-

Daily Gold News: Tuesday, July 28 - Gold's New Record High Followed by Sharp Downward Reversal

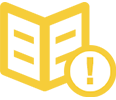

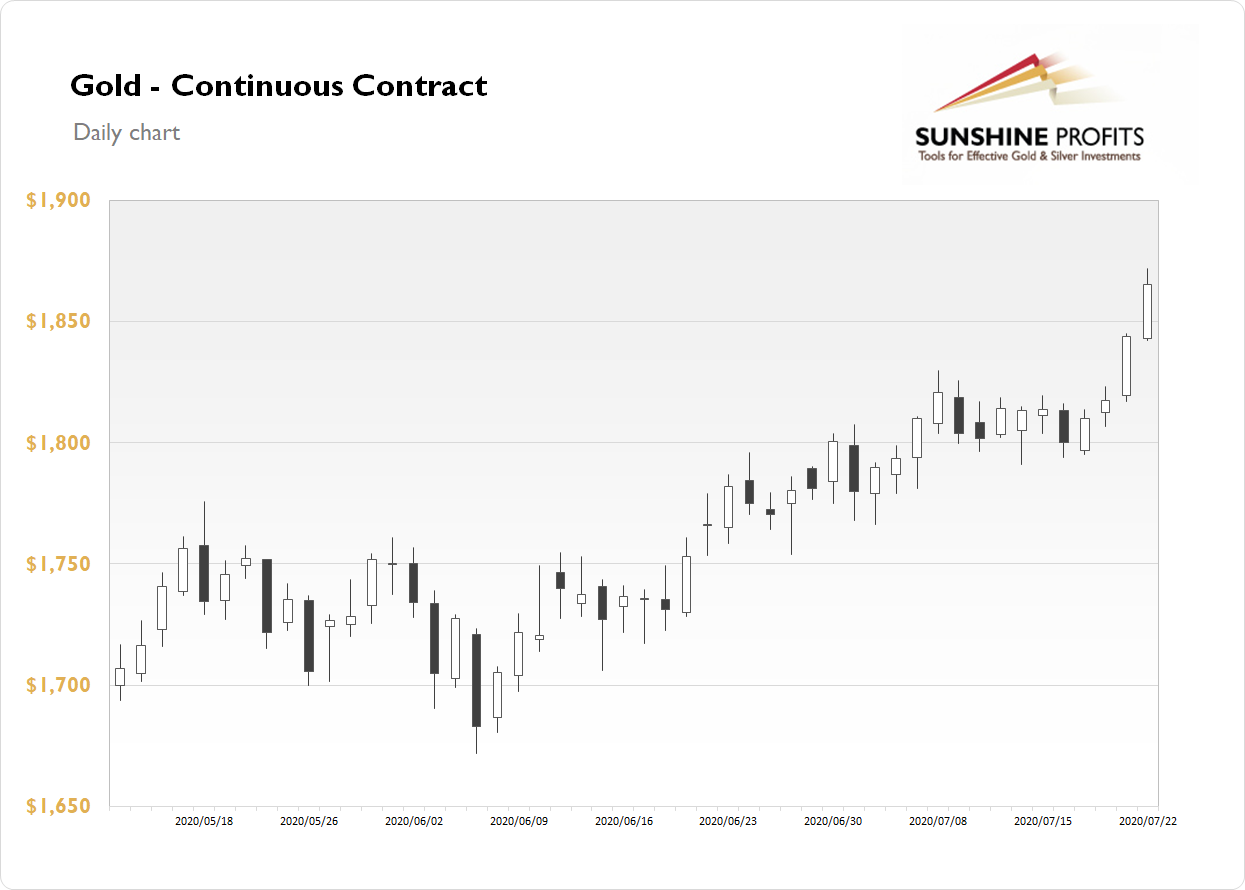

July 28, 2020, 7:49 AMThe gold futures contract reached new record high yesterday at the price level of $1,941.90, as it further extended the advance following recent breakout above the short-term trading range and $1,800 level. The yellow metal has reached the highest in history following U.S. dollar sell-off, among other factors. And overnight it reached close to $1,980, before sharply retracing that after-hours rally. Last month gold broke above medium-term local highs along $1,750 price level, as we can see on the daily chart:

Gold is 0.5% lower this morning after bouncing from $1,980 price level. The market traded at new record high. What about the other precious metals? Silver gained 7.23% on Monday and today it is 3.5 % lower following overnight reversal from $26 an ounce. Platinum gained 1.11% and today it's trading 3.2% lower. Palladium gained 3.30% and today it's 0.7% lower. So precious metals are retracing their overnight rally this morning.

Yesterday's U.S. Durable Goods Orders/ Core Durable Goods Orders numbers release has been mixed. Today we will get the relatively important CB Consumer Confidence release at 10:00 a.m.

But the markets will await tomorrow's FOMC Statement release and Thursday's U.S. Advance GDP number. The GDP is expected to decline by a stunning 35.0% q/q!

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Tuesday, July 28

- 9:00 a.m. U.S. - S&P/CS Composite-20 HPI y/y

- 10:00 a.m. U.S. - CB Consumer Confidence, Richmond Manufacturing Index

- 9:30 p.m. Australia - CPI q/q, Trimmed Mean CPI q/q

Wednesday, July 29

- 8:30 a.m. U.S. - Goods Trade Balance, Preliminary Wholesale Inventories m/m

- 10:00 a.m. U.S. - Pending Home Sales m/m

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate

- 2:30 p.m. U.S. - FOMC Press Conference

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Monday, July 27 - Gold at New Record High as U.S. Dollar Selling Continues

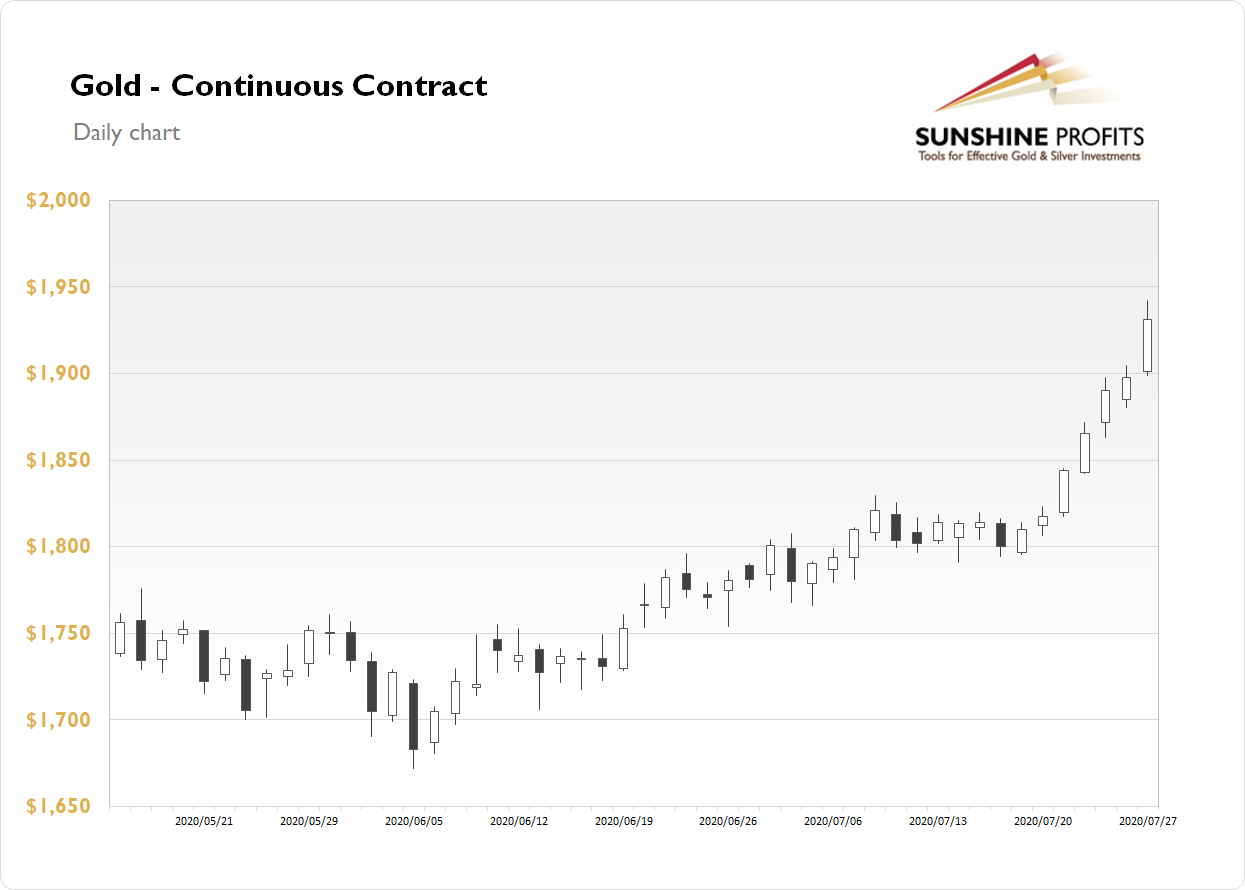

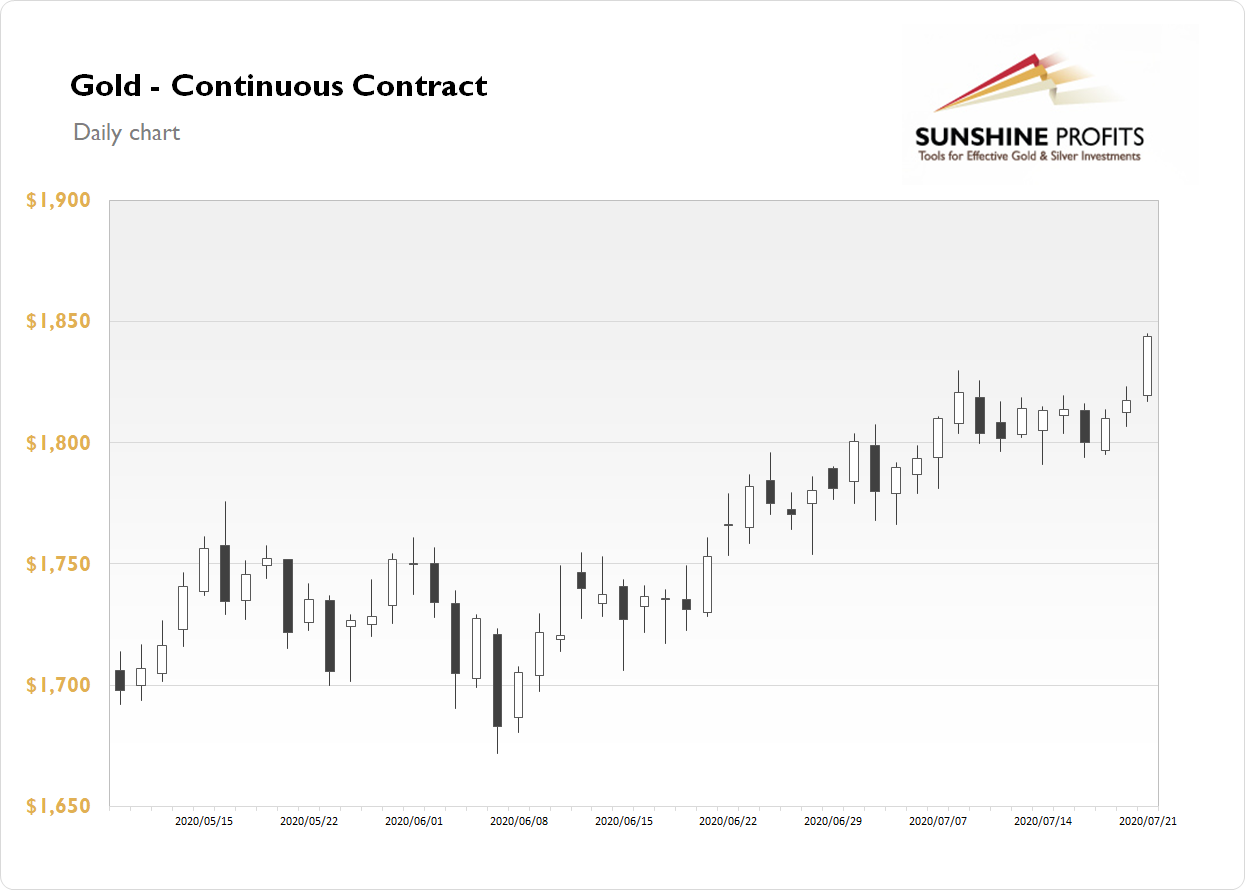

July 27, 2020, 7:49 AMThe gold futures contract gained 0.4% on Friday, as it extended its uptrend following recent breakout above the short-term trading range and $1,800 price level. The yellow metal has reached the highest since August-September of 2011 once again following U.S. dollar sell-off, among other factors. Last month gold broke above medium-term local highs along $1,750 price level, as we can see on the daily chart:

Gold is 2.2% higher this morning, as it is accelerating the uptrend. The market is at a new record high. What about the other precious metals? Silver lost 0.60% on Friday and today it is 7.7 % higher. Platinum lost 0.81% and today it's trading 3.1% higher. Palladium gained 2.42% and today it is 3.4% higher. So precious metals are extending their uptrend this morning.

Yesterday's U.S. Flash Manufacturing PMI/ Flash Services PMI releases have been slightly worse than expected. Today we will get the Durable Goods Orders number at 8:30 a.m. But the markets will await Wednesday's FOMC Statement release and Thursday's U.S. Advance GDP number. The GDP is expected to decline by a stunning 35.0% q/q!

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, July 27

- 4:00 a.m. Eurozone - German ifo Business Climate

- 6:00 a.m. Eurozone - German Buba Monthly Report

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

Tuesday, July 28

- 9:00 a.m. U.S. - S&P/CS Composite-20 HPI y/y

- 10:00 a.m. U.S. - CB Consumer Confidence, Richmond Manufacturing Index

- 9:30 p.m. Australia - CPI q/q, Trimmed Mean CPI q/q

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Friday, July 24 - Gold's Rally Reaching New High, Just Below $1,900

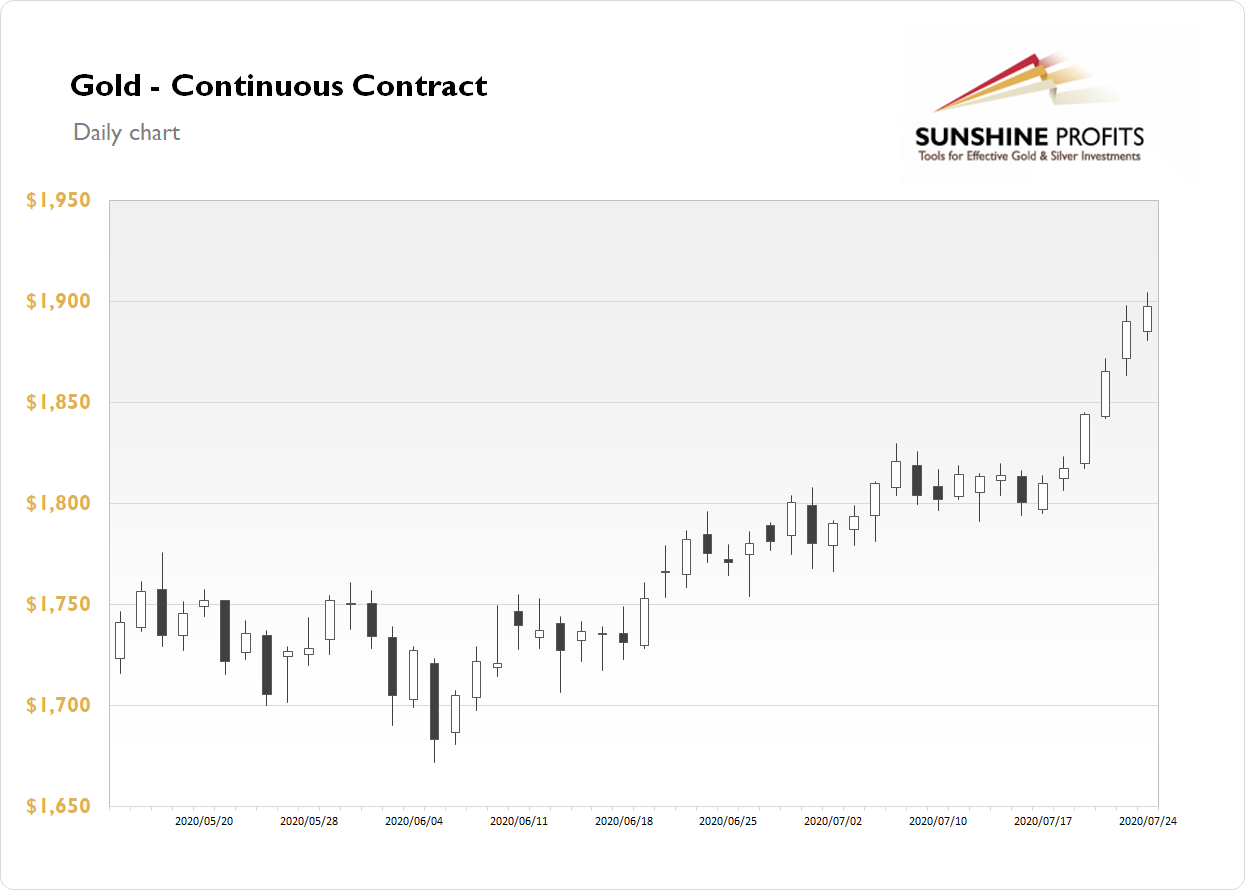

July 24, 2020, 7:34 AMThe gold futures contract gained 1.34% on Thursday, as it further extended its uptrend following recent breakout above the short-term trading range and $1,800 price level. The yellow metal has reached the highest since August-September of 2011 once again. Financial markets have been going risk-on following series of better-than-expected economic data and quarterly corporate earnings releases. Last month gold broke above medium-term local highs along $1,750 price level, as we can see on the daily chart:

Gold is 0.3% higher this morning, as it is fluctuating along yesterday's daily high. What about the other precious metals? Silver lost 0.67% on Thursday and today it is 0.1% higher. Platinum gained 0.67% and today it is trading 0.7% lower. Palladium gained 0.48% and today it's 1.4% higher. So precious metals are trading within a short-term consolidation this morning.

Yesterday's U.S. Unemployment Claims release has been worse than expected with a reading of over 1.4 million mark again. But today's Eurozone's PMI numbers have come out better than expected. The markets will wait for the U.S. Flash Manufacturing PMI/ Flash Services PMI release at 9:45 a.m. and then the New Home Sales release at 10:00 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for today:

Friday, July 24

- 3:15 a.m. Eurozone - French Flash Manufacturing PMI, French Flash Services PMI

- 3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

- 4:00 a.m. Eurozone - Flash Manufacturing PMI, Flash Services PMI

- 9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

- 10:00 a.m. U.S. - New Home Sales

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Thursday, July 23

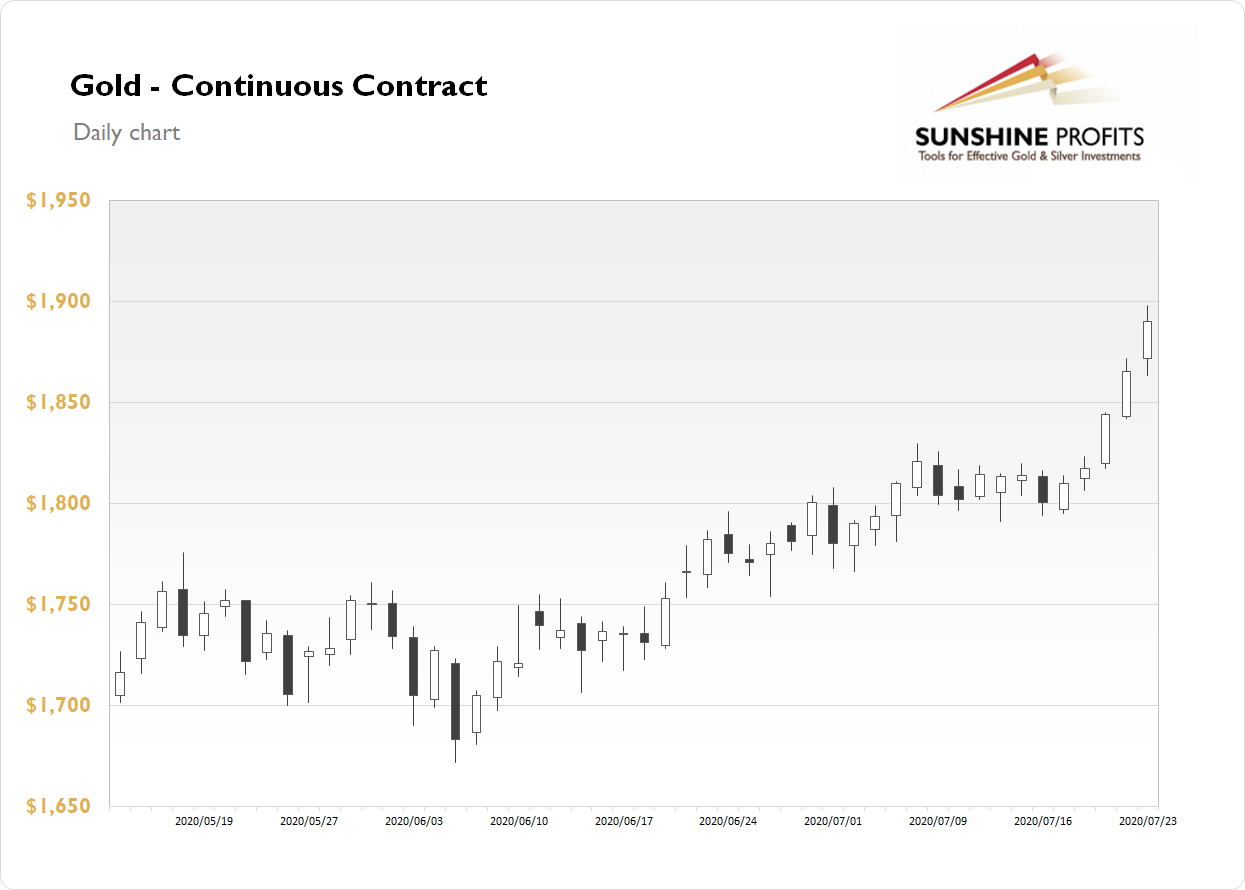

July 23, 2020, 7:19 AMThe gold futures contract gained 1.15% on Wednesday, as it accelerated its short-term uptrend following breaking above the recent trading range and $1,800 price level. The yellow metal has reached the highest since August-September of 2011. And silver has further extended its rally above $20 mark. The financial markets have been going risk-on following series of better-than-expected economic data and quarterly corporate earnings releases. Last month gold broke above medium-term local highs along $1,750 price level, as we can see on the daily chart:

Gold is 0.5% higher this morning, as it is further extending the uptrend. What about the other precious metals? Silver rallied 7.36% on Wednesday and today it is 1.1% lower. Platinum gained 4.19% and today it is 0.1% higher. Palladium gained 1.86% and today it's 0.7% higher. So precious metals fluctuate following their recent advances this morning.

Yesterday's U.S. Existing Home Sales release has been as expected. Today we will get the Unemployment Claims number at 8:30 a.m. and the CB Leading Index at 10:00 a.m. The markets will also wait for more quarterly corporate earnings and tomorrow's PMI's releases.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, July 23

- 8:30 a.m. U.S. - Unemployment Claims

- 10:00 a.m. U.S. - CB Leading Index m/m

- All Day, Japan - Bank Holiday

Friday, July 24

- 3:15 a.m. Eurozone - French Flash Manufacturing PMI, French Flash Services PMI

- 3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

- 4:00 a.m. Eurozone - Flash Manufacturing PMI, Flash Services PMI

- 9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

- 10:00 a.m. U.S. - New Home Sales

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Tuesday, July 22 - Silver Soaring After Breaking Above $20

July 22, 2020, 8:20 AMThe gold futures contract extended its uptrend on Tuesday, as it gained 1.46% following weakening U.S. dollar amid the Eurozone stimulus news. The market has broken above its recent trading range along the $1,800 price level. The financial markets have been going risk-on following series of better-than-expected economic data and quarterly corporate earnings releases. Last month gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.8% higher this morning, as it is further extending the uptrend. What about the other precious metals? Silver rallied 6.76% on Tuesday and today it is gaining another 7.3%. Platinum gained 7.11% and today it is 1.1% higher. Palladium gained 3.74% and today it is gaining 1.2%. So precious metals are extending their uptrend this morning and silver remains particularly strong.

Last week's Friday's economic data releases have been mixed. On Monday and Tuesday we didn't get any important economic data. However, the markets are reacting on the U.S. quarterly corporate earnings releases this week. Today we will get the Existing Home Sales number at 10:00 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Wednesday, July 22

- 8:30 a.m. Canada - CPI m/m

- 9:00 a.m. U.S. - HPI m/m

- 10:00 a.m. U.S. - Existing Home Sales

- All Day, Japan - Bank Holiday

Thursday, July 23

- 8:30 a.m. U.S. - Unemployment Claims

- 10:00 a.m. U.S. - CB Leading Index m/m

- All Day, Japan - Bank Holiday

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.

Gold News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver Trading Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM