Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3160 and initial upside target at 3550 are justified from the risk-reward perspective.

I told you that stocks would rally on election news. I was clear that they aren't rolling over for a fall. Just look at the current S&P 500 futures quote (a bit over 3380) and the still unfolding White House drama. If stocks are refusing to move lower when the mainstream polling predictions got it all wrong again, what do you think they would do once the winner is clear?

Yes, I called for a springboard, for new highs and for finishing 2020 above the early September top. And in today's analysis, I'll dive into the elections aftermath – the market reactions are particularly telling not only as to what were the expectations in the first place, but where market participants' patience with the resultant fits lay.

Before first results were announced, the table was set the following way:

- The elections would determine the stimulus price tag and structure

- Trump's odds were improving throughout the day, but he was still an underdog

- The market wasn't (again) prepared to see him win

- Knowing the winner right after the election night was preferable to waiting and dealing with legal challenges to the voting process

- The bookies got it more right again, and so did stocks (FCX or KOL, the coal ETF especially)

- Lockdowns were not the driving narrative du jour

As the results came trickling in:

- No blue wave, which means no large stimulus bill

- S&P 500 sold off well below 3350

- Gold and oil were hit on the realization that Trump isn't down and out (I expect him to put up a fight – he can still win)

- Yes, there won't be a sugar high from a large stimulus, but his business and tax policies are much more supportive of the real economy than Biden's plans

- Sooner or later the market would come to realize that instead of the short-term disappointment in no quick fix

- Still on the night, Trump already claimed he won, sending markets into a tailspin

- This is where the above mentioned market realization comes – stocks, gold and oil all reversed higher, going right into the "uncertainties" undaunted and not blinking (that's my favorite way of dealing with stuff too)

- While the bookies hiked Trump's odds of winning, it won't be a smooth sailing ahead – I look for namely the Pennsylvania, Michigan and Wisconsin voting to be challenged, for obvious reasons (perhaps Nevada too)

- Should stocks continue on their sharp, ultra-sharp upswing today, they might give up part of their gains even before it comes to recounts (I wouldn't be surprised about the Rust Belt experiencing them really)

Let's not forget that the country is bitterly divided, and this election certainly won't unite it when this many mail-in ballots erase the solid voting day lead in battleground states. True, Democrats are more likely to vote by mail, but still, that leaves a bad taste in one's mouth.

But what about the stock prospects? My yesterday's words naturally still apply:

(…) The bar … is set tremendously low – be it in economic output or earnings expectations. Couple that with activist Fed and stimulus on the horizon – this mix can power stocks higher. I know perfectly well that the bears are often sounding smarter than the bulls but lasting pessimism isn't a hallmark of anything. Track the calls, follow the money generated this way – that's the true metric of success (thus far, I captured 931 points of S&P 500 closed profits since Feb 2020).

No, this is not a double top in S&P 500 – the governments have become way more inventive since the Great Depression (and unshackled from the gold standard or its attenuated forms), and thus I call that we won't experience as harsh (stock) crashes as we would otherwise have had if we weren't under a fiat currency regime where new money creation and its transmission mechanisms have become this easy and smooth).

Look, the most important question that investors and traders need to ask, is whether we're in a bull or a bear market. And looking at the position of various (50-day, 200-day) EMAs on different (monthly, weekly and daily) timeframes (or EMAs slope, perhaps even their ribbon), I say that this is a bull market – and such a 10% correction is to be bought, not sold and declared as a start of a new bear market.

I would even go as far as to tell that it's been historically right after corrections of similar magnitudes that we have seen solid gains next – of course, within the bull market context only. And I have not been proven wrong that we are in a bear market – and unless I am (hint – I don't expect that market character transition in 2020 at all), the gains from the upcoming $SPX move are more likely than not to be worth it.

Just look at the tech sector and semiconductors – they're turning higher with the latter leading the way. That bodes well for the 500-strong index.

Check, check, check. The upswings of yesterday and today have proven clearly that we're in a bull market. Even the tech has turned around yesterday finally, in what was otherwise a value-driven upswing.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Rising solidly on the day, is the briefest description really. Now, we have a completed analogy to the June double bottom, where the second one didn't really reach as low as the first one. I see stocks rising to new highs with some consolidation thrown in here or there for good measure.

Credit Markets and the Dollar

High yield corporate bonds (HYG ETF) were again strong on a daily basis – tellingly strong. The credit markets are clearly supporting the stock upswing to go on.

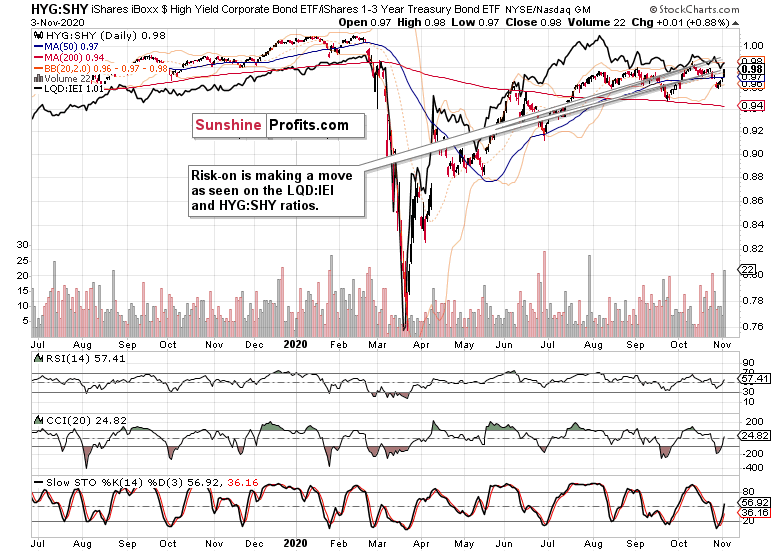

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – keep trading in a risk-on mode.

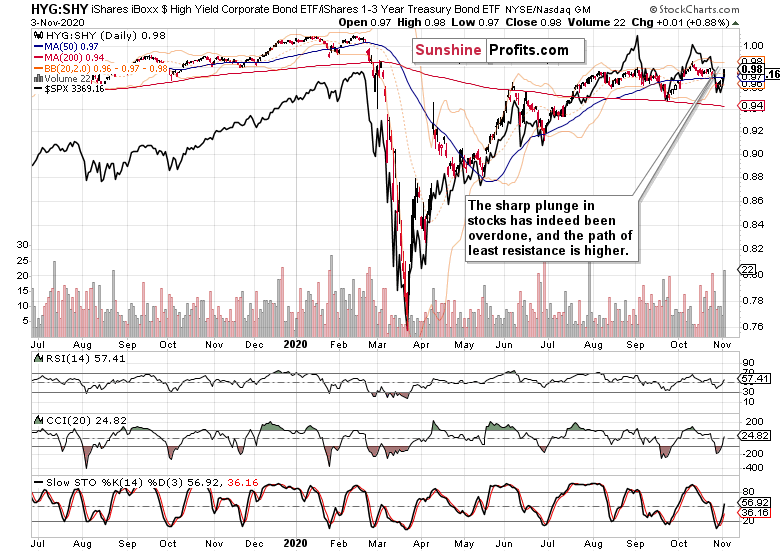

Overlaying the $SPX and HYG:SHY ratio shows just how discounted stocks have become lately – and it also proved that getting shaken out of long positions would have been a very bad call indeed.

Long-term Treasuries (TLT ETF) declined in confirmation – again, there is no rush to safety or to raise cash.

The dollar completes the risk-on picture – not even the greenback caught a bid yesterday. While the move was sharp, and I am not looking for the world reserve currency to give up this easily, it still tells you about the prevailing direction of the markets, including this one.

Summary

Summing up, stocks are marching higher also a day after the elections that ended thus far without a winner. But it was the credit markets, precious metals, oil and copper that have paved the way for the S&P 500, and stocks indeed followed.

The elections-related volatility has thus been resolved with an upswing, and markets are happy with the amount of certainty they've been provided so far. Let the stock bull market run on – it's a question of time when the early September highs would be overcome.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3160 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.