-

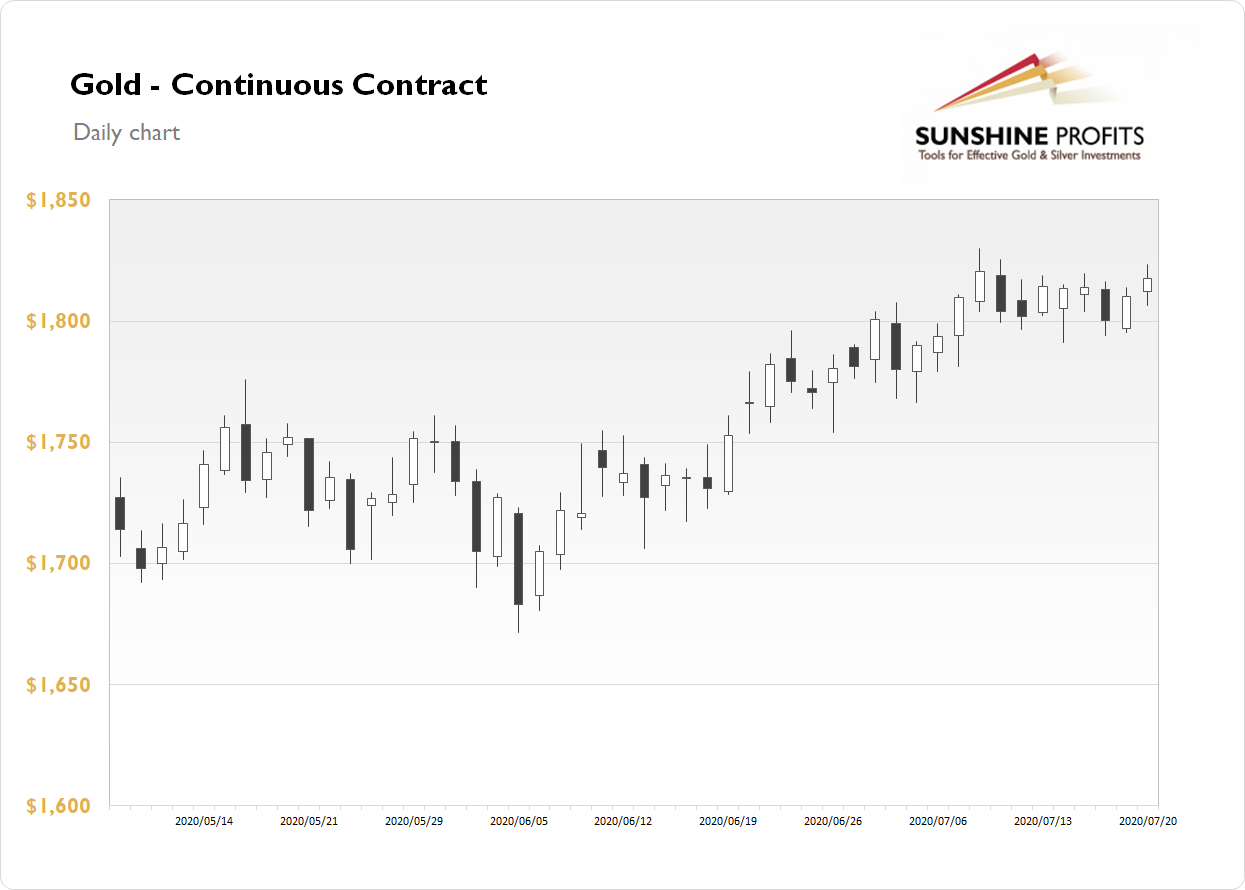

Daily Gold News: Tuesday, July 21 - Precious Metals Going Higher Again

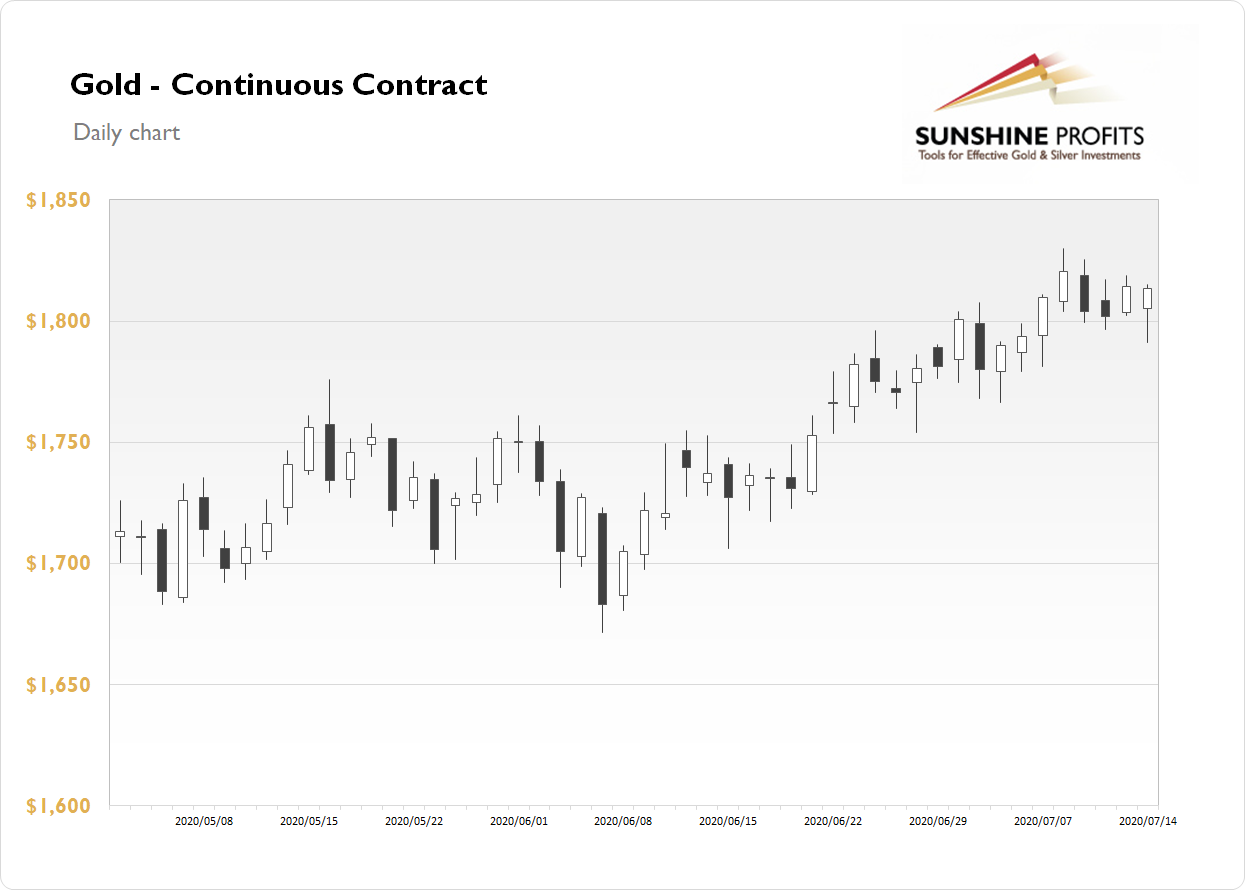

July 21, 2020, 7:58 AMThe gold futures contract gained 0.41% on Monday, as it extended its last Friday's advance of 0.5%. The market has retraced most of its relatively flat correction from new long-term high of around $1,830. The financial markets have been going risk-on following series of better-than-expected economic data and quarterly corporate earnings releases. Last month gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.5% higher this morning, as it is extending the uptrend. What about the other precious metals? Silver gained 2.17% on Monday and today it is gaining another 3.3%. Platinum gained 0.98% and today it is 1.9% higher. Palladium gained 1.82% and today it is gaining 3.8%. So precious metals are extending their uptrend this morning.

Last week's Friday's economic data releases have been mixed. Yesterday we didn't get any important economic data. However, the markets are reacting on the U.S. quarterly corporate earnings releases this week.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Tuesday, July 21

- 8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

Wednesday, July 22

- 8:30 a.m. Canada - CPI m/m

- 9:00 a.m. U.S. - HPI m/m

- 10:00 a.m. U.S. - Existing Home Sales

- All Day, Japan - Bank Holiday

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

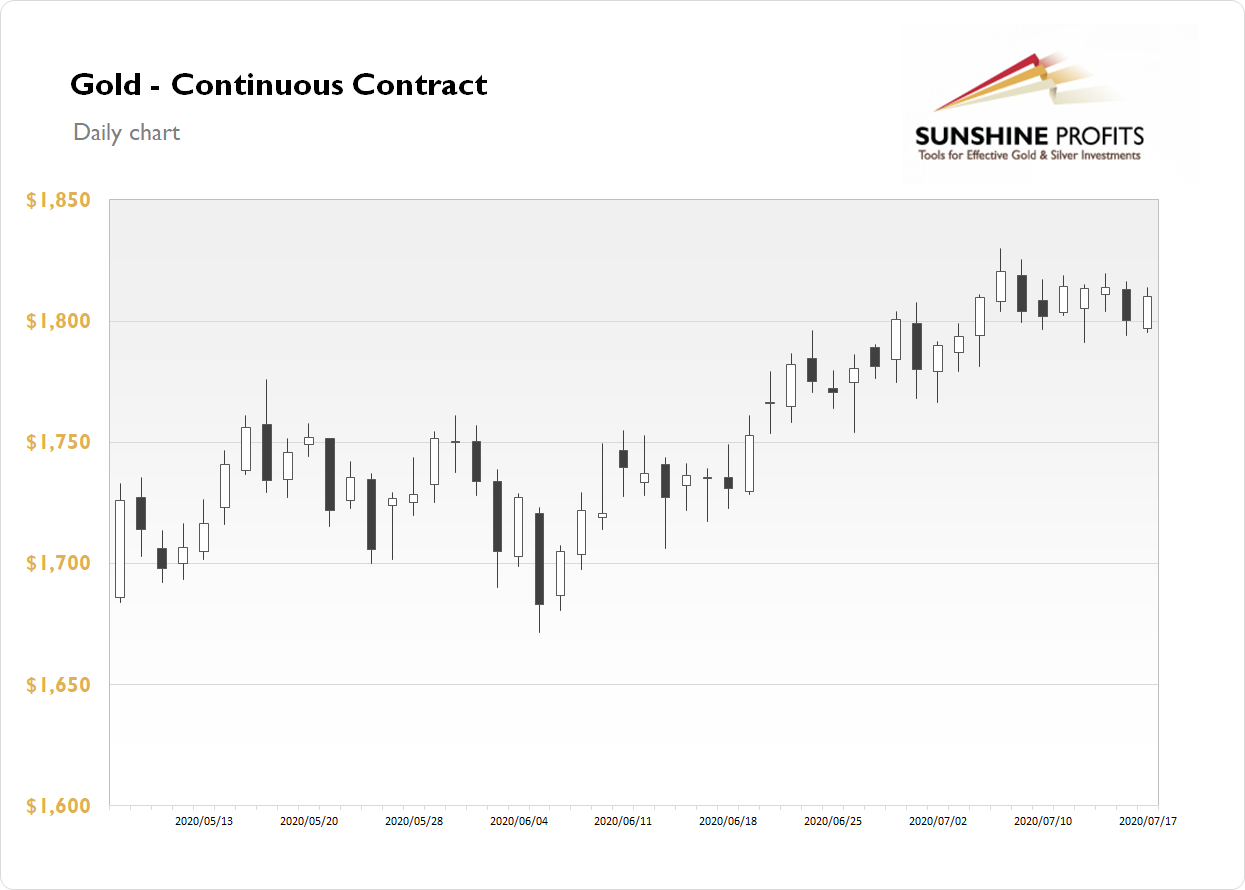

Daily Gold News: Monday, July 20 - Gold Extending Short-Term Advance

July 20, 2020, 8:03 AMThe gold futures gained 0.54% on Friday, as it further extended its short-term consolidation following the recent advance to new long-term high of $1,829.80. For now, it looks like a relatively flat correction within an uptrend. The financial markets have been going sideways recently, depsite series of better-than-expected economic data releases. Last month gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.2% higher this morning, as it's getting closer to its recent local high. What about the other precious metals? Silver gained 0.98% on Friday and today it is 1.2% higher. Platinum gained 1.51% and today it is 1.4% higher. Palladium gained 2.30% and today it is 1.3% higher. So precious metals are extending their short-term advance this morning.

Last week's Friday's housing market data have been basically as expected. But the Michigan Sentiment number has come out worse than expected. Today and tomorrow we won't get any important economic data releases. However, the markets will await series of the U.S. quarterly corporate earnings releases this week.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, July 20

- 10:30 p.m. Australia - RBA Governor Lowe Speech

- All Day, Eurozone - EU Economic Summit

Tuesday, July 21

- 8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

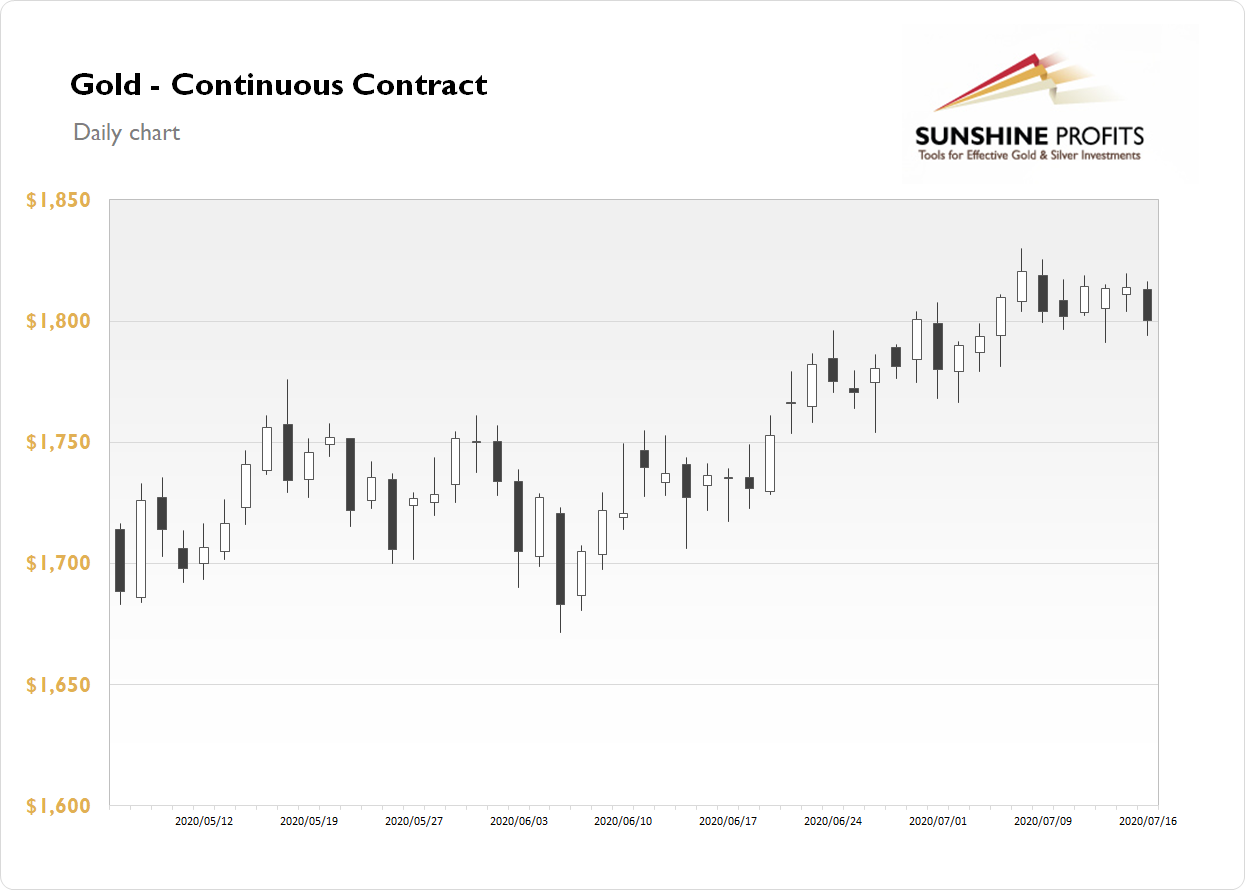

Daily Gold News: Friday, July 17 - Gold Above $1,800 Again

July 17, 2020, 7:28 AMThe gold futures lost 0.74% on Thursday, as it continued to fluctuate after last week's Wednesday's advance to new long-term high of $1,829.80. For now, it looks like a relatively flat correction within an uptrend. The financial markets have been going sideways recently, depsite series of better-than-expected economic data releases. Last month gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.5% higher this morning, as it is getting back slightly above $1,800 price level. What about the other precious metals? Silver lost 0.95% on Thursday and today it is trading 0.5% higher. Platinum lost 0.74% and today it is 0.9% higher. Palladium gained 0.75% and today it is 1.1% higher. So precious metals are advancing this morning.

Yesterday's U.S. Retail Sales number has been better than expected. However, the Unemployment Claims number has risen to 1,300 million vs. the expected value of 1,250 million. Today we will get the housing market data along with the Michigan Sentiment number.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for today:

Friday, July 17

- 8:30 a.m. U.S. - Building Permits, Housing Starts

- 10:00 a.m. U.S. - Preliminary UoM Consumer Sentiment

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

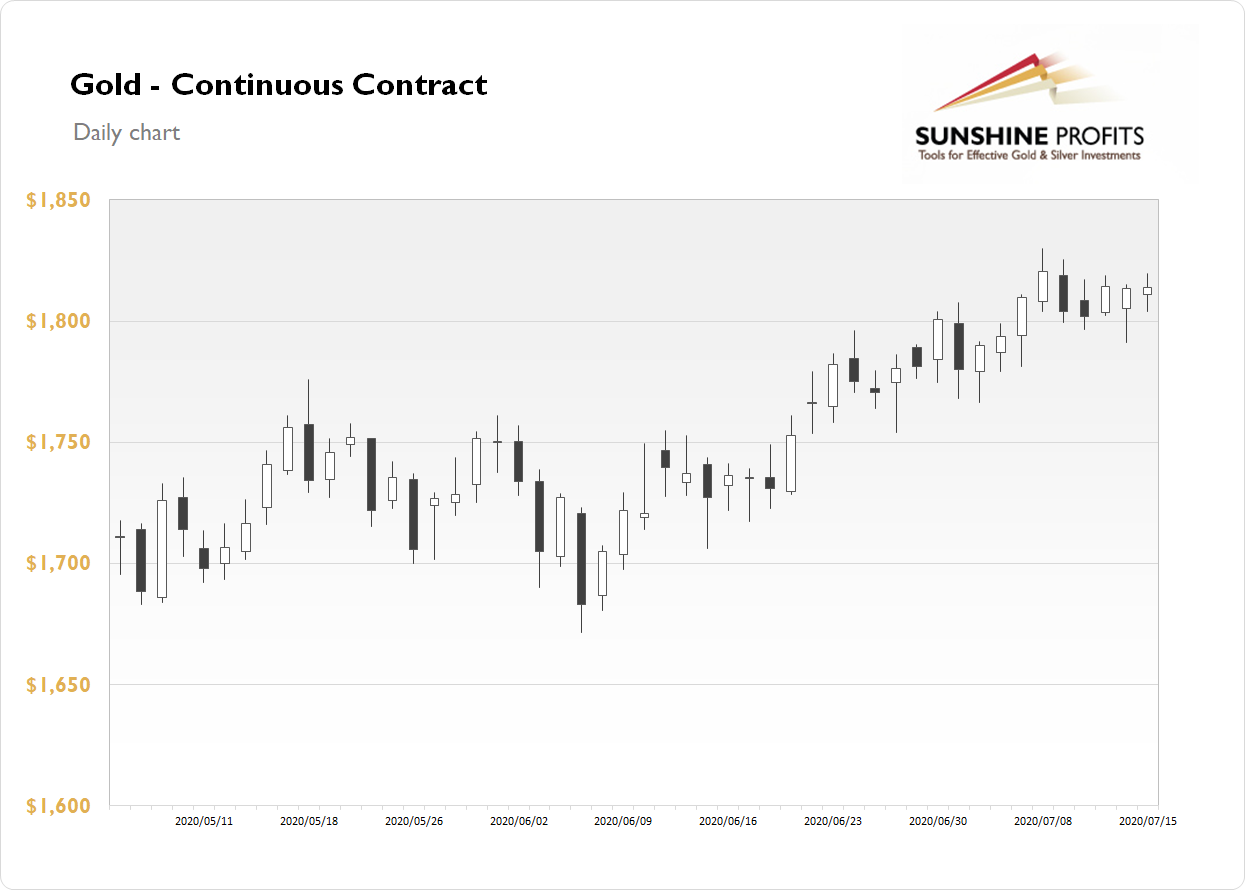

Daily Gold News: Thursday, July 16 - Gold Still Going Sideways Along $1,800 Price level

July 16, 2020, 8:23 AMThe gold futures contract gained 0.02% on Wednesday, as it further extended a short-term consolidation following last week's Wednesday's advance to new long-term high of $1,829.80. The recent economic data releases have been better than expected. Gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.4% lower this morning, as it continues to trade close to $1,800 price level. What about the other precious metals? Silver advanced 1.18% on Wednesday and today it is trading 1.1% lower. Platinum gained 0.76% and today it is 0.7% lower. Palladium gained 1.23% and today it is 0.75% lower. So precious metals' prices are going down this morning.

Yesterday's U.S. Industrial Production and China's GDP releases have been better than expected. Today the markets are waiting for the Retail Sales number release at 8:30 a.m., among others.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, July 16

- 7:45 a.m. Eurozone - Main Refinancing Rate, Monetary Policy Statement

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m, Unemployment Claims, Philly Fed Manufacturing Index

- 8:30 a.m. Eurozone - ECB Press Conference

- 8:30 a.m. Canada - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - Business Inventories m/m, NAHB Housing Market Index

- 11:10 a.m. U.S. - FOMC Member Williams Speech

Friday, July 17

- 8:30 a.m. U.S. - Building Permits, Housing Starts

- 10:00 a.m. U.S. - Preliminary UoM Consumer Sentiment

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Wednesday, July 15 - Gold Going Sideways After Last Week's Rally

July 15, 2020, 8:38 AMThe gold futures contract lost 0.04% on Tuesday, as it extended a short-term consolidation following last Wednesday's advance to new long-term high of $1,829.80. The recent economic data releases have been better than expected and financial markets have been going risk-on. Gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.2% lower this morning, as it continues to trade along $1,800 price level. What about the other precious metals? Silver lost 1.30% on Tuesday and today it is unchanged. Platinum lost 3.04% yesterday and today it is 1.2% higher, palladium lost 2.71% and today it is 0.2% higher. So precious metals are mixed again this morning.

Yesterday's U.S. Consumer Price Index release has been basically as expected at +0.6%. Today the markets are awaiting the U.S. Industrial Production number at 9:15 a.m. Then we will get Beige Book at 2:00 p.m. There will also be China's GDP announcement at 10:00 p.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Wednesday, July 15

- 2:30 a.m. Japan - BOJ Press Conference

- 8:30 a.m. U.S. - Empire State Manufacturing Index, Import Prices m/m

- 9:15 a.m. U.S. - Industrial Production m/m, Capacity Utilization Rate

- 10:00 a.m. Canada - BOC Monetary Policy Report, BOC Rate Statement, Overnight Rate

- 11:00 a.m. Canada - BOC Press Conference

- 12:00 a.m. U.S. - FOMC Member Harker Speech

- 2:00 p.m. U.S. - Beige Book

- 9:30 p.m. Australia - Employment Change, Unemployment Rate

- 10:00 p.m. China - GDP q/y

Thursday, July 16

- 7:45 a.m. Eurozone - Main Refinancing Rate, Monetary Policy Statement

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m, Unemployment Claims, Philly Fed Manufacturing Index

- 8:30 a.m. Eurozone - ECB Press Conference

- 8:30 a.m. Canada - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - Business Inventories m/m, NAHB Housing Market Index

- 11:10 a.m. U.S. - FOMC Member Williams Speech

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.

Gold News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver Trading Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM