In most cases we prefer to use options for speculation, rather than stocks. Our premium services should prove useful regardless of the decision to use or not to use options, however we find the unique characteristics of this instrument very useful for speculators, especially those interested in the precious metals. There are several reasons, however the main ones are:

Rare events – extreme price movements occur much more likely than it is generally believed. Technically speaking, the probability for the events that are said to be extremely unlikely is higher, than the normal distribution would tell you. The normal distribution, which is used very widely in financial modeling, should not be used at all, or at least not for most purposes.

The point is that we can do something at least about a portion of the risk that the rare events impose on us. We keep part of our holdings in physical bullion to prepare for a financial system meltdown, if one is to take place, buy what can we do regarding the speculative part of our portfolios? Please take a look at the simple simulation below.

The GDX ETF (proxy for PM stocks) is $35 at the moment of writing these words (in 2009), and we have just seen much lower prices. Anyone who believes in the bull market in the precious metals believes also that this ETF is going higher. Therefore $35 Jan 2011 (expire two years from the moment these words were written) call options seem like an ‘almost sure thing’. Their price today is around $11.50. If GDX goes to its previous high of around 55 it will rise 55/35-1 = 57.1%. If the volatility does not change much (which is a realistic assumption), the value of options should change from $11.5 to $23.5, which is a gain of 104.3%. That is almost 2 times more than the change in the value of the underlying stock, so let’s say that the leverage here is about 2:1

Therefore investing about 50% into these options and keeping the rest in cash should give you about the same end result after a year, as would the investment 100% of your money in the GDX itself. Not much of a difference if GDX goes up, like most of us believe it will or it just doesn’t make a major move down.

However, can we rule out that several things go wrong within the ETF itself or any other factors that would make it decline to just $5? Nonsense – some might say, but when HUI was above 500 level, did you believe that the HUI Index will go to 150 within several months? Apex Silver was priced above $20 in May 2007 only to go bust in the first days of 2009. That is exactly what rare events are all about. They are rather unlikely events that have very important implications.

Getting back to our simulation – what happens to this investor’s money (options vs. stocks) if GDX indeed plunged to $5?

Stocks: 100% invested capital * 5 / 35 = 14.3%

Options: 50% invested capital * 0 (options would become rather worthless) / 11.5 + 50% * 100% (cash) = 50%

That’s right, anyone who invested 100% in one stock, would end up with only 14.3% of their original cash. Conversely, anyone holding 50% in long-term options and 50% in cash would keep more than 3 times more.

In the first case, one would need to increase his capital about 7 times just to regain what was just lost. The latter case, with options, would require ‘only’ doubling your money. Not an optimistic perspective, but that is still dramatically better situation than that of the investor who invested everything in stocks.

Protection against short-term manipulations – naturally a limited one. In this paragraph by manipulation we mean the short term price swings that were created ‘artificially’.

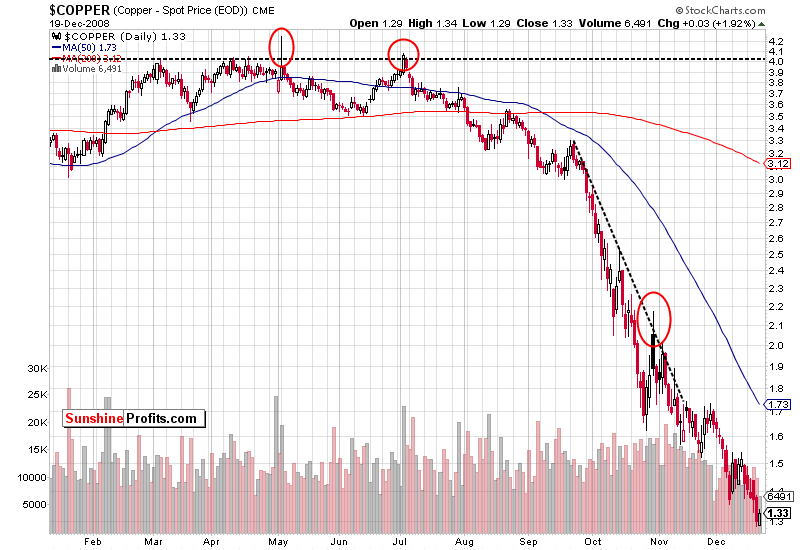

For example – the copper market (charts courtesy by http://stockcharts.com), and what happened at the beginning of July 2008, and at the end of October 2008 (the below should not be viewed as a proof that a manipulation occurred, but as an example how some factors caused the price to move in a very specific way - and manipulation is one of the possible reasons behind it).

Each of the marked areas contains a day, where price broke above an important resistance level, only to turn the other way around and plunge. Usually, when such things happen close to the point where the underlying equity / index has to break either up or down, the price will head in the opposite direction, than it broke to.

Why? The false rally is most likely caused by an individual or a company with large amount of capital (usually leveraged) that ‘somehow knows’ where the market is going to go or just knows that many people have stop loss orders below / above a given level. The artificial price swing is created in order to trigger these orders and to make other market participants close their positions. Investors/speculators who used the stop loss orders in this case bet on the correct direction of the price, but what’s the difference, if they will have their positions closed at a loss prior to the rally/decline that they have correctly predicted? If they lose money, then someone else has to win – as this is usually witnessed on the futures market, which is symmetrical.

Who gains? The one, who triggered the false breakout/breakdown, as this entity is able to reopen the position that it has just closed, but at more favorable price. I’m not saying that this is necessarily what happened at the abovementioned days, and I am not accusing anyone of temporary manipulating prices, but I view such an explanation as reasonable and I know that these signs are often a good indication of where the market is heading in the short term.

You decide how much you can afford to lose. With (buying) options the maximum amount of money that you can lose in a given transaction is fixed - it equals this options value. This may seem obvious to stock investors, but futures traders know too well that one's losses may exceed the initial capital. Options provide you with substantial leverage and keep your losses under control. Some will say that you can set up a "stop loss" order to limit your losses - ask them if the stop loss will work if market opens much lower than your stop loss was placed. Even if they say "yes" (which I doubt), ask them at what price will your position be closed - the price of the stop-loss order or will it be closed at the price that market opened that day - with a loss much greater than your limit. This is important also from the psychological point of view. If you invested in a stock 100% of your capital and this company performs poorly, but you find it hard to close a losing position, so you don't do it. Finally this company files for bankruptcy and you lose 100% of your cash. If you invested 20% of your capital in options that give you 5x leverage (similar exposure) and the stock goes to 0, the maximum that you could have lost here is 20%. Far from amazing but that is not a complete disaster - losing 100% cash is.

Profit on rising volatility – options’ value depends on several factors, and volatility is one of them. By buying options on stocks that are in the ‘calm before the storm’ mode is profitable not only thanks to the rise/fall (call/put options) of the underlying equity, but also thanks to increased volatility. You can read more on that topic in this essay.

You know what you bet on - practically you can bet on each volatility / price combination possible, which means that each trade can be tailored to your needs. Most often we don’t use the most complex option strategies, but we still encourage you to browse one or two tutorials dedicated to options. We have this subject covered, so make sure you will check it out in our .

You can limit risk by hedging - options allow you to hedge your risk using just a small part of your capital when you believe lower prices of PMs could decrease your profits. You can also sell part and hedge the rest or use any combination of the above, all depending on your risk preferences and the time you have to manage your portfolio. In our view, hedging your portfolio by using options is superior to simply selling your holdings, since it gives you the opportunity to gain additional profits thanks to the increase in options' value after dramatic (volatility rises) sell-offs. This means risk reduction if you decide to put less capital into this strategy, as less money is needed to give you the protection similar to the one you would get without 'the bet on volatility'.

Options can ensure that you get back on the long side of the rising market - the fact that options have time value can be seen as an advantage (yes!) if you use them to hedge your long positions. It’s counterintuitive, as the time-decay causes options to lose value, but we really think that it may prove profitable for some investors. The reality is that when people get out of the market, they sometimes fail to get back in at lower prices, as they start feeling the same emotions as other market participants. The prevailing emotion after a sell-off is fear, which prevents people from reinvesting in the shares they have just sold. After shares start to rally, people wait for a pullback, which either doesn't come or even if it does, it doesn't seem to be deep enough to make them purchase their favorite PM stocks. Finally people often get back into the market at prices higher than those at which they sold their shares in the first place. Since options have a "time limit", it means that you will get back your exposure to rising gold and silver prices rather sooner than later. Although this theory is questionable, we view this feature of put options as highly practical.

Are we advocating switching to options only? No, we’re not. There is another risk involved in options and that is the fact that they additional legal regulations, though they are not as bad as futures, where powers that be can raise position limits to absurd levels - they did that about ten years ago on the palladium market. Therefore we believe it is best to diversify and use options mainly for speculation on one hand, and on the other hand keep one’s long term holdings in stocks and physical bullion.

Back