Please log in to read the entire text.

If you don’t have a login yet, please select your access package.

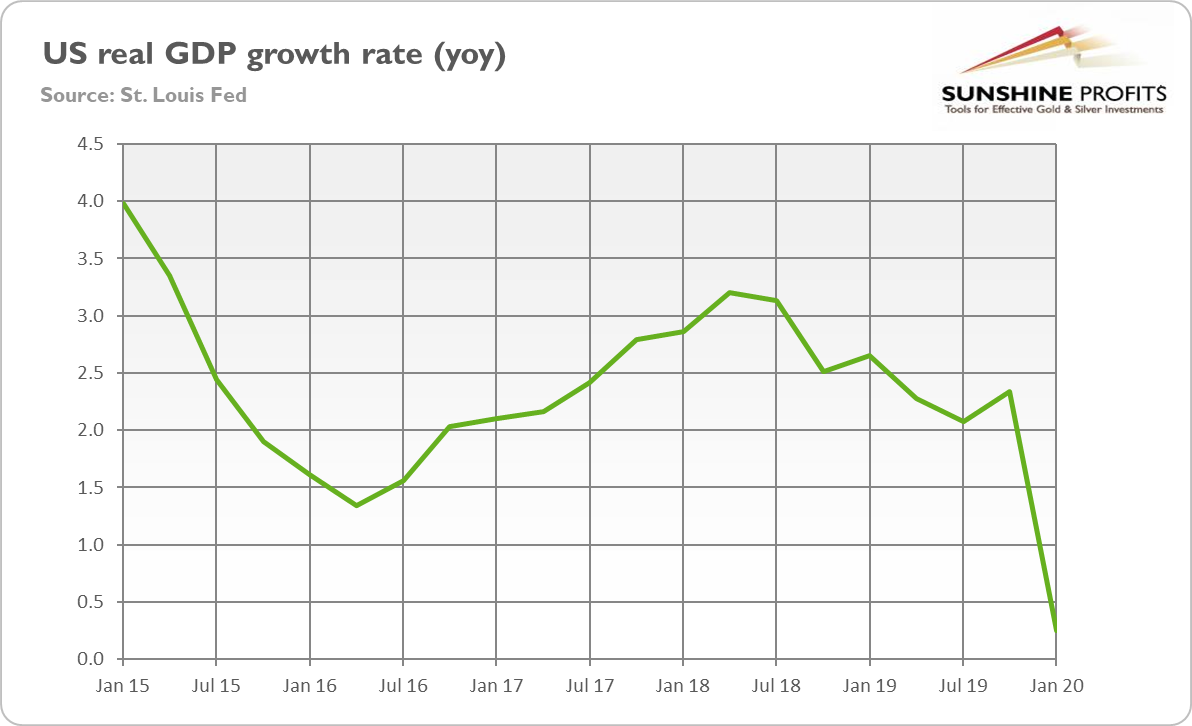

The coronavirus recession was shockingly big and swift, but also very short. The global economy has probably started to grow again in May, which was welcomed by the stock market investors. They perceive the crisis as an accident at work or completely external shock. However, the unpleasant truth is that even without the global epidemic, major economic would probably have entered recession. As we wrote earlier, Germany, Italy and Japan were already in recessions or in flirt with the recession before the pandemic. The American economy was in better shape, but the yield curve inverted and the real US GDP has been slowing down in 2019 compared to 2018, as the chart below shows.

It means that even if the economy recovers relatively quickly, it does not have to flourish and grow at a satisfactory pace. After all, when you start with the very low base, the reported numbers will always look rosy.

But the real question is what will happen when the economy will shake off from the coronavirus infection and the Great Lockdown. We bet that the economy will slow down relative to the pre-pandemic rate of growth because of the subdued demand, reduced labor supply, weak trade growth, and reconfiguration of the supply chains. Importantly, the world's merchandise trade volume, which normally rises significantly faster that the rate of the increase in GDP, last year declined by 0.1 percent. Such decreases are very rare, two others accompanied the deep recession of 1982 and the Great Recession of 2009. And this year may be even worse, as the world merchandise trade could plummet between 13 and 32 percent this year, because of the coronavirus.

Moreover, the collapse of the supply chains during the pandemic is likely to cause the return of protectionism and an increase in trade barriers. The supply chains will probably become shorter to increase their resilience, but also more expensive. What is here important is that given that globalism was deflationary, so its retreat should be inflationary, at least relatively, which is good news for gold, considered to be an inflation hedge.

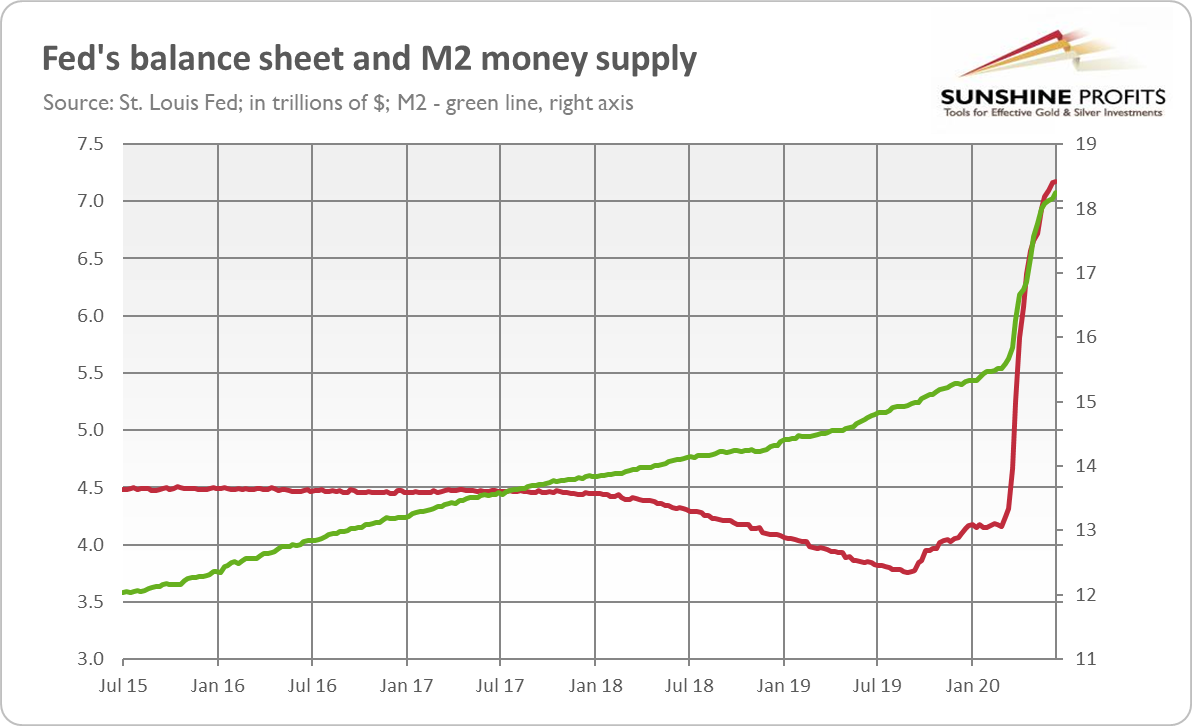

The subdued pace of economic growth should also be supportive for the gold prices. Importantly, it won't be the only positive developments that the pandemic triggered. Another will be the monetary U-turn. The normalization of monetary policy ended in 2019, even before the global epidemic. So it completely failed. And now, in the aftermath of the coronavirus recession, it is off the table for years, as the quantitative easing is the new normal. The monetary U-turn has a few significant implications. First of all, it means the expansion of the Fed's balance sheet and the broad money supply, as the chart below shows. It could at some point hit the confidence in the monetary system based on fiat currencies and the US dollar. The fact that "money printer goes brrr" (as the popular memes picture it) makes also the inflationary or stagflationary scenario more probable.

Moreover, the monetary about-face and the Zero Interest Rate Policy created the environment of negative real interest rates, which should also be supportive for the gold prices. Additionally, the ultra dovish Fed significantly reduced the divergence in the monetary policies and in interest rates between the areas of the US dollar and the euro (or Japanese yen), which should weaken the greenback, while supporting the gold prices.

What is crucial is that the very dovish monetary policy has been accompanied by a similarly expansive fiscal policy. The Congressional Budget Office estimates that the American budget deficit will be $3.7 trillion in the fiscal year of 2020, or 17.9 percent of GDP in 2020, compared with "only" 4.6 percent in 2019, while the federal debt is projected to be 101 percent, versus 79 percent in 2019, a huge increase. The ballooning public debt undermines the independence of the central banks (as it makes the normalization of the monetary policy more difficult), increases the odds of falling into the debt trap, and lowers the resilience of the global economic system.

If this all sounds bullish for gold prices to you, you are right. The stock market investors look beyond the valley of recession, but the precious metals investors should adopt even more long-term orientation and look beyond the nearest quarters. The legacy of the coronavirus crisis will be subdued economic growth, ultra-easy monetary and fiscal policies, and negative real interest rates. These factors are likely to support the gold prices, although there will be both ups and down on the way.

Thank you for reading today's free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.