Earlier today, the ADP report showed that non-farm private employment rose by 241,000 in December, beating expectation for an increase of 226,000. Additionally, data showed that the U.S. trade deficit narrowed to $39.00 billion in November from $42.25 billion in October, also beating analysts’ expectations. These bullish numbers added to expectations that the Federal Reserve will raise interest rates in the coming year, which pushed EUR/USD and AUD/USD below 2010 lows. How low could they go?

In our opinion the following forex trading positions are justified - summary:

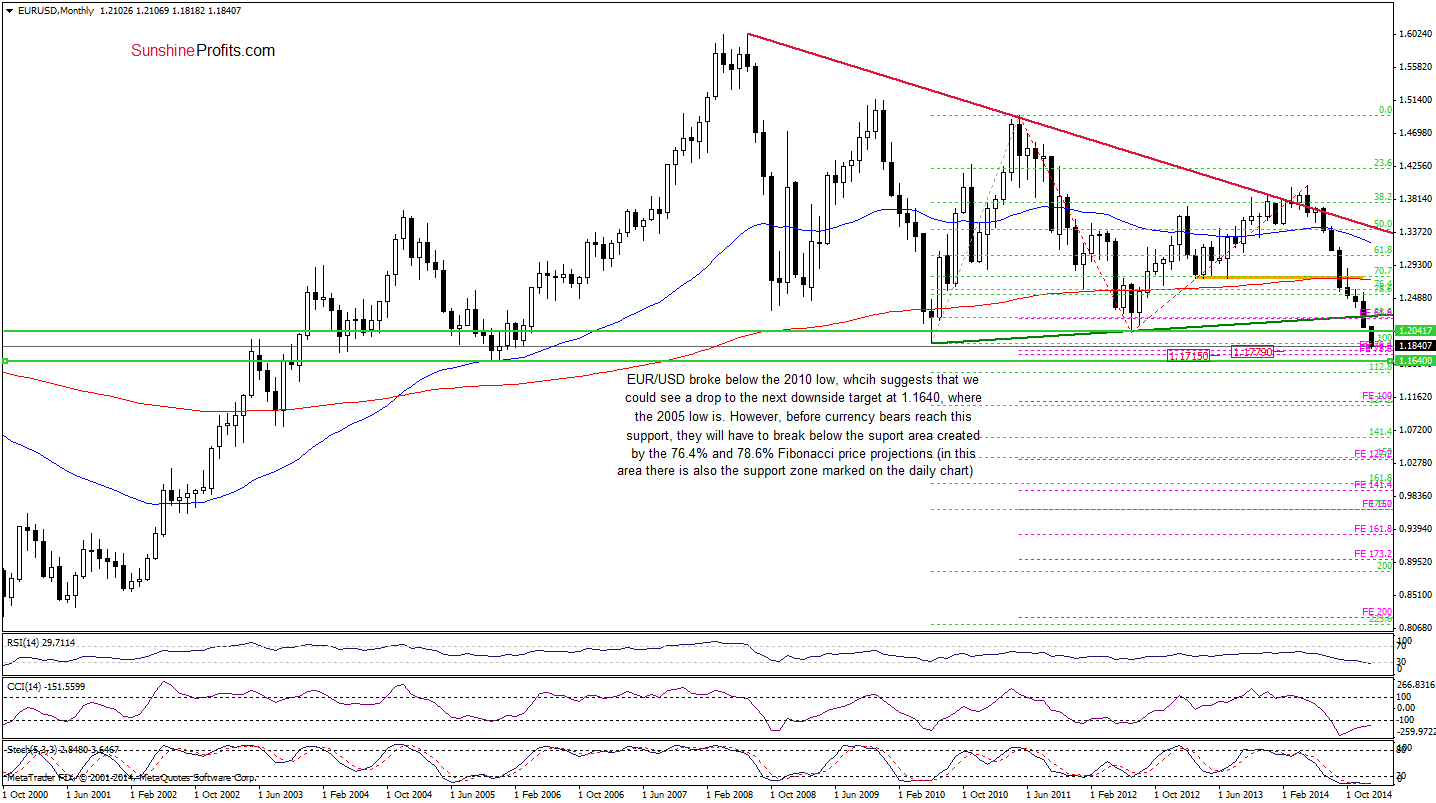

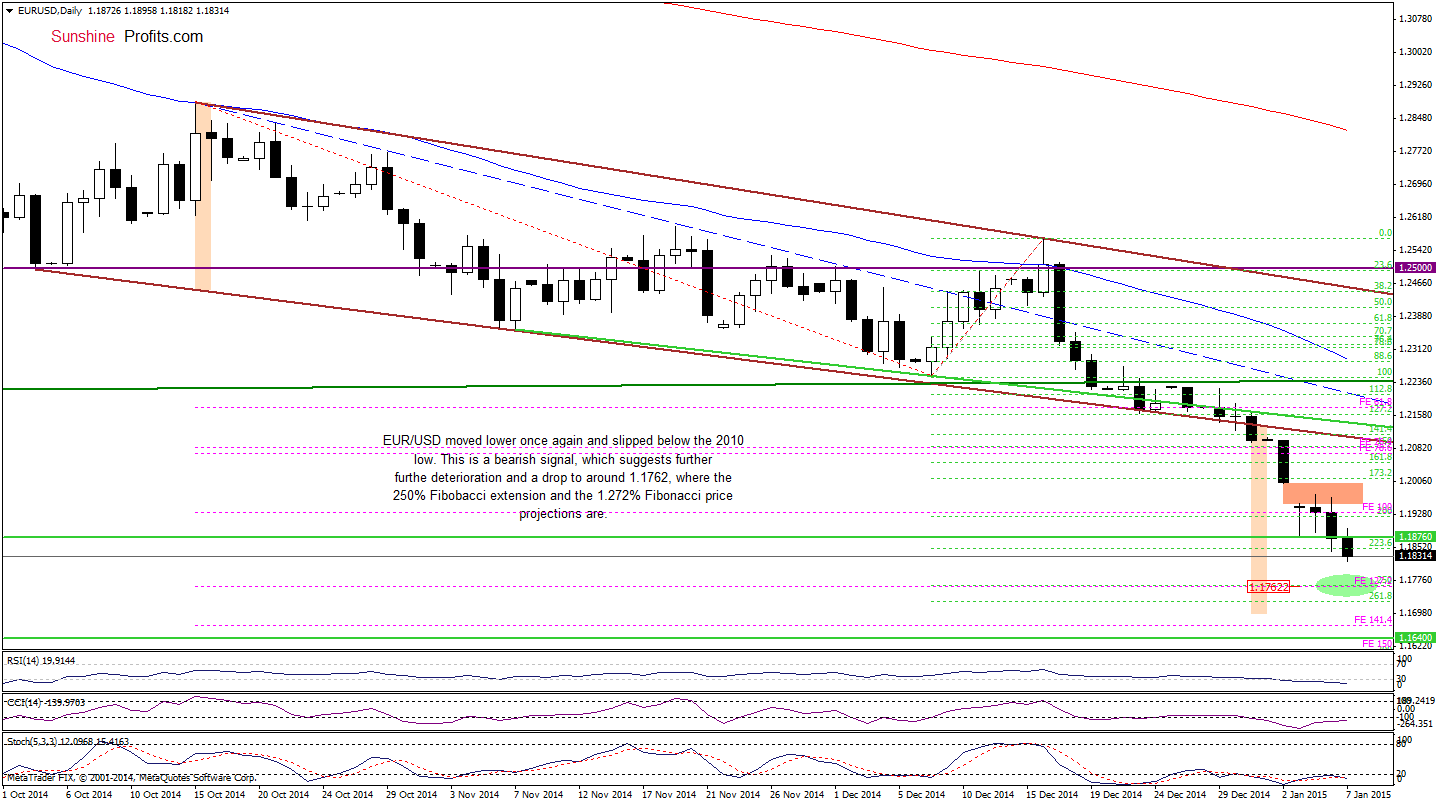

EUR/USD

In our Forex Trading Alert posted on Monday, we wrote the following:

(…) the exchange rate slipped below the 2010 low, but the pair reversed very quickly, invalidating this small breakdown. Although this is a positive signal, we should keep in mind that as long as the gap between the Jan 2 low and the Jan 4 high is open, another test of this very important support level is likely.

As you see on the charts, EUR/USD not only dropped to the 2010 low as we expected, but also slipped to a fresh multi-year low earlier today. Taking this fact into account, we think that the exchange rate will move lower once again and the downside target would be around 1.1762, where the 250% Fibonacci extension and the 127.2% Fibonacci price projection is. At this point, it’s worth noting that this level is in a support area around 1.1715-1.1779 (marked on the monthly chart and created by the 76.4% and 78.6% Fibonacci price projections), which suggests that we could see a rebound from here in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

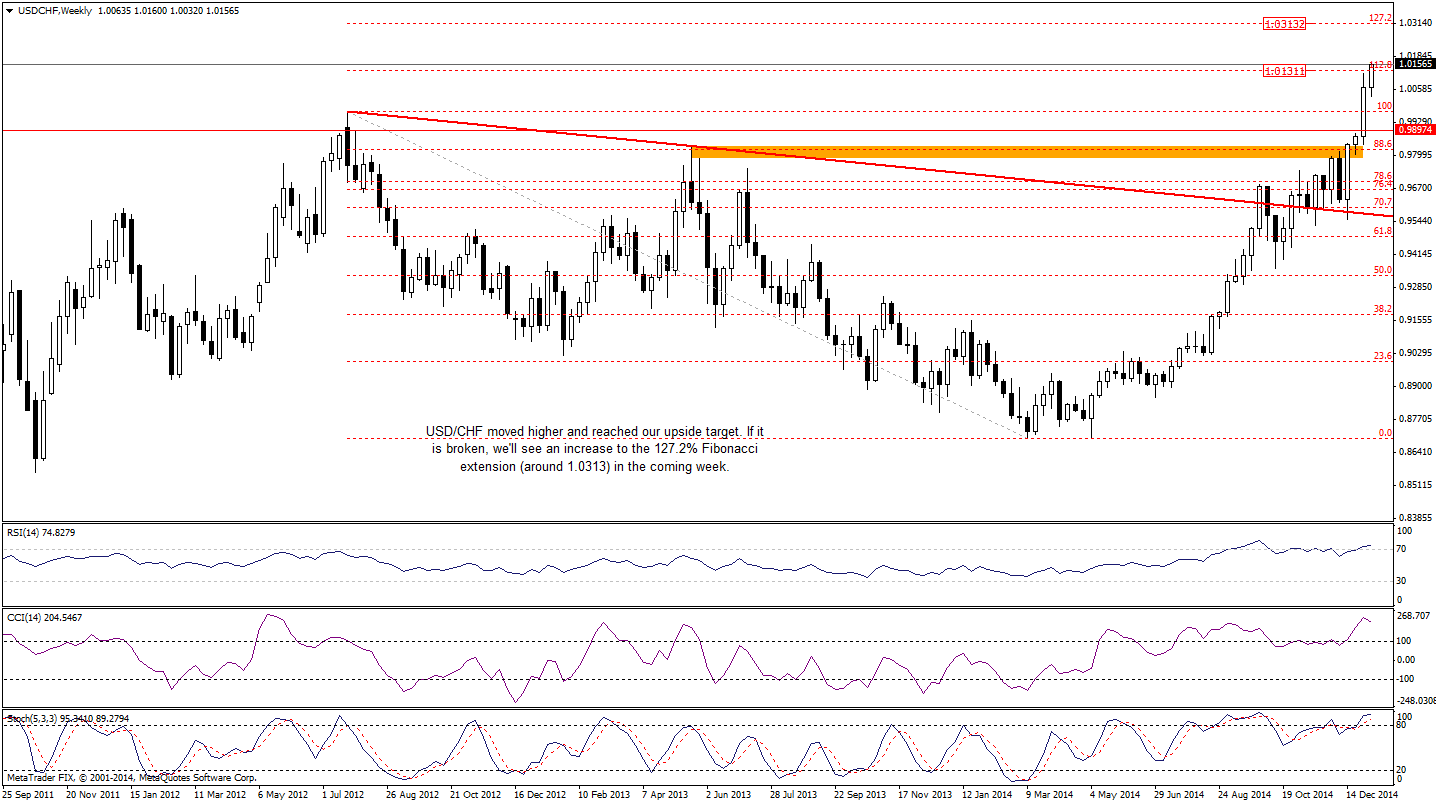

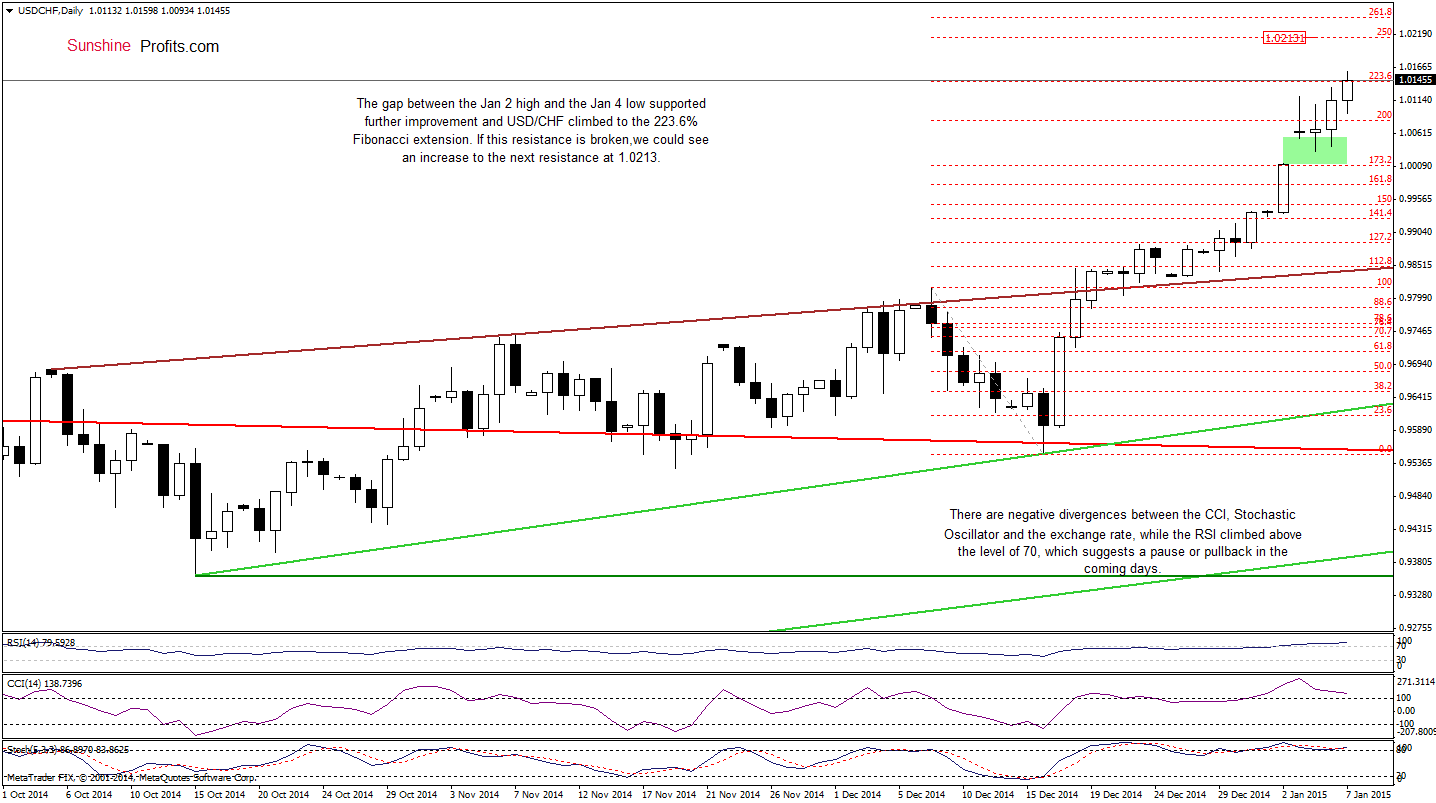

USD/CHF

Quoting our last commentary on this currency pair:

(…) the pair broke above the 2012 high, which suggests further improvement and an increase to around 1.013, where the 112.8% Fibonacci extension is (seen more clearly on the weekly chart).

Looking at the charts, we see that the situation developed in line with the above-mentioned scenario and USD/CHF reached our upside target. With this move, the pair also climbed to the 223.6% Fibonacci extension, which suggests that a breakout above these levels will trigger an increase to around 1.0213 (the 250% Fibonacci extension) or even to 1.0313, where the 127.2% Fibonacci extension (based on the entire 2012-2014 declines and marked on the weekly chart) is. Despite this positive outlook, we should keep in mind that there are negative divergences between the CCI, Stochastic Oscillator and the exchange rate, while the daily RSI climbed above the level of 70, which suggests that a pause or even a correction in the coming week should not surprise us.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

On Friday, we wrote the following:

(…) AUD/USD reversed and declined, invalidating a breakout above the upper line of the declining trend channel. This is a bearish signal (especially when we factor in the fact that the CCI and Stochastic Oscillator generated sell signals), which suggests further deterioration and a test of the recent low and the support zone created by the 2010 lows.

On the daily chart, we see that he situation developed in tune with our above-mentioned scenario and AUD/USD dropped below the 2010 low on Monday. Although the pair rebounded (invalidating a breakdown) and climbed above the upper line of the declining trend channel, currency bulls didn’t manage to push the exchange rate higher, which translated to an invalidation of the breakout. This bearish signal (similarly to what we saw on Dec 31) resulted in another pullback, which pushed AUD/USD under the 2010 low once again. In our opinion, this suggests further deterioration and a drop to at least the support line based on the recent lows (currently at 0.8022). If this line is broken (which is quite likely), we’ll see a test of the strength of the 61.8% Fibonacci retracement based on the entire 2008-2011 rally (around 0.7943) in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts