeks, but that’s just how long the consolidation in the USD Index took.

The USD Index broke to new yearly highs, and it has more than confirmed this breakout. Since this move was verified, it’s clear that the USDX is now ready to move much higher, quite likely to its next strong resistance close to the 97.5 level.

All in all, the outlook for the precious metals sector remains bearish for the following weeks and the next few months.

Having said that, let’s take a look at the markets from a more fundamental point of view.

When You Wish Upon a Star

With Fed Chairman Jerome Powell still searching for his inflationary shooting star, the FOMC chief isn’t ready to label inflation as problematic. “I don’t think that we’re behind the curve,” he said. “I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

However, before we dissect all of the details from Powell’s press conference, the FOMC officially announced the death of QE on Nov. 3. To explain, with the Fed reducing its bond purchases by $15 billion per month (effective immediately), QE should hit net-zero in June 2022.

The precious metals reacted, and mining stocks even managed to show strength, and I discussed details of the implications of the upswing in the GDX in my video analysis today. .

Moving back to the fundamental issues - the FOMC’s monetary policy statement read:

“In light of the substantial further progress the economy has made toward the Committee's goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities.

“Beginning later this month, the Committee will increase its holdings of Treasury securities by at least $70 billion per month and of agency mortgage‑backed securities by at least $35 billion per month. Beginning in December, the Committee will increase its holdings of Treasury securities by at least $60 billion per month and of agency mortgage-backed securities by at least $30 billion per month.

“The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook.”

As a result, while taper clouds have hovered over the precious metals for months and helped upend their YTD performance, have we finally reached the fundamental ‘all-clear?’ Well, in a word, no.

The reality is: while Powell has taken the path of least resistance to help calm inflation (the taper), his inability to understand the realities on the ground leaves plenty of room for hawkish shifts in the coming months (interest rate hikes).

For example, Powell said during his press conference that “the inflation that we’re seeing is really not due to a tight labor market. It’s due to bottlenecks and it’s due to shortages and it’s due to very strong demand meeting those…. We don’t see troubling increases in wages, and we don’t expect those to emerge.”

And as for “transitory:”

“Transitory is a word that has had different understandings,” said Powell. “Really for us, what transitory has meant is that if something is transitory it will not leave behind permanently – or very persistently higher – inflation. So that’s why we took a step back from transitory. We said ‘expected to be transitory.’”

For context, all inflation is transitory. And depending on one’s time horizon, 25 years can be considered transitory. Thus, while Powell’s explanation of his forecasting error is quite humorous, the taper is now in the rearview. However, now it’s time for the second act:

“We don’t think it’s time yet to raise interest rates,” said Powell. “Our decision today to begin tapering our asset purchases does not imply any direct signal regarding our interest rate policy. We continue to articulate a different and more stringent test for the economic conditions that would need to be met before raising the federal funds rate.”

However, to repeat what I wrote on Oct. 26:

Originally, the Fed forecasted that it wouldn’t have to taper its asset purchases until well into 2022. However, surging inflation pulled that forecast forward. Now, the Fed forecasts that it won’t have to raise interest rates until well into 2023. However, surging inflation will likely pull that forecast forward as well.

To explain, when asked about the FOMC “chasing inflation” and why investors have priced in rate hikes in 2022, Powell responded:

“What’s happened, and we’re very, very straightforward about it: inflation has come in higher than expected. Bottlenecks have been more persistent and more prevalent; we see that just like everybody else does. And we see that they’re now on track to persist well into next year. That was not expected. Not expected by us. Not expected by other macro forecasters.”

For context, I wrote on Apr. 30:

With Powell changing his tune from not seeing any “unwelcome” inflation on Jan. 14 to “we are likely to see upward pressure on prices, but [it] will be temporary” on Apr. 28, can you guess where this story is headed next?

More importantly, though, when a reporter pointed out that the pace of the current taper is strikingly faster than 2013, Powell responded:

“This is faster than what people had expected six months ago. It’s earlier and faster…. And that’s partly because we see inflation coming in higher.”

For context, I wrote on May 26:

For weeks, I’ve been warning that the U.S. Federal Reserve (Fed) is likely to reduce its bond-buying program much sooner than investors expect. And while investors are happy to ignore the warning signs, it was only two weeks ago that Clarida called April’s CPI print “one data point” and said that “the economy remains a long way from our goals.” As a result, the markets are a lot like the weather, and things can change rather quickly.

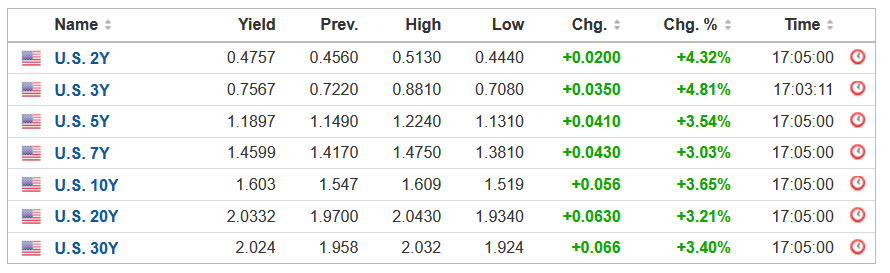

Thus, with “earlier and faster” likely to be repeated in the coming months, the fundamental outlook for the PMs is still quite treacherous. To explain, with U.S. Treausry yields rallying during Powell’s press conference, further momentum could elicit a re-enactment of the PMs’ drawdowns that we witnessed in early 2021.

Please see below:

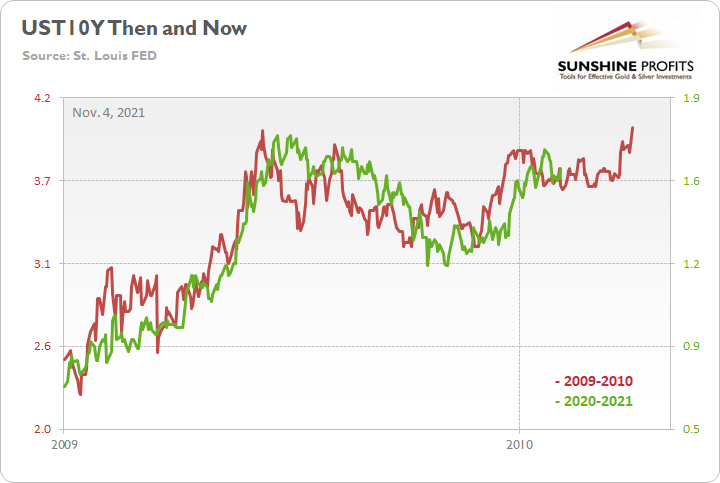

On top of that, while the U.S. 10-Year Treasury yield has consolidated in recent weeks, the benchmark is still following its 2009-2010 analogue.

To explain, the red line above tracks the U.S. 10-Year Treasury yield’s rally off of the bottom in 2009-2010, while the green line above tracks the U.S. 10-Year Treasury yield’s current move. If you analyze the fits and starts, you can see that excessive optimism often gives way to excessive pessimism. However, after the dust settled in 2009, the U.S. 10-Year Treasury yield continued its uptrend and ultimately made a new high.

For context, the yield fell off a cliff in April 2010, before another sharp rally ensued in October 2010 (which recouped most of the losses). However, the important point is that the second cliff arrived roughly four months after the U.S. 10-Year Treasury yield recorded its second bottom. As a result, with the pace of the current economic recovery tracking well ahead of 2009, it will likely take a Black Swan event to keep the U.S. 10-Year Treasury yield from following a similar script.

Finally, while I haven’t mentioned the Fed’s daily reverse repurchase agreements (repos) in some time, the liquidity drain will now be augmented by an official taper. For context, the Fed’s reverse repos haven’t hit a new daily high since Sep. 30. However, the daily average has made a new all-time high – increasing from $642 billion in June, to $848 billion in July, to $1.053 trillion in August, to $1.211 trillion in September, and now, to $1.426 trillion in October.

Please see below:

To explain, a reverse repo occurs when an institution offloads cash to the Fed in exchange for a Treasury security (on an overnight or short-term basis). And with U.S. financial institutions currently flooded with excess liquidity, they’re shipping cash to the Fed at an alarming rate.

And while I’ve been warning for months that the activity is the fundamental equivalent of a taper – due to a lower supply of U.S. dollars in the system (which is bullish for the USD Index) – the psychological effect is not the same. However, with an official taper now in place, the combination is fundamentally bullish for the U.S. dollar.

The bottom line? While the USD Index endured a ‘sell the news’ event on Nov. 3, the greenback’s fundamentals are stronger now than at any other point in 2021. And with Powell’s lack of foresight poised to elicit more hawkish shifts over the medium term, the dollar basket’s uptrend should remain in place for the foreseeable future. Furthermore, with U.S. Treasury yields likely to resume their uptrends as well, more downside should confront the PMs over the next few months.

In conclusion, the PMs were mixed on Nov. 3, as mining stocks ignored gold’s plight and rode the S&P 500 higher. However, stock market strength can only uplift the miners for so long and the GDXJ ETF will likely succumb to the technical and fundamental realities over the medium term. As a result, the bearish thesis remains intact and lower lows should materialize in the coming months.

Overview of the Upcoming Part of the Decline

- It seems to me that the current corrective upswing in gold is over, and the next short-term move lower is about to begin. Since it seems to be another short-term move more than it seems to be a continuation of the bigger decline, I think that junior miners are be likely to (at least initially) decline more than silver.

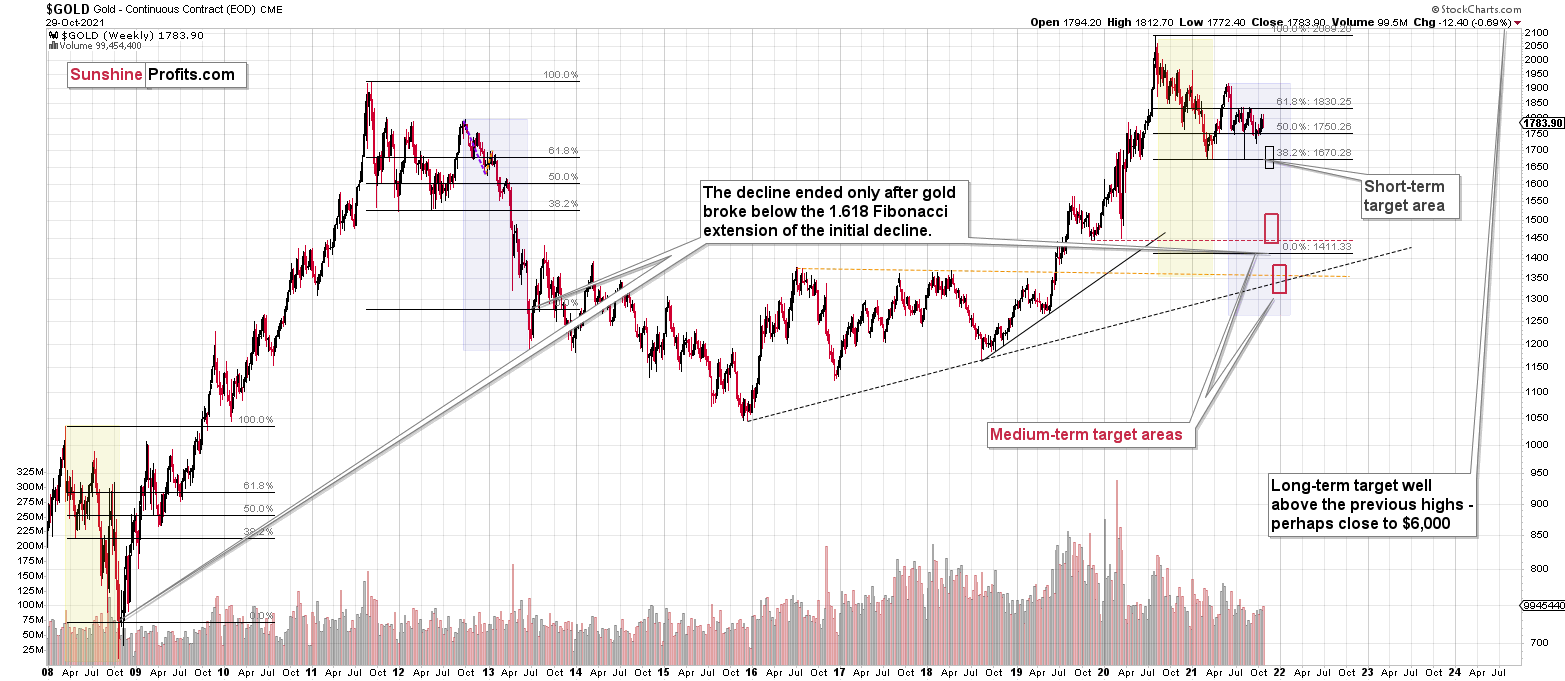

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions when gold shows substantial strength relative to the USD Index while the latter is still rallying. This might take place with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,375, but it’s too early to say with certainty at this time. I expect the final bottom to take place near the end of the year, perhaps in mid-December. It is not set in stone that PMs have to bottom at that time. If not then, then early 2022 would become a likely time target. The official start of tapering will serve as an additional indication or confirmation of the bottom.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops. The additional confirmation will come from the tapering schedule, as markets are likely to move on the rumor and reverse on the fact as they tend to do in general.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, the outlook for the precious metals sector remains extremely bearish for the next few months. Since it seems that the PMs are starting another short-term move lower more than it seems that they are continuing their bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years, or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $30.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief