Trading position (short-term; our opinion): short positions with stop-loss at 3050 and the initial downside target at 2200 are justified from the risk/reward perspective. It's a big-picture trade if you will, which means that the trade parameters are relatively distant price points. Remember that you can adjust your own position sizing so that the risk per trade meets your very personal preferences. We'll manage the open position flexibly and in line with the incoming signals supporting/refuting the projections, but the above price points are the big picture layout.

Egged on by the horrendous retail sales data, S&P 500 intraday decline has gathered steam yesterday. An 8.7% drop in consumer spending can't be just waved off. Neither can the Empire State Manufacturing Index at -78.2. We have the impression that the world is waking up to the realization that this downturn is going to be sharp. Do the stocks reflect that?

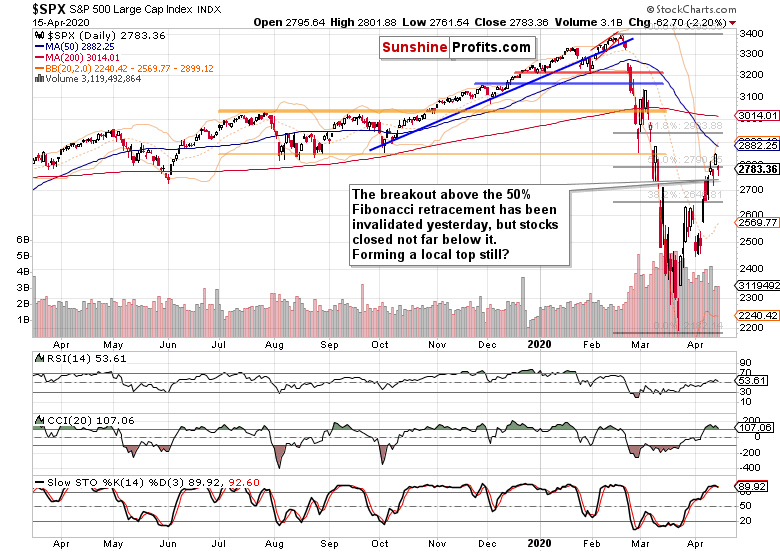

Let's check yesterday's price action in the S&P 500 (charts courtesy of http://stockcharts.com ).

These were our yesterday's observations:

(...) Yes, stocks broke above the 50% Fibonacci retracement and closed darn near their intraday highs. But note the low daily volume. One can be easily forgiven when looking for a much higher one on such a key resistance breakout - expecting a higher reading is justified. Moves that happen on comparatively low volume, are best viewed with a healthy dose of suspicion.

We certainly didn't see a bullish follow-through yesterday that would invalidate the above thoughts. Quite to the contrary - stocks moved back below the 50% Fibonacci retracement and closed there. True, the bears suffered setbacks as yesterday's lower knot shows. But does this make the outlook bullish and refresh the look of the daily indicators?

Well, Stochastics just flashed its sell signal. As it happened in its overbought territory, quite a few traders (us included) wouldn't take it at face value, and would prefer to wait for the indicator to clear the overbought area first. CCI points to decreasing strength behind the stock upswing, and is on the verge of generating its own sell signal, while the RSI is struggling around its midline. Quite a bearish combination overall.

Let's quote our Tuesday's observation:

(...) It's certainly true that quite a few tradable, sizable market moves start with a fake run in the opposite direction that ultimately burns itself out and reverses course. And this is what we're likely witnessing these days in stocks as well.

(...) Regardless of the backing-and-filling that may come over the nearest days, another leg lower will come as surely as an increase in selling pressure.

And regardless of another 5245K newly unemployed Americans, it may very well turn out so. S&P 500 futures have shrugged off the number and turned higher in its wake. More than 21 million (yes, million) lost their jobs within the last 4 weeks. Paying people to sit at home and do nothing must do wonders for corporate profitability and GDP as the real economy springs back to life in one go, just like that. In short, the V-shaped recovery is a fantasy. We've discussed the disruptions in our Sunday's special Stock Trading Alert, and encourage you to read it if you hadn't done so already.

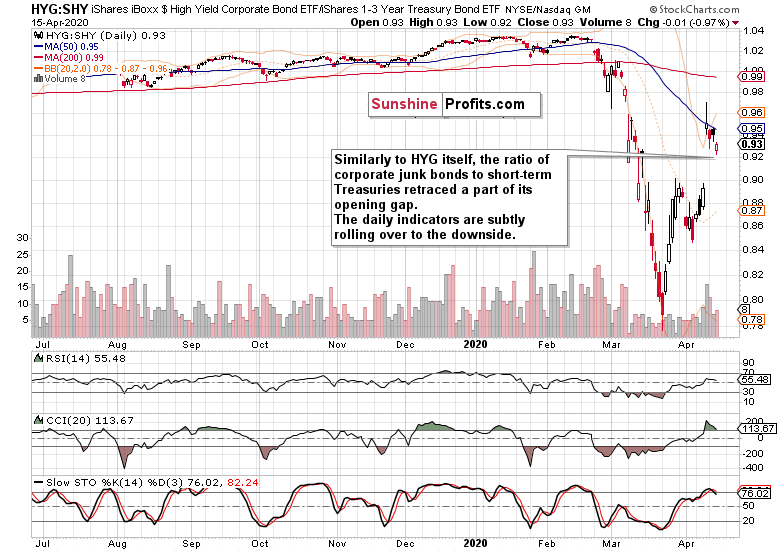

How did the credit markets do yesterday? Let's check one of the key ratios of their performance - high yield corporate bonds to short-dated Treasuries - and draw conclusions.

Mirroring the daily action in HYG ETF, the ratio opened lower and retraced part of its daily downside. Yet it closed clearly below yesterday's closing value, and the daily indicators (Stochastics is on its sell signal now and CCI on the verge of flashing its own).

Taking Thursday's bombshell Fed announcement as the starting point, this is a telling underperformance of the action in stocks. Therefore, stocks are likely to catch up with a downside move of their own, sooner or later. Most probably sooner rather than later.

As the S&P 500 trades below 2780 at the moment of writing these words, today's session will likely show just how steadfast the bulls really are. Can they hope for a result along yesterday's lines?

Before summarizing, one humble request. Is there anything else you would like to see covered? Do you have any question you would like to see answered here? As we strive to make Stock Trading Alerts even better and richer, please don't hesitate and let us know via our contact form. Much appreciated.

Summing up, whilethe stock bulls repelled part of yesterday's downswing, they didn't magically turn the outlook bullish. Tuesday's breakout above the 50% Fibonacci retracement has been invalidated. Notably, the credit markets continue to underperform the S&P 500 action. The risk-reward ratio simply isn't on the bulls' side as dreadful economic data are hitting the markets on a daily basis. Sideways trading followed by renewed selling pressure taking on the March lows, is the optimistic scenario here. The medium-term outlook remains bearish, and the short position justified as stocks won't likely keep disregarding weak incoming April and May data on retail sales, consumer confidence, employment, manufacturing or the GDP - let alone the Q1 earnings hit and lowered Q2 guidance as the lockdowns have started to really bite. Chicken are coming home to roost.

Trading position (short-term; our opinion): short positions with stop-loss at 3050 and the initial downside target at 2200 are justified from the risk/reward perspective. It's a big-picture trade if you will, which means that the trade parameters are relatively distant price points. Remember that you can adjust your own position sizing so that the risk per trade meets your very personal preferences. We'll manage the open position flexibly and in line with the incoming signals supporting/refuting the projections, but the above price points are the big picture layout.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care