Briefly: In our opinion speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective. We are adjusting the stop-loss levels, though, so in a way we are locking-in part of the profits from the current position and, at the same time, keeping a chance of increasing them.

While practically all points made in Monday’s alert remain up-to-date (so please read it if you haven’t had the chance to do it previously), yesterday’s decline might make you wonder if some things did change so we’ll comment on the latest developments in gold, silver and mining stocks. Let’s start with the former (charts courtesy of http://stockcharts.com).

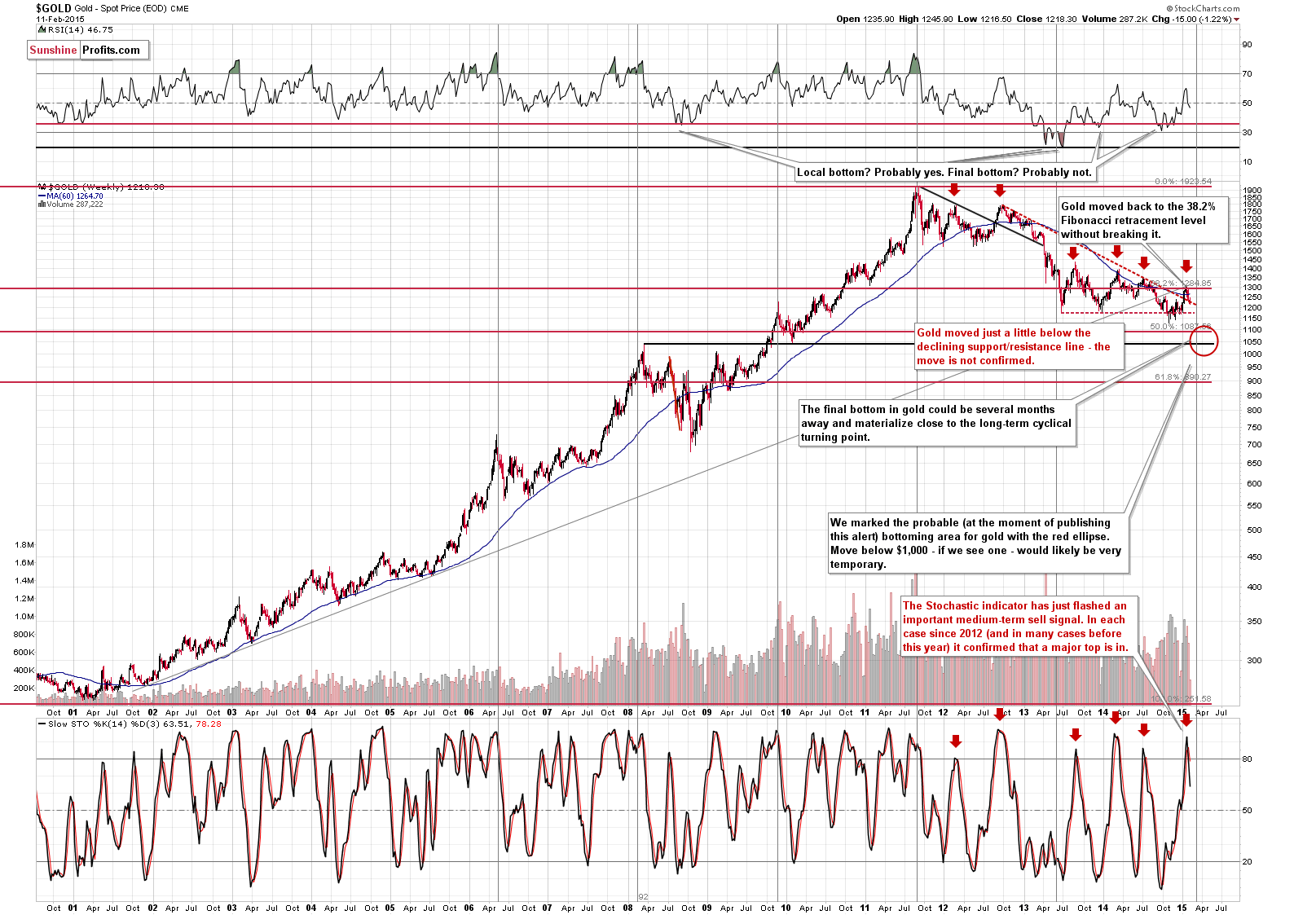

From the long-term perspective, gold moved lower, but not much lower. The move below the declining dashed resistance/support line was not significant and definitely not confirmed. Consequently, little changed from this perspective – the outlook is bearish, but not extremely bearish.

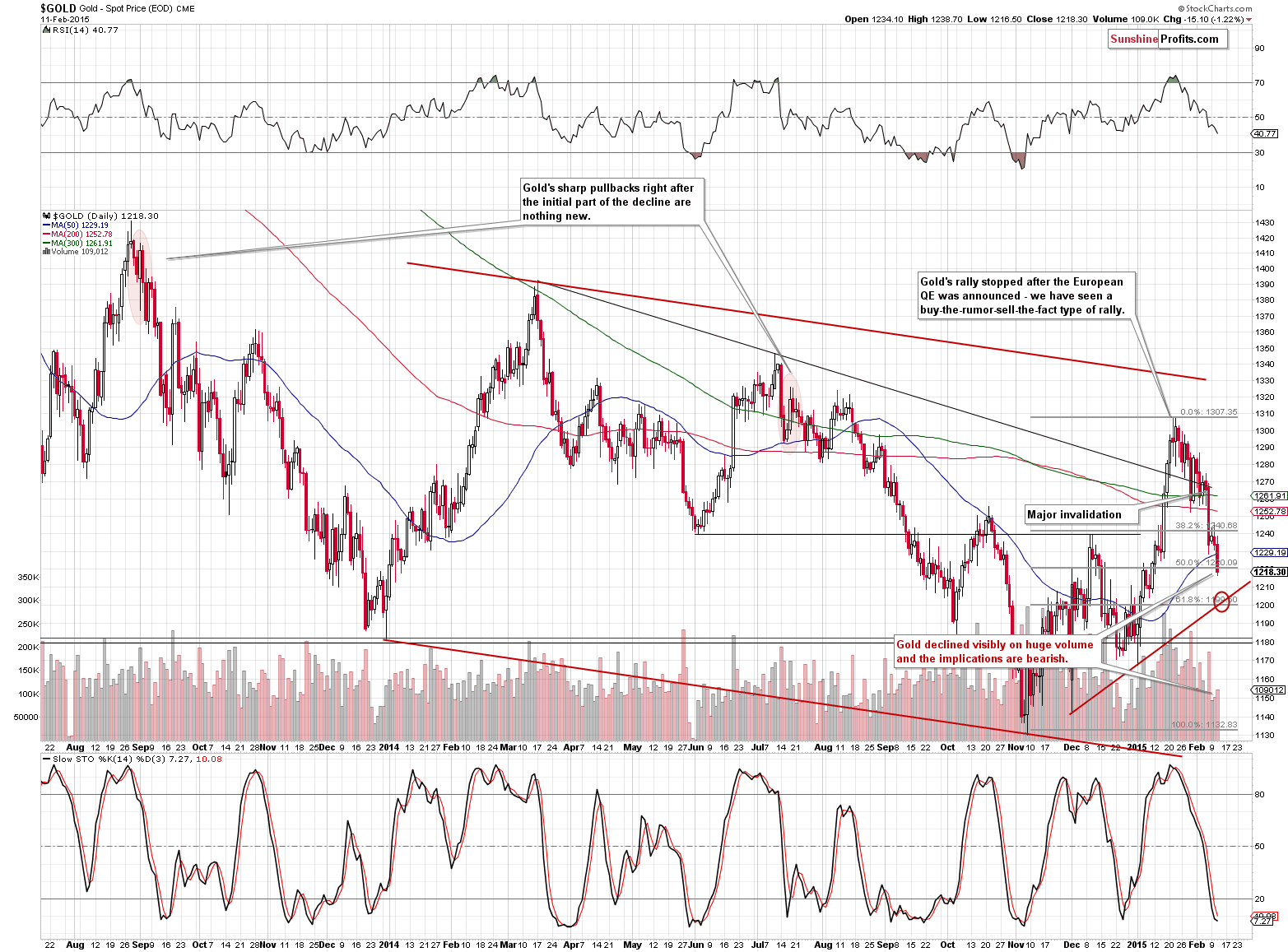

On a short-term basis we see that gold moved lower once again and that this move materialized on volume that was higher than what we had seen in the previous 2 days, but not higher than what we had seen during previous declines. The implications are bearish but not strongly bearish. Perhaps we will see a more visible bounce in the coming days (not necessarily right away).

The analysis of price levels suggests that the next interim target (but not the final target for this decline) is $1,200. That’s where the 61.8% Fibonacci retracement level and the rising short-term support line intersect. Plus, the $1,200 is a round number, which makes it significant from the psychological perspective. Will gold form a bottom at this level? A local one – quite likely. A final one – not likely.

Please note that the Stochastic indicator based on the daily prices is visibly below 20 and if we see some kind of strength, it will flash a buy signal. Based on the long-term picture, this signal is not likely to lead to a major rally, but let’s keep in mind that there have been quite a few cases when we saw a small counter-trend rally after similar signals, that were followed by further declines. Please consider the action that we saw after Nov. 11, 2013 and Aug. 25, 2014 - gold rallied by $25 or so and then declined once again. At this time we would not be surprised to see a move up from $1,200 to $1,220 - $1,230 that would be followed by further weakness.

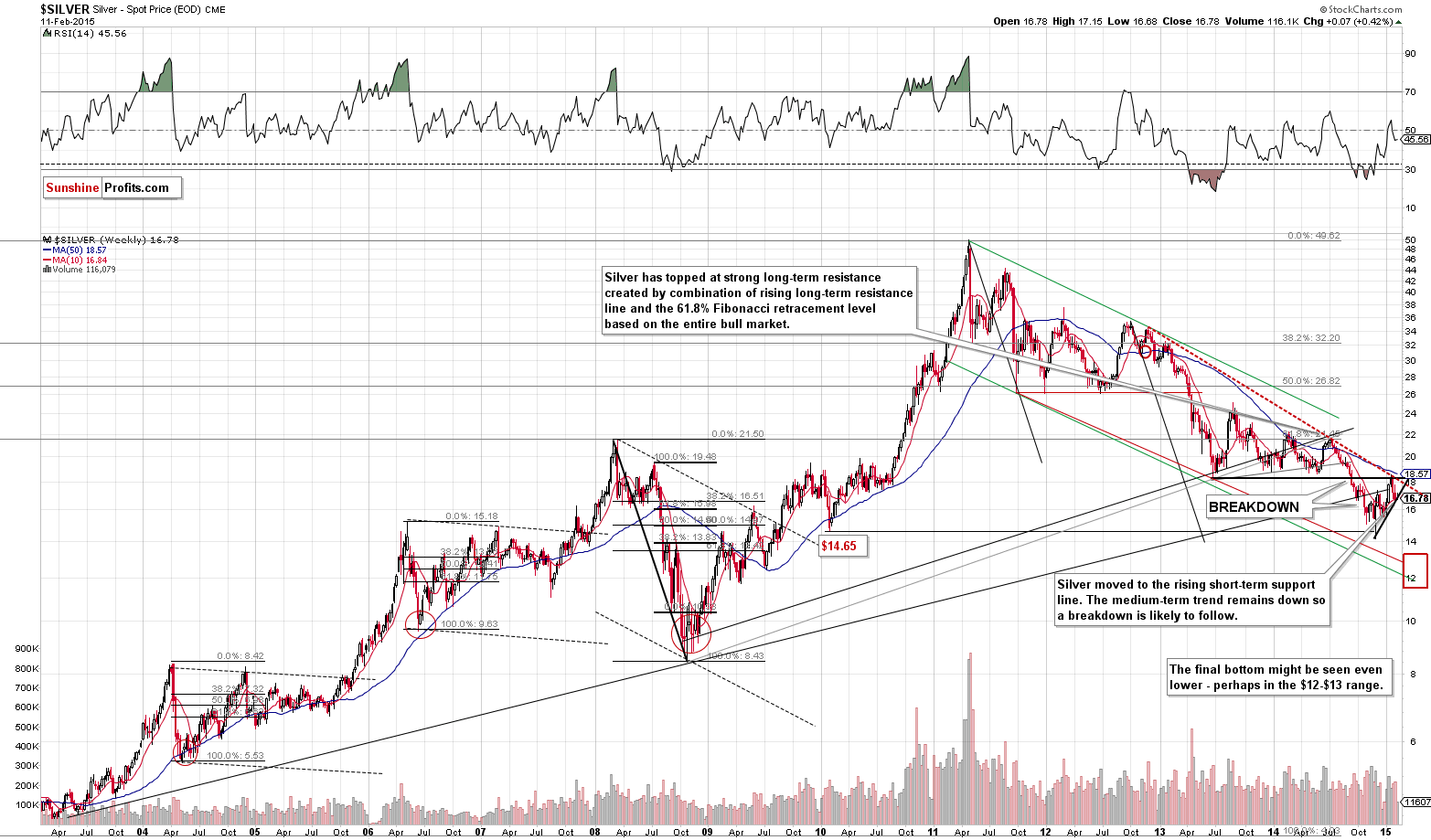

Moving on to the silver market, we see that there was no breakdown below the rising short-term support line. Is this a bullish observation? Not really. Silver is know to consolidate for longer than other parts of the precious metals sector and then to move in a manner that’s much more volatile than what we can see in other parts of the sector. At this time silver could be simply taking a bigger breather and in several days it could be catching up to a big extent. It’s not necessarily bullish – it’s normal.

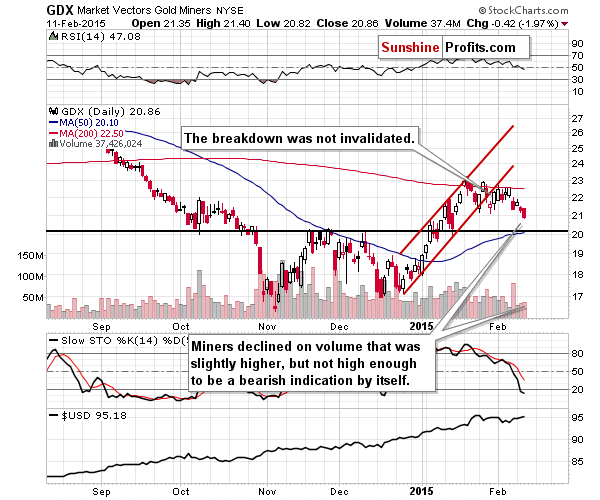

Mining stocks are declining as well, but not to a great extent. The move lower in the GDX ETF was not significant, especially compared to the one seen in gold. Overall, mining stocks are not underperforming gold at this time, which is concerning in light of the current short positions. There are no sell signs at this time, but perhaps the precious metals market needs to move higher once again (not necessarily significantly) before the major decline can continue.

The next support is slightly above the $20 level, at the Nov. and Dec. 2014 highs. It seems that it could correspond to the $1,200 level in gold if the entire precious metals sector moves lower.

Summing up, the outlook remains bearish, but we haven’t seen enough bearish confirmations to believe that the outlook has deteriorated even further (therefore we’re not making any adjustments to the long-term investment positions). At the same time, the situation has not become more bullish because of the relative strength of the mining stocks. It seems that we might see some kind of rebound relatively soon (after gold reaches the $1,200 level), but at this time it’s unclear if it will really materialize (after all we are right after major sell signals from the Stochastic indicator for gold and the HUI Index), so all in all, we think its best to leave the current positions intact and wait for additional signals before taking any action.

The only change that we’ll make today is moving the stop-loss orders a bit lower, thus securing bigger profits and at the same time allowing them to become even bigger.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks with the following stop-loss orders and initial (!) target prices:

- Gold: initial target level: $1,180; stop-loss: $1,263, initial target level for the DGLD ETN: $75.23; stop loss for the DGLD ETN $61.69

- Silver: initial target level: $15.70 ; stop-loss: $17.83, initial target level for the DSLV ETN: $66.25 ; stop loss for DSLV ETN $45.00

- Mining stocks (price levels for the GDX ETN): initial target level: $18.40 ; stop-loss: $23.37, initial target level for the DUST ETN: $18.99 ; stop loss for the DUST ETN $9.06

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: initial target level: $23.37; stop-loss: $28.57

- JDST: initial target level: $12.30 ; stop-loss: $6.89

Long-term capital (our opinion): Half positions in gold, half positions in silver, half position in platinum and half position in mining stocks.

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Tuesday, crude oil lost 2.80% as a combination of weak Chinese price data, and bearish reports from the International Energy Agency and the U.S. Energy Information Administration weighed on the price. In response to these circumstances, light crude declined, invalidating earlier breakouts and losing for the first time in four sessions. Does it mean that the recent rally is over?

Oil Trading Alert: Bearish Reports and Their Impact on Crude Oil

=====

Hand-picked precious-metals-related links:

Gold demand hits five-year low as jewellery, coin, bar sales slip - WGC

Central Banks Are Boosting Their Gold Reserves

Gold Demand Trends Full Year 2014

Interactive Infographic: 10 Countries With Highest Gold Reserves

Swiss Bank Says Investors Favor Gold Amid Charges on Cash

We’ve got a solid five years ahead of us – Randgold CEO

=====

In other news:

Ukraine Cease-Fire Sealed After All-Night Minsk Peace Summit

Greece, euro zone fail to agree on debt, to try again on Monday

Swedish quantitative easing surprise, Russia-Ukraine deal lift gloom

Little noticed, new Saudi king shapes contours of power

Top Anecdotal Signs of a Market Bubble

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts