Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

In yesterday’s analysis, I wrote the following:

It’s the Fed’s decision day, so we can expect to see lots of volatility in both directions, not only after the interest rate decision and during the following conference, but also beforehand, when investors try to guess what the Fed will do and say.

Yesterday’s close in the GDXJ was the second-lowest close that we’ve seen this year. Junior miners also broke – once again – below the early-2022 and late-2021 lows. Will this breakdown be completed?

Eventually? That’s extremely likely. This week? It’s still likely, but it’s not as clear.

You see, even if the Fed hikes rates by 0.75%, we could see an immediate decline, but that is then followed by a corrective rally, based on the “hey, at least it’s not 1%” approach and the fact that junior miners are so close to their previous lows.

What’s a trader to do given the above possibility?

Naturally, everyone will make the decision themselves, but in my opinion, what I wrote yesterday about the downside targets, remains intact. It is not the point to catch all the tiny corrections, but to focus on the ones that provide very good risk-to-reward ratios.

Consequently, I don’t plan to exit the short position even in the case of an immediate-term reversal or a rally. The analogies to 2008 indicate that it might be a good idea to do so when the GDXJ is trading close to the $27 level and when gold is trading close to its 2021 lows (below $1,700).

In other words, if gold declines to $1,650-1,690 today (and yes, that’s possible), then I will consider temporarily exiting the short position, but if that doesn’t happen, then I’ll probably not change the current position and I’ll simply let profits grow over time.

I also wrote that there might be some pressure for the (stock) market not to decline this week due to the specific situation in the options market.

Well, the above more or less materialized. We saw intraday volatility, and overall stocks and PMs moved higher in the at-least-it-is-not-1-percent style. What does it change here? Absolutely nothing.

Just as real interest rates were one of the two key drivers of gold prices (the other being the USD Index), before yesterday’s session, this is the case right now. Since they are moving higher, the pressure on gold will be to slide.

The markets were after rather volatile moves yesterday, and gold already declined on the initial news that there would be a 0.75% hike, so yesterday’s intraday action was rather normal, not something extraordinary and/or bullish. It’s simply a breather within a decline – no market can move up or down without periodic corrections, and we just saw one.

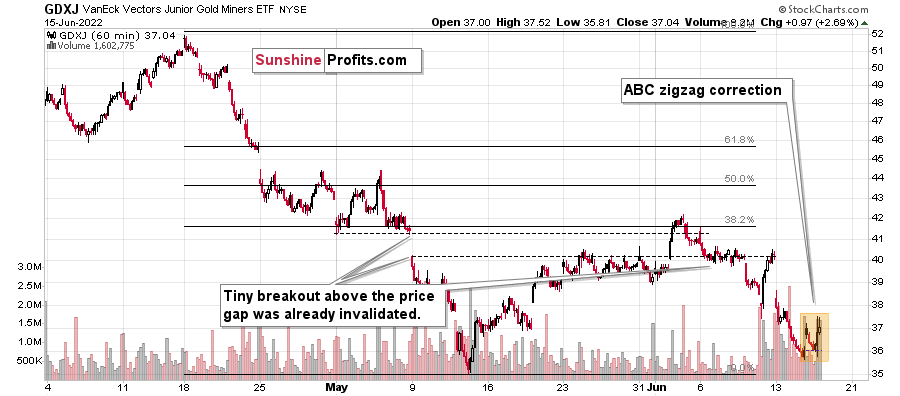

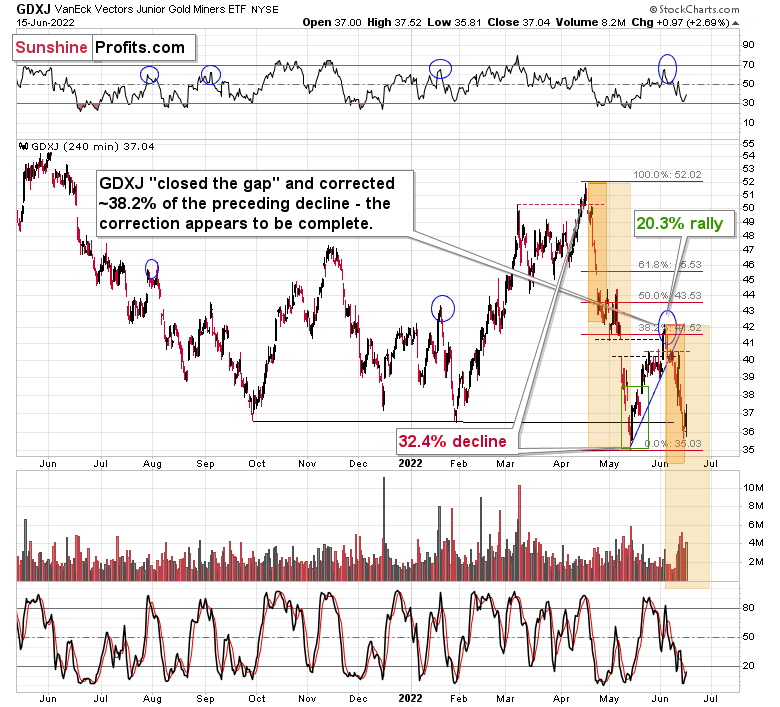

Interestingly, it took an ABC zigzag pattern shape in the case of GDXJ’s 1-hour candlestick chart.

That’s a fairly common way the markets correct previous price moves, so the pattern fits my other comments and analogies to previous huge declines.

Additionally, yesterday’s relatively small rally fits the midpoint of the April-May decline. The smaller rectangles on the above chart (there are smaller, more intensely colored rectangles within the bigger ones) are based on the initial part of the April-May decline. The small rectangle ended when the initial sharp part of the decline was over.

It didn’t mean that it was a good idea to close the short position that we had at that time, though. The following consolidation was relatively insignificant, and the slide continued shortly thereafter.

This time the price didn’t decline as much on a very short-term basis, but it did decline as long as it did back then, and many traders will confirm that time is more important than price.

Consequently, yesterday’s relatively small rally didn’t change anything, and the outlook remains extremely bearish for the following weeks and months. The profits on our short position in junior miners are likely to become much bigger, even if it doesn’t happen within the next few days.

Having said that, let’s take a look at the markets from a more fundamental point of view.

Another Squeeze, Don’t Panic

With the FOMC increasing interest rates by 75 basis points on Jun. 15, inflation has officially forced the Fed’s hand. Moreover, with the latest rise expanding the count to six rate hikes in 2022 (25 basis point increments), the tally puts us on recession watch.

However, with the PMs (and most assets) rallying during Chairman Jerome Powell’s press conference, I warned earlier in the day that a short squeeze could materialize. For context, it wasn’t a prediction. I simply noted that extremely bearish positioning could lead to a reversion. I wrote:

With the recent carnage across the financial markets rattling the bulls, sentiment and positioning are extremely stretched. Therefore, while a ‘sell the rumor, buy the news’ event may unfold, it’s prudent to stay focused on the S&P 500 and the GDXJ ETF’s medium-term downtrends.

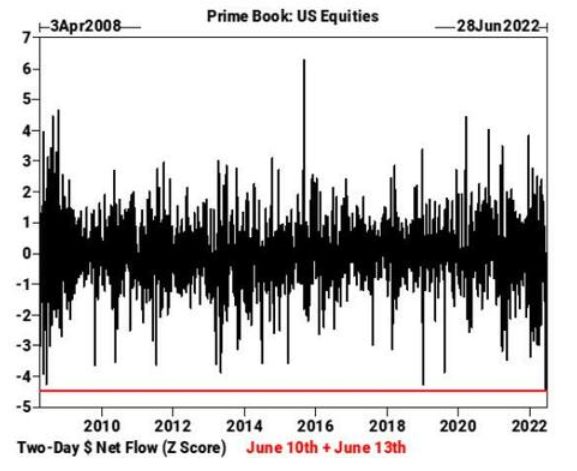

The liquidation frenzy (margin calls) that erupted recently coincided with hedge funds going on the largest two-day selling spree on record. If you analyze the chart below, you can see that Goldman Sachs’ prime brokerage data shows the z-score of combined net dollars sold on Jun. 10 and Jun. 13 exceeded the sell-off following the collapse of Lehman Brothers in 2008.

Thus, while it’s far from a sure thing, it’s prudent to note how these variables may impact the short-term price action.

As such, while the PMs enjoyed daily relief rallies, hedge funds’ cumulative net flows on Jun. 10 and Jun. 13 were more than four standard deviations below the average. Therefore, we’ve seen several short squeezes before, and they haven’t impacted the PMs’ medium-term trajectories.

The FOMC Statement and the June SEP

As mentioned, the FOMC increased interest rates by 75 basis points on Jun. 15. The release read:

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1‑1/2 to 1-3/4 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May.”

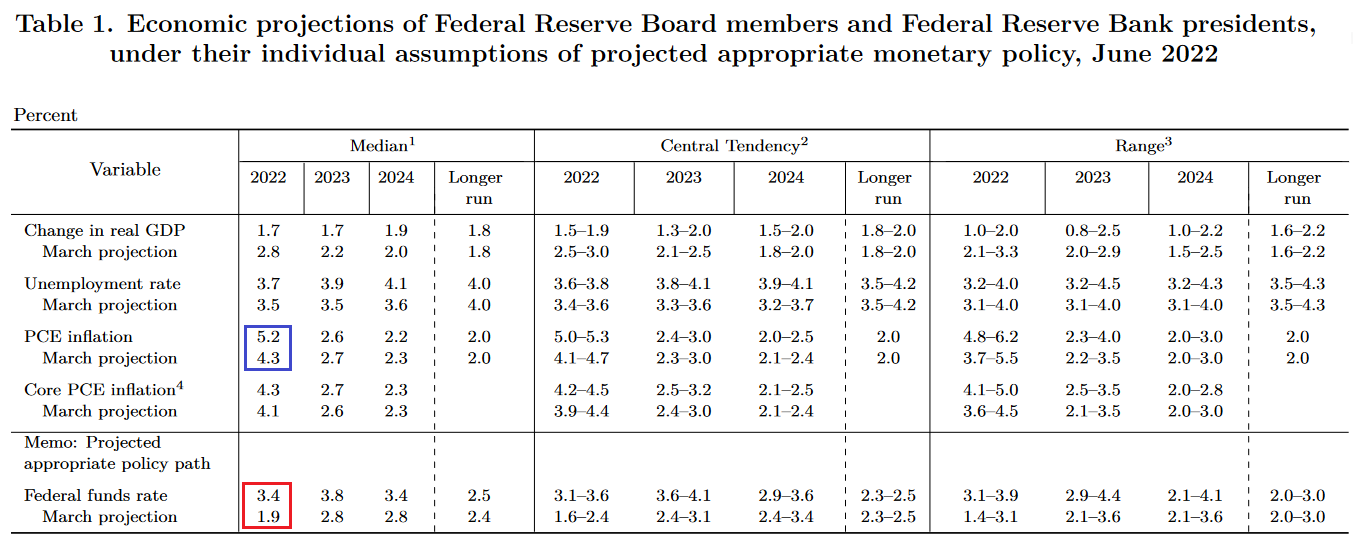

More importantly, the FOMC released its June Summary of Economic Projections (SEP).

Please see below:

To explain, the FOMC provides its economic forecasts every second meeting. If you analyze the blue box above, you can see that officials increased their median Personal Consumption Expenditures (PCE) index projection from 4.3% year-over-year (YoY) in March to 5.2% YoY in June. As a result, inflationary realities have proven forceful once again.

Furthermore, the red box at the bottom of the chart shows that officials’ median U.S. federal funds rate projection increased from 1.9% in March to 3.4% in May. Therefore, FOMC participants expect nearly 14 rate hikes in 2022.

For context, I have been bullish on the U.S. economy for a while and expected a much more hawkish Fed policy than the consensus. However, it’s a near certainty the U.S. will enter a recession as these rate hikes unfold.

Also noteworthy, officials’ median real GDP projection was cut from 2.8% in March to 1.7% in June. Moreover, I’ve long warned the Fed has to hike rates to contain inflation, and patience will only worsen the situation.

Yet, here we are. FOMC officials increased their inflation estimate and lowered their growth estimate, which has the mix going in the wrong direction. In addition, waiting only exasperates the ominous divergence. As such, that’s why I warned on Jun. 7 that hiking interest rates is the lesser of two evils. I wrote:

The Fed finds itself in a catch-22. Curbing inflation should lead to a recession, as nearly all bouts of unanchored inflation have ended with an economic downturn over the last ~70 years. Likewise, waiting for inflation to subside on its own would result in even more suffering.

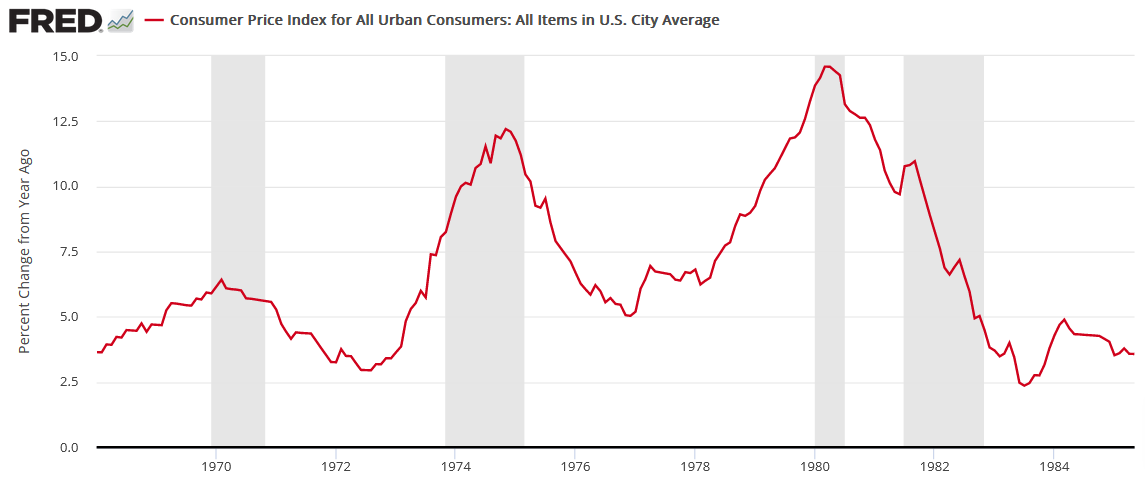

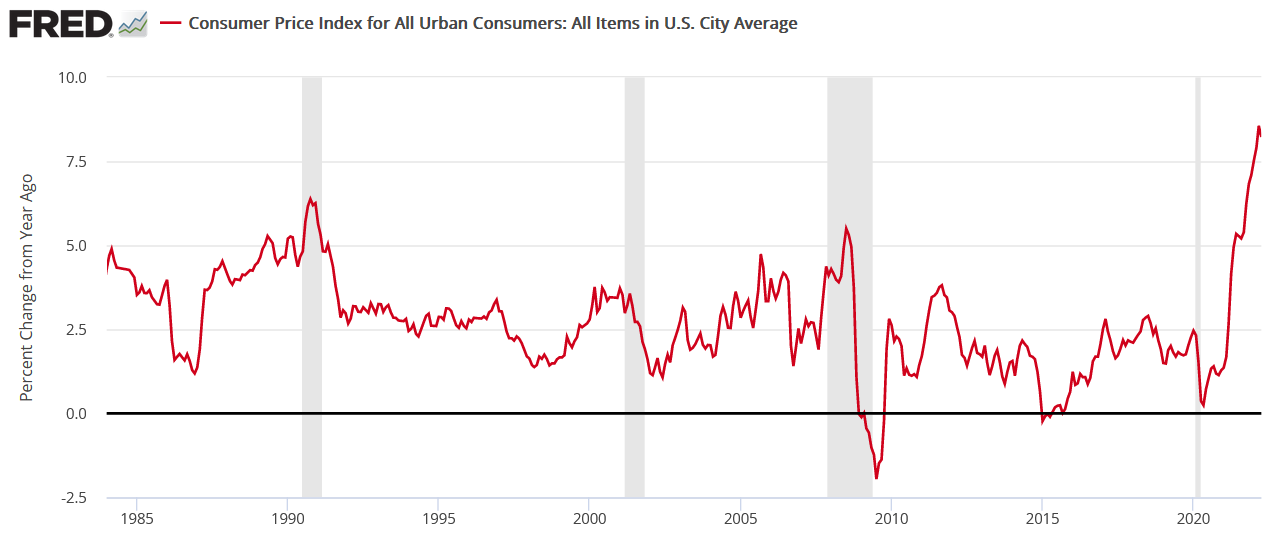

To explain, I noted above that unanchored inflation in the 1970s/1980s pushed the U.S. into recession four times over ~12 years. As such, that’s roughly one recession every three years. Conversely, stable inflation often coincides with a recession roughly every eight to 10 years.

Moreover, the chart below highlights how all of the post-1970/1980 recessions coincided with rising inflation (except for COVID-19). Thus, with the current inflation rate much higher than any of those periods and more similar to the 1970/1980s, the Fed and the BoC should know that the smaller and less frequent recessions below are preferable to the larger and more frequent recessions above. As a result, the post-GFC crowd suffers from recency bias, and fails to understand these economic challenges.

The Balancing Act

While the fundamentals of the FOMC’s SEP and the potential for ~14 rate hikes are extremely hawkish, Powell was relatively dovish during his press conference. Moreover, this statement near the beginning helped light a fire under risk assets.

“Clearly today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common,” Powell said. “From the perspective of today, either a 50-basis-point or a 75-basis-point increase seems most likely at our next meeting.”

Therefore, while another 50 or 75 basis point hike in July is profoundly hawkish, Powell puts to rest fears of panic-like 1% or more increases. As a result, it was enough to uplift sentiment.

In addition, Powell added:

“As mentioned, 75 basis points today and the next meeting could well be about a decision between 50 and 75; that would put us at the end of the July meeting in a more normal range and that’s a desirable place to be because you begin to have more optionality about the speed with which you proceed going forward.”

Thus, the statement also increases hope that the Fed could pause and reassess its outlook after the July meeting. Therefore, it assuages investors’ fears of a swift hiking cycle on autopilot.

However, after the sharp sell-offs across bonds and equities recently, it’s reasonable that Powell would attempt to calm the situation. While he helped to uplift daily sentiment, the realities of unanchored inflation and ~14 rate hikes will be much more important over the medium term.

For example, Powell said:

“The federal funds rate, even after this move, is at 1.6%. The committee is moving rates up expeditiously to more normal levels, and we came to the view that we’d like to do a little more front-end loading on that.”

He added:

“Committee participants widely would like to see policy at a modestly restrictive level at the end of this year” and “that is generally 3% to 3.5%.”

However, the most important quote of the press conference occurred when Powell was asked: does 3.8%-4% [federal funds rate] get the job done and break the back of inflation?

He responded:

“I think we’ll know when we get there. You would have positive real rates and inflation coming down. I think you would have positive real rates across the curve.”

Thus, Powell confirmed what I’ve been warning about for months: the Fed needs higher real yields to curb inflation. Moreover, while beneficiaries of lower real interest rates like Bitcoin, the ARK Innovation ETF, and the GDXJ ETF have suffered in 2022, I warned on Dec. 23, 2021 that the liquidity drain would take no prisoners. I wrote:

Please note that when the Fed called inflation “transitory,” I wrote for months that officials were misreading the data. As a result, I don’t have a horse in this race. However, now, they likely have it right. Thus, if investors assume that the Fed won’t tighten, their bets will likely go bust in 2022.

Finally, Powell also made my point about how further patience will only intensify inflation and exacerbate the stagflationary cocktail. For context, this was the second most important quote of the press conference. Powell said:

“The worst mistake we could make would be to fail. It’s not an option. We have to restore price stability. It’s the bedrock of the economy. If you don’t have price stability, the economy is really not going to work the way it’s supposed to. It won’t work for people. Their wages will be eaten up. So we want to get the job done.”

As a result, while Powell softened his overall tone to reduce the panic across the financial markets, the fundamentals of the day were clear:

- The FOMC increased its median rate hike projection to ~14 in 2022.

- Powell wants higher real interest rates.

- Letting inflation rage is “not an option.”

- The FOMC “widely” wants “a modestly restrictive” policy by the end of 2022.

Therefore, while I’ve stated this many times throughout 2021 and 2022, the PMs’ medium-term fundamental outlooks continue to worsen.

The Bottom Line

While Powell sounded relatively dovish, actions speak louder than words. Moreover, with six rate hikes on the books and another 50 to 75 basis point increase scheduled for July, that would take us to eight or nine 25 basis point rate hikes in 2022. In addition, with FOMC officials’ median estimate for the U.S. federal funds rate nearly doubling from 1.9% to 3.4%, the liquidity drain should occur even faster than expected a few months ago. As a result, the developments are profoundly bearish for the S&P 500 and the PMs.

Furthermore, while the USD Index and U.S. Treasury nominal and real yields declined on Jun. 15, we’ve seen this movie before. Investors often sell the news after strong rallies. Yet, all three keep climbing as the fundamental realities commence. Thus, this time should be no different.

In conclusion, the PMs rallied on Jun. 15, as Jay saved the day. However, their bearish medium-term fundamentals intensified. As such, while sentiment ruled the day, the optimism should evaporate in the coming weeks and months.

Naturally, as always, I’ll keep you – my subscribers – informed.

Overview of the Upcoming Part of the Decline

- It seems to me that the short-term rally in the precious metals market is over.

- We’re likely to (if not immediately, then soon) see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,600.

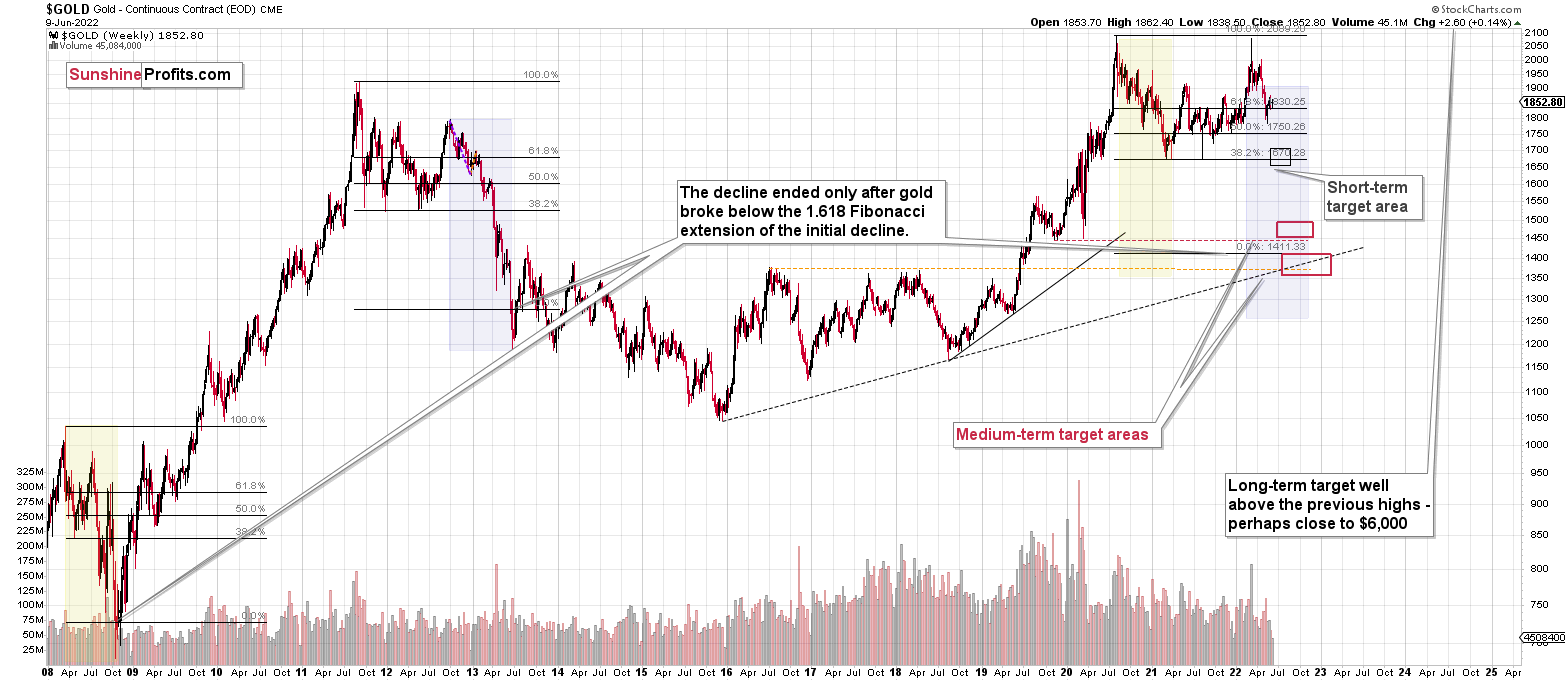

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is over, and the decline will now continue.

I previously wrote that the profits from the previous long position (congratulations once again) were likely to further enhance the profits on this huge decline, and that’s exactly what happened. The profit potential with regard to the upcoming gargantuan decline remains huge.

As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $27.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $18.35; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $17.22

SLV profit-take exit price: $16.22

ZSL profit-take exit price: $41.47

Gold futures downside profit-take exit price: $1,706

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $11.87

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $31.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief