What a remarkable day Friday has been! Going into the U.S. session open, we have seen gold challenging its early-June highs. The barrage of geopolitical news has been deafening and gold had literally nowhere to go but up. But something "unexpected" yet totally predictable happened to those who have jumped on the gold bandwagon. Friday's U.S. session has sent gold lower. On huge volume. And not only gold, that is. Those looking at the charts' bigger picture, those familiar with our analyses, hadn't been surprised. Now that the dust is settled and gold pushes lower, let's examine the aftermath. And draw lessons for the days ahead.

Gold Reverses

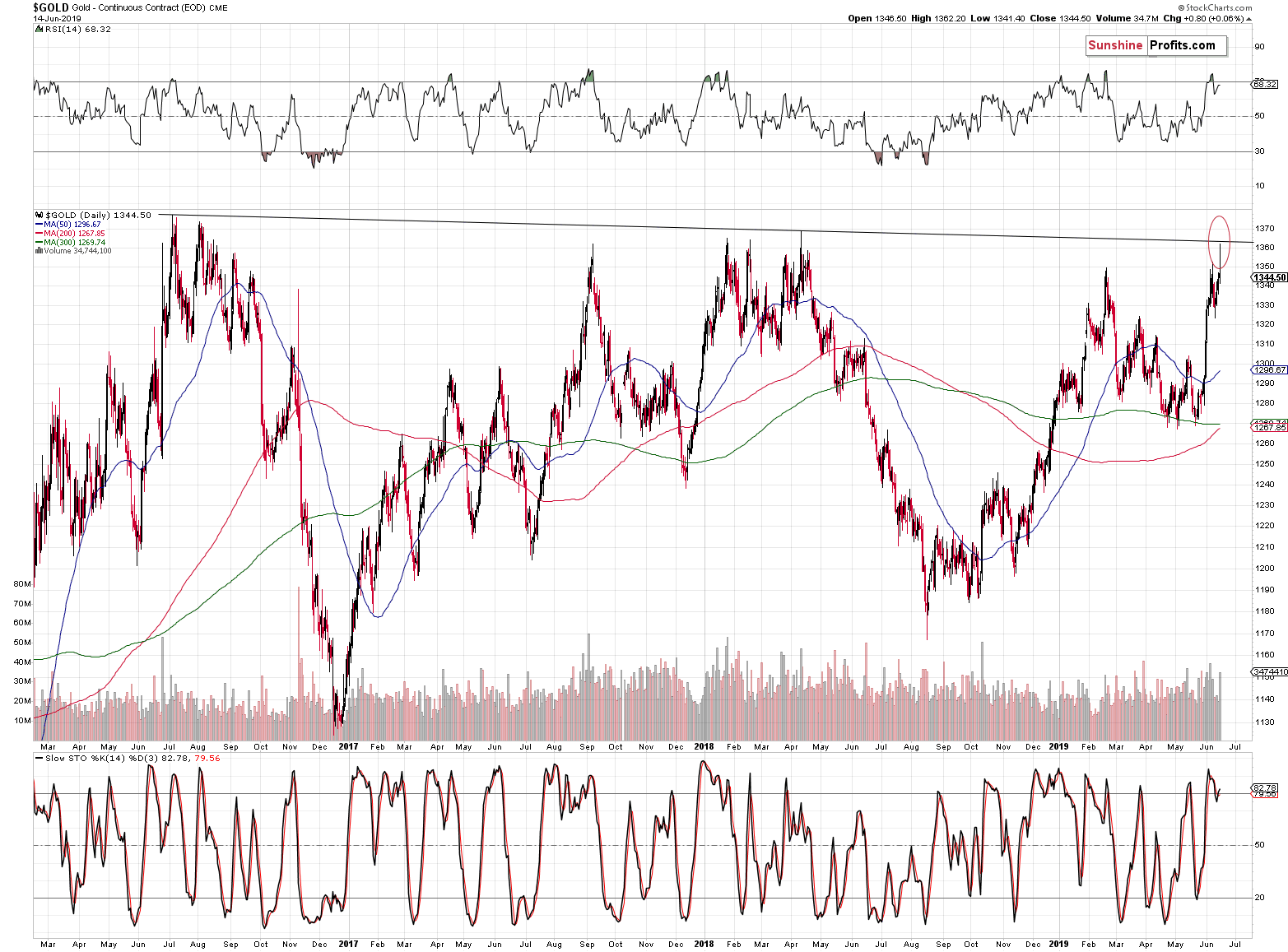

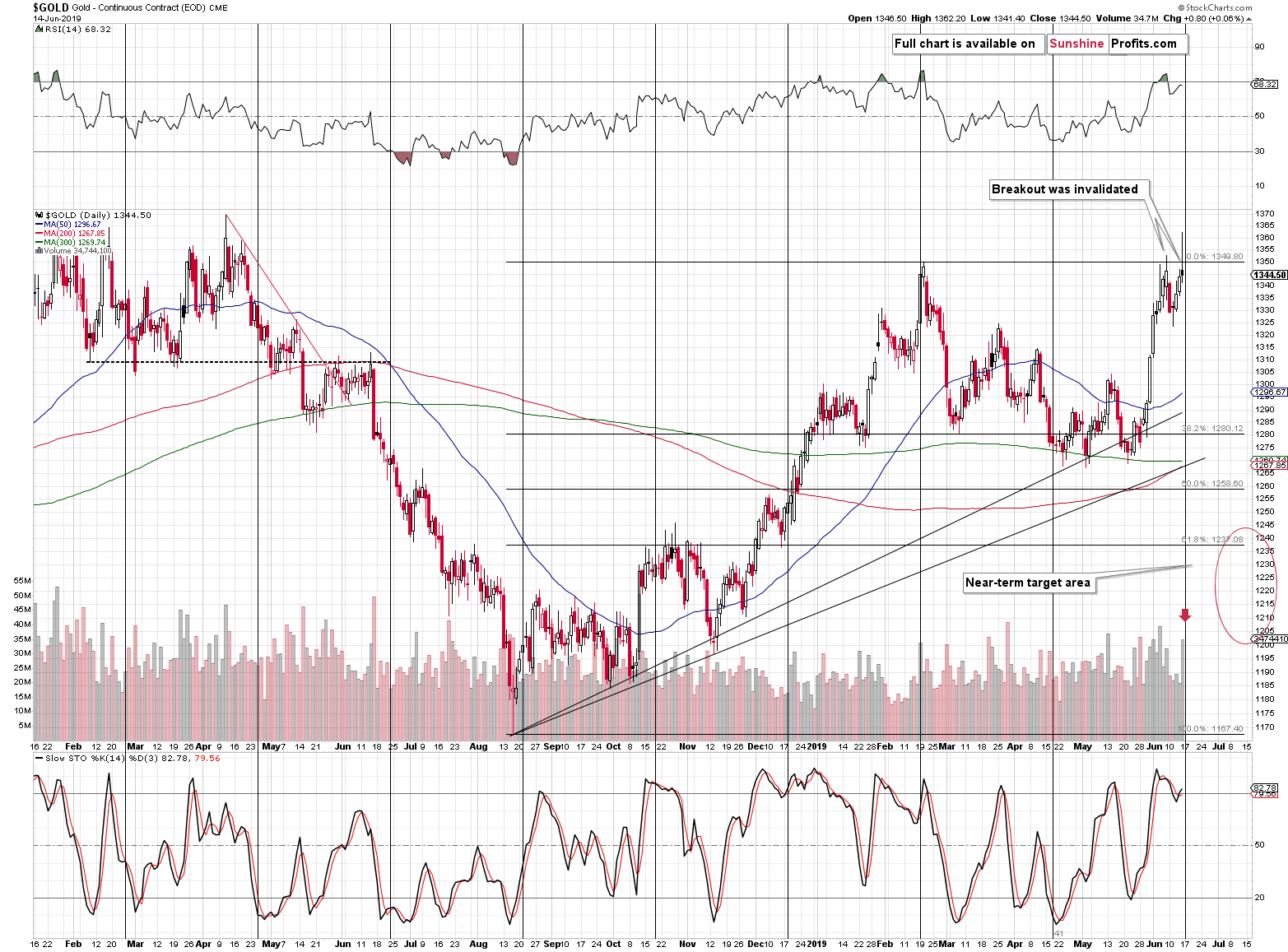

Friday's reversal was the most important development of the previous week. Initially gold rallied on Iran-related note and went on to rise to its long-term resistance. Shortly after touching the resistance line, gold topped right in the middle of the target area that we first mentioned to our subscribers on June 7, and then on June 10 within the free gold article on our website.

And it took place on huge volume.

Not only that - the RSI indicator is very close to the 70 level and the reversal took place right before gold's cyclical turning point. What else happened? Gold moved to new 2019 highs but only in intraday terms. If we focus on the closing prices, which are more important in some ways, this was gold's third highest close of the year. From this perspective, the true high was formed in February, the early June high was a failed attempt to move above it, and we can say the same thing about Friday's price action. In fact, Friday's movement, was - by itself - a failed attempt to close above the early-June highs.

The combination of gold's reaching the very long-term resistance line, the immediate invalidation of the breakout to new 2019 highs, huge volume, proximity of the cyclical turning point, and RSI almost at the 70 level all suggest that the 2019 top for gold is in.

Did we see anything similar in silver?

You bet.

Silver Reverses, Too

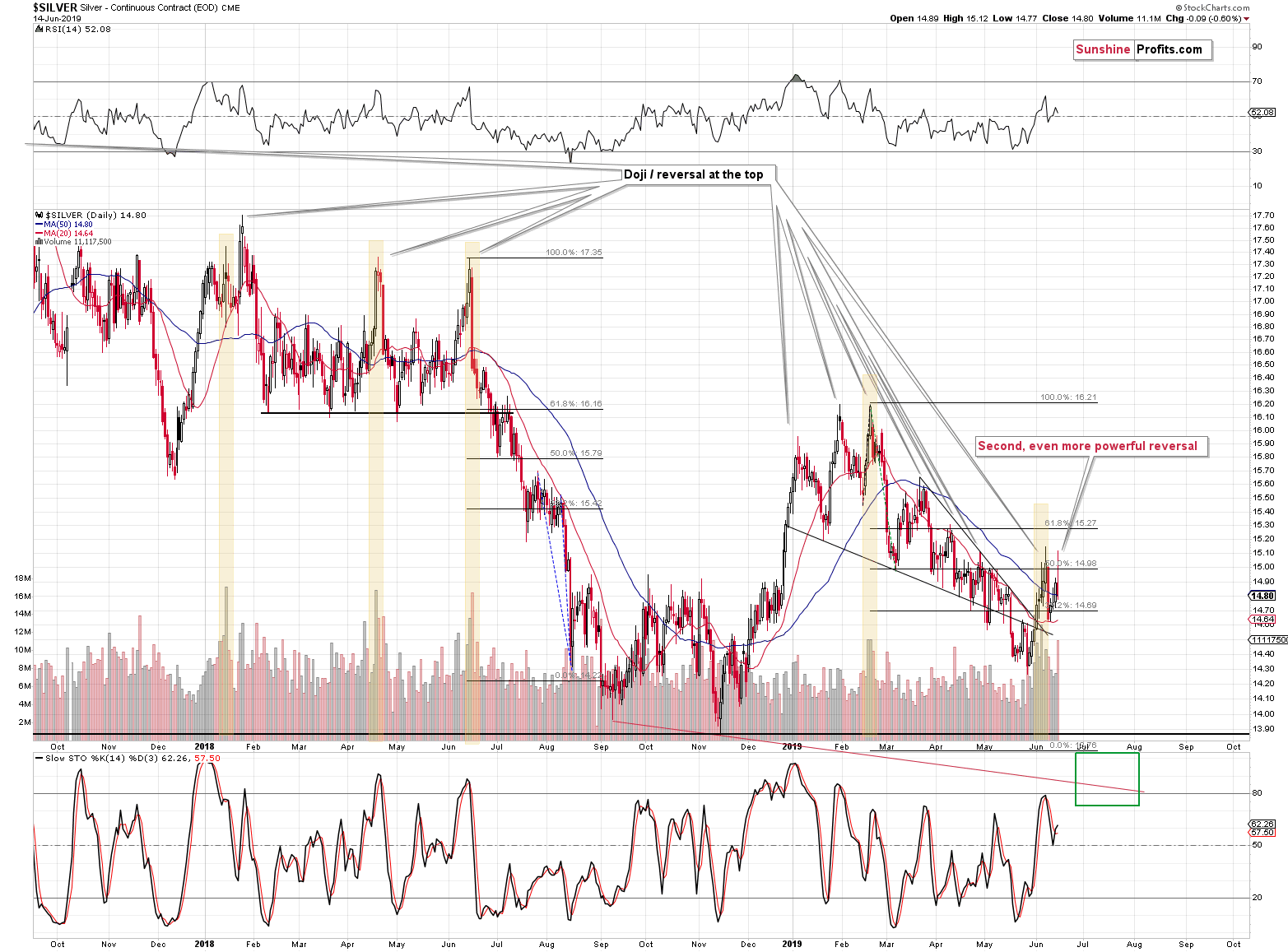

The white metal declined on Friday, while having temporarily outperformed gold on the upside. This is as bearish as it gets in case of the silver - gold dynamics. Big reversal on huge volume is a bearish sign for all markets, but seeing the above-mentioned specific relative performance makes it extremely bearish.

Silver is likely to move to new 2019 lows relatively soon. Perhaps even this month.

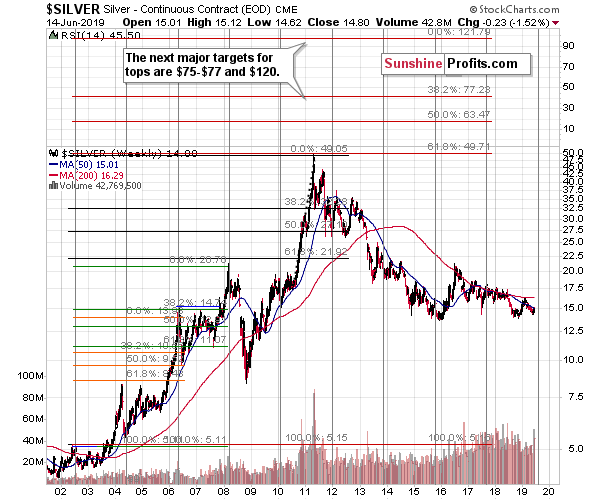

Before moving to mining stocks and the USD Index, we would like to show you a silver price prediction technique that you might not remember. After all, we previously commented on it many months ago.

The reason is that we simply don't comment too often on the things that don't really change. For instance, we like gold's and silver's fundamental picture with the long-term in mind and we expect gold to move much higher in the following years. But it doesn't change from day to day, week to week, or even month to month, so that's not something that we're going to discuss very frequently.

The same is the case with silver's very long-term cycles. This is something that is useful every 2 years or so, which means that there's little reason to discuss it in the meantime. Now it's a good time to get back to this topic, as the next very long-term turning point is just around the corner.

Turning points can work in both ways: they can be tops and they can be bottoms. All in all, it means that volatility is likely to increase and that something big is likely to happen. Given that silver is on a verge of breaking below the 2018 and 2015 lows, this "something big" could be a massive decline. Thus, Friday's powerful reversal might have been the start of something epic.

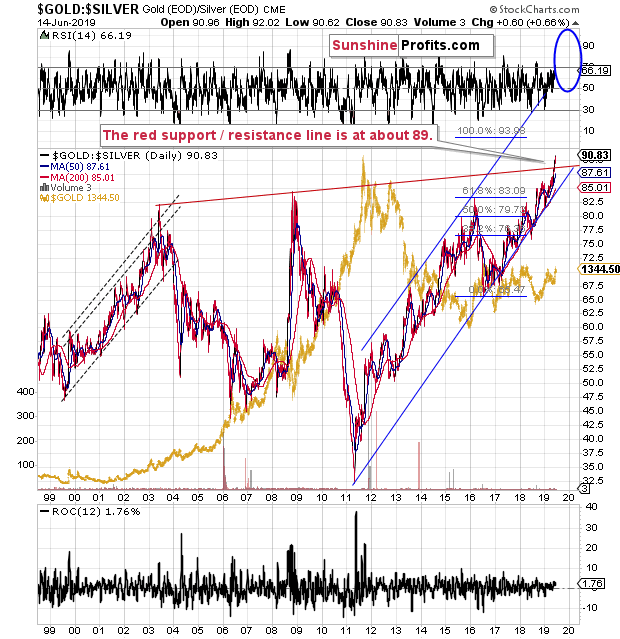

Why would silver break lower instead of rallying? For instance, because gold is topping and the gold to silver ratio is after a major breakout.

The ratio is not only well above the 2003 and 2008 highs, but also above the rising line that is based on them.

The massive moves in the precious metals market are characterized by big medium-term moves in the gold-silver ratio in the opposite direction. For instance, in 2008, the ratio soared as both precious metals declined, and in 2011, the ratio plunged when both metals rallied. The current breakout points to a big, medium-term decline in the precious metals sector. Combining this knowledge with silver and gold's reversals and the looming silver long-term turning point suggests that we're going to see a big decline in the price of silver in the following months, and - quite likely - weeks.

Before summarizing, let's take a look at the USD Index.

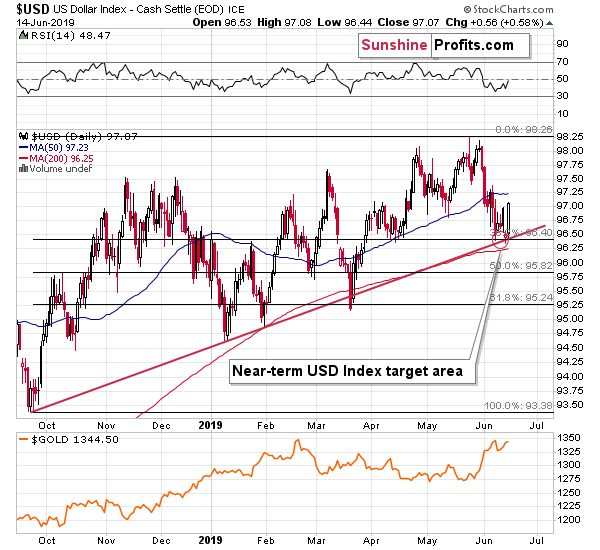

The USD Index Turns Higher

The USD Index bottomed in our target area as it seems to have absorbed the bearish news and is now ready to resume its previous trend - which is up. Our Friday's comments on the news-USD dynamics remain up-to-date:

All the above-mentioned chaotic news were U.S.-centered. It was Iran that was accused of being involved in the attack on the tanker, but who suggested that? The Bloomberg news story's title explains it: "U.S. Says Video Shows Iran Was Involved in an Attack on Tanker". Theoretically anyone can claim anything about any damaged ship. Why did the "American officials release images they said show that Iran was involved in an attack on an oil tanker"? What's the common denominator among all the above?

It's the U.S. dollar. What did the U.S. currency do during - and most importantly - before the 2003 invasion of Iraq (the tensions rose gradually before the war)? The USD Index declined severely. In fact, it was the biggest multi-year decline of the recent history. On a side note, it turned out that there were no weapons of mass destruction found in Iraq, despite the supposed "solid proof" to the contrary. Doesn't the just-released "proof" of Iran's involvement look at least a bit suspicious?

President Trump likely doesn't want any wars - he said so many times - but he knows that words and threats can sometimes do a lot on their own. If a simple tweet can change a lot and move the markets, then a simple accusation that people will associate with "war with Iran" could do even more and cause the USD to decline without any military intervention whatsoever.

The problem is that in 2002 and 2003, the USD was after a powerful rally and significantly overvalued. This time, the technical and - especially - fundamental situation appears quite different. The U.S. dollar may be a bad (fiat) currency, but it's still best house in a bad neighborhood. Europe has quite a lot of structural problems and the Japanese money-printing machine is almost overheating. Which country has actually been raising interest rates and not only talking about it? The U.S.

The market can be tricked on a short- or medium-term basis, but in the long run, the market forces always win. We have already reached the point when surprising news is not something that triggers really big declines in the USD. The amount of people that wants to get into the USD Index at lower prices is growing, while the amount of people that takes the surprising news at its face value is declining. The result is weaker reaction to the downside.

The interesting fact is that because USD appears to be the fiat currency of choice, it acts as a safe haven for many investors. Sure, gold is the real hard currency, but since we live in the fiat world, many people simply prefer the world reserve currency backed by the world's most powerful economy and military. This means that in case of the geopolitical turmoil, especially if it's not directly related to the U.S. - like the just-released "story" about Iran, we could actually see increased demand for the U.S. dollar. The plan to lower the USD value may simply not work this time.

How could this be resolved? The Powers That Be will know that they can't keep the USD low for long, so they would do as much as they can to actually take advantage of it. They - or the companies they "are in association with" - would take aggressive bets on higher USD values before the major breakout. As they would no longer be trying to suppress the price, the rally following the breakout should be very significant.

This means that the decline in the precious metals should be very significant as well.

Summary

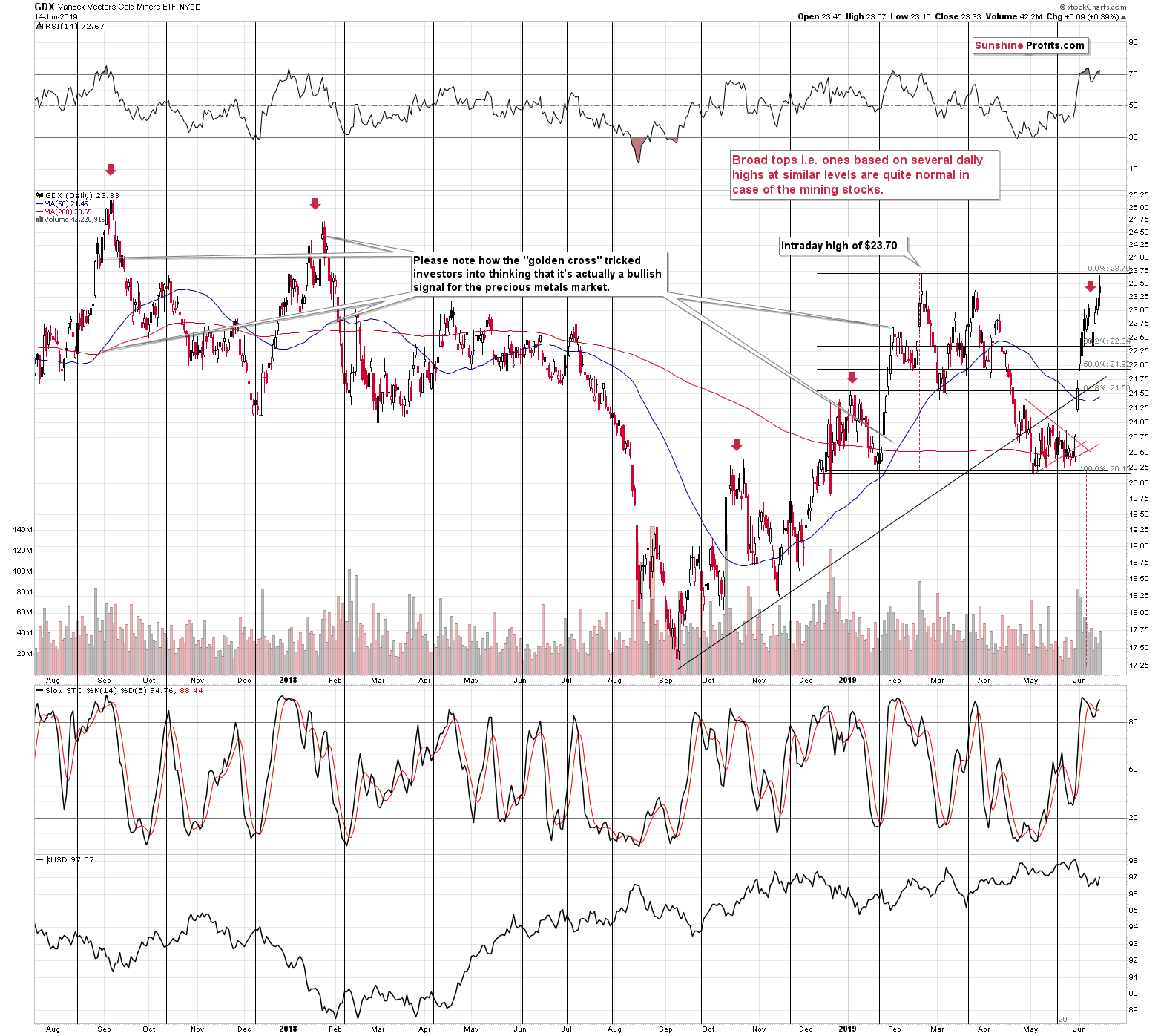

Summing up, the combination of gold's reaching the very long-term resistance line, the immediate invalidation of the breakout to new 2019 highs, huge volume, proximity of the cyclical turning point, and RSI almost at the 70 level all suggest that the 2019 top for gold is in, and silver's price action clearly confirms it. Bottoming USD Index and miners reversing at their previous high and almost right at their turning point confirm the bearish outlook for the following weeks and months.

Today's article is a small sample of what our subscribers enjoy regularly. For instance today, we've also shared with them the detailed analysis of the miners. To keep informed of both the market changes and our trading position changes exactly when they happen, we invite you to subscribe to our Gold & Silver Trading Alerts today.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care