Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

A week ago, the stock bulls stumbled – and could have been forced on the defensive quite some more, yet the benefit of the (medium-term) doubt stayed with them. The short-term caution that still warranted staying long, proved to be the right decision as the medium-term outlook hasn't changed one bit.

That reminds me of my favorite resilience maxim: "Lose not faith; but when you become down, or get frustrated on something you can't change, work on something you CAN change. Start small, and you will work forward to larger things. Keep your faith, your family, and your hope!"

Beautiful inspiration along the lines of Franklin Covey's "Focus your energy and attention where it counts, on the things over which you have influence. As you focus on things within your Circle of Influence, it will expand."

I agree wholeheartedly with both empowering expressions. It makes no sense to remain mired when you see that such is the faithful expression of the status quo. So, have the stock bulls expanded their circle of influence on Friday just as successfully as they did throughout the week?

I think so they did – regardless of the today's premarket visit of the 3420s area. Elections are here in two weeks, and the S&P 500 keeps being resilient – above 3400. It doesn't matter right now that I looked (and look) for it to be so (though should the 3400 area get broken, the resultant selloff would be likely sharp), but it's nothing short of a demonstration of the markets' collective wisdom given that more than half of Americans are preparing for a civil war.

This is indeed a stark choice the nation faces, and against the many polls, I'm making it clear today that I expect a Donald Trump landslide. Yes, this has serious and positive implications for the stock market. Can you imagine how the capitalistic system would take to Biden's increased social spending, Obamacare expansion, more progressive tax code, $15 an hour federal minimum wage or the Green New Deal?

I think that stocks anticipate the incumbent's win. Of course, volatility can and likely will increase as we approach those key days, but a lot depends upon the instrument that you're using to trade the S&P 500 moves.

The full S&P 500 futures contract might be too strong a proposition for some of you, but with e-mini S&P 500 contracts, a 1-point S&P 500 move translates into merely $50, which is manageable for most accounts. And if you're willing to merely dip your toe and no more, there is micro e-mini S&P 500, where a 1-point S&P 500 move only means $5.

This way, you can easily see what my (very flexible in that I am not too shy to close the position way earlier as you know) trade parameters (namely the stop-loss) would do to your trading account if hit, and risk only those few percent of your equity that you're comfortable with – per each trade taken.

That's the right way to go about it, the way I do it before each move – planning every single trade from the full trading account's perspective. Conscientious money management comes first.

All right, that's the game plan for this trade – and for the trading marathon in full.

S&P 500 in the Medium- and Short-Run

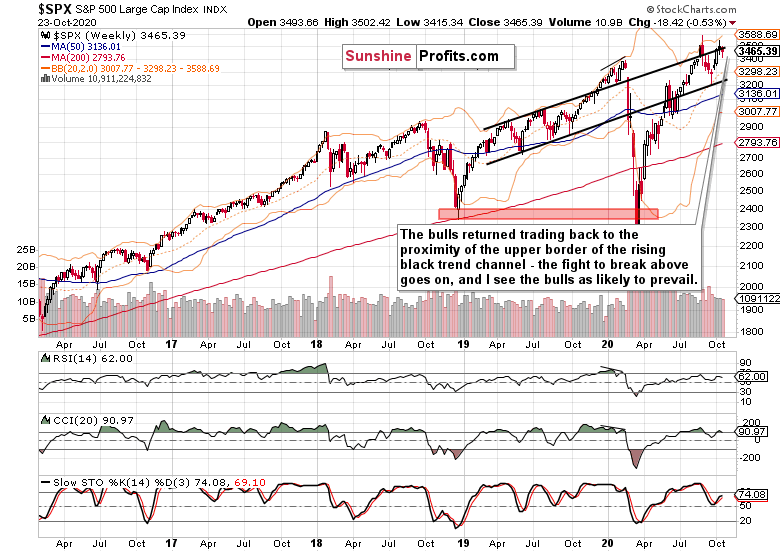

I’ll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

On Oct 19, I disputed the notion of having seen a reversal. And stocks are back at the upper border of the rising black trend channel. I continue to think their consolidation goes on – the weekly indicators don't look problematic here at all.

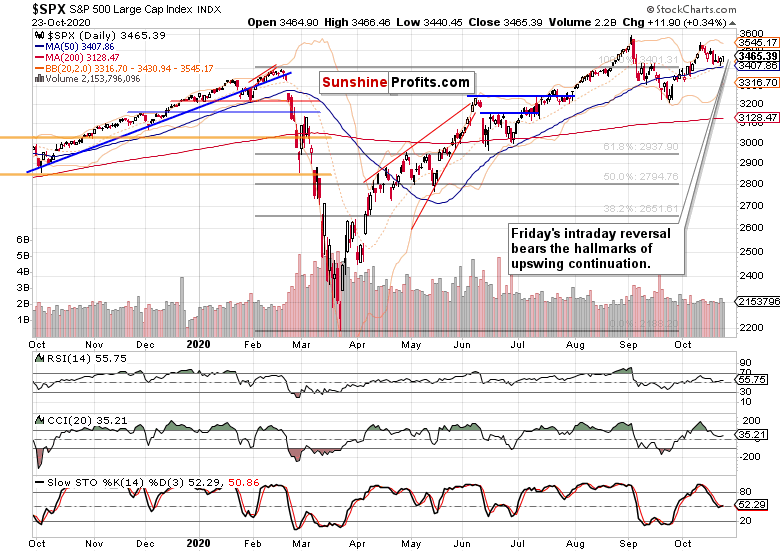

The daily chart refines the picture of a very slow, very measured stabilization with an upward bias. On Friday, the bulls staged yet another successful intraday reversal, and I see the upswing as more likely to continue than not.

Credit Markets’ Point of View

My Friday's observations still keep holding true after the closing bell:

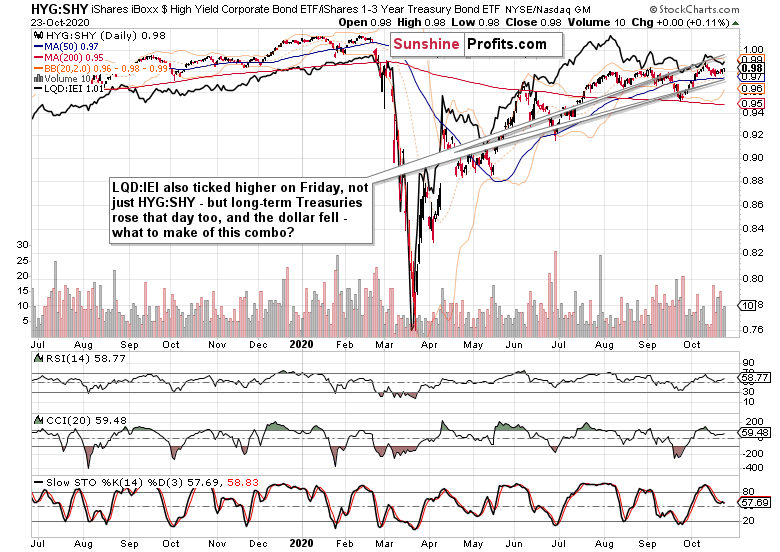

(..) High yield corporate bonds (HYG ETF) went up, just as could be expected during a stock market upswing. Not stealing the spotlight on its own, but a solid performance nonetheless. Yes, the very short-term sign of willingness to go higher and take stocks along was indeed there.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – were in tune on Friday. On one hand, long-term Treasuries (TLT ETF) rose, and on the other hand, the USD Index fell. Overall, my interpretation is still risk-on.

International Risk Appetite

Comparing the S&P 500 to German DAX is a very helpful tool, revealing that U.S. stocks are in high demand, relatively speaking. That's little surprising given the economically self-defeating European corona measures (have you noticed how well the Red states, the South such as Georgia etc rebounded when they left the lockdown mentality behind?) and weakening eurozone indicators.

Take a look also at the beginning of September, which goes to show how overdone the U.S. selloffs were. While the S&P 500 isn't dirty cheap right now, it'll likely become more pricey than overseas markets as we go.

Sectoral View of the S&P 500

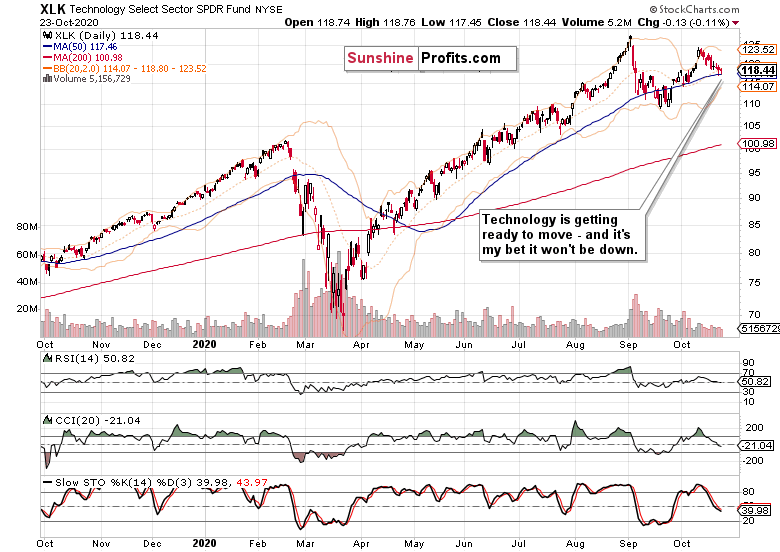

Technology (XLK ETF) is likely to move higher next – looks primed to do so. I like those lower knots and declining volume.

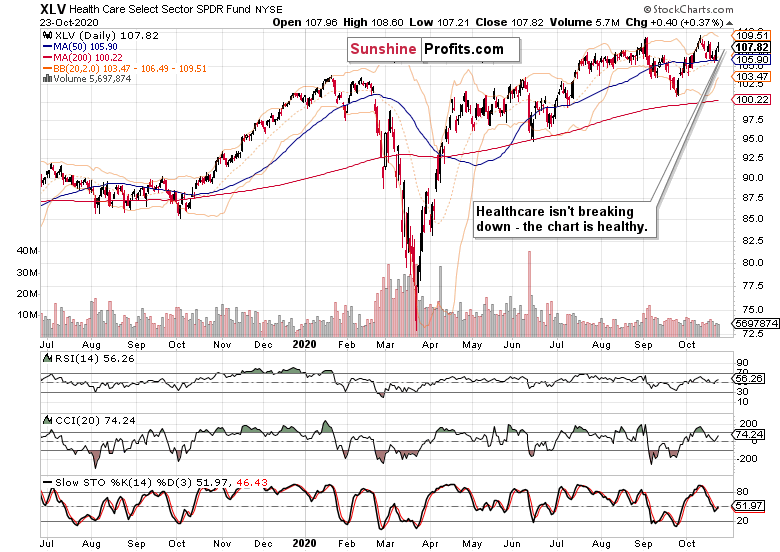

I'm keeping a close eye on healthcare (XLV ETF) too – and the sector is consolidating with a bullish bias, not too far from its highs.

Financials (XLF ETF) are coming back to life, and the price action just illustrates cyclicals are likely to do better than they have done so thus far.

Summary

Summing up, the $SPX tug of war in the short run keeps favoring the medium-term probabilities that see the bulls emerging victorious. The stimulus saga is closer to its end than its beginning, making the bearish case for a short-term move down in stocks less and less probable. The markets are looking past, anyway. Credit markets, precious metals, copper and technology are gearing up for an upswing, while I see signs of budding rotation into many other sectors – the stock bull run remains amply supported.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.