Briefly: Outlook for the precious metals market remains bearish for the following few weeks, and bullish for the following months and years.

Welcome to this week's Gold Investment Update.

Even though it might seem to be the case, the most important analogies and long-term trends didn't change during the previous week, and most of our previous extensive comments still remain up-to-date in general.

As it is the case usually, we will quote last week's comments while updating everything that needs to be updated or changed. In the end, the entire below analysis is up-to-date at the moment of publishing. The parts that we didn't change (or changed only insignificantly) since last week, will be put in italics.

The most important fundamental factor right now remains the Covid-19 pandemic and what might be referred to as the Great Lockdown. We'll start with discussing the latest news on this front and we'll move to the technical part of today's analysis next. Today's fundamental discussion will be shorter than previously.

COVID-19 Revisited

The reason for the latter is that due to testing kits shortage, neither new reported Covid-19 cases, nor the reported Covid-19 deaths are particularly meaningful. The official US Covid-19 death toll at the moment of writing these words is 39k, and there are officially 735k Covid-19 cases in the US.

But, as we wrote previously, the real numbers are bigger, perhaps much bigger, and one of the reasons is the limited amount of testing that can be done each day. The title of this article from Milwaukee Independent summarizes it quite well: "A Shortage of Everything".

Quoting NY governor Andrew M. Cuomo:

Supply chain problems have prevented widespread COVID-19 diagnostic testing, Cuomo said Saturday during his daily coronavirus briefing in the state Capitol.

A shortage of chemical reagents used to process COVID-19 tests created a testing bottleneck, Cuomo said. The majority of the required chemicals are manufactured in China -- a supply chain flaw the governor characterized as a national security problem.

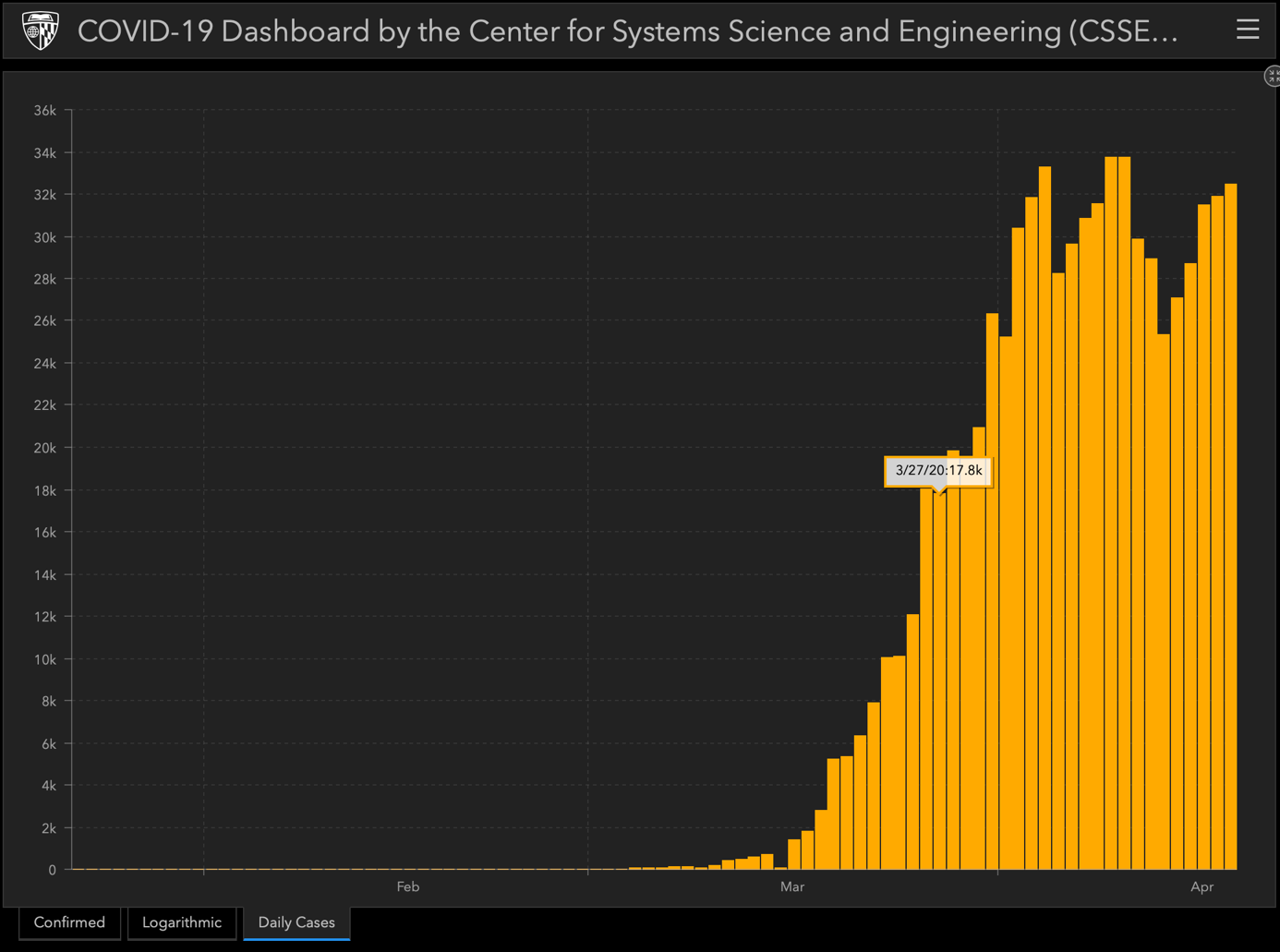

From the market's point of view, the key take-away is whether the economy is going to be restarted anytime soon, so that's what we'll focus on. And there's only one chart that we need to show you that it's not likely to be the case.

The new cases count is not reliable, because smaller of bigger numbers of daily case count could be based not on the situation improving, but rather simply on the number of tests that were conducted on a given day.

However, if we look at how many of those who were tested on a given day were infected, and how many died, we could see whether the situation is improving or not.

And better yet, we could average out the recent daily fluctuations that could be attributed to relatively random factors by applying something we know from our technical chart analysis - a moving average.

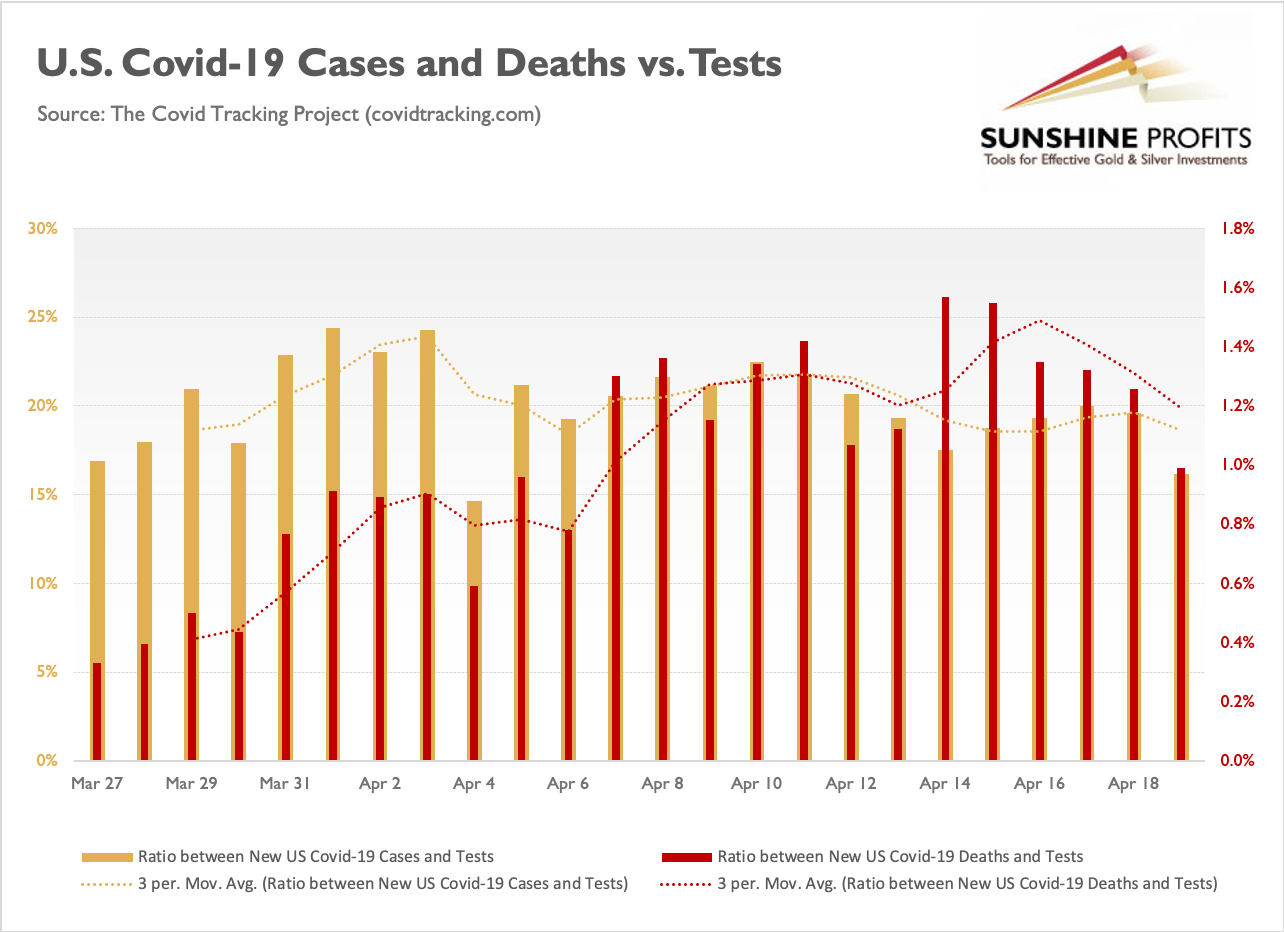

That's exactly what the chart below features.

The golden bars represent the daily ratios between the new US Covid-19 cases and the US Covid-19 tests. The red bars represent the daily ratios between the daily US Covid-19 deaths and the US Covid-19 tests. The dotted lines are the 5-day moving averages of both ratios.

The dataset starts on March 27, which was the first day when the number of US cases climbed above 100k.

The key takeaway is that there is no meaningful improvement. There is a relatively stable link between the number of tests and the number of new cases. About one fifth (20%) tests result in new Covid-19 cases. There were daily back-and-forth moves in the ratio, but overall, it remains quite stable at the 20%. The exact percentage is not as important as the fact that it's stable.

This means that the situation with new cases is not improving. Moreover, it also means that we have no idea how many more people are really infected. We would need to see both in order to really discuss the re-opening of the US economy.

The daily death toll is actually trending higher, despite temporary decreases in the ratio. The temporary declines give hopes that the worst is over, but nothing more than hope. It's very far from a strong indication, and even further from a proof.

There's one more blood-chilling thing that's not that apparent. Please note that the new-cases-to-tests ratio was already at about 20% (on average) in the final days of March.

We know that the new cases continued to climb in the following days, and then plateaued out.

What if the spread of the virus was not really contained as the above chart might indicate, but what we actually saw was the maximum testing capacity that plateaued?

The problem is that it is possible that the new cases actually continued to climb at their late-March pace. They might have plateaued at a different - much higher - level, or they might have not plateaued at all. Given limited testing, we can't know that.

This means that we are very far from being able to tell when the US economy could fully reopen, let alone be ready for reopening .

This, plus the rapid outbreaks in South America, Russia, and India confirms that the situation in the world - overall - is likely to get worse, putting further upward pressure on the US dollar.

Stocks (globally) are likely to fall further but gold is likely to bottom sooner. In fact, gold bottoming despite the rising USD Index is what will be the confirmation that we will use to say that the final bottom in the precious metals market is in.

The above is the key factor that makes the outlook for the precious metals market bearish for the next two weeks or so.

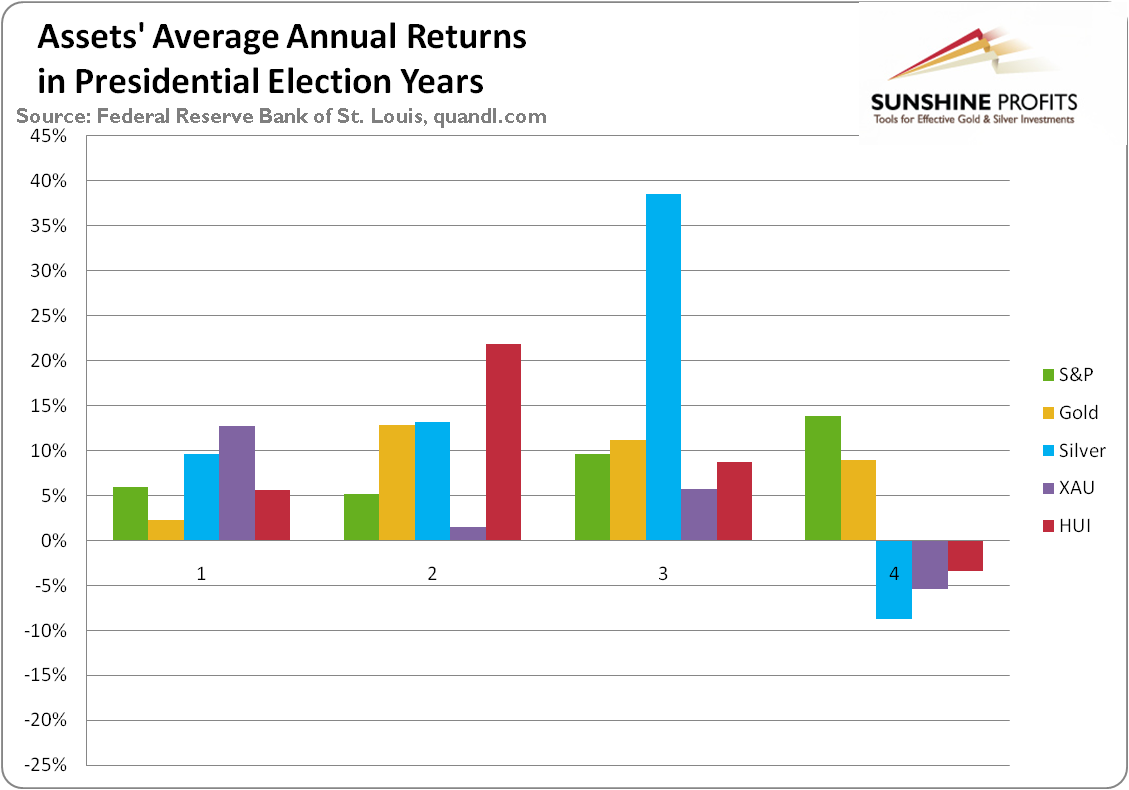

Silver and miners are likely to be particularly affected, just like they were previously. This is also the case since it's the final year of the US Presidential cycle.

Assets' Returns and Presidential Cycle

Average annual return of S&P (1948-2015, green line), gold (London P.M. Fix, 1972-2015, yellow line), silver (London Fix, 1972-2015, blue line), XAU Index (1984-2015, purple line) and HUI Index (1997-2015, red line) in presidential election cycles.

Gold's performance is more or less average in the election year, but in case of silver and mining stocks, we see something very different. Namely, the election year is the only year when - on average - they all decline.

So, does it mean that gold won't be affected by this specific cyclicality, but silver and miners will be? Not really. It seems that the above chart shows that silver and miners - on average - lead gold lower. They perform worst in the election year and the yellow metal is the worst choice in the following year - the first year of presidency.

Silver is already at new multi-year lows and miners just declined the most during the previous week...Ever. The above-mentioned analogy seems to have worked quite well.

We previously supplemented the above with the discussion of interest rates and QE4. We argued that the lower rates are not likely to help in a sustainable manner and neither will QE4. But we could see a temporary rally based on this factor.

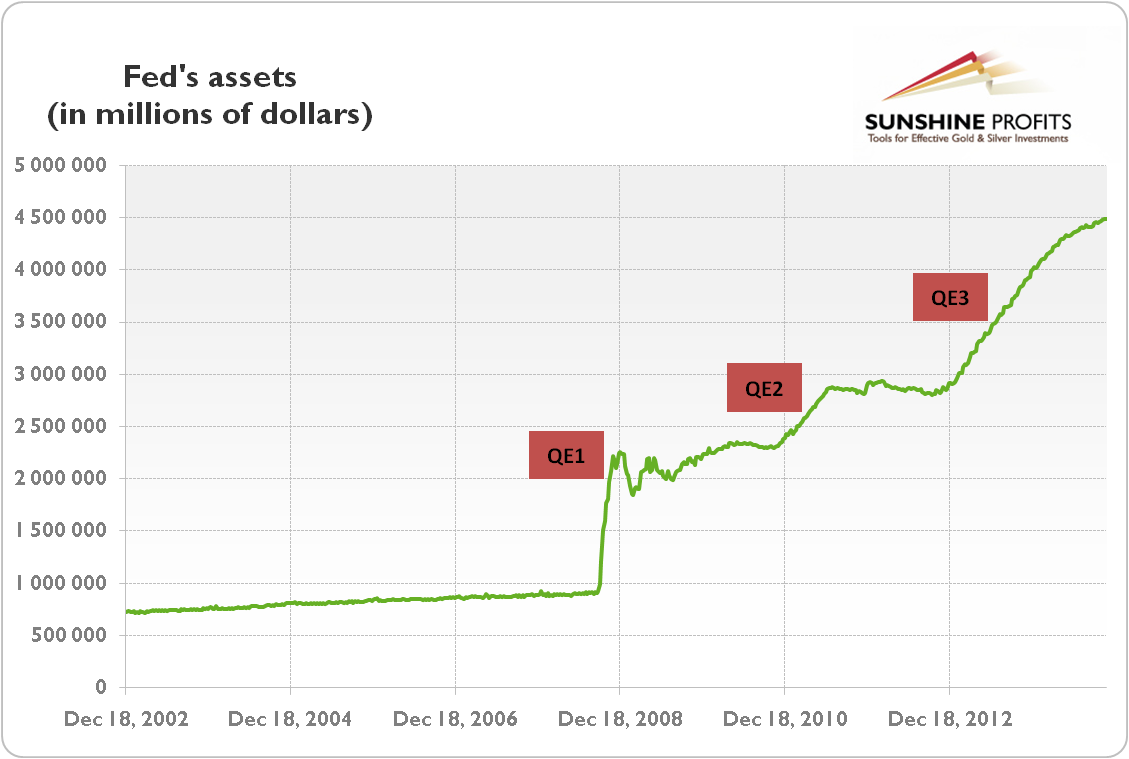

Well, let's see what the previous quantitative easing programs did.

Quoting from our explanation of the link between QE and gold:

"The effects of quantitative easing on the gold market depended on how it was perceived by investors. Initially, after the financial crisis of 2008, quantitative easing was positive for the price of gold. It was a new and unprecedented program, which undermined the investors' confidence and caused a fear of inflation or even hyperinflation. However, the U.S. economy recovered after some time and there was no inflation on the horizon. In consequence, the price of gold entered a decline in September 2011, just two months after the end of the QE2. As the confidence in the Fed and the U.S. economy was restored, the third round of the quantitative easing was welcomed by the investors. The increased confidence reduced risk premia and the bidding for tail risk insurance. Consequently, the stock market rose, while the price of gold declined."

QE1 was very bullish for the precious metals sector - the market was surprised, and the precious metals market was already after a huge decline.

QE2 was still bullish for the PMs and miners, but not as much as the first round.

QE3 started in the final part of 2012 and as it continued, PMs and miners declined profoundly. QE3 didn't prevent the decline.

Each round of the QE program was less bullish than the previous one. This trend doesn't suggest placing a lot of bullish faith in QE4 with regard to the precious metals market.

The most bullish QE was the one that was launched after gold had already declined severely for months. This is definitely not the case right now. What is the case right now is that gold just declined tens of dollars despite the dovish change in investors' expectations toward interest rates. This suggest than neither rate cuts, nor QE4 may be able to stop the decline that just started - at least not on their own and not until gold drops much further.

One more thing regarding the elections. Trump is the anti-establishment President. Perhaps the "establishment" actually wants the stock market to tumble this year, to make sure that the next U.S. President will be pro-establishment. Consequently, perhaps the stock market won't be saved until it drops much lower, and until the U.S. dollar is soaring much higher, proving that pro-lower-dollar-Trump was unable to get what he aimed for.

The Big Picture View of the USD Index and Gold

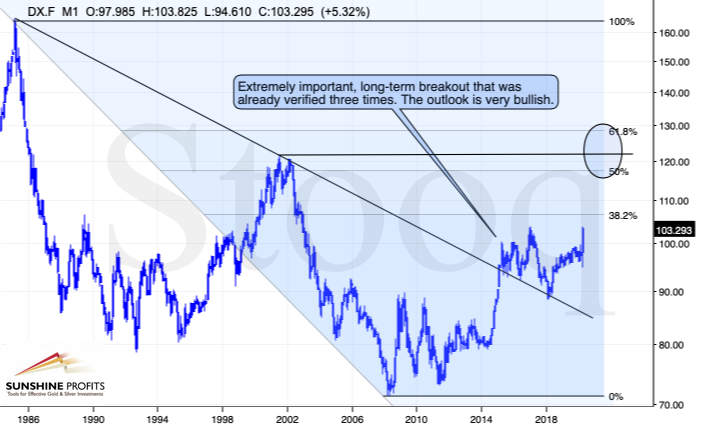

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

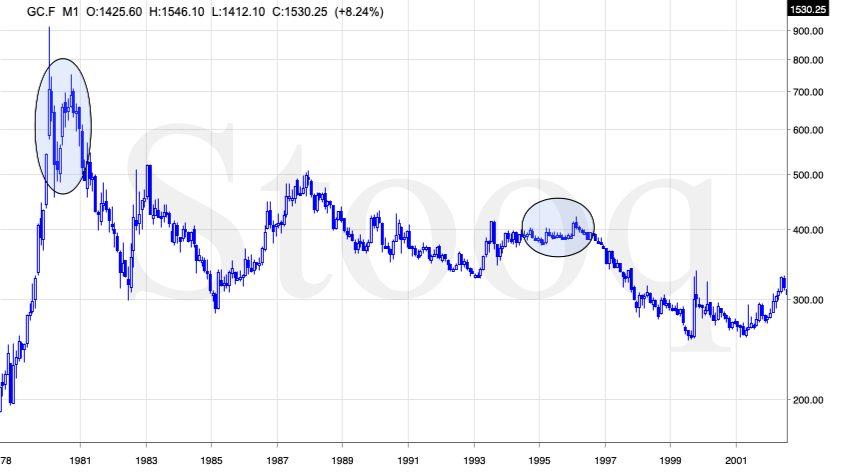

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in mid-90s. What happened in gold at that time?

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we saw earlier this year, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they indeed are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

Please note that the pace at which gold declined initially after the top - in the first few months - was nothing to call home about. However, after the initial few months, gold's decline visibly accelerated.

Let's compare the sizes of the rallies in the USDX and declines in gold. In the early 80s, the USDX has almost doubled in value, while gold's value was divided by the factor of 3. In the mid-90s, the USDX rallied by about 50% from its lows, while gold's value was divided by almost 1.7. Gold magnified what happened in the USD Index in both cases, if we take into account the starting and ending points of the price moves.

However, one can't forget that the price moves in USD and in gold started at different times - especially in the mid-90s! The USDX bottomed sooner, which means that when gold was topping, the USDX was already after a part of its rally. Consequently, when gold actually declined, it declined based on only part of the slide in the USDX.

So, in order to estimate the real leverage, it would be more appropriate to calculate it in the following way:

- Gold's weekly close at the first week of February 1996: $417.70

- USDX's weekly close at the first week of February 1996: 86.97

- Gold's weekly close at the third week of July 1999: $254.50

- USDX's weekly close at the third week of July 1999: 103.88

The USD Index gained 19.44%

Gold lost 39.07% (which means that it would need to gain 64.13% to get back to the $417.70).

Depending on how one looks at it, gold actually multiplied USD's moves 2-3 times during the mid-90 decline.

And in the early 1980s?

- Gold's weekly close at the third week of January 1980: $845

- USDX's weekly close at the third week of January 1980: 85.45

- Gold's weekly close at the third week of June 1982: $308.50

- USDX's weekly close at the third week of June 1982: 119.01

The USD Index gained 39.27%

Gold lost 63.49% (which means that it would need to gain 173.91% to get back to $845).

Depending on how one looks at it, gold actually multiplied USD's moves by 1.6 - 4.4 times during the early-80 decline.

This means that just because one is not using U.S. dollars as their primary currency, it doesn't result in being safe from gold's declines that are accompanied by USD's big upswings.

In other words, the USD Index is likely to soar, but - during its decline - gold is likely to drop even more than the USD is going to rally, thus falling in terms of many currencies, not just the U.S. dollar.

Please note that there were wars, conflicts and tensions between 1980 and 2000. And the key rule still applied. Huge rallies in the USD Index mean huge declines in gold. If not immediately, then eventually.

On April 6th, we wrote that gold could first rally to or slightly above its 2020 high and decline in a volatile manner shortly thereafter. The former has already taken place, and now it seems that the latter will happen, especially that gold already declined last week, even without USD's help.

Since the USD Index is such an important piece of the puzzle, let's take a look at its charts.

More on the USD Index and Gold

You already saw the most important USD Index chart 2 charts ago - the USDX is after a major, long-term breakout that was confirmed a few times, so it's now in a strong long-term uptrend. Let's keep in mind that it doesn't mean that the situation in the US is perfect - it means that it's better than in other territories - mostly in the EU and Japan. And that does seem to be the case.

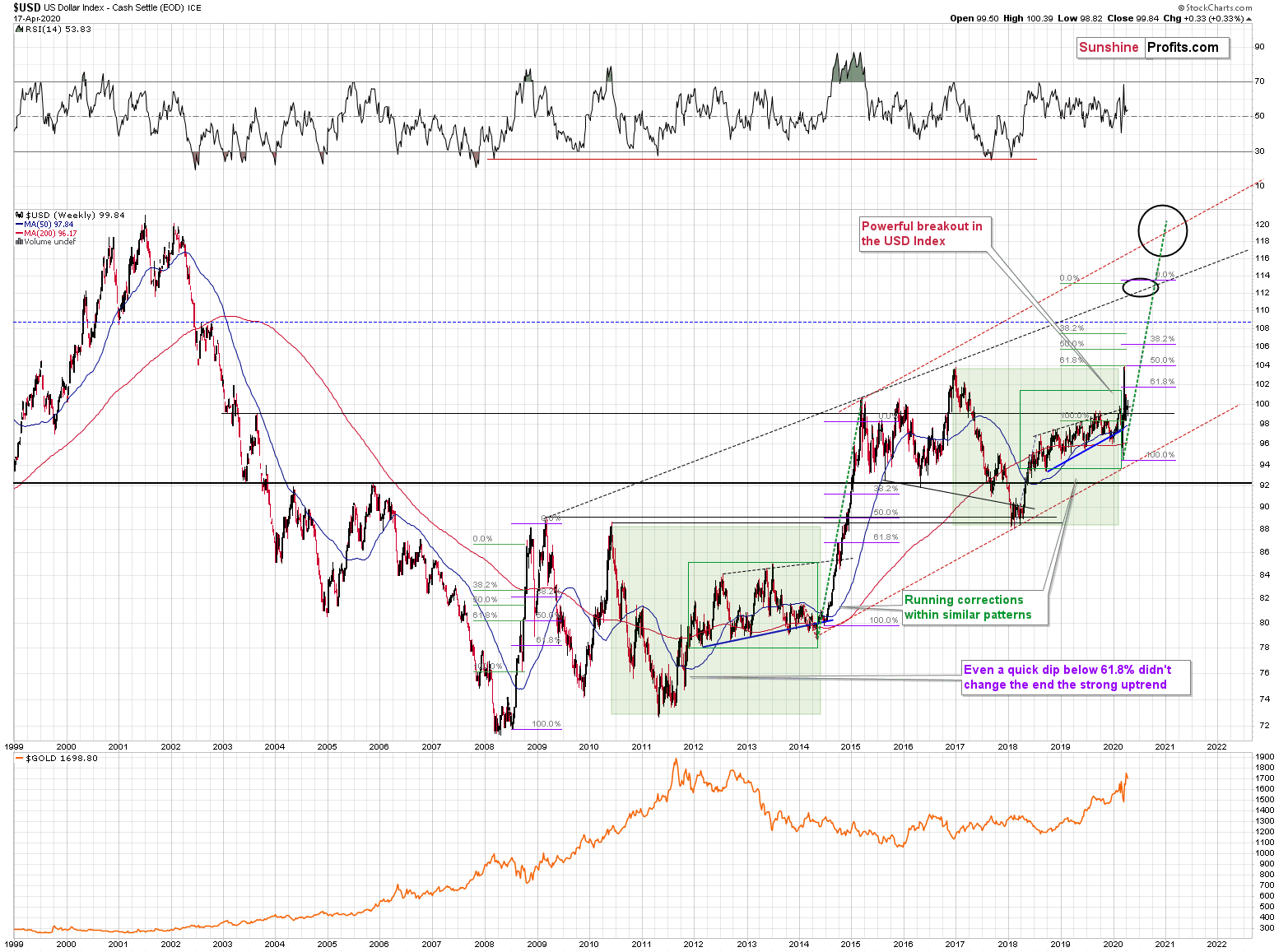

Having said that let's take a look at the above chart. Quoting our previous comments on it appears justified as practically all the long- and medium-term points remain up-to-date.

The USD Index was previously (for the entire 2019 as well as parts of 2018 and 2020) moving up in a rising trend channel (all medium-term highs were higher than the preceding ones) that formed after the index ended a very sharp rally. This means that the price movement within the rising trend channel was actually a running correction, which was the most bullish type of correction out there.

If a market declines a lot after rallying, it means that the bears are strong. If it declines a little, it means that bears are only moderately strong. If the price moves sideways instead of declining, it means that the bears are weak. And the USD Index didn't even manage to move sideways. The bears are so weak, and the bulls are so strong that the only thing that the USD Index managed to do despite Fed's very dovish turn and Trump's calls for lower USD, is to still rally, but at a slower pace.

We previously wrote that the recent temporary breakdown below the rising blue support line was invalidated, and that it was a technical sign that a medium-term bottom was already in.

The USD Index soared, proving that invalidation of a breakdown was indeed an extremely strong bullish sign.

Interestingly, that's not the only medium-term running correction that we saw. What's particularly interesting is that this pattern took place between 2012 and 2014 and it was preceded by the same kind of decline and initial rebound as the current running correction.

The 2010 - 2011 slide was very big and sharp, and it included one big corrective upswing - the same was the case with the 2017 - 2018 decline. They also both took about a year. The initial rebound (late 2011 and mid-2018) was sharp in both cases and then the USD Index started to move back and forth with higher short-term highs and higher short-term lows. In other words, it entered a running correction.

The blue support lines are based on short-term lows and since these lows were formed at higher levels, the lines are ascending. We recently saw a small breakdown below this line that was just invalidated. And the same thing happened in early 2014. The small breakdown below the rising support line was invalidated.

Since there were so many similarities between these two cases, the odds are that the follow-up action will also be similar. And back in 2014, we saw the biggest short-term rally of the past 20+ years. Yes, it was bigger even than the 2008 rally. The USD Index soared by about 21 index points from the fakedown low.

The USDX formed the recent fakedown low at about 96. If it repeated its 2014 performance, it would rally to about 117 in less than a year. Before shrugging it off as impossible, please note that this is based on a real analogy - it already happened in the past.

In fact, given this month's powerful run-up, it seems that nobody will doubt the possibility of the USD Index soaring much higher. Based on how things are developing right now, it seems that the USD Index might even exceed the 117 level, and go to 120, or even higher levels. The 120 level would be an extremely strong resistance, though.

Based on what we wrote previously in today's analysis, you already know that big rallies in the USD Index are likely to correspond to big declines in gold. The implications are, therefore, extremely bearish for the precious metals market in the following months.

On March 23rd, we wrote that the USD Index was ripe for a correction, and that was indeed the case.

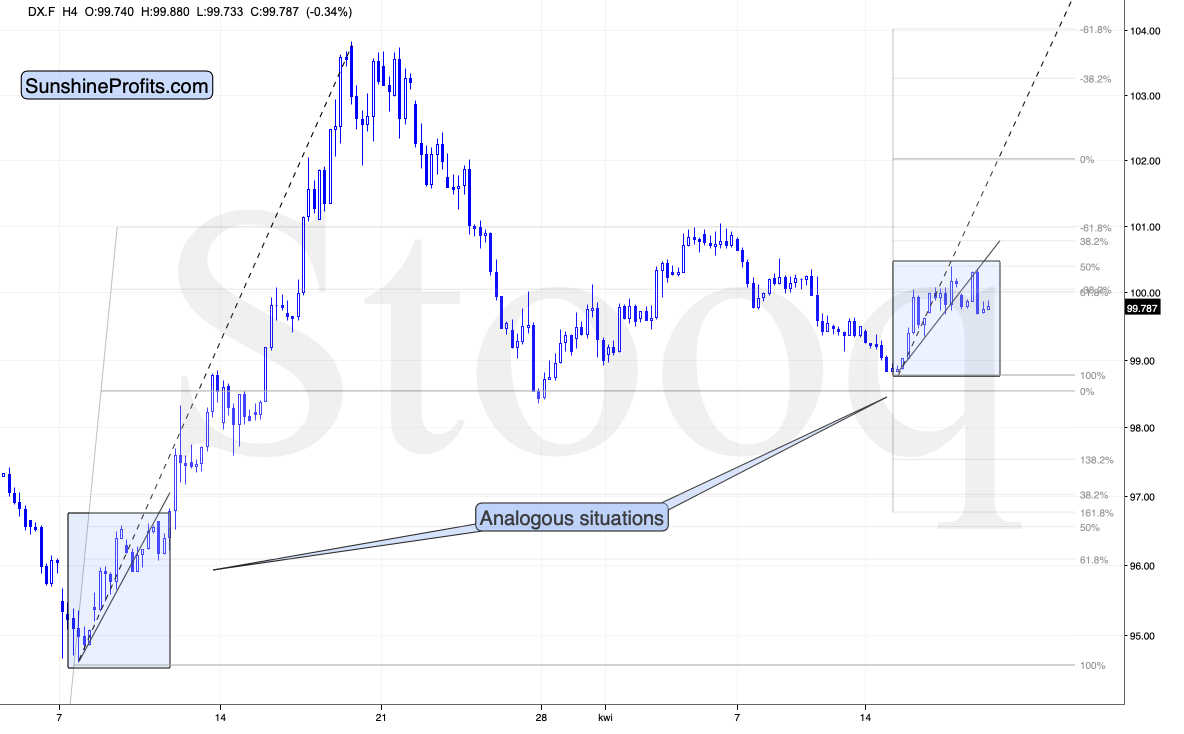

However, a few weeks passed, and the USD Index now appears to be ready for another powerful upswing.

We saw the first very strong short-term signs of it last week, as the situation in the USD Index is very similar to how the USDX was trading back in March, in the early part of the sharp upswing.

The USD index soared after forming an intraday reversal. It then declined, rallied back up, and declined quickly once again - all just as it did in early March.

The final 4-hour decline was sharp and it took place as the USDX broke below the rising support line that was based on the early intraday lows. We saw the analogous decline on Friday, and the USD Index has been moving slowly up since that time. Both situations are very similar from the pattern point of view.

Back then, the analogous price action triggered further upswings, which translated into lower prices of the precious metals. The bearish implications remains in place at this time as well.

How could the above translate into a gold price prediction?

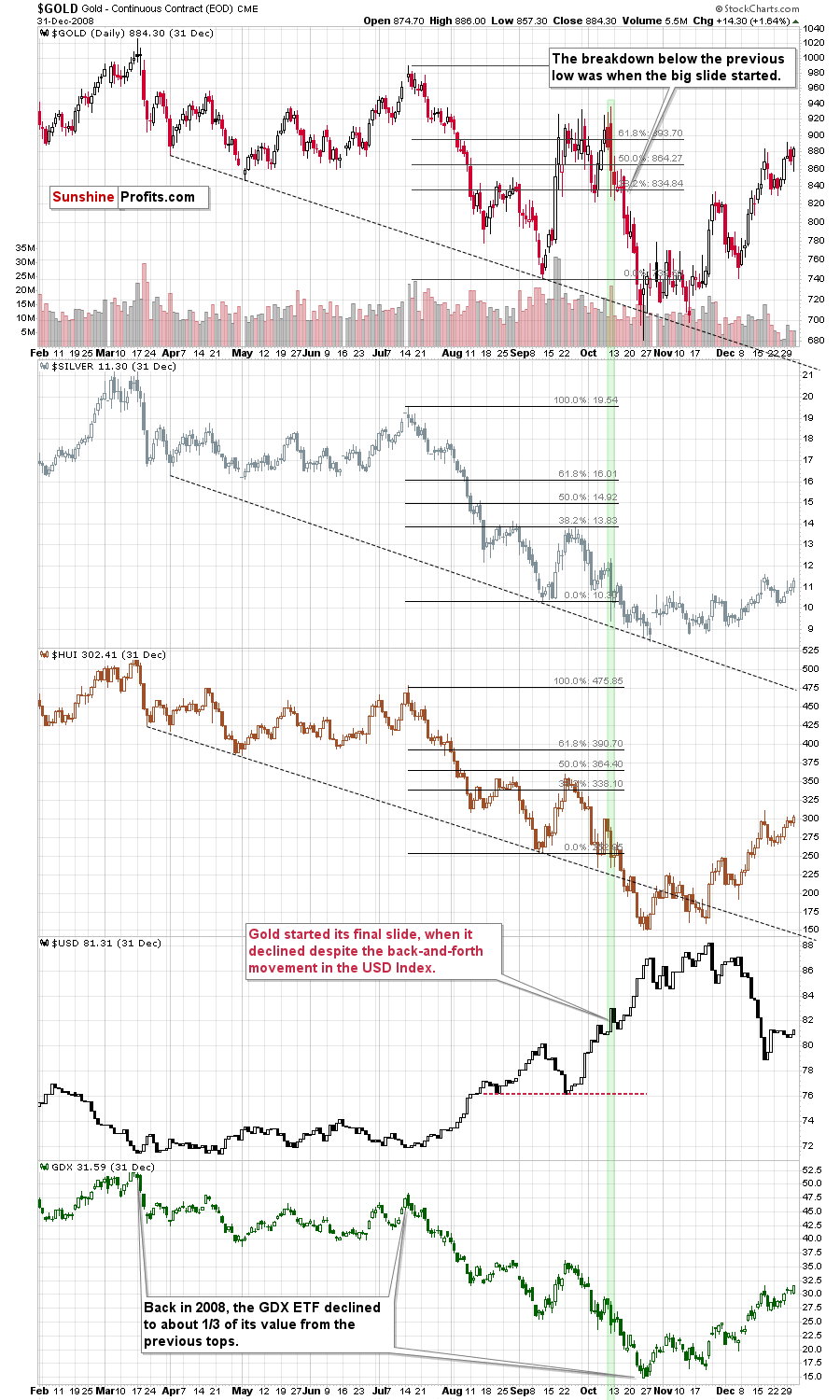

The 2008 USD - Precious Metals Lesson

Please note what triggered the final decline in gold, silver, and mining stocks. It was the continuation of the rally in the USD Index. The first part of the decline in gold took place when the USD Index was rallying, and it soared back up when the USDX corrected.

Interestingly, the yellow metal ignored the first (late-September) rally in the USD Index and gold topped once the USD Index paused, likely based on the assumption that the USDX uptrend was already over at that time.

We saw something similar right now. Gold generally ignored USD's early-April upswing. When the USD Index corrected, gold soared, likely based on the assumption that the USDX uptrend was already over.

Right now, the USD Index seems to have started to take off once again. And this time, gold is really reacting to it - just like it did in early October 2008.

The USD Index was up by just 0.33% last week. During the same time, gold reversed and declined by 3.08% ($54). Silver was down by 4.72% ($0.76).

As the USD Index rally unfolds, the precious metals market is likely to slide, just like it did in 2008.

Please note that the shape of the most recent price moves became increasingly different from the shapes of 2008 price moves, due to various news that hit the market, for example the enormous stimulus programs.

The 1:1 link between 2008 and 2020 in terms of the price shape has definitely changed. However, this doesn't mean that the entire analogy is useless.

The way gold stopped reacting to USD's bullish signals and magnified USD's bearish signals last week tells us that gold is likely to slide shortly, just like it did in 2008. Miners moved much higher than they did during the analogous time in 2008, but they did so along with a much bigger and longer rally in the general stock market. A rally that is almost certainly unsustainable and about to turn into a huge decline. Given this link, miners are likely to slide once again, quite likely similarly profoundly to how they decline in March.

2008 - 2020 Time Analogy

Based on the most recent price moves and the big chance that we already saw the final top for this rally, we can update the analogy in terms of time.

Back in 2008, it took gold 21 trading days to rally from the September bottom to the October high.

This year, it took gold 20 trading days to rally from the March low to the April high. Almost exactly as long as in 2008.

Back in 2008 gold then declined for the next 10 trading days. It initially declined a bit over 11% and in total, it declined about 27%.

Gold has been declining for 4 trading days so far and it declined by only about 5%. If the initial decline ends at about $1,600, however, it would mean that the initial slide was about 11% - just like in 2008. The decline of 27% from the recent top would imply gold's bottom below $1,400.

If gold is to keep this analogy in terms of time or invalidate it by just a little, it would have to slide very fast this week. Yes, that's still possible.

Today's breakdown below $15 in crude oil proves that no strong support is unbreakable and what was unthinkable just a few months ago, might be very real now. And yes, we have been shorting crude oil in our Oil Trading Alerts, and subscribers to these alerts are now enormously profitable thanks to this slide (we also profited on the previous slide, and on the rebound).

Just like in 2008, the fundamental situation for the precious metals market just improved dramatically, but just like then, the markets are first likely to panic and push the USD higher, which would very likely translate into lower PMs and mining stock prices, especially since the general stock market is likely to slide anyway.

Speaking of the general stock market, the S&P 500 is just below a very strong combination of resistance levels.

Both: the 61.8% Fibonacci retracement level, and the upper border of the huge March price gap provide strong resistance levels on their own, and the fact that they align, makes the resistance super strong.

This, plus the lack of improvement on the fundamental front is a very bearish combination. If you'd like to read more about the stock market, we are making today's flagship Stock Trading Alert available to all subscribers to my analyses. It's quite a lengthy read, so we suggest finishing this report first, and move to the stock market analysis next.

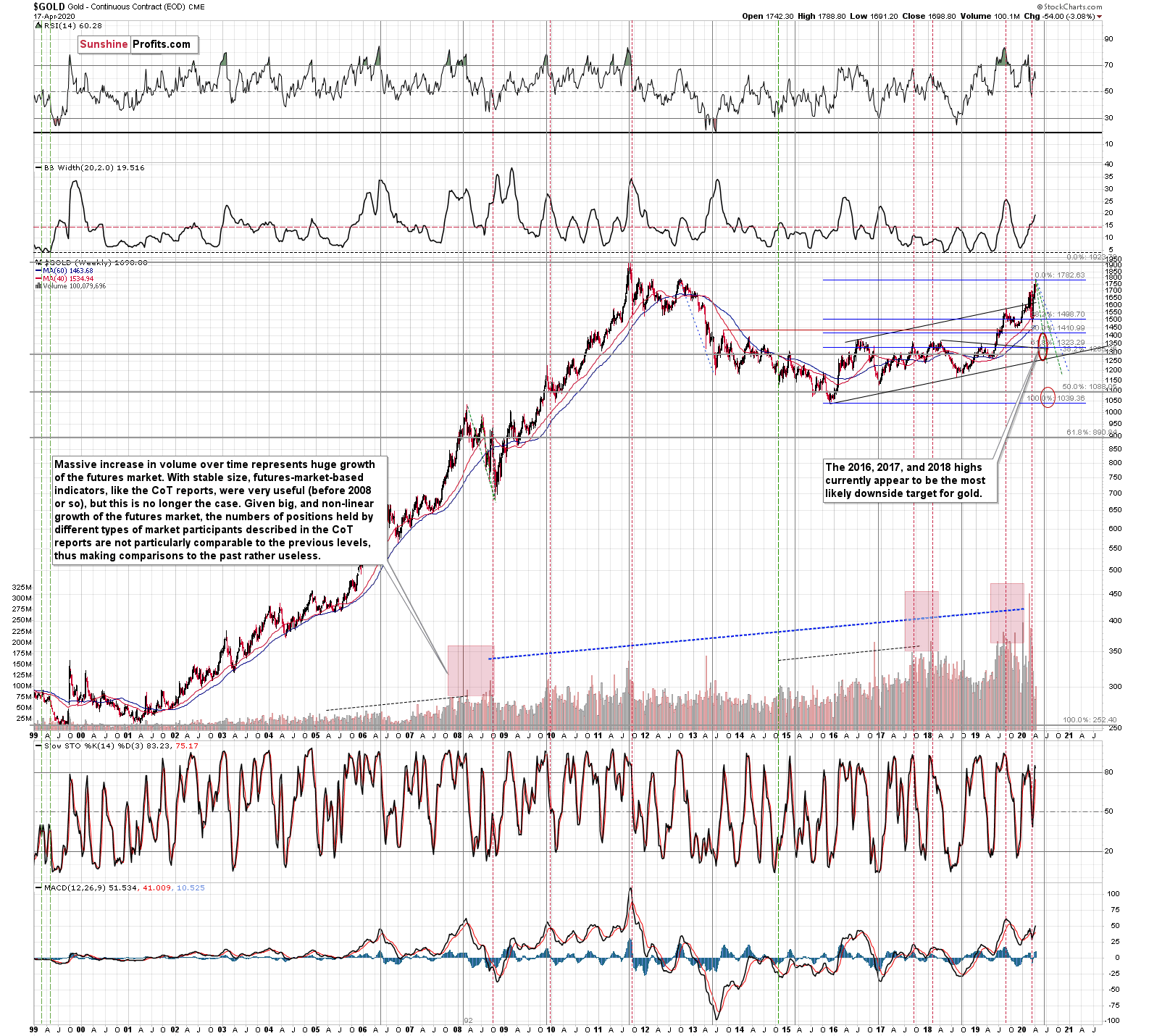

Now, since the decline in gold started from levels that were higher than the analogous levels in 2008, how low could the gold price sink at the bottom?

Our current (and it might change in the following days) estimate is that gold would decline to the 2016, 2017, and 2018 lows - slightly below $1,400. Why? Because this level is confirmed by several major highs, which makes it the strongest support that's below the previous 2020 lows.

Moreover, back in 2008, gold bottomed about 8% below its initial September bottom. The recent bottom in gold was about $1,451. If the history repeats itself, gold could decline to 92% x $1,451 = about $1,335.

In 2008, gold also declined by about 27% from its previous high. If the history repeats itself here, and gold topped yesterday (which seems quite likely), we can see gold's bottom at 73% x $1,789 = about $1,306.

The 2016, 2017, and 2018 highs are the strongest gold support that we have close to the above-mentioned price levels. Gold's fundamental situation is even better now than it was in 2008, so we think that looking for the support above the above-mentioned 2008-based price levels is more appropriate than basing it the above-mentioned gold trading tips. The 2016, 2017, and 2018 highs fulfill this requirement.

This means that gold would be likely to bottom between about $1,350 and $1,380.

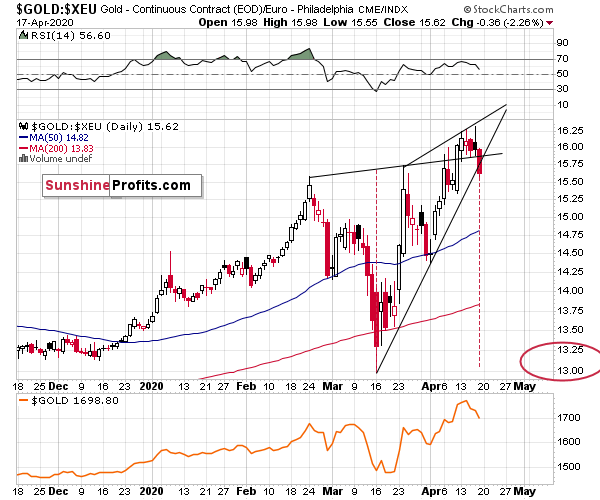

In other news, gold just invalidated its breakout above the previous highs in terms of the euro, and it also broke below the rising support line, which by itself is a lower border of the rising wedge pattern.

That's a very bearish sign as it means that gold is likely to continue to magnify USD's rallies as it declines.

Gold just invalidated the breakout above the $1,700 level and the breakout above the inverse head-and-shoulders formation in intraday terms. This is a major sell confirmation.

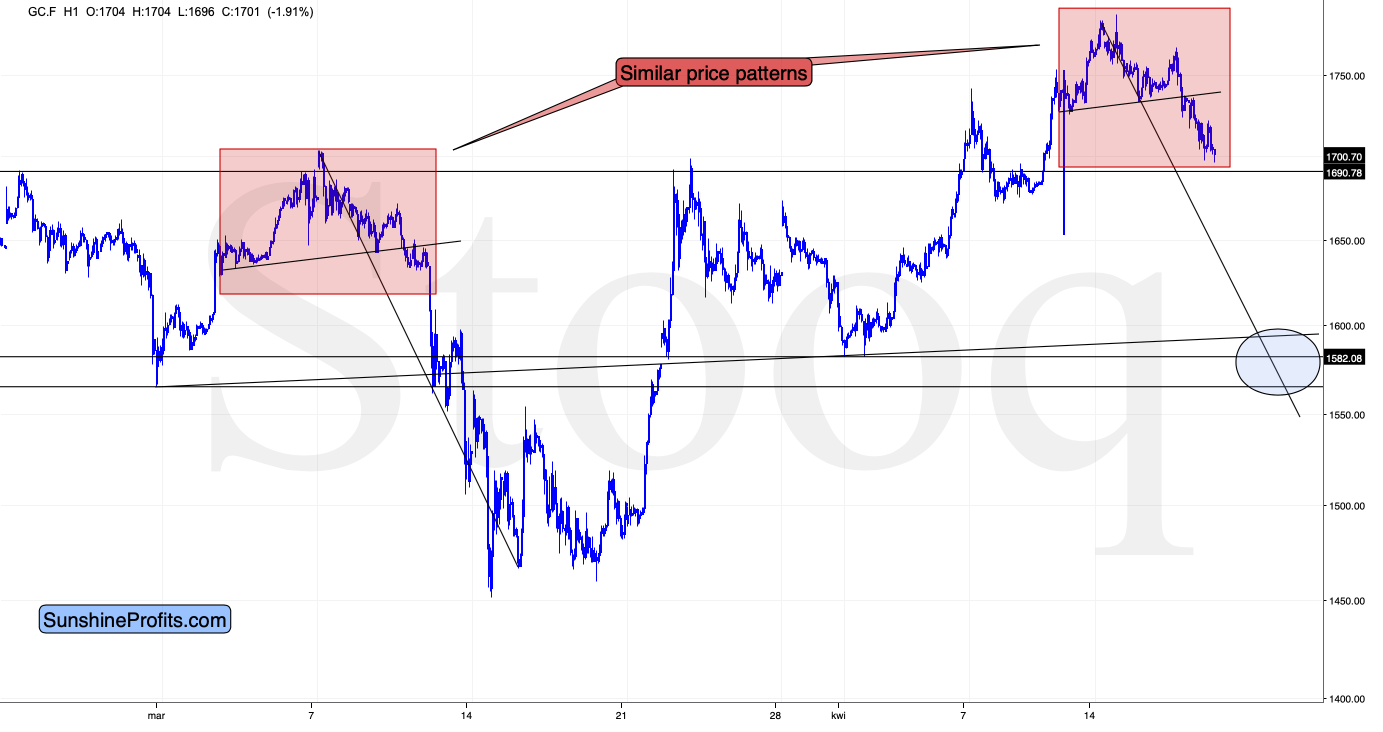

Moreover, on a short-term note, we see that the USD Index wasn't the only market that's been repeating its early March performance. Gold has been trading in a very similar way as well. We marked the similar patterns with red rectangles.

Back in March, gold topped in a head-and-shoulders form, and we saw the same pattern also recently. In March, gold plunged as it got a strong boost from the rising USD Index.

Right now, gold didn't get the USDX boost, and... It's been declining decisively nonetheless. This is a very bearish combination, because it shows that gold just can't wait to slide lower.

The next support is theoretically at the early April lows, but given gold's weakness relative to the USDX and the fact that the latter is likely to soar shortly, it seems rather unlikely that gold will decline by just $25 or so. A move several times larger seems more likely. The nearest strong support level that fills this requirement is the early April low - a bit below $1,600.

That's our next interim target that could generate a (dead cat) bounce before the decline continues.

What about silver?

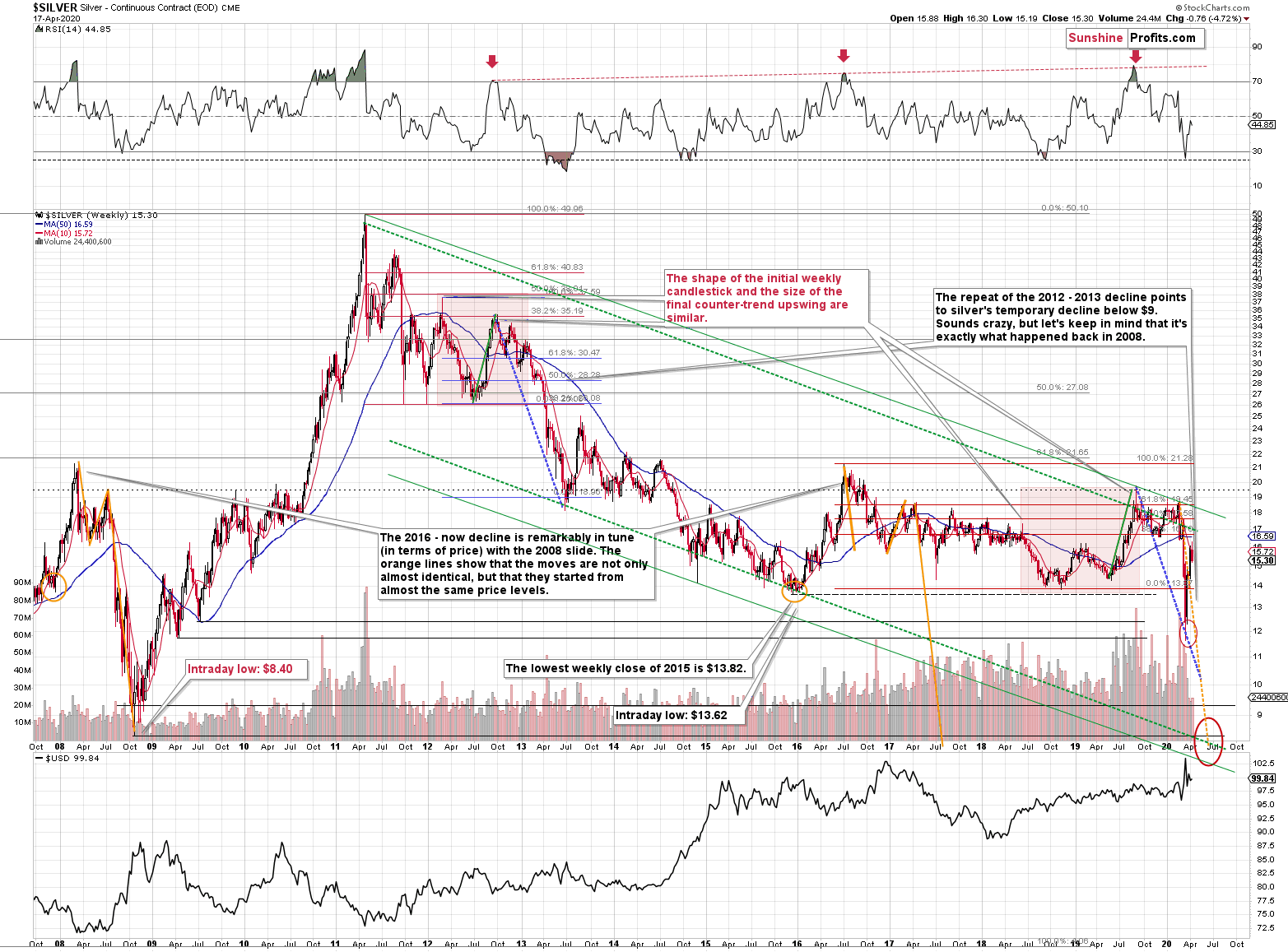

In short, the major 2008 - 2020 analogy in terms of price moves remains intact.

Silver Shares Its Two Cents

Silver just plunged to our initial target level and reversed shortly after doing so. It was for many months that we've been featuring the above silver chart along with the analogy to the 2008 slide. People were laughing at us when we told them that silver was likely to slide below $10.

Well, the recent low of $11.64 proves that we were not out of our minds after all. Our initial target was reached, and as we had explained earlier today, the entire panic-driven plunge has only begun.

Those who were laughing the loudest will prefer not to notice that silver reversed its course at a very similar price level at which it had reversed initially in 2008. It was $12.40 back then, but silver started the decline from about 50 cent higher level, so these moves are very similar.

This means that the key analogy in silver (in addition to the situation being similar to mid-90s) remains intact.

It also means that silver is very likely to decline AT LEAST to $9. At this point we can't rule out a scenario in which silver drops even to its all-time lows around $4-$5.

Note: Silver at or slightly below $8 seems most probable at this time.

Crazy, right? Well, silver was trading at about $19 less than a month ago. These are crazy times, and crazy prices might be quite realistic after all. The worst is yet to come.

Let's quote what the 2008-now analogy is all about in case of silver.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Now, some may say that back in 2008, silver rallied only to about $14 and since now it rallied to about $16, so the situation is now completely different and that the link between both years is broken. But that's simply not true.

The nominal price levels are just one of the ways that one should look at the analogy - far from being the perfect or most important one.

Please note that back in 2008, there were two smaller bottoms in silver, and this time we saw just one. The decline before the bottom was sharper, so is it really that surprising that the rebound was sharper as well? Silver ended the 2008 corrective upswing once it moved visibly above the declining orange line and that's exactly what happened recently. It also topped once it reached its 10-week moving average (red line). That's exactly what just happened. This MA is at $15.81 and at the moment of writing these words, silver is back below it, trading at $15.65.

The situations are not perfectly identical in terms of nominal prices, but they remain remarkably similar given how different fundamental reasons are behind these price moves (in reality, what's behind both declines is fear that - itself - doesn't change).

The technique used for predicting silver price is clearer than the one that we applied for gold, so it seems useful to look not only at the USD Index for signs, but also at the white metal itself. Once silver moves to $8 or below it, it will likely serve as a strong buy sign for gold, regardless of the price at which gold will be trading at that time.

Also, please note that silver formed a big shooting star candlestick, which is a topping sign. The volume was low, but it was not low just during the formation of this candlestick, but it's been low during this month's upswing as well. It's relatively unclear whether the volume is confirming or invalidating the shooting star. Consequently, we view it as a bearish confirmation, and we wouldn't open a position based just on it. However, since it's just one of the factors pointing to much lower silver prices in the next few weeks, we view the very bearish outlook as justified.

And what about the miners?

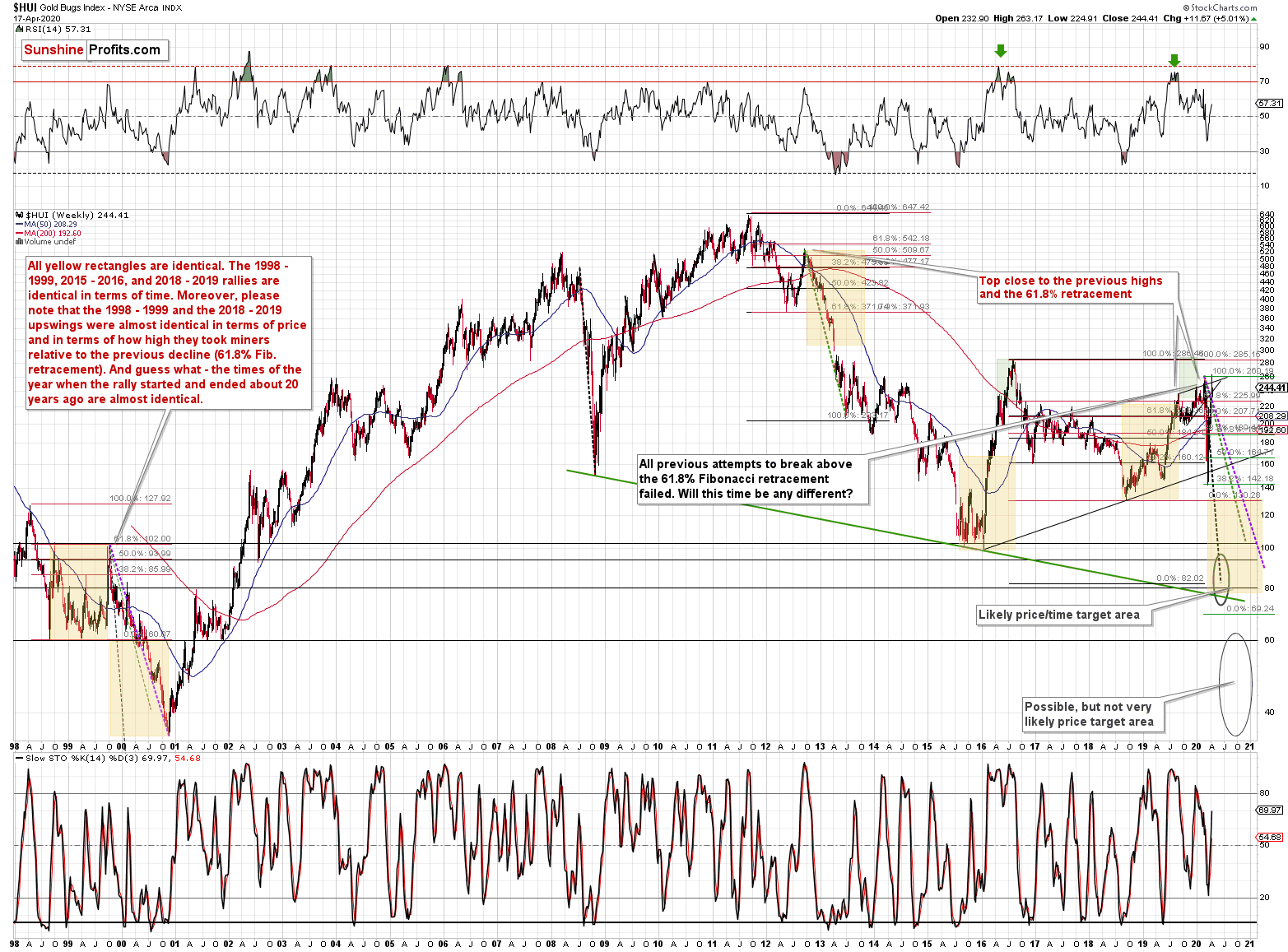

The HUI Index declined significantly, and then it rebounded significantly.

Both are likely linked. Miners first declined more sharply than they did in 2008, so the rebound was also sharper. Based on the stimulus and gold reaching new yearly highs, miners also rallied and tried to move to new yearly highs. It's not surprising.

However, if the general stock market is going to decline significantly one more time, and so will gold - and as you have read above, it is very likely - then miners are likely to slide once again as well. This would be in tune with what happened in 2008.

At this time, it may seem impossible or ridiculous that miners could slide below their 2015 lows, but that's exactly what could take place in the following weeks. With gold below their recent lows and the general stock market at new lows, we would be surprised not to see miners even below their 2020 lows. And once they break below those, their next strong resistance is at the 2016 low. However, please note that miners didn't bottom at their previous lows in 2008 - they moved slightly lower before soaring back up.

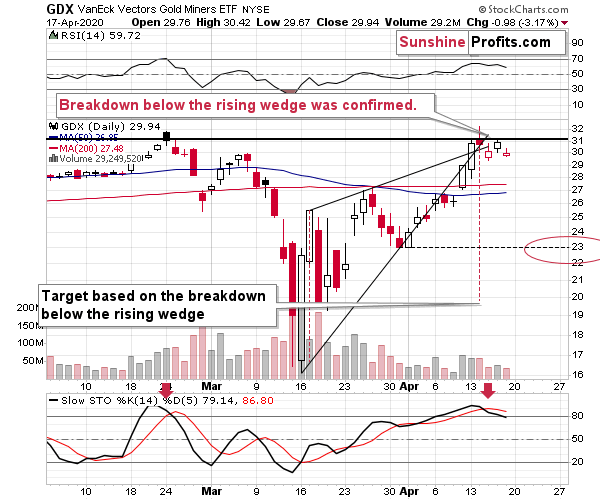

On a short-term basis, we see that the GDX ETF just tried to break to new 2020 highs. And it failed to do so. This attempt was made after GDX moved higher on relatively low volume, so it's no wonder that it failed - there was not enough buying power to keep prices at a new yearly high.

The invalidation of the small breakout is a bearish sign. Given the above, along with the pre-market move lower in gold and the general stock market, it seems that miners will move lower this week.

The above scenario is further confirmed by the fact that the miners' breakdown below the rising wedge formation was just verified by the third daily close. Breakdowns below rising wedges often trigger waterfall selling that leads to very volatile price drops.

This would be in perfect tune with the mining stocks responding to a decline in gold and stocks, and to the rally in the USD Index.

The downside target based on the rising wedge pattern is in tune with the mid-March low of about $20. There is, however, another downside target that's based on the April low - at about $23. Please note that it's also more or less where the GDX ETF paused right before sliding to its March lows.

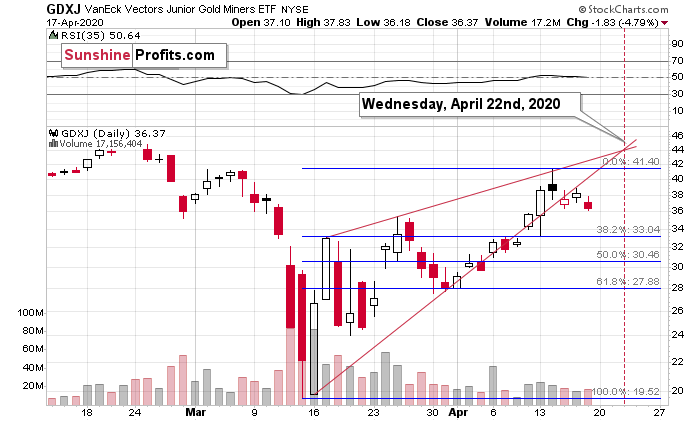

Please note that the GDX ETF topped right at the vertex of the rising wedge. The same technique might tell us something about the timing of the next bottom. That's the case, because in the GDXJ ETF, the rising wedge vertex is a few days away.

The breakdown below this formation was confirmed also in case of the GDXJ, but this time the resistance lines cross on Wednesday, April 22nd - that's when the next local extreme is likely to form.

It seems most likely that this price extreme will be the next bottom, but if the USD Index soars today and then consolidates or corrects, then gold could truly plunge today and rebound in the following days. This could translate into a quick bottom in the miners today and the next local top (perhaps close to the late-March highs at about $34 - $35) on Wednesday.

The downside GDXJ price targets analogous to the ones in the GDX are: $24 and $28. Once they are reached and we see a pause, the miners are likely to decline even lower.

Please note that unlike GDX, the GDXJ ETF was unable to move back to its previous 2020 highs. We've been previously writing about junior miners being weaker than senior miners and the above action serves as confirmation.

Finally, before summarizing, we would like to reply to questions that we received recently.

From the Readers' Mailbag

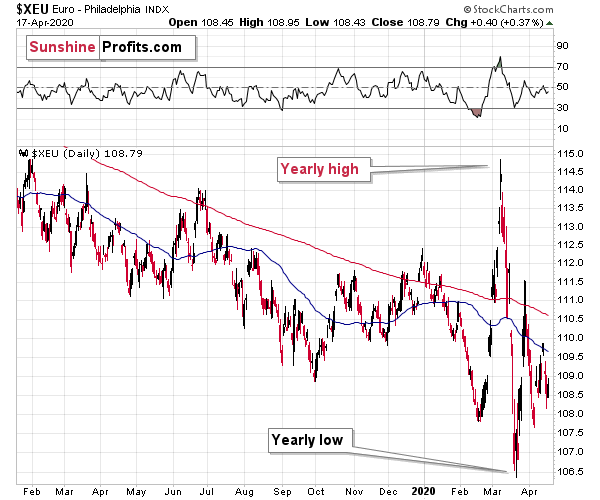

Q: I have a question about euro dollar. Last week you said that usd index could go up to 115~120, and euro could go below 1.0, even 0.9.

However, euro hit high on March 2008, and hit low on March 2020. That's 144 month. 144 is an important Fibonacci number.

Will March 2020 be an important pivot point for euro?

Also, euro hit low on Oct 2000, and hit high on March 2008. That is 89 month.

A: These are very good technical points, thank you.

March 2020 could indeed be a major pivot point for the euro. However... The euro didn't just hit a major low in March 2020... It also hit a major high!

Depending on the way in which the euro moves now, and if it will manage to break above the March highs, or the March lows, we'll see if what we saw in March, was most likely a yearly high or a yearly low. Right now, the euro is much closer to the March lows, than it is to march highs, and the medium-term trend is down. Consequently, the odds are that we'll see new lows sooner than new highs, especially given what we already described on the USD Index charts.

This means that the real price extreme of March 2020 that we should take into account, is the high.

Just as the euro hit the yearly high in 2008 (the highest monthly close), it might have hit a high in March 2020 as well. Back in 2008, the situation in March was not as volatile as it is right now, so we had to wait for several months before the decline accelerated. It seems that given this kind of short-term price swings, we'll see bigger declines much sooner.

Q: It's an honor to read your article. I have three questions.

One, I asked last week when gold breaked up 1700 neckline, and formed inverse head and shoulder.

You said it will be invalided. However, gold has been above 1700 for several days. Is this valid?

I know you said gold is in a rising wedge. However, rising wedge has 25% to break up.

Two, GDX try to break seven year neckline at 31, and you said it is invalid.

What if GDX act the same way as gold, and go up above 31 for several days.

Is this a valid break up?

Three, NASDAQ future NQ, is now at about 8900, which is well above 0.618 level (8500).

Does this mean NQ has potential to go back to bull market? If this happen, 2020 would not like 2008, and is it time to reconsider your strategy?

A: Thank you for the kind words - they mean a lot to us.

Well, gold ended the week back below $1,700, invalidating the inverse head-and-shoulders pattern, so yes, our comments remain valid.

The wedges have already broken to the downside (even on featuring gold in terms of the euro), so the implications are very bearish.

Given GDX's breakdown below the rising wedge pattern, it seems very unlikely that it would move above the previous highs anytime soon - at least not without plunging first.

Regardless of any technical details for the US stock market, we see very little chance for the rally's continuation due to the Covid-19 situation and the related lockdowns. Investors seem to have believed that the situation is now under control and that things will be back to normal soon - despite the data indicating otherwise.

Technically, Nasdaq did indeed manage to break above the 61.8% Fibonacci retracement and it stopped the rally only after reaching its March highs. This shows that the tech sector is the strongest part of the economy... And it's pretty obvious why this is the case - much of the technical work can be conducted online. However, Nasdaq seems to be the exception from the rule, not the sign showing that things are going to improve everywhere else - in other sectors.

Ultimately, tech companies will suffer too when people can't afford to buy their services.

If Nasdaq breaks to new highs and leads other stock indices, we might change our views, but for now, it seems that we're about to see another huge wave down - perhaps bigger than what we saw so far this year.

Summary

Summing up, the outlook for the precious metals market remains bearish for the next few weeks, despite the upswing that we saw recently. In fact, based on the way the USD Index moved last week, it seems that the top in the PMs and miners is already in and the final part of the decline has already started.

Gold showed exceptional weakness by invalidating the inverse head-and-shoulders pattern and closing the week below $1,700 despite almost no help from the USD Index, which is a screaming sell indication.

If you've been staying on the sidelines, or have been waiting for a good moment to add to the short positions (or open them at all), in our opinion, this is a good moment to do so. The risk to reward ratio appears particularly favorable right now.

After the sell-off, we expect the precious metals to rally significantly. The decline might take as little as 1-3 weeks, so it's important to stay alert to any changes.

Also, as promised earlier, here's the link to today's flagship Stock Trading Alert.

Most importantly - stay healthy and safe. We're making a lot of money on these price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

To summarize:

Very short-term outlook for the precious metals sector (our opinion on the next 2-3 weeks): Bearish

Short-term outlook for the precious metals sector (our opinion on the next 2 months): Bearish for about 2-3 weeks, and then bullish once again

Medium-term outlook for the precious metals sector (our opinion on the period between 2 and 6 months from now): Bullish

Long-term outlook for the precious metals sector (our opinion on the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion on the period starting 2 years from now): Bullish

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can't promise that it will be the case each week.

Please note that this service does not include daily or intraday follow-ups. If you'd like to receive them, we encourage you to subscribe to our Gold & Silver Trading Alerts today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager