Trading position (short-term; S&P 500 futures; my opinion): no positions are justified from the risk-reward perspective.

Stocks rallied as the election news progressed, satisfied with the unfolding story of Biden taking a lead as served by the media. But I view the situation as less than clear cut, and it actually reminds me of the February hooray in stocks while the corona clouds gathered on the horizon – and then it just reversed as the realization dawned.

No, I am not calling for stocks to take a plunge into a new bear market – absolutely not. To the contrary, I am calling for a springboard, for new highs and for finishing 2020 above the early September top. But given the dynamics of market reactions to the headlines presented in yesterday's regular Stock Trading Alert:

(…)

- No blue wave, which means no large stimulus bill

- S&P 500 sold off well below 3350

- Gold and oil were hit on the realization that Trump isn't down and out (I expect him to put up a fight – he can still win)

- Yes, there won't be a sugar high from a large stimulus, but his business and tax policies are much more supportive of the real economy than Biden's plans

- Sooner or later the market would come to realize that instead of the short-term disappointment in no quick fix

- Still on the night, Trump already claimed he won, sending markets into a tailspin

- This is where the above mentioned market realization comes – stocks, gold and oil all reversed higher, going right into the "uncertainties" undaunted and not blinking (that's my favorite way of dealing with stuff too)

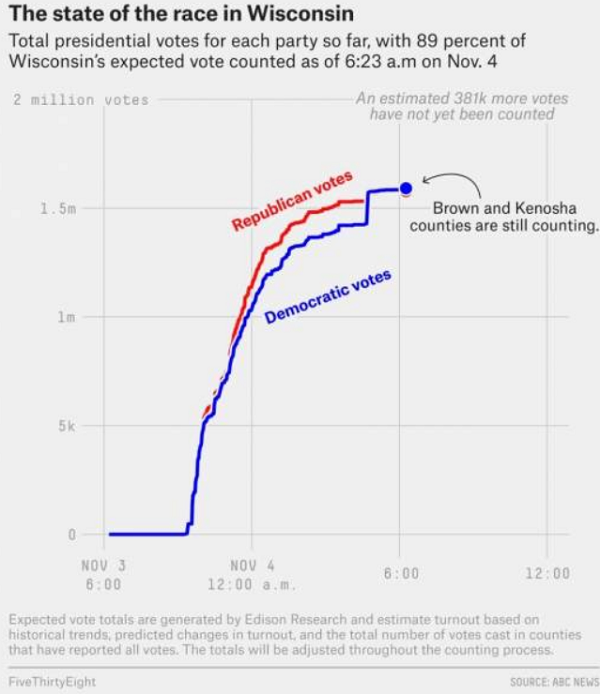

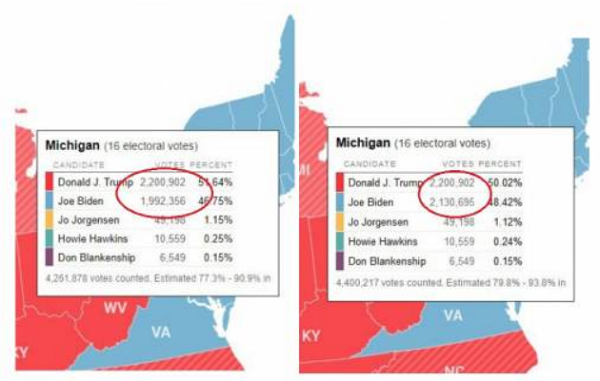

- While the bookies hiked Trump's odds of winning, it won't be a smooth sailing ahead – I look for namely the Pennsylvania, Michigan and Wisconsin voting to be challenged, for obvious reasons (perhaps Nevada too)

- Should stocks continue on their sharp, ultra-sharp upswing today, they might give up part of their gains even before it comes to recounts (I wouldn't be surprised about the Rust Belt experiencing them really),

I see great potential for a short-term disappointment – and a temporary setback ushered in by the constellation I described late yesterday:

(…) It seems everyone and their brother are expecting Biden win – and stocks led by tech have taken off understandably. But my point is not to debate whether he would be declared by the media as winner in Wisconsin, Michigan, Maine, Arizona or Nevada.

Given the Rust Belt situation, I look for Team Trump to introduce some uncertainty into the markets, and the question to me is when would that happen. I.e. when would the proceeding be initiated. Not that they would not find reasons good enough to take legal action.

If you remember, the S&P 500 plunged overnight to 3320 when Trump declared victory. Should the markets feel getting rocked, they might throw a tantrum again. After all, it's the size of the stimulus that's at stake.

The above intraday Alert also contained tightening of currently open trade's parameters, yet due to the internal publishing reasons, it couldn't have gotten to you fast enough to spare you some of the overnight downside. An hour of delay counts, and you've certainly noticed that I am not featuring as many trade calls in the post Sep 30 era as I did before Sep 14 given the circumstances.

While a viable compromise can be reached during calmer market environment (established trend with both short- and medium-term indications pointing the same way, less headline sensitivity, lower volatility and politics not stealing the spotlight), this is not the case currently, and the overnight experience proves that.

While I could take with clear conscience a long position on Oct 01 and exit it on Oct 12 for a 155-point gain, and similarly found it justified to go long again on Oct 13 at lower prices than when I exited the prior long, the steep plunge lower in the pre-election week was a stomach churning experience since $VIX spiked on Oct 26, only to move from below 30 at Oct 23 to above 40.

But I could have stayed long, as it was the short-term outlook that was under pressure – the medium-term and 2016 analogy supported a reversal of fortunes. I am happy that it came and that my validated analysis brought us back almost to B/E. When I saw the sputtering at 3480 yesterday, I looked to tighten the open trade well above the pre-market local top at 3430, as that would be reasonable from the risk-reward perspective.

Instead with time delay, I had to readjust to the pace of late session's decline, anticipated after-market correction's shape that took us out by less than a 1-point move. It can happen, market do undershoot or overshoot realistic targets at times. But such little things add up to the bottom line of results, they manifest themselves on the equity curve.

It's my interest to see you prosper as you come first, and while I can over time easily recover from such little mishaps (that wouldn't have occurred under optimal circumstances though in the first place, that's the gist here) in the region of 20 or 30 points, I won't expose your precious capital to wild swings of over 100 point intraday moves and accompanied by sizable gaps on top, when I can't react immediately with your best interests at heart.

I am here to be bringing you the very best in myself, to the full of my skills and abilities. And turning on a dime in trading is part and parcel of what I bring to the table. At times, such fast adaptability isn't the make-or-break characteristic of trading results, but in the unsettled post-elections dust (how long the legal battles would draw before justice is served, is anyone's guess) and heightened volatility in both directions in the now, it is.

And that means that dutifully and faithfully commenting on the odds of stock market moves (both in the moment and both short- and medium-term), on their drivers and expectations for the future, while keeping the trade calls to a minimum until conditions more conducive to medium-term trades (as opposed to very short-term momentum or reversion to the mean ones entered and exited at immediate notice) arrive again.

It's my opinion that the market is acting a bit too complacent about the election results. The Republican grassroots opposition is rising in places like Arizona, while Wisconsin, Michigan and Pennsylvania will see scrutiny not only as regards the unprecedented overnight counting break with ballots in the interim going almost fully in Biden's favor, but also the suspicious voter turnout in several Milwaukee wards of over 100%.

Knowing how hard stocks turned south when Trump won Florida, declared victory, or vowed to challenge the results in the Supreme Court, it would be irresponsible of me to put capital to work when charts such as the below Michigan and Wisconsin night voting tally are making the rounds courtesy not only of Natural News reporting:

The markets are extremely sensitive to politics right now, and justifiably so. It's about the stimulus next, and they're underappreciating the Republican Senate. Hard to say when they would take Trump's crusade seriously – but when they do, I look for the S&P 500 to weaken.

And as the medium-term trend is up, and would remain up thanks to Trump's pro-business and tax policies (or the salivating prospects of a multi-trillion Biden stimulus), it makes most sense to wait for an opportune entry point on the long side that wouldn't be so fraught with short-term risks.

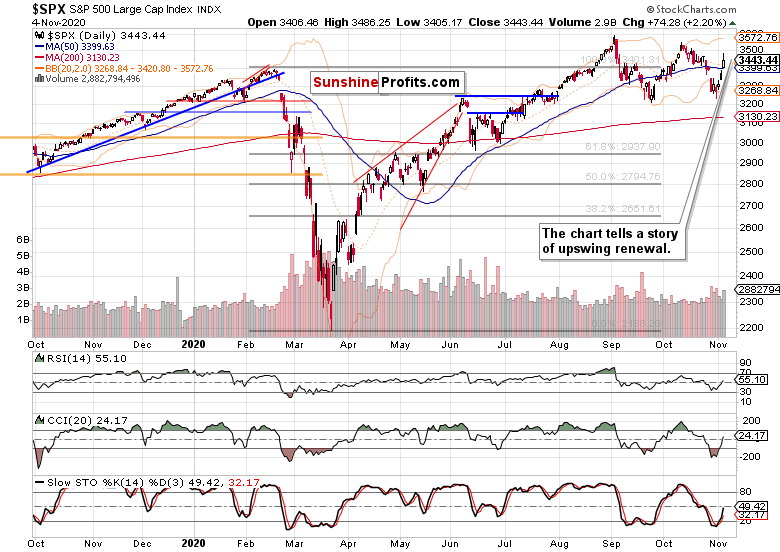

Let's do a quick check on the markets yesterday, and answer one timely question next.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Another day solidly in the black, yet showing the rally giving off some hot air late in the day, illustrating the very direct impact I described above. Regardless of the election tremors, it's an upswing within a larger uptrend, but it's pretty volatile as it's about… tremors.

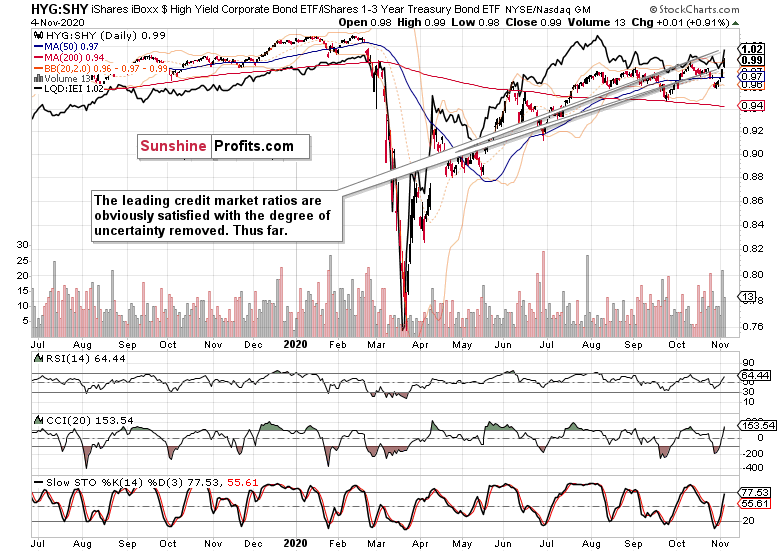

Credit Markets' Point of View

Great strength in high yield corporate bonds (HYG ETF) again – but with this high a volume, some consolidation next wouldn't be all too surprising.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – keep abundantly clearly trading in the risk-on mode.

While that's positive for the stock market, and telling of willingness to move forward, I don't think we've experienced all the volatility there is in store in these elections yet. Still, the markets are leaning bullish yet I don't view them as immune to a short-term news-induced takedown.

From the Readers' Mailbag

Q: Hi Monica, it's more a comment than a question but maybe you will like to say something - if yes, go ahead. I am very wary at the moment on sp500 so have not entered a position. My thinking is the US dollar is going to make a run as the 30yr bond is rising and that can be real scary. But thank you for your trading tips you do a great job.

A: Thank you for your appreciation – I'll definitely respond to what I perceive to be the main theme(s) of your question. First, I've laid out the case above why this level of volatility, headline sensitivity and influences outside of economics (I mean beyond the stimulus or Fed moves) make it impossible to responsibly enter or exit brief trades without ability to execute the calls right away, and hamper mamagement of existing positions. Thus, I perfectly understand your risk aversion at the moment – rest assured, there'll be always opportunities in the markets, so keep being picky about the most promising ones, about a defined, palatable and manageable risk.

I am also watching the developing pressures in the bond and currency markets. Not if but when the bond vigilantes wake up from their slumber since 1981, it'll be a show (of horrors, if you will). Regardless of the short-term moves, I thus see the dollar as on the strategic defensive, just as you do. Thus far though, gold has predictably risen strongly today while oil isn't really badly hurt. The bond vigilante dynamic will take a long, long time (years) to unfold – there is still confidence in the Fed to save the day.

Summary

Summing up, today is one of those rare days when reading the full analysis is justified regardless of the seemingly one sided S&P 500 move. This move though is well supported by the many other markets on my watch, but I'm not ruling out a hissy fit in the short-term in the least.

Trading position (short-term; S&P 500 futures; my opinion): no positions are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.