Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Introduction

As I mentioned yesterday, today's technical part will be rather short. As for my latest forecasts, not much has changed and what I wrote on June 24 remains valid.

The commodity complex continues to unravel, as recession fears have sparked frantic selling. The daily drama coincided with gold falling by 0.47%, silver shedding 1.77% and the GDX ETF sinking by 3.89%. In the process, the USD Index rallied by 0.23%.

More importantly, with the GDXJ ETF plunging by 4.70% on Jun. 23, our short position continues to reap profits.

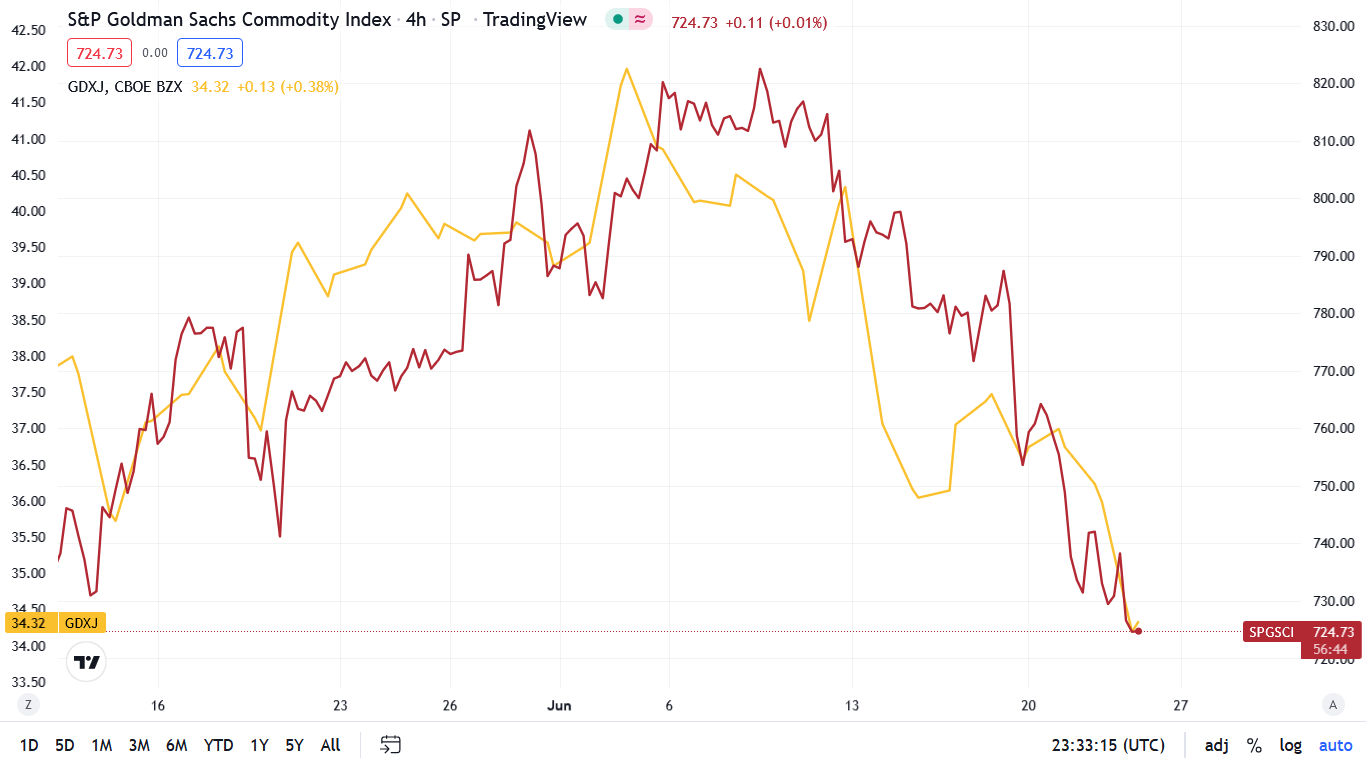

Please see below:

To explain, the gold line above tracks the four-hour performance of the GDXJ ETF, while the red line above tracks the four-hour performance of the S&P Goldman Sachs Commodity Index (S&P GSCI). As you can see, optimism has turned to pessimism. Moreover, with the U.S. economy wobbling and commodity prices still materially elevated, more downside should commence in the coming months.

Powell on the Prowl

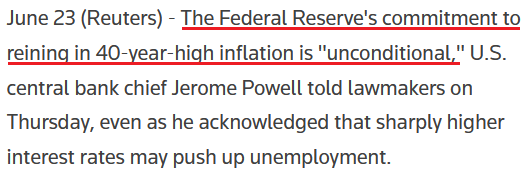

With Fed Chairman Jerome Powell capping off his two-day Congressional hearing on Jun. 23, he reiterated his pledge to combat inflation. He said:

“We really need to restore price stability... because without that we're not going to be able to have a sustained period of maximum employment where the benefits are spread very widely. It's something that we need to do, we must do."

As a result, Powell realizes that persistent periods of unanchored inflation are much worse than an impending recession.

Please see below:

In addition, he added:

"We don't have precision tools, so there is a risk that unemployment would move up, from what is historically a low level though. A labor market with 4.1% or 4.3% unemployment is still a very strong labor market."

Thus, Powel is laser-focused on curbing inflation. Remember, I warned on numerous occasions that letting inflation rage would be the worst long-term outcome for the U.S. economy. In a nutshell: turning dovish would hurt the U.S. dollar and embolden commodity traders to bid up prices even more.

As a result, Powell must follow through with his hawkish threats or the progress will reverse and he’ll be back to square one. However, he sounds like a man who realizes that fighting inflation is the only plausible path forward. Moreover, a rising unemployment rate won’t be enough to deter future rate hikes.

Please see below:

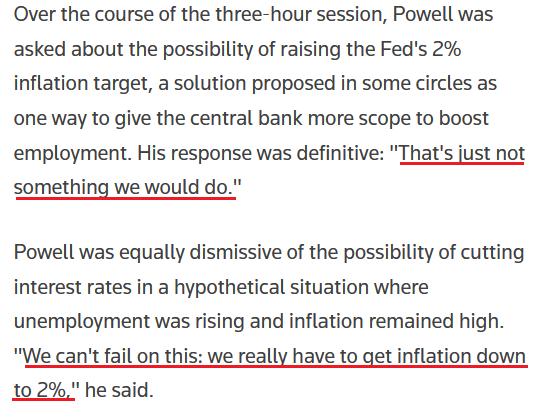

Supporting the argument, Fed Governor Michelle Bowman said on Jun. 23:

“The inflation data show that, after moderating slightly for a short time, price increases for motor vehicles have picked up again, energy prices rose sharply in May, and prices for food have risen more than 10 percent from a year ago.”

She added:

“One important factor that we often point to in driving today's spending decisions and inflation outlook are expectations of future inflation (…). If expectations move significantly above our 2 percent goal, it would make it more difficult to change people's perceptions about the duration of high inflation and potentially more difficult to get inflation under control.

“As we see surveys like the Michigan survey report higher longer-term inflation expectations, we need to pay close attention and continue to use our tools to address inflation before these indicators rise further or expectations of higher inflation become entrenched.”

As a result, Bowman expects rate hikes of “at least” 75 and 50 basis points at the next “few” FOMC meetings.

Please see below:

As it relates to her second point, remember what I wrote on Jun. 16 following the FOMC meeting?

The most important quote of the press conference occurred when Powell was asked: does 3.8%-4% [federal funds rate] get the job done and break the back of inflation?

He responded:

“I think we’ll know when we get there. You would have positive real rates and inflation coming down. I think you would have positive real rates across the curve.”

Thus, Powell confirmed what I’ve been warning about for months: the Fed needs higher real yields to curb inflation.

The fundamentals of the day were clear:

- The FOMC increased its median rate hike projection to ~14 in 2022.

- Powell wants higher real interest rates.

- Letting inflation rage is “not an option.”

- The FOMC “widely” wants “a modestly restrictive” policy by the end of 2022.

Therefore, while I’ve stated this many times throughout 2021 and 2022, the PMs’ medium-term fundamental outlooks continue to worsen.

Thus, while Powell and Bowman delivered another dose of reality to the financial markets on Jun. 23, it was commodities’ turn to suffer. In contrast, the general stock market rallied and short-term interest rates declined.

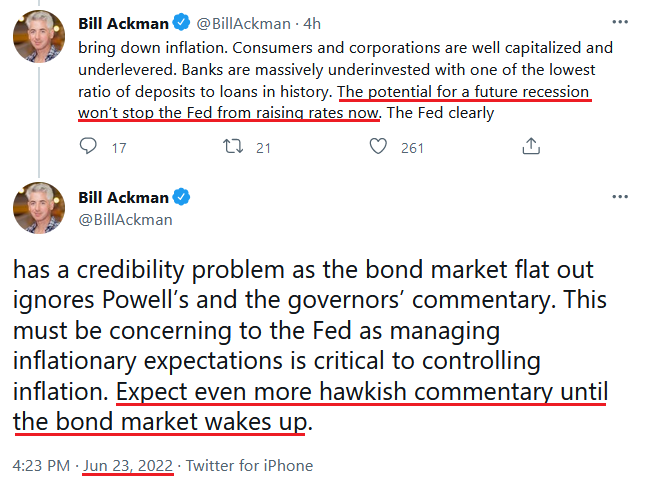

However, billionaire hedge fund manager Bill Ackman – who has sounded the alarm on inflation for months – wrote on Jun. 23:

“Despite [Fed officials’] coordinated commentary, the bond market has ignored these statements leading to a massive decline in short-term rates since the Fed meeting. A prediction: the Fed is serious. Powell and the governors care about the American people, our economy and their legacy.”

“Powell does not want to be known as a worse chair than Arthur Burns. The Fed will raise rates 75 bps or more in July and 50 bps or more in subsequent meetings and won’t pause until it is clear and convincing that inflation is headed back to 2%. [Federal funds rate] FF of 5% or more next year is in the cards.”

As a result, Ackman shares our view that a dovish pivot would be extremely harmful to the U.S. economy. Sure, it may provide the financial markets with a short-term sugar high. However, the long-term consequences of unaffordable food, housing, gasoline, and other basic necessities would lead to social unrest. Therefore, investors don’t realize they’re not the most important variables in this equation.

Please see below:

Take Stock

With the ‘bad news is good news’ crew out in full force on Jun. 23, the general stock market rallied. Moreover, the NASDAQ Composite outperformed, as weaker economic prospects crushed commodities and increased the appeal of high-multiple growth stocks. Moreover, the positioning shift was spurred by a weak PMI print.

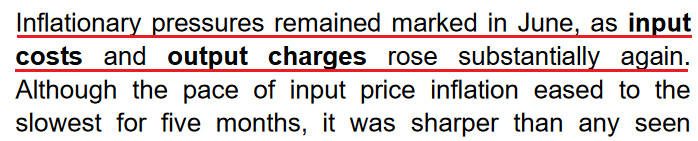

For example, S&P Global released its U.S. Composite PMI on Jun. 23. The headline index declined from 53.6 in May to 51.2 in June. Moreover, while output is still expanding, the report stated:

“The decline in the index reading signalled further easing in the rate of expansion in business activity to a pace notably slower than March’s recent peak. Although service providers continued to indicate a rise in output, it was the weakest increase for five months.”

Moreover:

“Weaker demand conditions, often linked to the rising cost of living and falling confidence, led to the first contraction in new orders since July 2020.”

However, while the prospect of more rate hikes has rattled U.S. businesses, inflation remains extremely problematic. As a result, the Fed’s catch-22 is on full display, and Powell has rightfully determined that actively reducing inflation is the lesser of two evils.

Please see below:

To that point, while old habits die hard, I warned on May 25 that the post-GFC crowd doesn’t realize this time is different. I wrote:

A decade of dovish pivots has left a generation of investors believing that the central bank is all talk and no action. However, with inflation at levels unseen in 40+ years, Powell is not out of ammunition, and the Fed pivot crowd should suffer profound disappointment as the drama unfolds.

The bottom line? We’ve officially entered the monetary version of The Boy Who Cried Wolf. With Fed officials running to the rescue each time the financial markets show signs of stress, investors are programmed to ignore their hawkish threats. However, while these post-GFC pivots occurred with inflation perched near 2%, investors are so steadfast in their belief that they ignore the climactic consequences of unanchored inflation.

Furthermore, little has changed. Despite six rate hikes (25 basis point increments) and more on the way, the consensus continues to await a dovish pivot. Therefore, the Cboe Volatility Index (VIX) still hasn’t cracked 40, and the S&P 500’s 20%+ drawdown has been relatively orderly. However, while oversold conditions made a case for a short-term rally, the medium-term outlook is much more ominous.

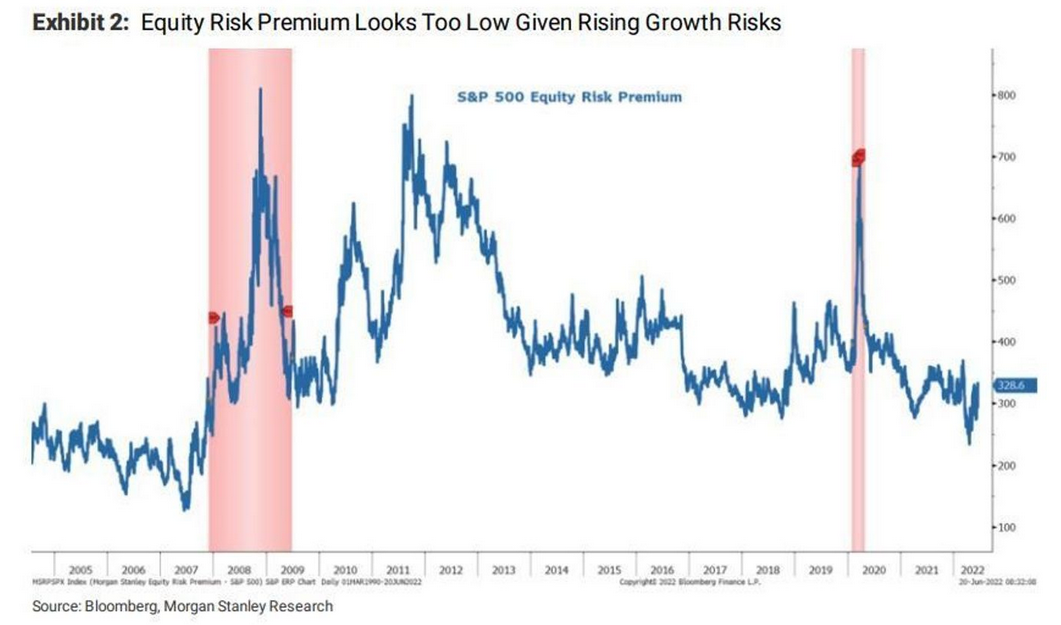

For example, Morgan Stanley’s Chief U.S. Equity Strategist Mike Wilson told clients on Jun. 21: “With our view for lower multiples and earnings now more consensus, the markets are more fairly priced. However, it does not price the risk of a recession, in our view, which is 15-20% lower, or roughly 3,000 [for the S&P 500]. The bear market will not be over until recession arrives or the risk of one is extinguished.”

As such, with Wilson reducing his medium-term target from 3,400 to 3,000, he again cited investors’ complacency.

Please see below:

To explain, the blue line above tracks the S&P 500’s equity risk premium (ERP). In a nutshell: a higher ERP and lower stock prices should coincide with periods of high uncertainty to compensate investors for the increased risks. However, if you analyze the right side of the chart, you can see that the ERP remains relatively low.

In contrast, the pink vertical bars highlight the material spikes that occurred in 2008 and 2020 during their respective crises. As a result, with no real fear in the market, the true panic should materialize as the Fed’s rate hike cycle continues.

The Bottom Line

The Fed has to choose between supporting Americans and curbing inflation or supporting the financial markets and uplifting asset prices. Moreover, while investors are used to the latter, Powell made it clear that a higher unemployment rate won’t derail his quest to harness inflation. Unfortunately, it’s his only option, as short-term economic pain is preferable to long-term devastation.

Therefore, while investors hope that weakening data points will change his tune, turning dovish will only push stock and commodity prices higher and re-ignite inflation’s flames. As such, Powell’s acceptance of reality should push the S&P 500 and the PMs to lower lows in the coming months.

In conclusion, the PMs declined on Jun. 23, as economically-sensitive commodities felt the Fed’s wrath. Moreover, while the U.S. 10-Year Treasury yield has fallen recently, so has the U.S. 10-Year breakeven inflation rate. As a result, the U.S. 10-Year real yield ended the Jun. 23 session at 0.59%. Moreover, with Powell and Bowman telling us they want higher real yields, this realization is profoundly bearish for the PMs.

Overview of the Upcoming Part of the Decline

- It seems to me that the very-short-term rally in the precious metals market is either over or very close to being over. It’s so close to being over that I think it’s already a good idea to be shorting junior mining stocks.

- We’re likely to (if not immediately, then soon) see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

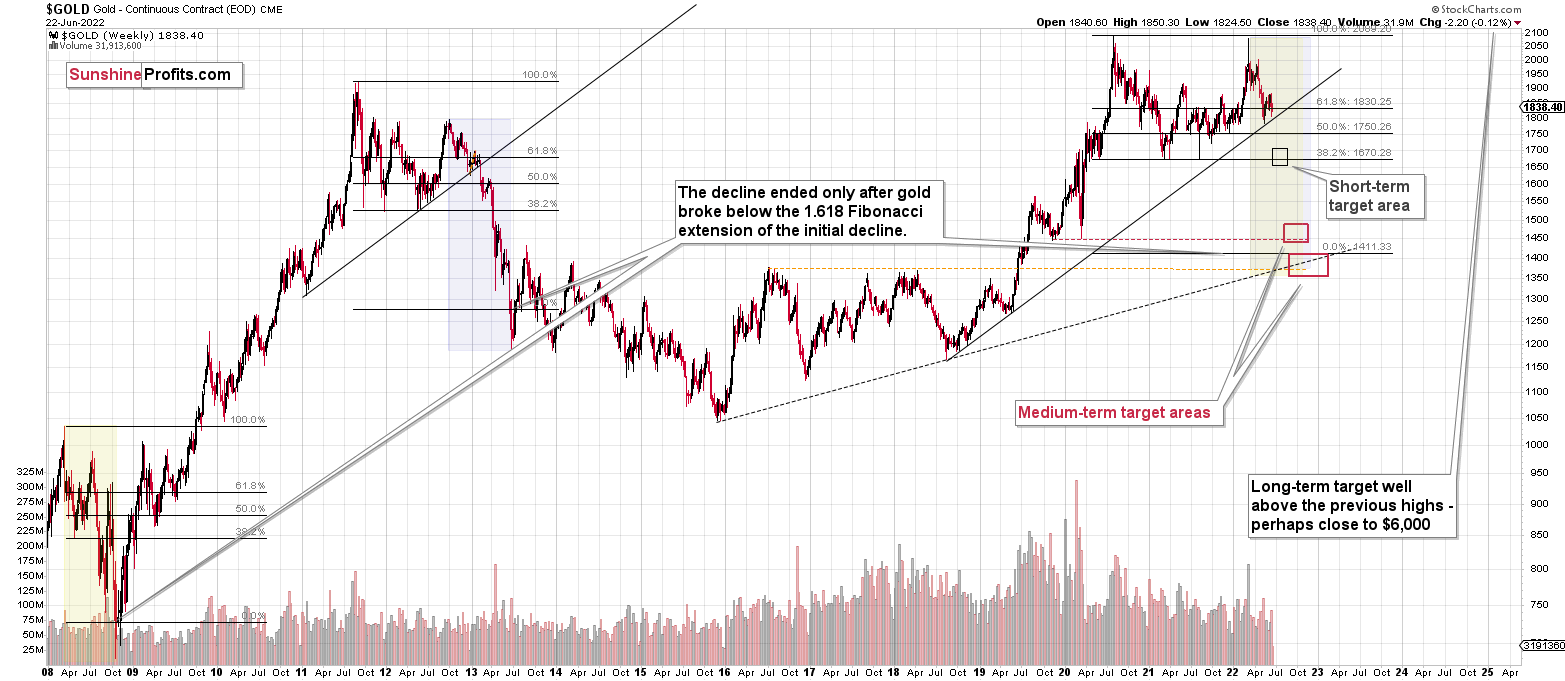

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is over, and the decline will now continue. And the tiny correction’s days are likely numbered, too.

I previously wrote that the profits from the previous long position (congratulations once again) were likely to further enhance the profits on this huge decline, and that’s exactly what happened. The profit potential with regard to the upcoming gargantuan decline remains huge.

As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Also, on an administrative note, due to your Editor’s travel schedule, tomorrow’s regular Gold & Silver Trading Alert will cover the fundamental part of the analysis. However, if anything major happens and it impacts my views on the positions that are currently justified from the risk to reward point of view, I’ll send you a quick intraday message.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $27.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $18.35; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $17.22

SLV profit-take exit price: $16.22

ZSL profit-take exit price: $41.47

Gold futures downside profit-take exit price: $1,706

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $11.87

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $31.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief