Another day, another all-time high seems to have been the prevailing theme lately. Sticking with working strategies and themes may seem challenging, but fighting the tape is not the answer.

It can feel counterintuitive for traders to go with the trend sometimes. I know! A trader may see a chart going from the bottom left of the chart to the upper right-hand corner and wants to take the other side of the trade badly, even though it is counter-trend. Logic might dictate that whatever market you are following should be selling off, and it continues roaring higher like a roaring bull. While I am not trying to be oversimplified here, I want to reiterate that the trend is indeed your friend.

Even when many technical indicators might indicate that a market is overbought (or oversold), a market will oftentimes continue moving in the same direction, leaving many counter-trend traders in its wake. This is the reason that buying pullbacks in a bull market has been the focus here, opposed to trying to pick tops. It is never easy picking tops and bottoms in any market.

This is the major reason that I like to revisit what has been working.

Looking back at the US equity markets over the last couple of weeks, the theme seemed to be bipolar at face value; but has it really? If we take out the fundamental development of the Fed changing stance on interest rates, has the price action been anything more than typical?

Figure 1 - S&P 500 Index May 18, 2021 - June 29, 2021, 10:00 AM, Daily Candles Source stockcharts.com

I know it felt like the sky was falling when the Fed changed its stance on future interest rate guidance. In reality, the pullback was pedestrian on the day of the event, and the subsequent market digestion brought the S&P 500 to the 50-day SMA (slightly below) for a short period. There is nothing so spectacular about that. It is just the sign of a healthy bull market.

Looking at the pullback that we saw two weeks ago, it was approximately 2.24%. It felt like it was a larger selloff than that, right? That is what happens when the markets are fired up with emotion, and everyone has their take on what is going to happen next.

In reality, if a trader had a plan to buy the pullback at a predefined level, the news of the projected interest rate hikes was just a vanilla buying opportunity. Our readers were prepared, as we have been analyzing what has been working recently: buying the $SPX at the 50-day moving average as detailed on several occasions - including the June 10th publication. It was on our shopping list, and waiting for the pullback was indeed the right move.

It takes discipline, patience, and execution.

As the S&P 500 has marched higher since touching the 50-day moving average, we currently have the daily RSI(14) sitting near 65-66 and the index trading near the psychologically round number of 4300. Many traders may use these metrics to take some chips off the table. However, is shorting the market there the right thing to do? Some traders may try, some may succeed, and some will lose. The important message of the day is to trade with the trend, and have a plan in place when conditions are right.

It is not to say that buying dips is the only way. For example, our Premium subscribers were alerted to TAN Invesco Solar ETF in our June 15th publication.

Figure 2 - TAN Invesco Solar ETF April 27, 2021 - June 29, 2021, Daily Candles Source stockcharts.com

On June 14th, TAN closed above its 50-day moving average for the first time in a long time. While this entry seems like more of a momentum-based entry, it is important to note that TAN had undergone a long period of consolidation and pullback.

Figure 3 - TAN Invesco Solar ETF May 8, 2020 - June 29, 2021, Daily Candles Source stockcharts.com

So, in this case, we identified a market with a good theme that has pulled back for an extended period. For a trigger, a close above the 50-day SMA made sense.

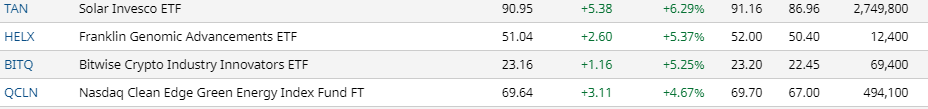

Let’s take a look in more detail at TAN for any premium subscribers that have open positions. Did I mention that TAN was the top-performing ETF of all unleveraged ETFs yesterday? It was up 6.29% on June 28, 2021.

We now have TAN at potentially short-term overbought levels. Short-term traders can look to take profits today. Last Trade $91.42 (last time I checked). Daily RSI(14) is showing 73-74 levels with the hourly RSI showing similar measurements.

Personally, I like this for a longer-term run, so I would be looking to hold unleveraged positions for longer terms. However, since everybody is different, there is nothing wrong with taking some TAN off the table here and then looking to reenter on a pullback. The 200-day moving average is currently $86.58, and that would be a level to watch for a reentry.

Yesterday triggered closing out the IWM trade for a positive return since the May 27th publication.

To sum up the current viewpoint and opinion:

I have BUY opinions for:

- Defiance Quantum ETF (QTUM) between $44.00 - $49.50. Update 06/25: This one is still in the upper area of our buy idea zone. Look for pullbacks for entries near the 50-day SMA (currently $47.77). Update 06/26: Last trade $49.85. Do not chase and consider buying pullbacks. Always use a stop loss level that caters to your individual risk tolerance.

- Amplify Transformational Data Sharing ETF (BLOK) between the 200-day moving average and $40.00 200-Day Moving Average is currently $40.43 Update 06/25: I have the same outlook here: Bitcoin and crypto have gotten slammed, but I am in no rush. There could be another shoe to drop. Patience. Update 06/26: We never got quite the pullback that we wanted here. Still monitoring for pullbacks to the 200-day SMA .Always use a stop loss level that caters to your individual risk tolerance.

- Invesco MSCI Sustainable Future ETF (ERTH) between $65 and $66. Update 06/22: Important note on ERTH: This one had me scratching my head on the open yesterday and then I quickly discovered that there had been a $9.95 dividend issued. You can read about the dividend on Invesco’s website here. Call your broker if you have any questions about how the dividend was applied to your account. This dividend was abnormally high for ERTH based on the past. Since $9.95 came out of the stock price in the form of a dividend, we must adjust our pricing outlook by $9.95. I like this name for the longer-term around $65-$65.80 (dividend adjust price) at this time. Update 06/25: I like the theme of this ETF. Look to enter on pullbacks between $65 and $66.00. Update 06/26: Another steady grinder that keeps moving higher. Hold longs and consider buying pullbacks. Always use a stop loss level that caters to your individual risk tolerance.

- Invesco Exchange-Traded Fund Trust - S&P SmallCap 600 Pure Value ETF (RZV) on pullbacks. Update 06/22: This one touched the 50-day MA on Friday (we were waiting for that!) and tacked on 2.51% in yesterday’s session. If you didn’t catch the big pullback, look to enter on any pullback from $93 - $94.90. Update 06/25: I still think this has legs. If not on board yet, look for intraday pullbacks in the low to mid $95’s. Update 06/26: In our zone with the last trade at $94.96. Like small caps? Consider long entries if not already long. Always use a stop loss level that caters to your individual risk tolerance.

- iShares Global Timber & Forestry ETF (WOOD) Initial buy idea zone between $79.07 and the 200-day moving average ($79.82 as of 06/16 close). Update 06/16: Given the price action in the lumber futures described in today’s alert, consider an entry into ½ of a normal position size between $86.50 - $87.50. Should it pull back further, we can look to add another ½ position size. Update 06/17: WOOD provided the entry opportunity levels that we were looking for on Wednesday and even finished higher on the day. What a great sign. Look to be long on this underappreciated ETF. Update 06/21: WOOD traded through our first tranche level between $86.50 and $87.50. It closed Friday @ $84.15. I am looking at the above-mentioned price levels between $79.16 and $79.82 - $80.00 for the second tranche. See Above. Update 06/22: Wood tacked on 2.33% yesterday. Hold longs and look to add between $79.16 - $80.00. Update 06/25: Hold existing longs and look to add between $79.16 - $80.00. Update 06/26: Hold existing longs and look to add between $79.16 - $80.00. Always use a stop loss level that caters to your individual risk tolerance.

- Invesco Solar ETF (TAN) between the 50-day moving average ($80.32 as of June 14th) and $81.50. Look for an intraday pullback for entry. Update 06/16: We wanted a pullback, and we got a big one on Tuesday, with the range being $78.00 - $80.69. Ideally, this was taken advantage of on this pre-Fed meeting day. There could have been some “sell the news” price action with the SEIA report being released yesterday. Although we are below the 50-day MA, I like the previous consolidation and would look to be long at these levels. Update 06/17: TAN tacked on 1.51% in Wednesday’s overall down session. Great sign. I like this one and I think there is still time to get on board. Always use a stop loss level that caters to your individual risk tolerance. Update 06/21: We really nailed this entry and I am looking for continued upside. I think there is still time to get on board - look for pullbacks near the $81.00 level. I like this for a longer-term holding with price appreciation potential north of $100.00. Update 06/22: I think there is still time to get on board: look for pullbacks approaching the 50-day SMA of $79.75 - $81.00 for long entries. I like this one for a longer-term move above $100.00. Update 06/25: I continue to love TAN. This one has been up and up. If you are still not on board, look for pullbacks and do not chase. The current 50-day SMA is $79.72. $80 - $82 would be a nice level to initiate or add. Shorter-term traders note the 200-day moving average that acted as resistance on Friday near $86.19. Since I like this one for the longer-term, I would prefer to hold through any pullbacks.

- 06/26: SEE ABOVE FOR DETAILS TODAY

- Always use a stop loss level that caters to your individual risk tolerance.

- First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID). GRID has traded through our idea range of between $86.91 and $88.17. Update 06/17: GRID closed at $91.50 yesterday, moving lower on the overall down day. I see no major technical damage and like this one over the longer run. Opinion: hold existing longs and/or look for entries on pullbacks. Update 06/22: Another one that briefly touched the 50-day SMA. Did you get it? If not I like it anywhere below $91 - look to enter on pullbacks. I am looking for $100 level or maybe higher in the longer term. Update 06/25: I still love GRID too. It has been a steady Eddie. Do not chase though, perhaps we get a pullback to the $90 level if you are not long yet. Update 06/26: Consider buying on a pullback to $90, if not long yet. Always use a stop loss level that caters to your individual risk tolerance.

I have SELL opinions for:

NONE

I have a HOLD opinion for:

NONE

Thanks for reading! Your readership is valued and appreciated.

Thank you,

Rafael Zorabedian

Stock Trading Strategist