-

Daily Gold News: Tuesday, September 29 - Gold Closer to $1,900 Price Level Again

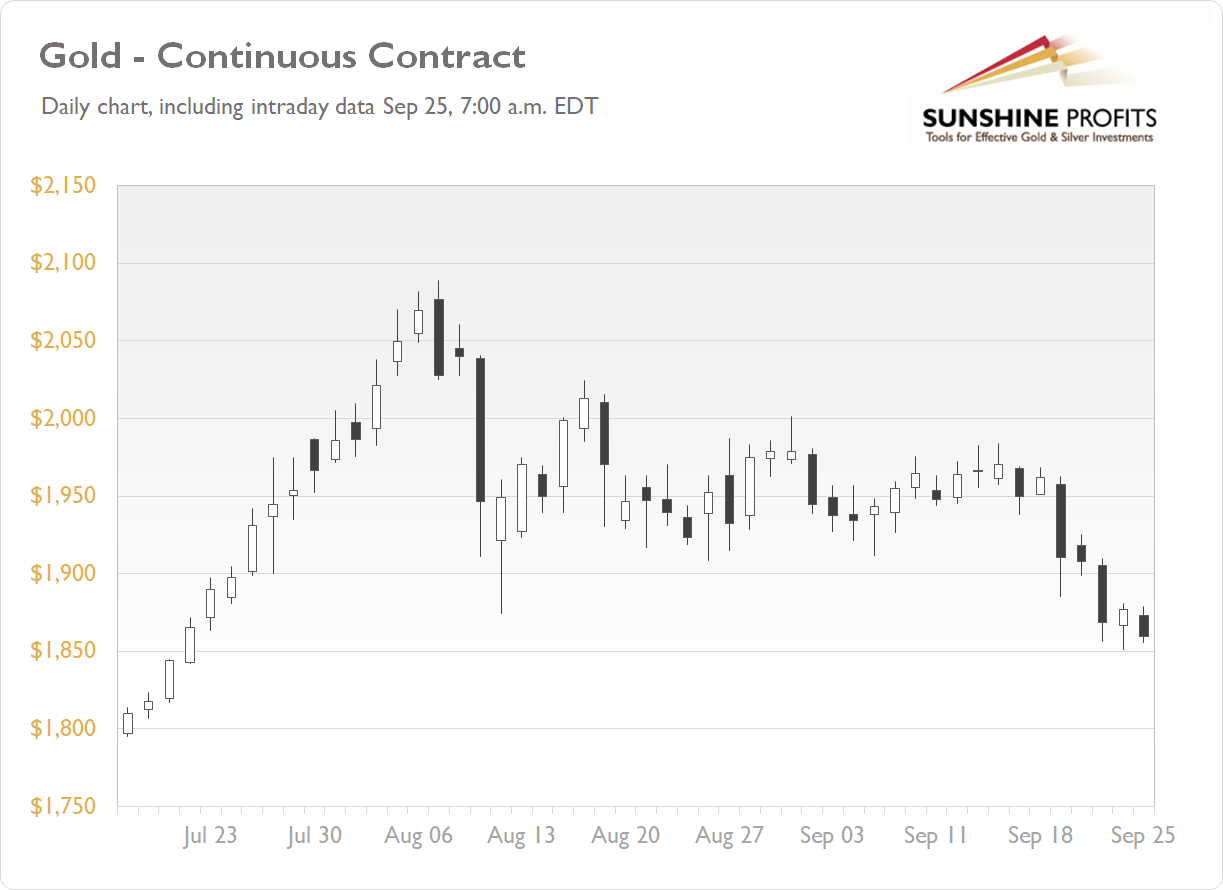

September 29, 2020, 7:02 AMThe gold futures contract gained 0.86% on Monday, as it retraced some of last week's decline following breaking below the price level of $1,900. But the market came down to around $1,850 level again yesterday, before moving back closer to $1,900. Recently gold was retracing its rally from around $1,800 to August 7 record high of $2,089.20 in reaction to U.S. dollar rally, among other factors. Gold also broke below mid-August local low, as we can see on the daily chart (the chart includes today's intraday data):

Gold is 0.1% higher this morning, as it is extending a short-term uptrend. What about the other precious metals? Silver gained 2.21% on Monday and today it is 0.2% higher. Platinum gained 5.87% and today it is 0.7% lower. Palladium gained 2.22% on Monday and today it's 0.2% lower. So precious metals are going sideways this morning.

On Monday we didn't get any new important economic data releases. Today we will get the Consumer Confidence number release at 10:00 a.m. And there will be a lot of Fed talk.

The markets are waiting for the important monthly jobs data release on Friday.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Tuesday, September 29

- 8:30 a.m. U.S. - Preliminary Wholesale Inventories m/m, Goods Trade Balance

- 9:15 a.m. U.S. - FOMC Member Williams Speech

- 9:30 a.m. U.S. - FOMC Member Harker Speech

- 10:00 a.m. U.S. - CB Consumer Confidence

- 11:40 a.m. U.S. - FOMC Member Clarida Speech

- 1:00 p.m. U.S. - FOMC Member Quarles Speech, FOMC Member Williams Speech

- 3:00 p.m. U.S. - FOMC Member Quarles Speech

- 9:00 p.m. China - Manufacturing PMI, Non-Manufacturing PMI

- 9:45 a.m. China - Caixin Manufacturing PMI

Wednesday, September 30

- 3:20 a.m. Eurozone - ECB President Lagarde Speech

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 8:30 a.m. U.S. - Final GDP q/q, Final GDP Price Index q/q

- 8:30 a.m. Canada - GDP m/m

- 9:45 a.m. U.S. - Chicago PMI

- 10:00 a.m. U.S. - Pending Home Sales m/m

- 11:00 a.m. U.S. - FOMC Member Kashkari Speech

- 1:40 p.m. U.S. - FOMC Member Bowman Speech

- All Day, China - Bank Holiday

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Monday, September 28 - Precious Metals' Short-Term Consolidation Continues

September 28, 2020, 7:11 AMThe gold futures contract lost 0.56% on Friday, as it extended a short-term consolidation following the decline after breaking below the price level of $1,900. The market reached the lowest since late July last week. Gold keeps retracing its rally from around $1,800 to August 7 record high of $2,089.20 in reaction to U.S. dollar rally, among other factors. Gold also broke below its mid-August local low, as we can see on the daily chart (the chart includes today's intraday data):

Gold is 0.1% lower this morning, as it is trading along Friday's daily closing price. What about the other precious metals? Silver lost 0.4% on Friday and today it is 0.1% higher. Platinum gained 0.48% and today it is 1.7% higher. Palladium lost 0.21% on Friday and today it's 1.2% higher. So precious metals are mixed this morning.

Friday's Durable Goods Orders release has been worse than expected. Today we won't get any important data releases. However, there will be a lot of Fed and ECB talk this week. We will also have the important monthly jobs data release on Friday.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, September 28

- 9:45 a.m. Eurozone - ECB President Lagarde Speech

- 2:00 p.m. U.S. - FOMC Member Mester Speech

Tuesday, September 29

- 8:30 a.m. U.S. - Preliminary Wholesale Inventories m/m, Goods Trade Balance

- 9:15 a.m. U.S. - FOMC Member Williams Speech

- 9:30 a.m. U.S. - FOMC Member Harker Speech

- 10:00 a.m. U.S. - CB Consumer Confidence

- 11:40 a.m. U.S. - FOMC Member Clarida Speech

- 1:00 p.m. U.S. - FOMC Member Quarles Speech, FOMC Member Williams Speech

- 3:00 p.m. U.S. - FOMC Member Quarles Speech

- 9:00 p.m. China - Manufacturing PMI, Non-Manufacturing PMI

- 9:45 a.m. China - Caixin Manufacturing PMI

-

Daily Gold News: Friday, September 25 - Gold's Short-Term Consolidation Following Recent Declines

September 25, 2020, 7:16 AMThe gold futures contract gained 0.45% on Thursday, as it fluctuated following the decline after breaking below the price level of $1,900. The market reached the lowest since late July. Gold keeps retracing its rally from around $1,800 to August 7 record high of $2,089.20 in reaction to U.S. dollar rally, among other factors. Gold also broke below its mid-August local low, as we can see on the daily chart (the chart includes today's intraday data):

Gold is 0.5% lower this morning, as it is trading within yesterday's daily trading range. What about the other precious metals? Silver gained 0.39% on Thursday and today it is 2.0% lower. Platinum lost 0.59% and today it is 1.1% lower. Palladium lost 1.39% yesterday and today it's 2.0% lower. So precious metals are extending their downtrend this morning.

Yesterday's Unemployment Claims release has been slightly worse than expected at 870,000 and the New Home Sales number has been better than expected at 1,011 million. The main stock market indexes went sideways following the recent decline.

Today we will get the Durable Goods Orders release at 8:30 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for today:

Friday, September 25

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

- 3:10 p.m. U.S. - FOMC Member Williams Speech

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Thursday, September 24 - Gold Breaking Lower, as Correction Deepens

September 24, 2020, 6:55 AMThe gold futures contract lost 2.05% on Wednesday, as it extended its short-term downtrend following breaking below the price level of $1,900. The market is the lowest since late July. Gold keeps retracing its rally from around $1,800 to August 7 record high of $2,089.20 in reaction to U.S. dollar rally, among other factors. Gold also broke below its mid-August local low, as we can see on the daily chart:

Gold is 0.6% lower this morning, as it is trading along yesterday's low. What about the other precious metals? Silver lost 5.78% on Wednesday and today it is 2.8% lower. Platinum lost 1.7% and today it is 0.2% lower. Palladium gained 1.29% yesterday and today it's 0.5% lower. So precious metals are mixed this morning.

Yesterday's Flash Manufacturing/ Services PMI releases have been overall better than expected. But markets continued going risk-off as stocks extended their short-term downtrend.

Today we will have a Testimony from the Fed Chair Powell at 10:00 a.m. and a speech from Treasury Secretary Mnuchin. We will also get the Unemployment Claims release at 8:30 a.m. and New Home Sales number at 10:00 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, September 24

- 8:30 a.m. U.S. - Unemployment Claims

- 10:00 a.m. U.S. - Fed Chair Powell Testimony, Treasury Secretary Mnuchin Speech, New Home Sales

- 2:00 p.m. U.S. - FOMC Member Williams Speech

Friday, September 25

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

- 3:10 p.m. U.S. - FOMC Member Williams Speech

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits. -

Daily Gold News: Wednesday, September 23 - Short-term Consolidation After Monday's Sell-off, Gold Below $1,900

September 23, 2020, 7:42 AMThe gold futures contract lost 0.16% on Tuesday, as it fluctuated following its Monday's sell-off of 2.6%. The precious metals' market followed an advance in U.S. dollar and stocks' sell-off early in the week. Recently gold retraced most of the decline from September 1 local high of $2,001.20. On Wednesday it has reached new short-term local high of $1,983.80 before coming back lower. This week it got close to $1,900 price mark, as we can see on the daily chart:

Gold is 0.6% lower this morning, as it is trading along its short-term local lows. What about the other precious metals? Silver gained 0.56% on Tuesday following Monday's big decline of over 10% and today it is 3.4% lower. Platinum lost 2.13% and today it is 0.1% higher. Palladium lost 2.28% yesterday and today it's 1.1% higher. So precious metals are mixed this morning.

Yesterday's Existing Home Sales release has been as expected and the Richmond Manufacturing Index has been better than expected.

Today there will be another Testimony from the Fed Chair Powell at 10:00 a.m. We will also get the important Flash Manufacturing/ Services PMI releases at 9:45 a.m. The earlier Eurozone's PMI releases have been pretty much mixed. The Manufacturing PMI numbers from Germany and France have been better than expected but the Services PMI have been worse than expected.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Wednesday, September 23

- 3:15 a.m. Eurozone - French Flash Manufacturing PMI, French Flash Services PMI

- 3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

- 9:00 a.m. U.S. - FOMC Member Mester Speech, HPI m/m

- 9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

- 2:00 p.m. U.S. - FOMC Member Quarles Speech

Thursday, September 24

- 8:30 a.m. U.S. - Unemployment Claims

- 10:00 a.m. U.S. - Fed Chair Powell Testimony, Treasury Secretary Mnuchin Speech, New Home Sales

- 2:00 p.m. U.S. - FOMC Member Williams Speech

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.

Gold News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver Trading Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM