Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3115 and initial upside target at 3550 are justified from the risk-reward perspective.

Despite the intraday back-and-forth trading, Friday wasn't shaping up to be the best S&P 500 day ever. The daily parallel to 2016 remains still intact though. Let's recap some facts:

- There won't be a stimulus deal before elections

- Fed stepped in and lowered the Main Street lending facilities' loan threshold from $250K to $100K, helping with the late-Friday stock rebound

- Trump isn't broadly expected to win

- The winner might not be known on Nov 03

- Stocks (FCX vs. ICLN lately – FRAK or KOL ETFs alone don't tell the full story) lean more favorably to Trump than the mainstream polls or even the bookies

- Lockdowns overseas are largely priced in

S&P 500 in the Long-, Medium- and Short-Run

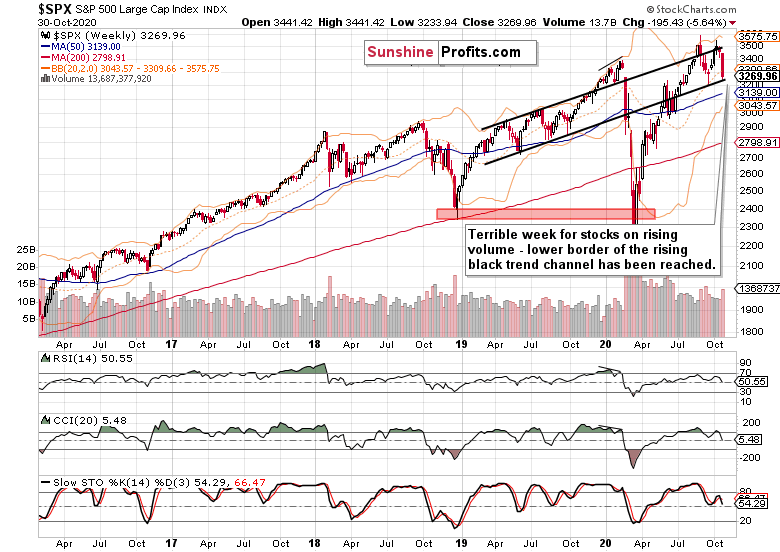

I’ll start with the monthly chart perspective (charts courtesy of http://stockcharts.com ):

Tough, reversalish month, but the volume wasn't totally there, behind the move. The long-term picture isn't clear, and prices could either slide in November again, or gradually reverse higher.

Bad week, really bad week – on par with March. While the S&P 500 stopped at the lower border of the rising black trend channel, that's no guarantee it's the end station as there are two more trading days to the election results. But I don't view the revisit of Friday's lows as likely to happen tomorrow.

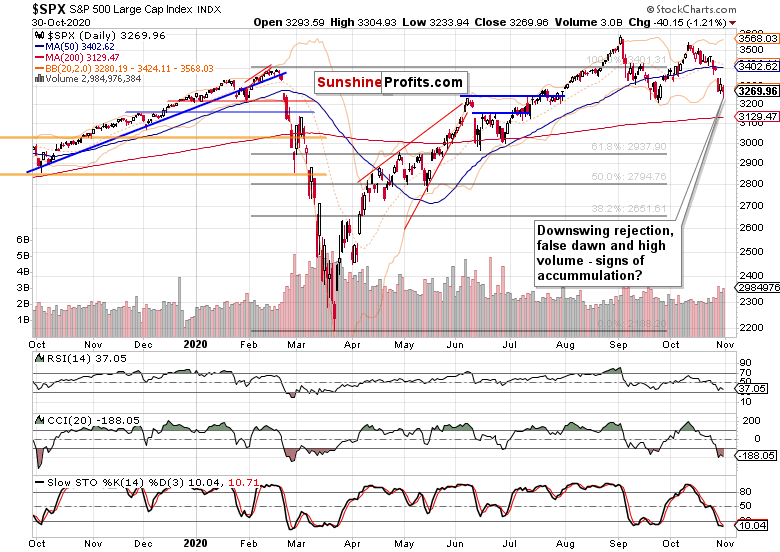

The daily chart shows the rebound off the 3220s lows, and the question remains how much of the turnaround spills over into Monday's session, or better yet how much of it sticks till the closing bell. I'm leaning towards a sizable upswing today.

Do the credit markets bring in more clarity?

Credit Markets’ Point of View

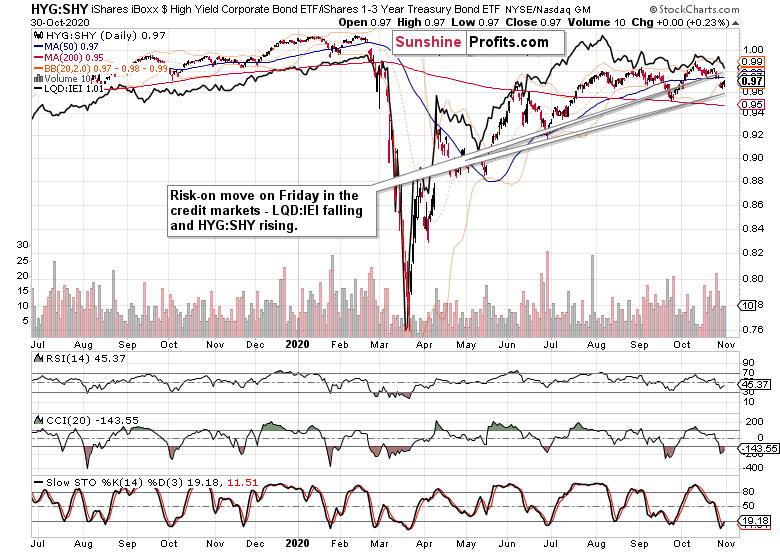

High yield corporate bonds (HYG ETF) again showed daily strength – that's a very encouraging sign. Obviously, the rally needs to go on over the coming days to provide a more conclusive evidence, but the ball is in the bulls' court now.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – paint a picture of Friday being a risk-on day. Yes, risk-on regardless of the S&P 500 decline.

This mood was reflected in long-term Treasuries (TLT ETF) – they had a strong down day.

Also, the ratio of junk corporate bonds to all corporate bonds (PHB:$DJCB) doesn't agree with the stock market downturn, and actually points to the turn of fortunes.

Market Breath and Volatility

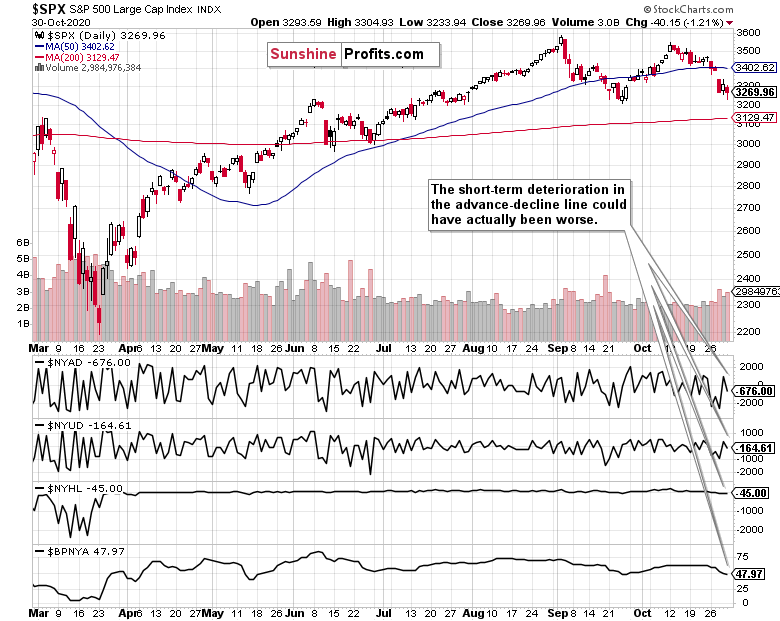

The advance-decline line could have taken a bigger hit, but didn't – rotation into value has been kicking into gear.

$VIX reversed also on Friday, but didn't actually decline. While that's inconclusive, it bears a certain promise to the coming days. Would it be clear enough to drive market volatility lower who won after Tuesday already?

Summary

Summing up, stocks again declined, and again provided signs of a turnaround that fits the 2016 analogy. Fleeting turnaround, or a springboard that would take on last week's index losses? That's a tough call but given how (unintentionally or intentionally – have your pick) wrong the media has been since 2016, and what I term as the rise of the shy Trump voter, I am leaning towards a post-election rally rather than slump continuation.

The medium-term bullish trend thus far hasn't changed, and it's bullish. The Fed is supportive, stimulus will come, and inflation isn't on the front burner. All bull markets are climbing a wall of worry, and this one is no exception.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3115 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.