Trading position (short-term; S&P 500 futures; our opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Another day, another gain in stocks – in spite of the almost textbook Tuesday's reversal that I didn't trust one bit. The slow grind higher in stocks goes on, and my previously profitable long position has become even more so today.

With mid-September highs in sight, the question becomes when will the S&P 500 power through, and take on the early September climactic highs that I called out precisely to the day?

Yesterday, I gave you several reasons why the bull run will succeed, and they came from the bond markets. Both fundamental and technical in nature, showing a great future for the S&P 500 in the many weeks ahead.

At the same time though, I did cautiously say within the summary that as for now, a very measured grind higher in the 500-strong index remains a safe bet for the days and immediate weeks ahead.

Let's check the market pulse for the health of yesterday's advance and its extension in today's premarket.

S&P 500 in the Short-Run

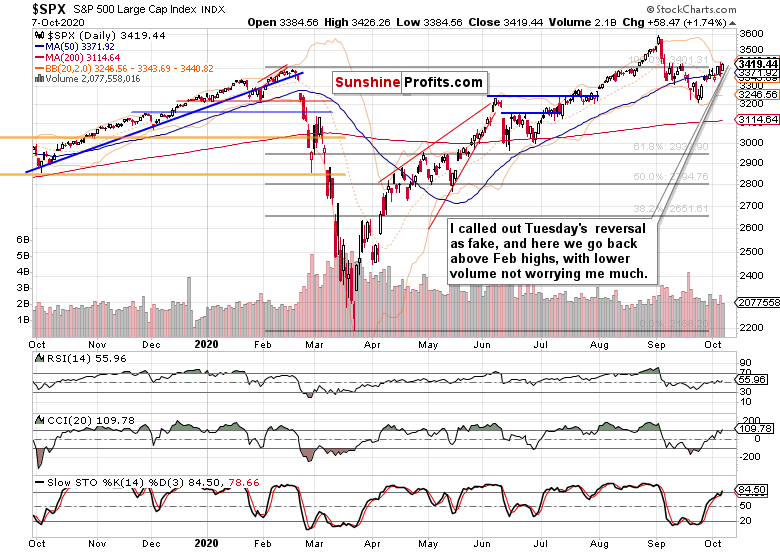

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

I told you it wasn't a breakout rejection in earnest, and prices closed back above the Feb highs yesterday. And again, the session's lower volume doesn't concern me – as the worst case scenario, I see a protracted sideways consolidation before the Feb highs are decidedly overcome.

But that's not the most likely possibility – I think that these highs would be beaten in a few days. After the stormy September, the month of October is shaping up to be calmer thus far – but I look for the approaching elections to bring turbulence still, as in later this month.

Credit Markets’ Point of View

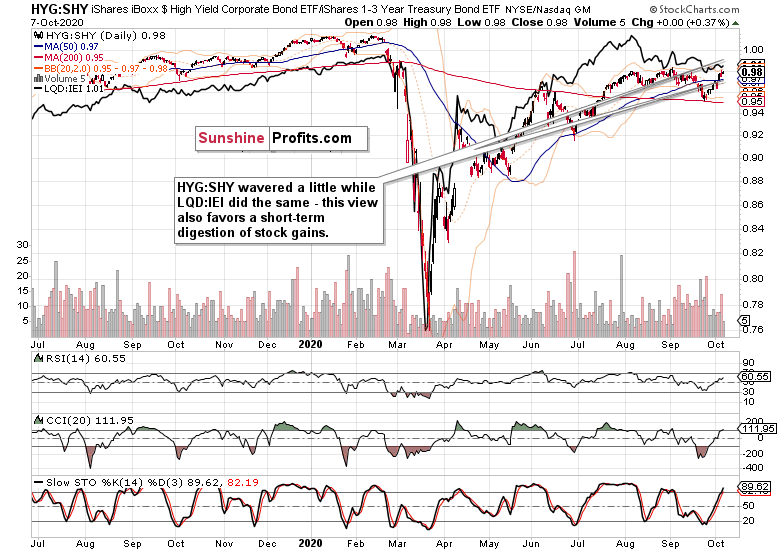

High yield corporate bonds (HYG ETF) didn't move much yesterday. The higher open was defended successfully, but the lower volume hints at a likely consolidation shortly. I expect it would take a brief while before the September HYG highs are overcome – yesterday's volume is not a show stopper.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have paused yesterday. The more risk-on one (HYG:SHY) is still leading higher relatively speaking, but until I see its move supported by LQD:IEI more so than is the case currently, I am not calling for dramatic credit market ratios' moves higher.

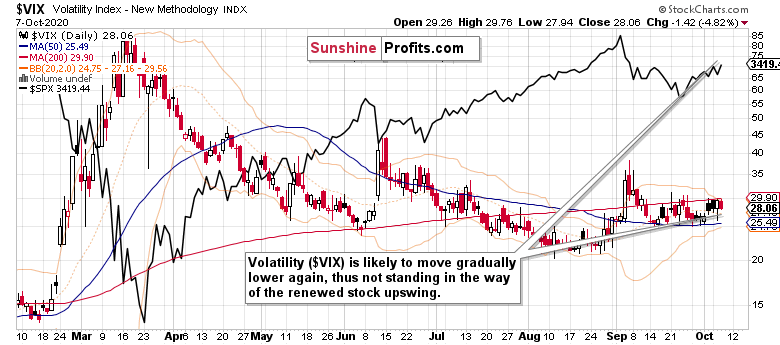

SPX Volatility and Force Index

Volatility got a little elevated at the beginning of October, but appears to have made a local peak, which would facilitate the stock upswing to reassert itself somewhat more next.

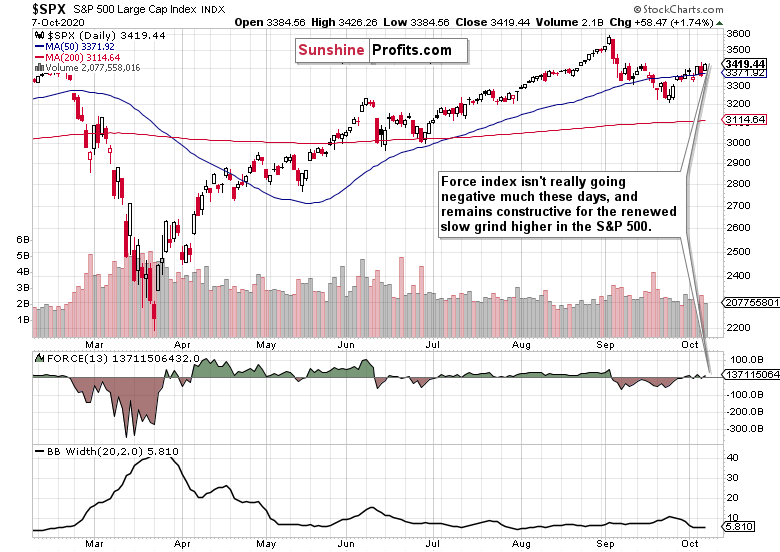

Time flies – it's been mainly in March and April when I was featuring the S&P 500 Force index often. The September dive is clearly visible in this powerful indicator (it combines prices and volume), and the subsequent recovery brought it slightly above zero. That's where it's meandering right now, and the current trajectory sets stocks up as likely to extend gains modestly in October.

Currencies and Risk-on Sentiment

However hopelessly indebted the Japanese economy, the yen is a safe-haven currency and a key funding one for carry trades - these are "brainless safe bets" where the investor borrows at low or negative rates (hello Japan), and parks the funds in e.g. U.S. Treasuries or whatever higher-yielding debt instrument of their choosing (since the Fed quelled the corona panic in spring, the juicy yield differential between these government bonds isn't really there anymore).

Such trades work until they don't – and once they don't, we see their rapid liquidation and money flowing back to the funding currency, the Japanese yen. So, has the yen been really spiking recently?

Bottoming days before the stock market did, USD/JPY is on the mend, which means that the risk-on spirit is returning, solidly returning.

Another currency barometer I like to use for stocks (for oil, I use USD/CAD due to the importance of Canadian tar sands), is EUR/CHF. Euro is a high beta currency, which means that it rises when the global economy starts doing better – just look at EUR/USD and how it left the sub-1.10 levels in the dust in early June. Swiss franc is one of the currencies that tend to benefit from flight to safety.

Over many recent weeks, EUR/CHF has been trading in a rather stable band, giving no sign of either a systemic stress (credit default swaps do a great job highlighting such tensions too), or a headlong rush into the riskiest of trades. In other words, the measured pace of S&P 500 appreciation can go on.

Summary

Summing up, I look for stocks to extend gains from yesterday's sharp upswing that might have caught off guard those not reading my analyses. A day ago, I have laid down a strong case why the debt markets support further S&P 500 gains, and today, I discussed several currency pairs, which also favor such conclusion overwhelmingly. This comes on top of the broad repertoire of my tools ranging from market breadth, sectoral analysis, other stock indices, narratives, headlines and macroeconomic data analysis.

In short, the economic recovery goes on, and so does the stock bull run – and that means more profits ahead.

Trading position (short-term; S&P 500 futures; our opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.