Trading position (short-term; S&P 500 futures; my opinion): no positions are justified from the risk-reward perspective.

Stocks are behaving as the big Blue stimulus was already a done deal, when in reality it's far from being so. They're still valid, my yesterday's lines that the markets are a bit too:

(…) satisfied with the unfolding story of Biden taking a lead as served by the media. But I view the situation as less than clear cut, and it actually reminds me of the February hooray in stocks while the corona clouds gathered on the horizon – and then it just reversed as the realization dawned.

No, I am not calling for stocks to take a plunge into a new bear market – absolutely not. To the contrary, I am calling for a springboard, for new highs and for finishing 2020 above the early September top.

Then I went into market reactions to headlines, so let's check the latest developments alongside their effect:

- Republicans strengthened in both the Senate and the House

- Yet states are magically flipping to Biden

- Stories of 750K newly discovered Pennsylvania votes for Biden or mysterious ballot deliveries in Detroit, illustrate my below points and links

- How do you call election irregularities politely?

- Can you call a spade a spade?

And S&P 500 is supposed to keep on rallying in this newfound stability as the Orange Man is banished? Not so fast, on either count. This will take time to unfold, untangle, and stocks are prone to hissy fits I talked about yesterday – their reaction thus far tells me they care more about the short-term sugar high from stimulus than about more solid, capitalist fundamentals in the long run.

One could have almost overlooked the non-farm payrolls that came in a little stronger than expected. Good, let's not lose sight of the progressing economic recovery, for it's ultimately down to the fundamentals to drive stocks regardless of e.g. short-term financial engineering (share buybacks). That's chump change though, because economic policy and total margin debt can affect the valuations more profoundly.

Repeating my yesterday's point on the game plan ahead that I hope to able to get out to you just when the time is right:

(…) it makes most sense to wait for an opportune entry point on the long side that wouldn't be so fraught with short-term risks.

Let's see in the charts how the cards are being dealt.

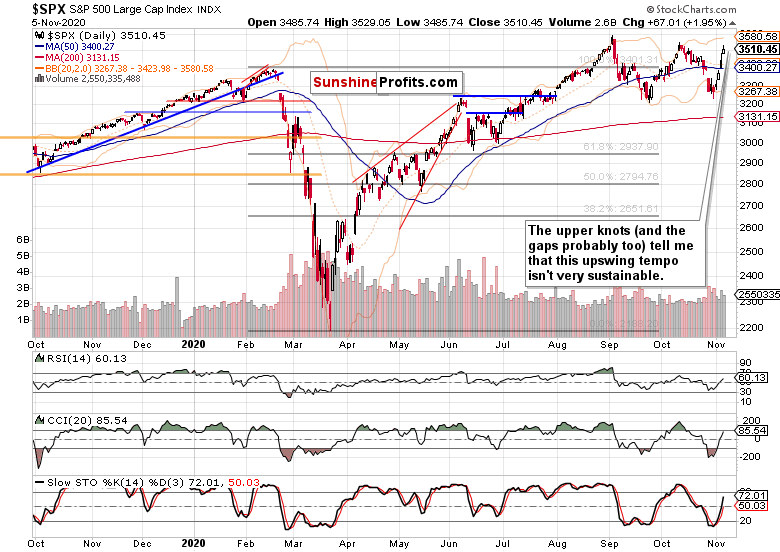

S&P 500 in the Short-Run

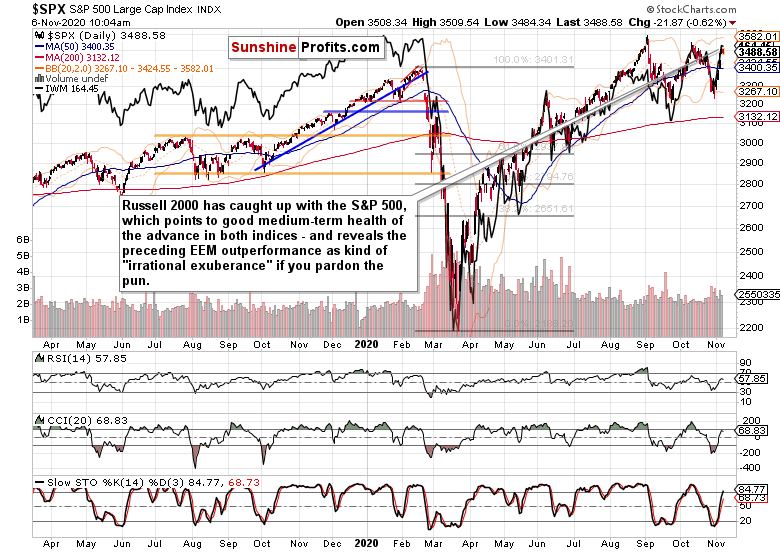

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The one-way elevator ride is facing increasing headwinds, and appears ripe for a breather as a minimum.

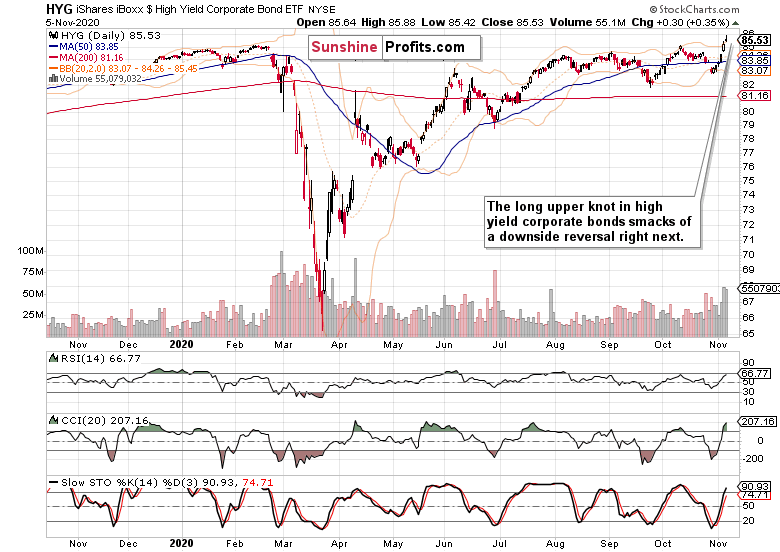

Credit Markets and the Dollar

High yield corporate bonds (HYG ETF) didn't show great strength for the first time in quite a few days – is some consolidation ahead?

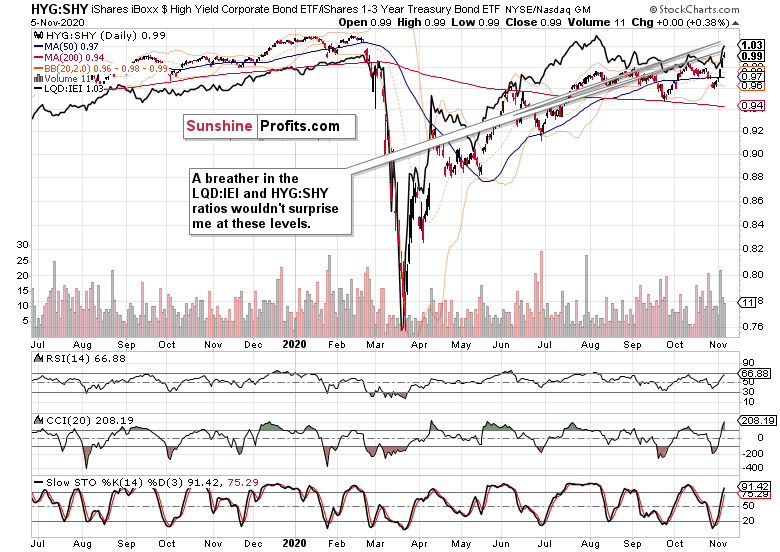

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – are clearly in the risk-on mode. HYG:SHY perhaps a bit too much right now.

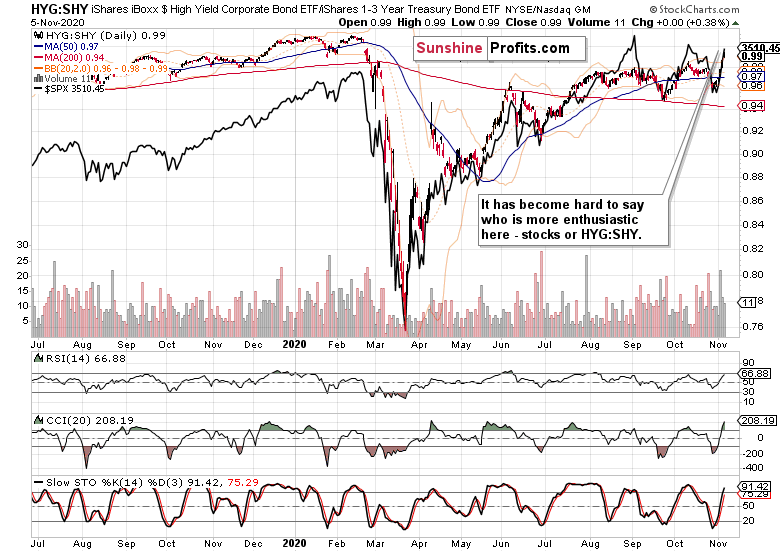

The HYG:SHY overlay against S&P 500 shows that clearly – bullish spirits are running high.

But junk corporate debt to all corporate debt is turning cautious, and didn't follow yesterday's hooray. That's one of the mounting signs that I'll discuss in the precious metals and commodities section.

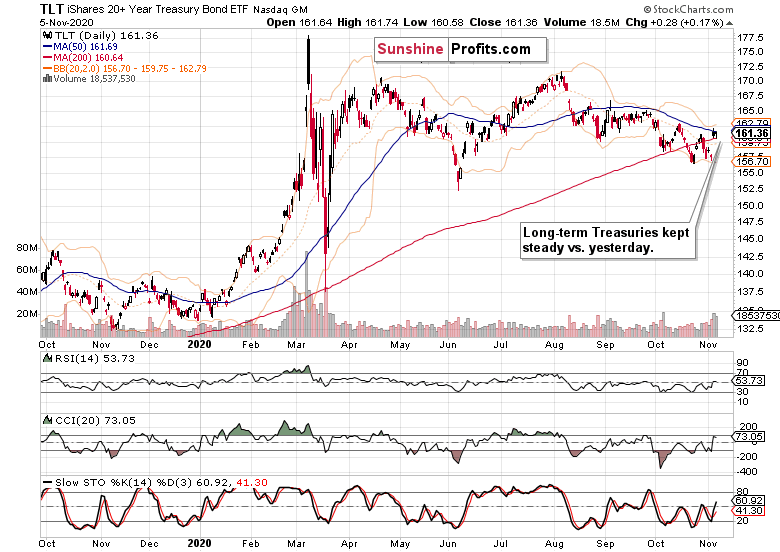

But first, long-term Treasuries (TLT ETF). They held steady vis-à-vis the rising stock market. They aren't plunging, they aren't spiking. Uneventful days.

It's the dollar that's the odd one here. Plunging greenback and marginally higher Treasuries isn't the most usual combination – I wouldn't be surprised if the dollar put up some fight again shortly.

That doesn't though invalidate my yesterday's point (see From the Readers' Mailbag section) about the world reserve currency being on the strategic defensive. It's just that the bond vigilantes might (and will) take ages to show up – who watches money aggregates as closely as in the late 1970s and a tad later. That's the way it is.

Commodities and Metals

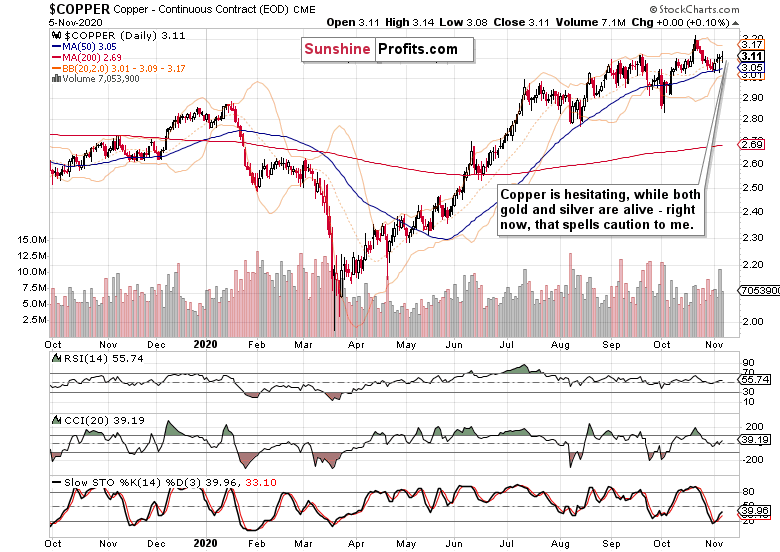

Copper is somewhat hesitating in the very short run. Not too listening to the elections drama. That might be actually a wise signal that not that much in terms of economic prospects has changed thus far, i.e. the red metal isn't jumping the gun (as stocks are).

Silver fireworks are here as the white metal has lately strengthened against gold. Given the background since late October till today, I wouldn't be surprised to see it retrace a part of recent gains – that would fit the story of stocks not running higher right now, of stocks being vulnerable to a short-term, temporary takedown.

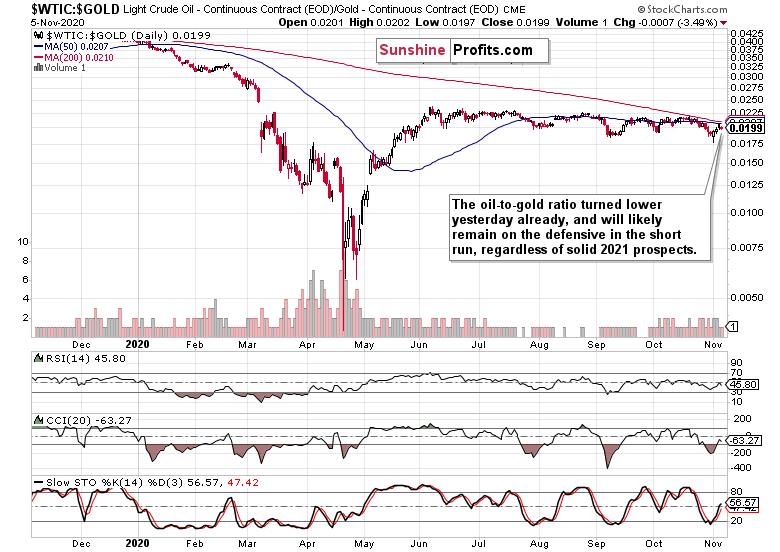

The oil to gold ratio remains under short-term pressure, and has turned lower yesterday already. That's another factor arguing for some selling in stocks.

Volatility and Stock Market Ratios

I simply don't trust yet the $VIX turning south this much, this early and this substantially. Similarly to the plunging dollar, it doesn't feel right – but the market is the arbiter, and not all pieces of the puzzle fit always together.

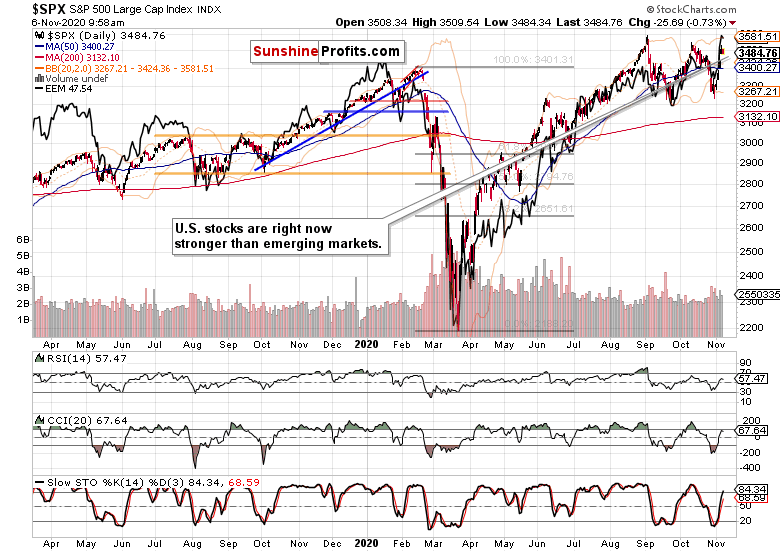

When the S&P 500 is stronger than international stocks, I see that as a cautionary sign within the current market context – for the short run.

This chart of U.S. stock indices firing on all cylinders put the above note on EEM into much less cautionary light – the caption says it all. And I lean towards this chart's interpretation rather.

Summary

Summing up, in today's long analysis I've made the case for why the elections are far from a done deal – and thus can bring short-term downside spike – yet was also clear on the medium-term picture being very conducive to the stock upswing (stock bull run) to continue. It once again boils down to a favorable entry point – regardless of whether stocks end higher today, I would wait for a more favorable risk-reward ratio (the risk of a sudden, quick plunge with relatively fast recovery, is still there in my opinion). I am simply picky about the momentary opportunities given how fast I can get the message out to you at times.

Trading position (short-term; S&P 500 futures; my opinion): no positions are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.