Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Days ago, I called for this consolidation to take shape of a bull flag. I also laid out what would be the developments to make me worry and reconsider the short-term outlook. But the intraday reversal I saw as likely to happen either yesterday or today, arrived – and the bull flag hypothesis has been confirmed in the short-run.

Thinking in scenarios, considering alternatives, that's the trader's job. If things work out according to plan, you stay the course. If they don't, you better turn on a dime. It's the same in life – if you do your best but are treated poorly and there is no light at the end of the tunnel, you just turn around and leave as fast as you can. Traders do the same – if the open position isn't profitable, and its rationale isn't there anymore, you just cut your losses and get ready for the next opportunity.

There is no looking back and trying to rationalize the sunk costs. Or reframing that as headwinds that only the bravest of the brave can overcome because (the favorite reason why the trade was taken in the first place goes here). No, trading is not a perverse test of courage that has to hurt like hell to be worth it in the end. You deserve better and life is a great inspiration for finding and appreciating real value anywhere you look.

Works 100% like that with me, and in today's analysis, I'll present the case for why the stock bull run is unchallenged both in the medium- and short-term.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

So far, so good. Prices have rebounded and the bull flag shape is still intact. Yesterday's spike in volatility that was visible only on the daily chart to start with, was reversed. As I have written above about self-respect and saying enough is enough, the bulls have done so yesterday.

And judging by the premarket action thus far (stock futures are trading at around 3485 as we speak), the bulls are (you may remember the theme of my Sep 11 article Rocky S&P 500 Recovery From the Sharp Correction Goes On) made of steel and rising up to the challenges.

Credit Markets’ Point of View

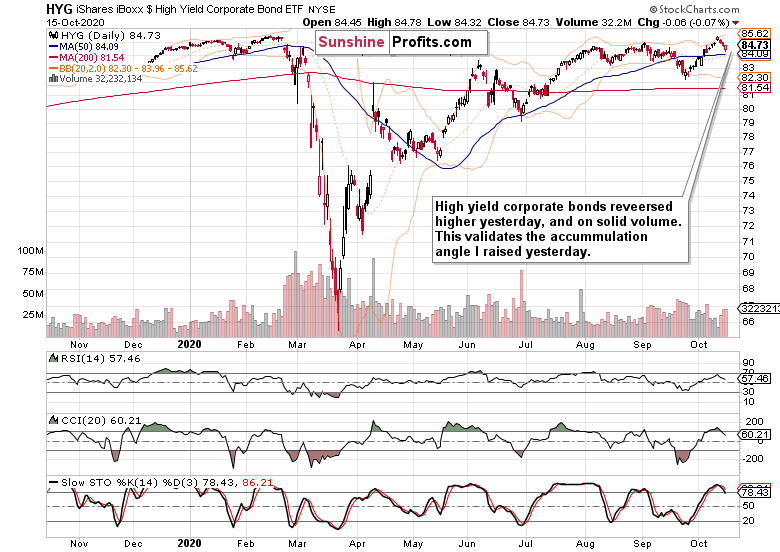

High yield corporate bonds (HYG ETF) reversed from the opening lows, and the volume was there. That's promising and exactly what I wanted to see accompanying a stock upswing to make it credible. Credible, that's the key word here because there is no shortage of poseurs or false signals all around us.

The brief and shallow buying in long-term Treasuries (TLT ETF) has hit the wall yesterday – and Wednesday's candle was indeed a telling one. Yes, that still means the bond markets are tentatively supporting the economic recovery story.

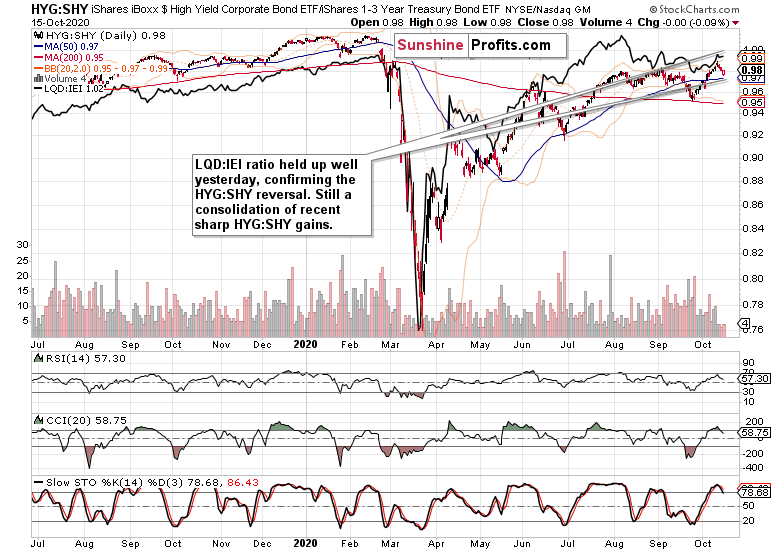

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have moved up, with the more risk-on one travelling a farther distance. That's good for the stock upswing's prospects.

Metals and Currencies

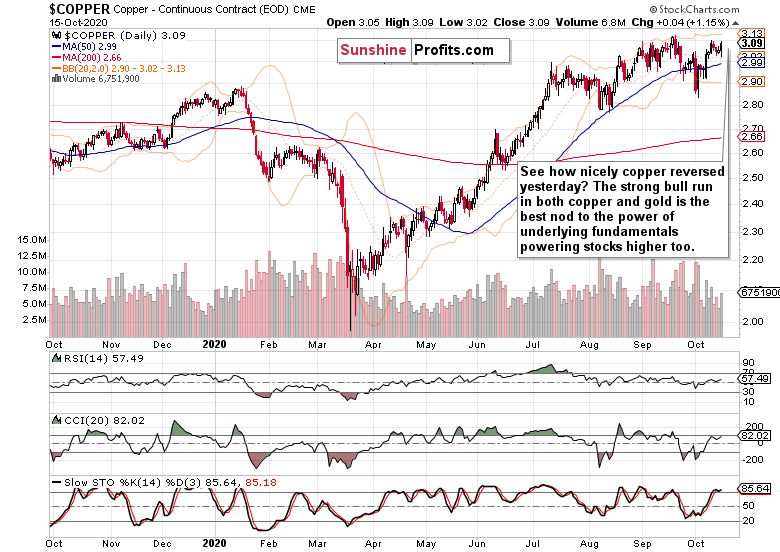

Copper tirelessly keeps pushing higher, recovering from every setback. It's not alone doing so, both precious metals are keeping steady. The long sideways consolidation before another leg higher keeps unfolding – and the stronger the base, the stronger the subsequent advance, fundamentals and technical are aligned.

Talking fundamentals, they're clearly reflected in the dollar's struggles. I don't think the budding divergences would take the greenback far and lastingly – stocks certainly don't seem to get under too much pressure due to spiking dollar.

Is EUR/CHF breaking down, or has its breakdown just been rejected? It's the latter in my view – the risk-on euro will be favored at the expense of Swiss franc as the recovery progresses.

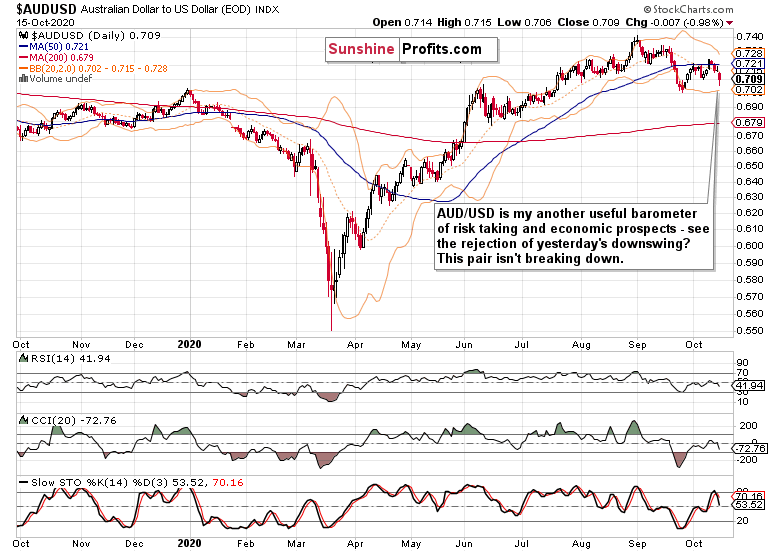

On Oct 08, I talked why I follow currencies, on Oct 14 I discussed the above pair, noting that it doesn't represent a reversal of fortunes in the risk-on-risk-off trade. And today, I'll add another key pair to follow.

AUD/USD is giving an impression of breaking down – if you ignore the lower knot, that is. In my view though, we're in for another leg higher in here that would be accompanied by bullish divergences. That's another supportive factor for the stock bull run to reassert itself.

Summary

Summing up, the sellers were stopped yesterday – enough is enough, and time to run higher is approaching. The bull flag remains intact thus far, and the 500-strong index looks set to be led higher by smallcaps and technology. As I noted yesterday, if commodities are anything to go by, then the stock downswing is likely to run into headwinds soon – it indeed did, and commodities keep supporting $SPX recovery.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.