A week ago, currency bulls used the buy signals generated by the indicators to trigger a quite sharp rebound after earlier declines. As it turned out, we didn’t have to wait long until they lost their "power" and disappointed those who trusted them without a deeper analysis of the technical situation. Did they deceive us too?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.4480; the initial downside target at 1.3851)

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3221; the next downside target at 1.2790)

- USD/CHF: none

- AUD/USD: none

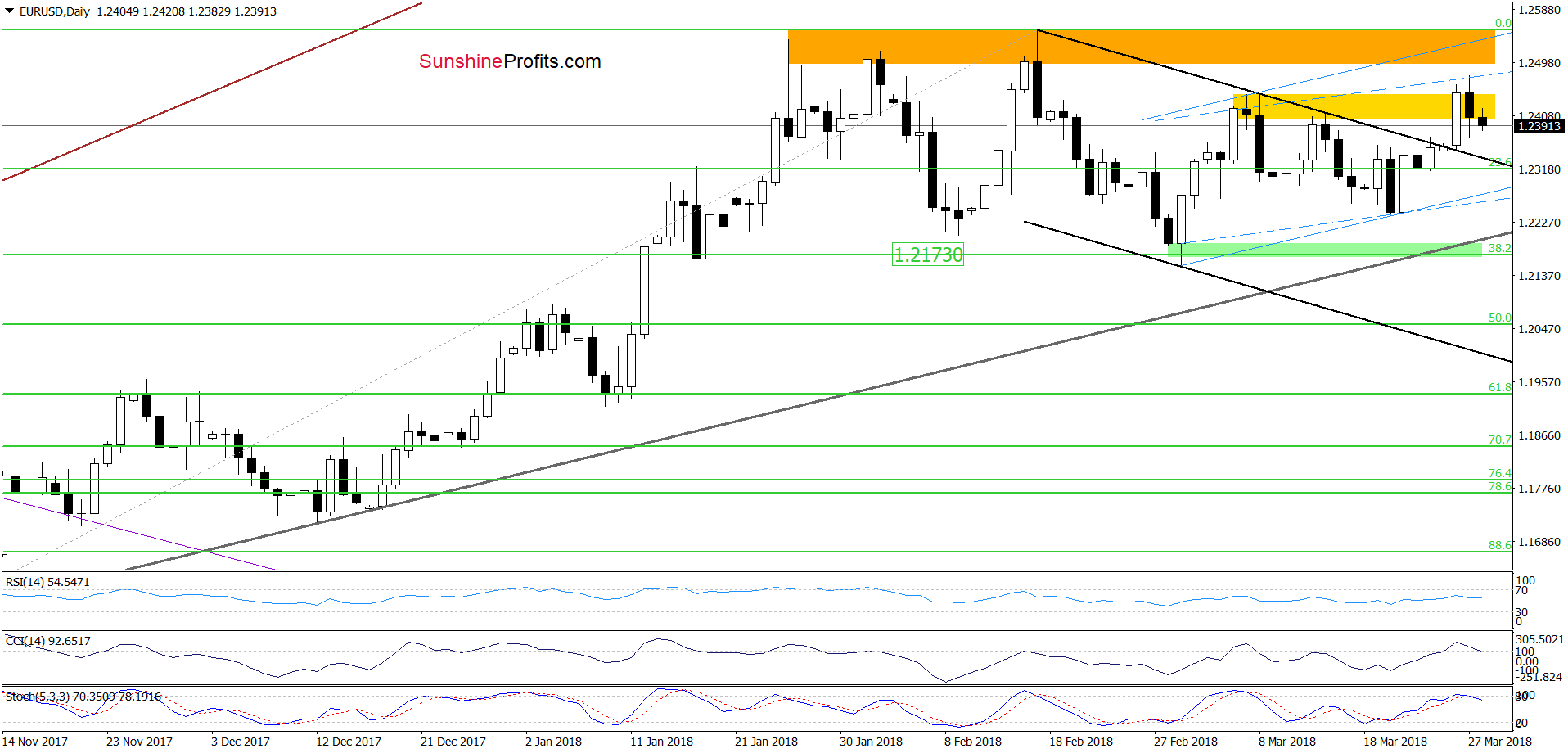

EUR/USD

Quoting our previous alert:

(…) the pair invalidated the earlier tiny breakout above the early March peaks which in combination with the sell signal generated by the Stochastic Oscillator (the CCI is very close to doing the same) increases the probability of further deterioration in the coming day(s).

As you see on the daily chart, currency bears pushed EUR/USD lower (as we had expected) earlier today, which together with the sell signal generated by the indicators suggests further deterioration in the coming day(s).

Despite these signals, we decided to wait for more bearish developments before opening short positions. Why? In our opinion, as long as the exchange rate remains above the previously-broken upper border of the black declining trend channel all downswings could be verifications of the earlier breakout.

However, if we see an invalidation of the breakout above this line, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

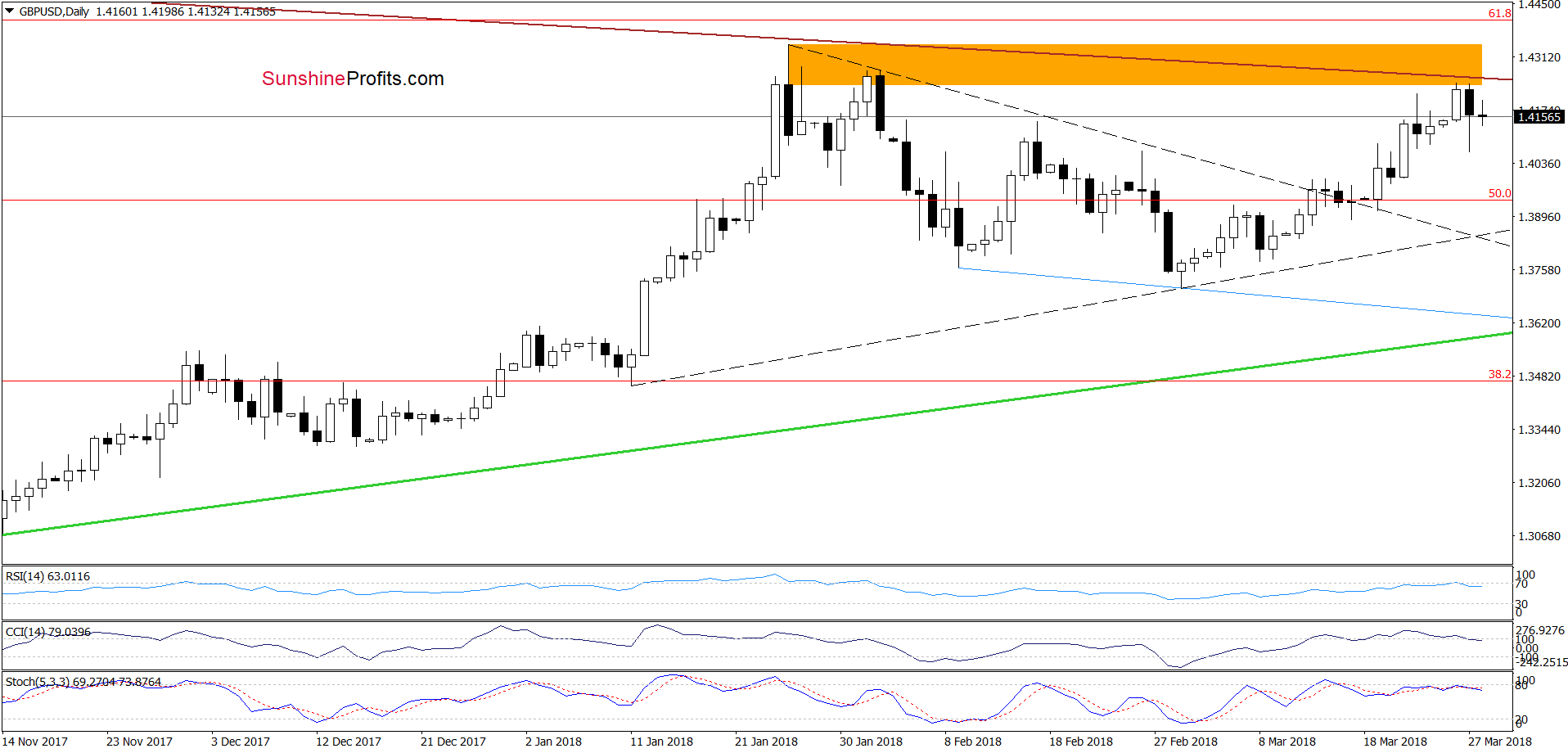

GBP/USD

On Monday, we wrote the following:

(…) a climb above the mid-February high. Taking this positive event into account and the lack of the sell signals generated by the indicators, it seems that GBP/USD will test the orange resistance zone and the brown declining resistance line (based on the mid-June and August 2015 highs) in the very near future.

From today’s point of view, we see that the proximity to the above-mentioned resistances was enough to encourage currency bears to act. As a result, GBP/USD moved quite sharply lower yesterday, which together with the sell signals generated by all daily indicators suggests lower values of the exchange rate – especially when we factor in the triangle apex reversal pattern.

What do we mean by that? Looking at the above chart you can notice the triangle (marked with the black dashed lines) created by the resistance line based on the January and February highs and the support line based on the January and March lows. The intersection of his arms took place yesterday, which resulted in a reversal. Such price action increases significantly the probability of further declines in the following days.

Nevertheless, even if currency bulls manage to push the pair a bit higher from current levels (which seems a much less likely scenario for this moment) the way to the north will be close as long as GBP/USD remains under the major resistance zone about which we wrote two days ago:

But will we see a breakout above this major resistance area?

In our opinion, such bullish scenario is quite doubtful. Why? First, all indicators climbed to their overbought areas, which means that generating sales signals is just a matter of time (not a very long time).

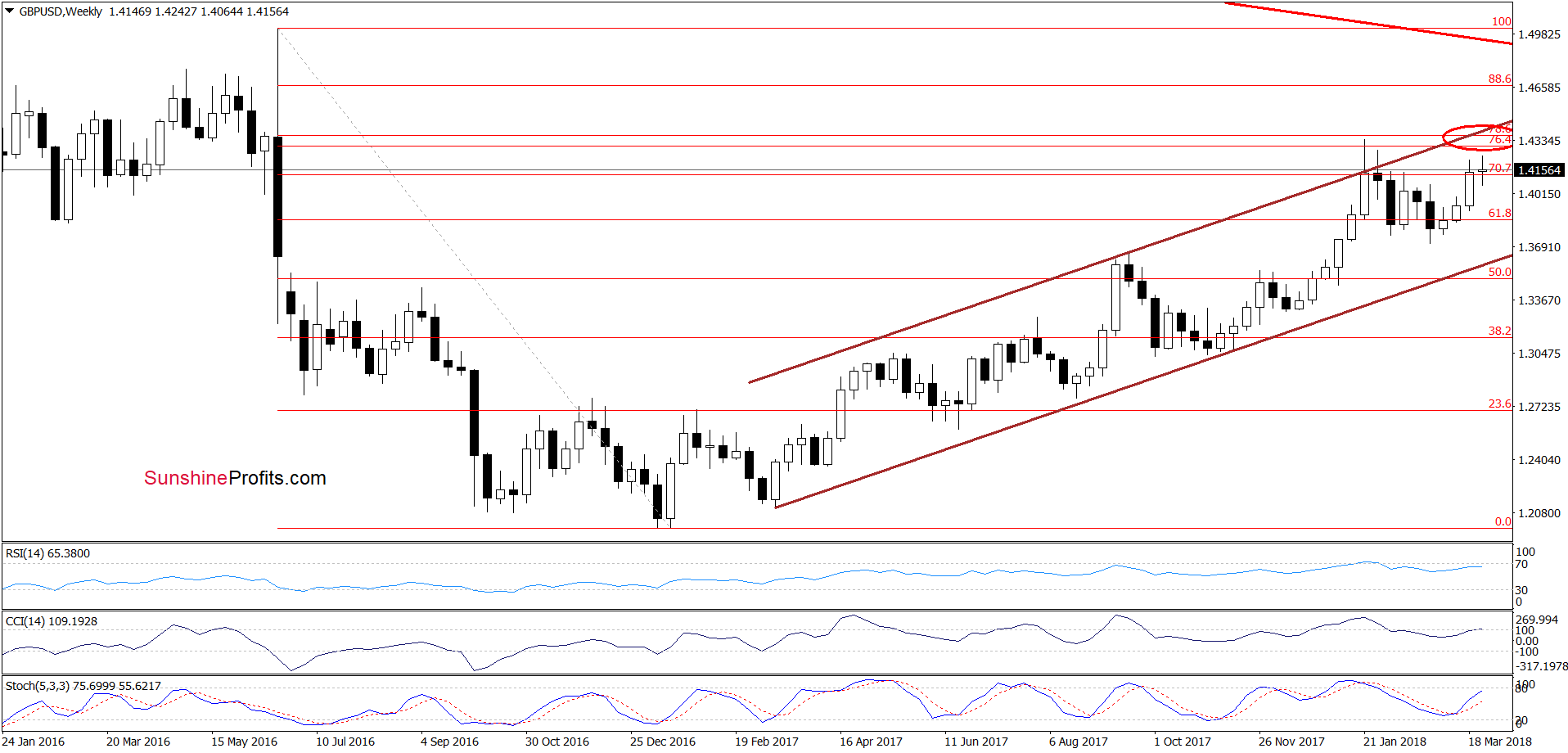

Second, the above-mentioned orange area is reinforced not only by the 61.8% Fibonacci retracement seen on the daily chart, but also by the combination of several resistances marked on the weekly chart below (with the red ellipse)

From this perspective, we see that even if currency bulls move higher, not far from current levels, we can see the 76.4% and 78.6% Fibonacci retracements, which were strong enough to stop currency bulls at the end of January. Additionally, they are currently intersected and reinforced by the upper border of the brown rising trend channel, which increases the probability of reversal in the coming week.

Connecting the dots, opening short positions is justified from the risk/reward perspective as the major resistance zone continues to keep gains in check and all the above-mentioned technical factors support lower values of the exchange rate in the coming days.

How low could GBP/USD go?

In our opinion, if the pair extends declines, the initial downside target for currency bears will be around 1.3851, where the lower border of the black triangle (marked with dashed lines on the daily chart) currently is.

Trading position (short-term; our opinion): Short positions with the stop-loss order at 1.4480 and the initial downside target at 1.3851 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

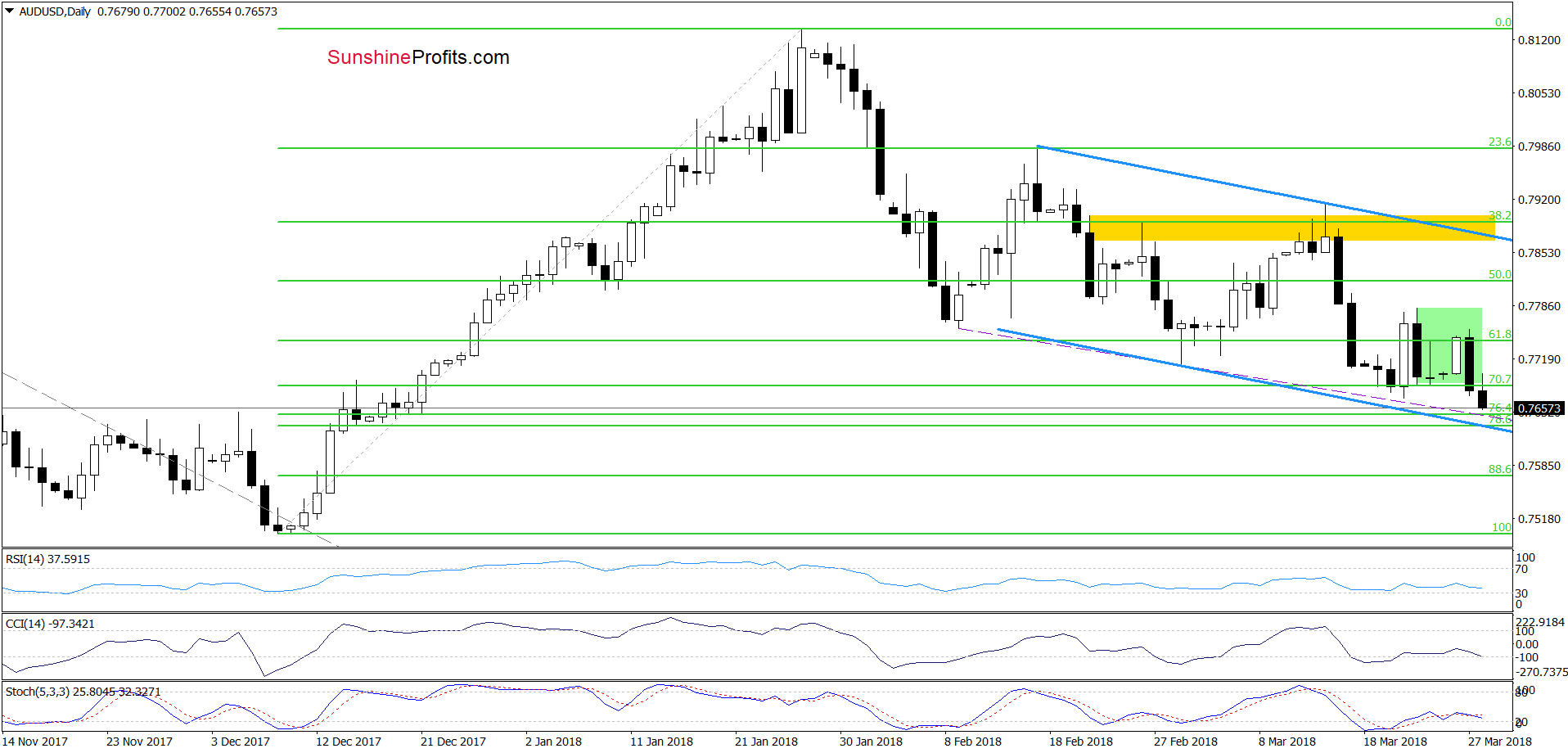

AUD/USD

In our last commentary on this currency pair:

(…) Although the buy signals generated by the daily indicators remain in the cards, we think that as long as there is no breakout above the upper line of the formation a reversal and a re-test of the last low (or even the support area created by the 76.4%, 78.6% Fibonacci retracements and the lower line of the blue trend channel) should not surprise us.

Looking at the daily chart, we see that the situation developed in tune with our assumptions and AUD/USD moved sharply lower yesterday. Earlier today, the pair extended losses and almost touched our downside targets, which suggests that reversal is just around the corner.

If this is the case, and we see more reliable pro-growth factors (like an invalidation of the earlier breakdown under the lower border of the green consolidation), we’ll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts