Quick Update

In a quick update to kick off 2021, I wanted to summarize my correct calls, and what I profited on since beginning to publish these updates. While nobody can predict the future, the major calls I am most proud of since writing these letters are calling the short-term downturn in small-cap stocks, adding emerging market exposure, and hedging or selling the U.S. dollar.

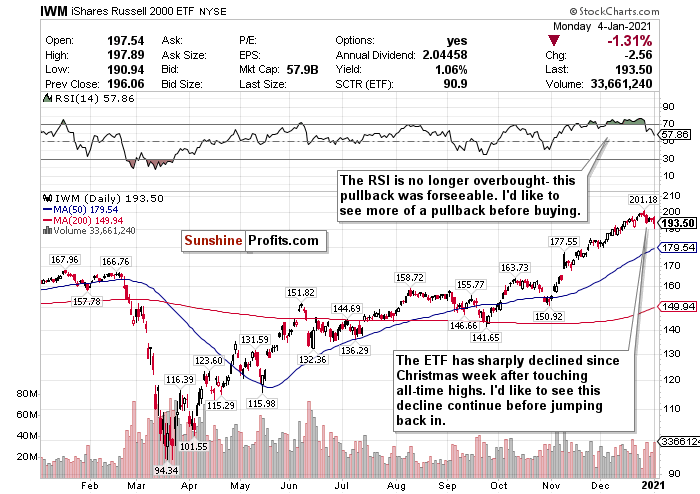

I switched my call on small-caps, specifically the Russell 2000 from a HOLD to a short-term SELL on December 16th. The iShares Russell 2000 ETF (IWM) surged to unprecedented record gains since November 2020, however, I believed then and still believe that the index has overheated by many measurements. Since December 16th, the IWM ETF is largely flat. However, since peaking on December 23rd, the IWM has underperformed ETFs tracking the larger indices and has declined by nearly 3%. While I am still bullish on small-caps in the long run and maintain my STRONG BUY call on the Russell for the long-term, it is contingent on a pullback. I believe that pullback may have begun. I am hoping for a minimum 10% decline before jumping back in for the long-term.

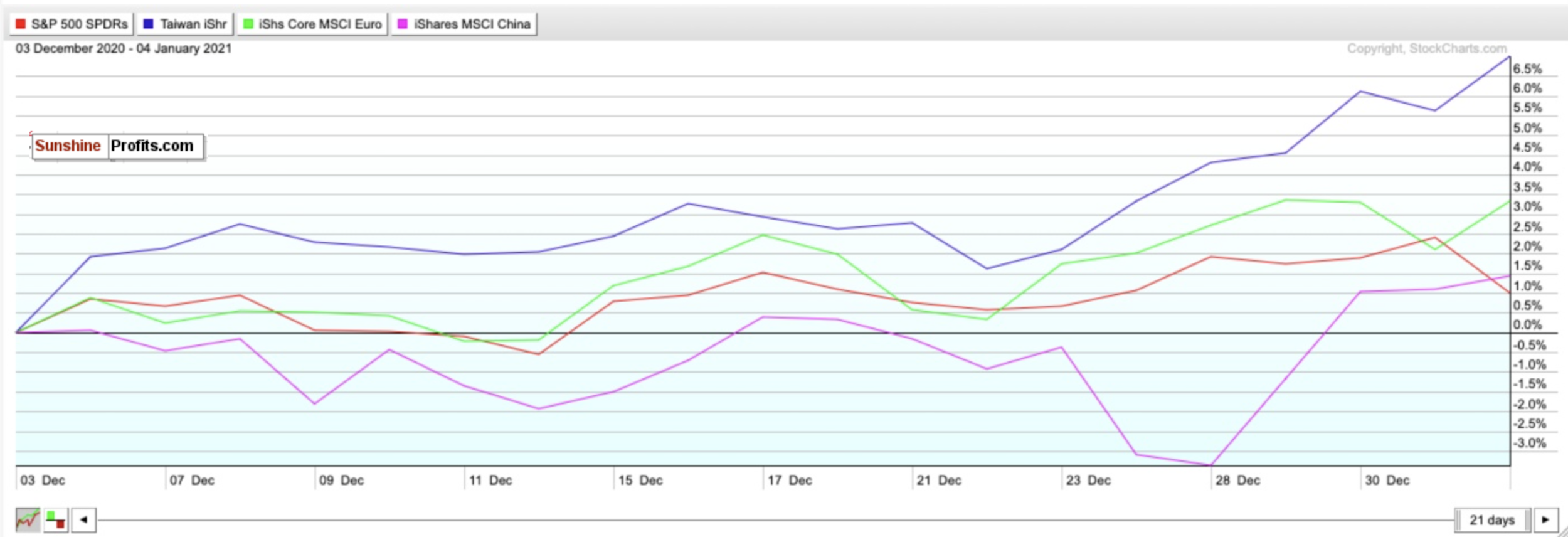

Emerging markets have been some of the best performers in 2020, and I have made some bullish calls on specific regional markets for 2021 as well. I have been touting emerging markets since my first report, but when I switched my focus to specific regions, my calls became even more correct. I called Taiwan (EWT ETF) the best bet for emerging market exposure while avoiding the risks and baked in profits of China on December 3rd. Since then, the EWT ETF which tracks Taiwan has gained over 7% while the MCHI ETF which tracks China has barely gained over 1.4%. The Taiwan ETF has also outperformed the SPY S&P 500 ETF and the IEUR ETF which tracks Europe.

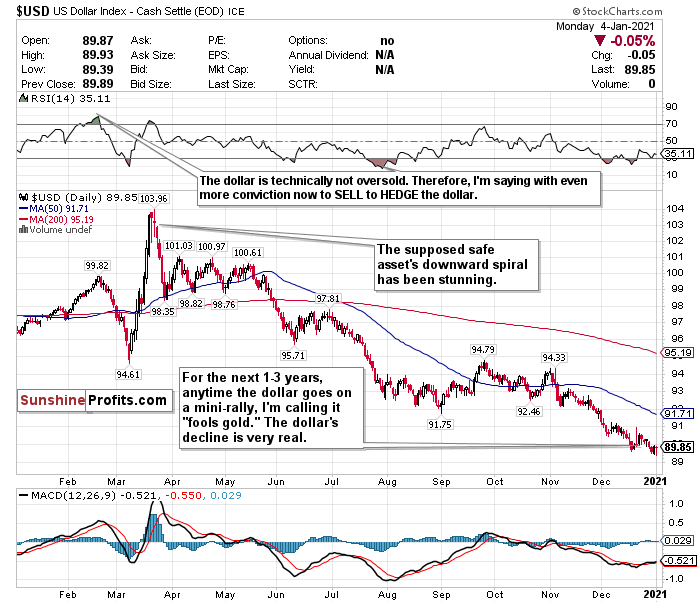

In conjunction with my bullish calls on emerging markets, my bearish calls on the U.S. dollar were also correct. Since I started doing these newsletters about a month ago, I consistently said that the dollar should be hedged or avoided because of the Fed’s policies, effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation. I also said that any minor rally the dollar would experience would be fool’s good. Since the dollar briefly pierced the 91-level on December 9th, it has fallen nearly 1.4%. Despite it experiencing another mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearish outlook of the dollar. Since the open on December 23rd, the U.S. Dollar has declined another 0.77%. I believed it would drop back below 90 before the new year, and here we are to start off 2021, with the dollar at 89.85.

Markets kicked off the first trading day of 2021 with a dud, due to further concerns of COVID-19 cases and the Georgia Senate run-off elections.

News Recap

- Monday (Jan.4) marked the first negative start to a year for the Dow Jones since 2016. The Dow Jones closed 382.59 points lower, or 1.3%, at 30,223.89. The Dow at one point fell more than 700 points.

- The S&P 500 also fell 1.5% to 3,700.65, the Nasdaq fell 1.5%, and the small-cap Russell 2000 fell 1.47%.

- This was the biggest one-day sell-off since Oct. 28 for the Dow and S&P 500, and the Nasdaq’s worst sell-off since Dec. 9.

- While the sell-off to start the year could be due to natural consolidation, the growing number of COVID-19 cases around the world and its potential impact on the global economic recovery weighed on investors. To start the year off, U.K. Prime Minister Boris Johnson announced a national lockdown to slow the spread of a new, more contagious, coronavirus strain. With this lockdown, people are only allowed to leave their homes for essentials, work if they can’t from home, and exercise. Most schools, including universities, will also move to remote learning.

- According to data compiled by Johns Hopkins University, more than 85 million COVID-19 cases have been confirmed globally, including 20.7 million in the U.S. and 2.7 million in the U.K.

- Pay very close attention to the Georgia Senate run-offs on Tuesday (Jan. 5). The balance of power in the Senate is hanging on the vote and markets could be volatile due to the results. If the Democrats gain a majority, it could impact market performance and leave Biden’s powers largely unchecked. If the Republicans keep just one seat, it could likely check Biden’s more progressive ambitions.

- Coca-Cola (KO) and Boeing (BA) were the laggards on the Dow, falling 3.8% and 5.3%, respectively. Real estate stocks were the worst performing on the S&P and fell 3.2%. Utilities also declined 2.6%.

- About 4.6 million people in the U.S. have now gotten a COVID-19 vaccine.

Stocks dropped sharply on Monday (Jan. 4), to kick off 2021. It was the first time since 2016 that the Dow Jones started a year off with declines and was the biggest one-day sell-off since Oct. 28 for the Dow and S&P 500. It was also the Nasdaq’s worst one-day decline since Dec. 9.

Several catalysts can be blamed for the gloomy start to the year: natural consolidation, COVID-19, and the Georgia Senate runoff elections.

First and foremost, a decline like this was bound to happen, and I called this happening in the early part of the year. I still believe that there will be a short-term tug of war between good news and bad news, and that these moves are manic and based on sentiment. There was no pullback to end 2020 as I anticipated, but I still believe that markets have overheated in the short-term. Was Monday (Jan. 4) the start of a correction? Possibly. But either way, I think that between now and the end of Q1 2020, a correction could happen.

Carl Icahn seemingly agrees with me, and told CNBC on Monday (Jan. 4), “in my day I’ve seen a lot of wild rallies with a lot of mispriced stocks, but there is one thing they all have in common. Eventually they hit a wall and go into a major painful correction.”

I believe, though, that corrections are healthy and could be a good thing. Corrections happen way more often than people realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are overdue for one since there has not been one since the lows of March 2020. This is healthy market behavior and could be a very good buying opportunity for what I believe will be a great second half of the year.

Meanwhile, COVID-19 continues surging and there are very real fears of new strains discovered in the U.K. and South Africa that could be more contagious. U.K. Prime Minister Boris Johnson announced a national lockdown that could potentially last until mid-February. With this lockdown, people are only allowed to leave their homes for essentials, work if they can’t from home and exercise. Most schools, including universities, will also move to remote learning. This could be an ominous sign for stricter lockdowns to be implemented in other regions across the world.

Outside of COVID-19, political uncertainty has returned to the markets. The balance of power in the U.S. Senate is at stake, with Georgia run-off Senate elections set to occur on Tuesday (Jan. 5). Investors are likely to prefer a divided Senate. If the Democrats win both elections and wrestle away Senate control from the Republicans, it could leave President Biden’s powers largely unchecked, and enable him to pass more of his ambitious and progressive policies. Many investors do not anticipate these to be very market friendly. As results start to come in Tuesday evening, markets could react in a volatile manner.

According to John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, the S&P 500 could fall by 10% if the Democratic candidates win the Georgia runoffs.

“It is thought by not just a few folks on Main Street as well as on Wall Street that if tomorrow’s run-off results in a sweep for the Democrats — providing them with control of the Senate as well as the House — that it would bode ill for business with the likelihood that corporate tax rates could rise substantially,” Stoltzfus said.

This will also be a busy week for economic data with the manufacturing PMI report said to be released Tuesday (Jan. 5) and the non-farm payrolls report set to be announced Friday (Jan. 8).

Monday's sell-off (Jan. 4) serves as a very painful reminder that markets will still have to weigh the near-term risks against some of the more positive mid-term and long-term hopes on vaccines and re-opening.

The general consensus is that 2021 could be a strong year for stocks, despite short-term headwinds. According to a CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000, while five percent also said that the index could climb to 40,000.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

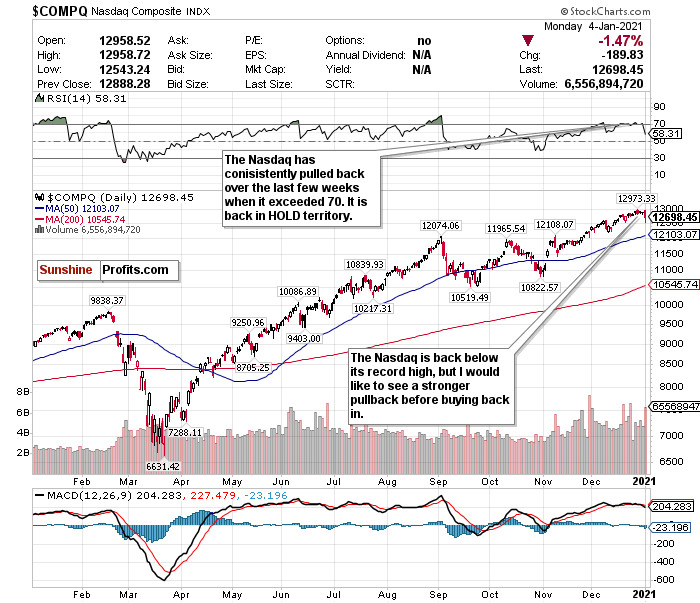

The Nasdaq is No Longer Overbought...but When is the Big Correction Coming?

I changed my short-term call on the Nasdaq to a SELL on December 18. While I did not say to fully exit positions, I said that now would be a good time to trim some profits before an eventual pullback. While the Nasdaq has been largely flat since, it is no longer at a record high and is no longer overbought according to its RSI. However, I still believe that a correction in the early part of 2021 is inevitable.

While an overbought RSI does not automatically mean a trend reversal, with the Nasdaq, always keep a close eye on this.

The Nasdaq pulled back on December 9th after it exceeded an RSI of 70, and briefly pulled back again after passing 70 once more two weeks ago. We exceeded a 70 RSI again before the new year, and what happened on the first trading day of 2021? A decline of 1.47%. I believe another decline is imminent after a short-term rally comes.

Although the tailwinds are very real, this has all the signs of a bubble with no fundamentals to back up the gains. Do not let anyone tell you “this time is different” if fears of the dot-com bubble are discussed. History repeats itself, especially in markets. I have many concerns about tech valuations and their astoundingly inflated levels. The recent IPOs of DoorDash (DASH) and AirBnB (ABNB) reflect this.

Do what you can though to research tech companies that have innovator and disruptor potential. There is always an opportunity somewhere. While tech has overheated in the short-term, my optimism and bullish thoughts for 2021 have not changed. I hope tech pulls back closer to its 50-day moving average for some quality long-term buying opportunities.

For now, because the RSI is back in HOLD territory, and I foresee a near-term return to the stay-at-home trade, I’m switching my call from SELL back to HOLD.

But the second the RSI goes back above 70, I’m switching back to SELL. There are clear patterns here.

I do not believe that now is the time to buy back into tech, but please remember that tech can be very helpful to own on pessimistic days because of all the “stay-at-home” names.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

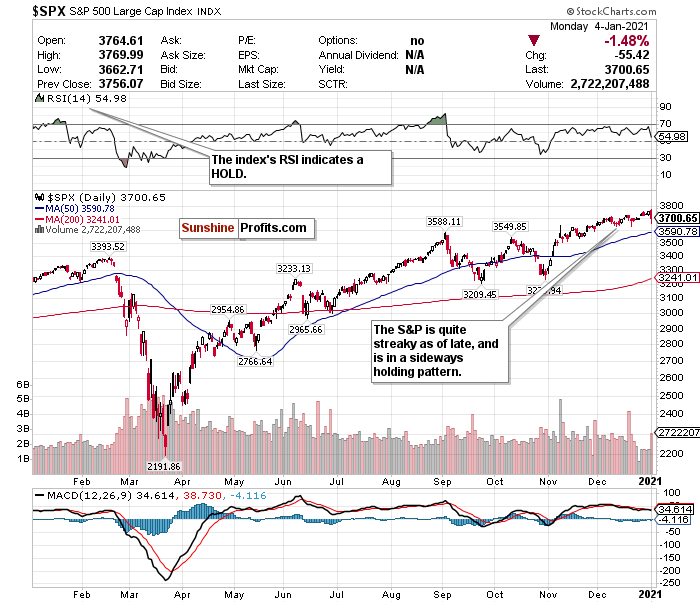

The S&P Has Long-term Upside Mixed with Uncertainty

The S&P 500 is a very streaky index. Reflecting the broader tug-of-war between good and bad news, it seemingly goes on multiple day winning streaks and losing streaks on a weekly basis.

Although it began 2021 at a record high, the index saw its worst one-day sell-off since October. I believe more of these days could be on the horizon. While I always cheer stocks going up and hitting records, I also want buying opportunities. I would like to see this blue-chip large-cap index drop to around 3600 or below before making a BUY call for the long-term. For now, my near-term outlook is murky at best.

Although the RSI is showing a HOLD, I believe that a short-term correction will inevitably occur by the end of Q1 2021. Especially if the Democrats sweep Georgia.

While many analysts and strategists believe this short-term uncertainty is worth it for long-term potential, (and I tend to agree), I would prefer a sharper correction to initiate S&P exposure at a discount. There is clear upside for the second half of 2021. I would just prefer to maximize the upside if I believe that it’s possible to buy the ETF at a lower level.

Some analysts believe that the S&P could have up to a 20% upside in 2021, while others caution against an overheating index. According to another survey of market strategists conducted by CNBC, a narrow majority believe that U.S. stocks will continue to rally into 2021, with the S&P 500 rising between 8% and 22% next year from these current levels. This very well could be the case - but I believe most of this will happen in the next 6-12 months rather than 1-3 months.

For now, I have the S&P 500 in a HOLD category.

For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Can Small-caps Own 2021?

Although the Russell 2000 small-cap index has outperformed with a record run since the start of November, I believe the party is over - for now.

I love small-cap stocks in the long-term, especially as the world reopens. But I believe that in the short-term, the index, by any measurement, has simply overheated. Before Jan. 4, the RSI for the IWM Russell 2000 ETF was at an astronomical 74.54. I called a pullback happening in the short-term and believe this could be the start of a bigger correction.

Although the RSI is now at a healthier HOLD level, I believe that small-caps in the short-term will be more sensitive to bad news. Stocks simply just don’t always go up in a straight line, and that’s what the Russell 2000 has essentially been doing between November and December.

I believe a larger pullback for small-caps will eventually happen, and I truthfully hope it does for long-term buying opportunities. This could potentially be the beginning of the correction. Since peaking on December 23rd, the IWM has declined by nearly 3%. I am hoping for a minimum 10% decline before jumping back in for the long-term.

SELL and take short-term profits if you can- but do not fully exit positions.

If there is a pullback, this is a STRONG BUY for the long-term recovery.

Mid-Term/Long-Term

Taiwan and Others for Emerging Market Exposure - Not China

Emerging markets in both the medium-term and long-term have robust potential. But at this point, it is very country-specific.

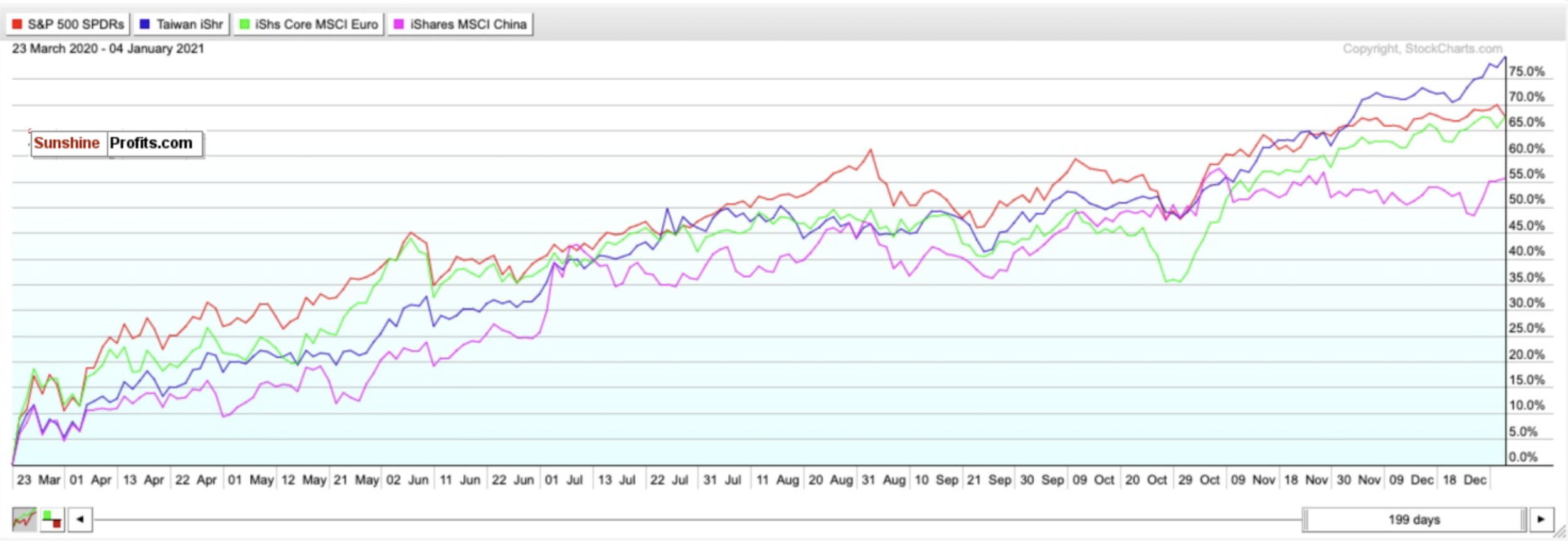

Although China garners most of the attention as a so-called “emerging market,” it has not been the top performer since markets bottomed on March 23rd and is no longer the top option for 2021. If you want China’s regional upside with less geopolitical risks or pandemic recovery baked-in, look at the Taiwan iShares ETF (EWT). Taiwan has outperformed China in the short-term, medium-term, and long-term.

As seen in the chart below, ever since I first called the Taiwan ETF (IWT) a BUY on December 3rd it has outperformed the MSCI China ETF (MCHI), the SPDR S&P ETF (SPY), and iShares Core Europe ETF (IEUR).

The EWT has gained over 7% while the MSCI China ETF (MCHI) has barely gained 1.4%. The Taiwan ETF has also outperformed the SPY S&P 500 ETF and the IEUR ETF which tracks Europe.

China may have handled the pandemic better than other countries and continues to demonstrate its ability to handle COVID-19’s economic shocks, however, keep in mind that this is a regional victory, not just China.

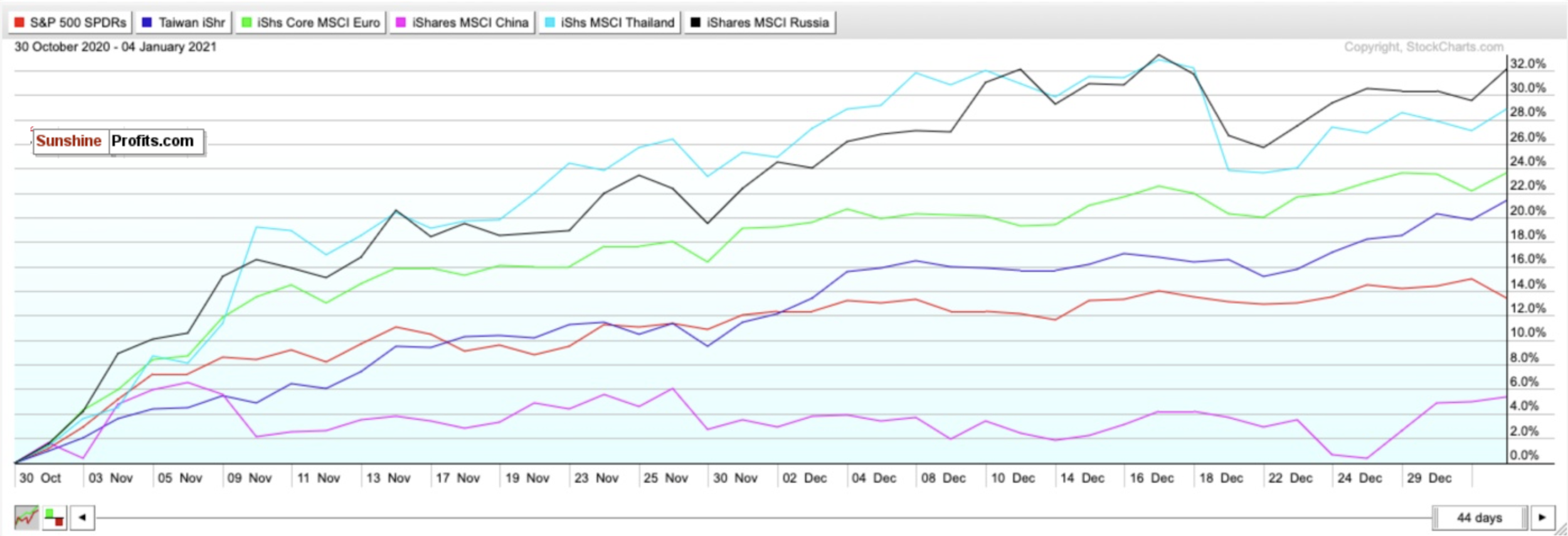

There are two other emerging markets I am very bullish on for 2021 as well - Thailand and Russia. According to a Bloomberg study from December 16th, based on 11 indicators of economic and financial performance, Thailand topped the list due to solid reserves and a high potential for portfolio inflows, while Russia scored second due to robust external accounts, a strong fiscal profile, and an undervalued currency.

Do you know who scored poorly on this list? China. High expectations were largely already baked in during its 2020 recovery, and there is little upside.

Do you also know who significantly outperformed the Taiwan ETF (IWT), the MSCI China ETF (MCHI), the SPDR S&P ETF (SPY), and iShares Core Europe ETF (IEUR) since October 30th? The iShares MSCI Thailand ETF (THD) and the iShares MSCI Russia ETF (ERUS).

For broad exposure to Emerging Markets, you will want to BUY the iShares MSCI Emerging Index Fund (EEM), for exposure to a regional economic power without the geopolitical risks of China, you will want to BUY the iShares MSCI Taiwan ETF (EWT). Consider the iShares MSCI Thailand ETF (THD) and the iShares MSCI Russia ETF (ERUS) as well for 2021 upside.

The Dollar is Below 90 and Could Fall Further

Although we may be in a “risk-off” environment in the short-term, I no longer have faith in the U.S. Dollar as a safe asset. I still am calling out the dollar’s weakness after several weeks, despite its low levels. I expect the decline to continue as well thanks to a dovish Fed.

Any time the U.S. Dollar rallies, I am calling it “fool’s gold.” Since I started doing these newsletters about a month ago, I have consistently said that any minor rally the dollar would experience would be a mirage. Since the dollar briefly pierced the 91-level on December 9th, it has fallen nearly 1.4%. Despite it experiencing another mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearish outlook of the dollar. Since the open on December 23rd, the U.S. Dollar has declined another 0.77%. I believed it would drop back below 90 before the new year, and here we are to start off 2021 with the dollar at 89.85.

Since hitting a nearly 3-year high on March 20th, the greenback has plunged nearly 13% while emerging markets and other currencies continue to strengthen.

On days when COVID-19 fears outweigh any other positive sentiments, dollar exposure might be good to have since it is a safe haven. But in my view, you can do a whole lot better than the U.S. dollar for safety.

I have too many doubts on the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on the dollar’s prospects over the next 1-3 years. Meanwhile, the U.S. has $27 trillion of debt, and it’s not going down anytime soon.

Another headwind to consider for the dollar is the Georgia Senate election. If Democrats sweep, there could be more aggressive stimulus in the near term. With Democrats controlling both the House and the Senate, more stimulus could be bearish for the dollar.

Additionally, according to The Sevens Report, if the dollar falls below 89.13, this could potentially raise the prospect of a further 10.5% decline to the next support level of 79.78 reached in April 2014. I believe this is more likely to happen than it piercing 91 again.

The dollar’s RSI is also somehow now under 30 despite significantly trading below both its 50-day and 200-day moving averages.

For now, where possible, HEDGE OR SELL USD exposure.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation within the next 6-12 months. The Fed has said it will allow the GDP to heat up, and it may overshoot in the medium-term as a result. Although JP Morgan and Goldman Sachs have cut their GDP growth estimates for Q1 2021, pay close attention to what happens in Q2 and Q3 once vaccines begin to be rolled out on a massive scale. It is only inevitable that inflation will return with the Fed’s policy and projected economic recovery by mid-2021.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITs.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), the SPDR Gold Shares ETF (GLD), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

There is so much to worry about in the short-term, but I believe that economic stimulus and the progress made with the vaccine(s) bodes well for the second half of 2021. We may be at the beginning of the end of the pandemic. But over the next 1-3 months, this could be a very bumpy ride back. Projections for the economy, the markets, and the pandemic are so all over the place right now.

There does seem to be one consensus though: 2021 could be a big year for stocks.

I have a very good feeling about stocks, especially small-caps, value stocks, and cyclicals. I just have a much better feeling for them in the second half of 2021. I almost hope we see a correction within the first three months of the new year. This could be a very strong buying opportunity.

Summary

While the current headwinds are very worrying and concerning, I am very optimistic for the second half of this year. But it will be a challenging path there.

Until COVID-19 is eradicated, there will inevitably be a tug of war between optimism and pessimism. I believe that a short-term correction to start 2021 is all but inevitable, but do not let this scare you. Try to remember that markets are forward-looking instruments and are investment vehicles that look 6-12 months down the road. Although it is very plausible that there could be some short-term uncertainty and volatility, use this as a time to find buying opportunities for the second half of 2021. Do not get caught up in fear if there is a correction.

I do not believe a crash like the one we saw in March is on the horizon, but a pullback of some sort is inevitable. If this happens, do not be fearful. Since markets bottomed on March 23rd, here is how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 96.46%. Nasdaq (QQQ) up 82.37%. S&P 500 (SPY) up 67.52%. Dow Jones (DIA) up 65.56%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

To sum up all our calls, in the short-term I have a SELL call for:

- iShares Russell 2000 ETF (IWM) (but do not fully exit positions – just trim profits)

I have a HOLD call for:

- Invesco QQQ ETF (QQQ)

- the SPDR S&P ETF (SPY),

- SPDR Dow Jones ETF (DIA)

I also have a long-term STRONG BUY call for:

- iShares Russell 2000 ETF (IWM) BUT IF AND WHEN IT PULLS BACK

For all these ETFs, I am more bullish in the long-term for the second half of 2021.

For the mid-term and long-term, I recommend selling or hedging the US Dollar, and gaining exposure into emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD), and

- the iShares MSCI Russia ETF (ERUS).

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- the SPDR Gold Shares ETF (GLD), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist