-

S&P 500 Is Hungry for Stimulus - And Will Get It

July 24, 2020, 9:08 AMYesterday I gave you all the reasons why a pullback in the S&P 500 was likely, and today I'll talk about the reasons why remaining bullish is still the most sensible thing to do if you love your trading account.

In short, little has changed in terms of the outlook. The S&P 500 closed back at the line connecting the early June highs - but quite a few bullish signs emerged yesterday, solidly tipping the odds of upcoming upswing in the bulls' favor.

S&P 500 in the Short-Run

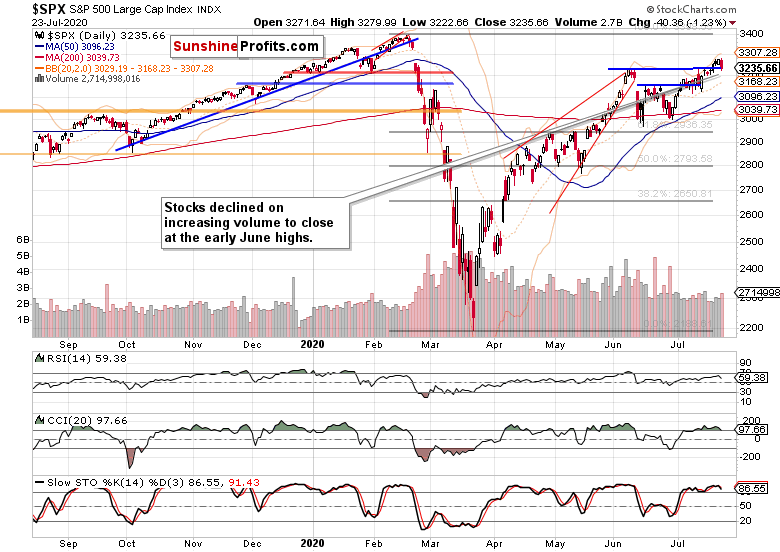

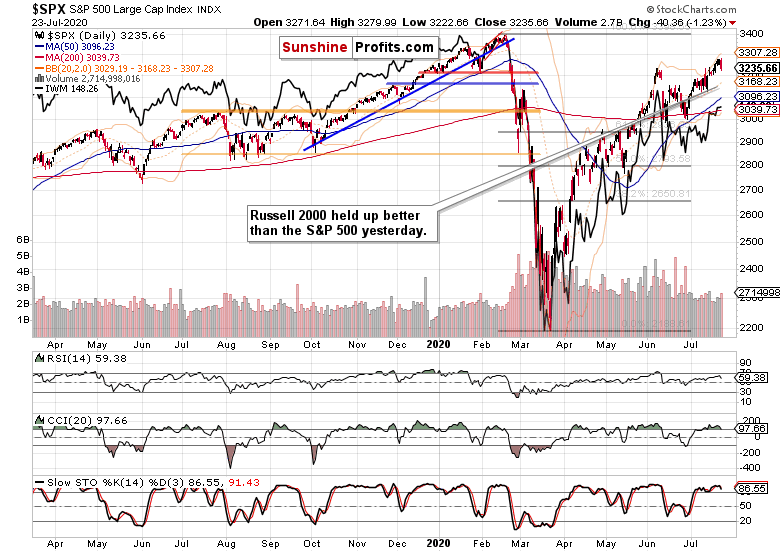

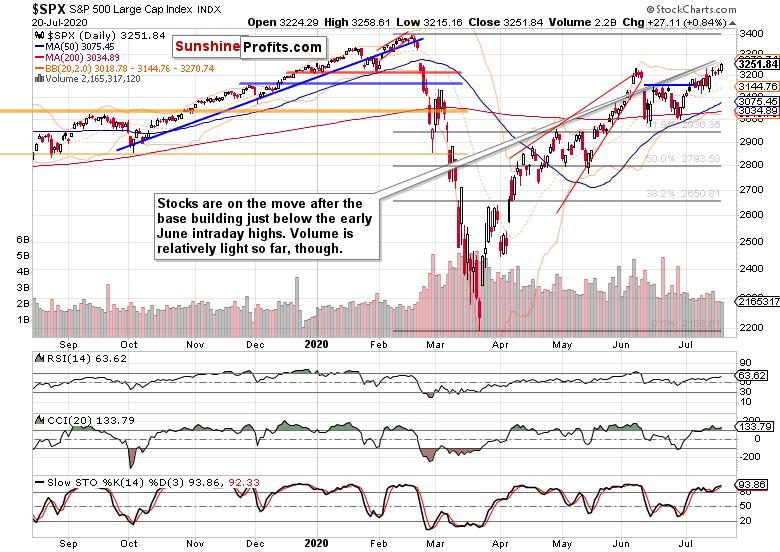

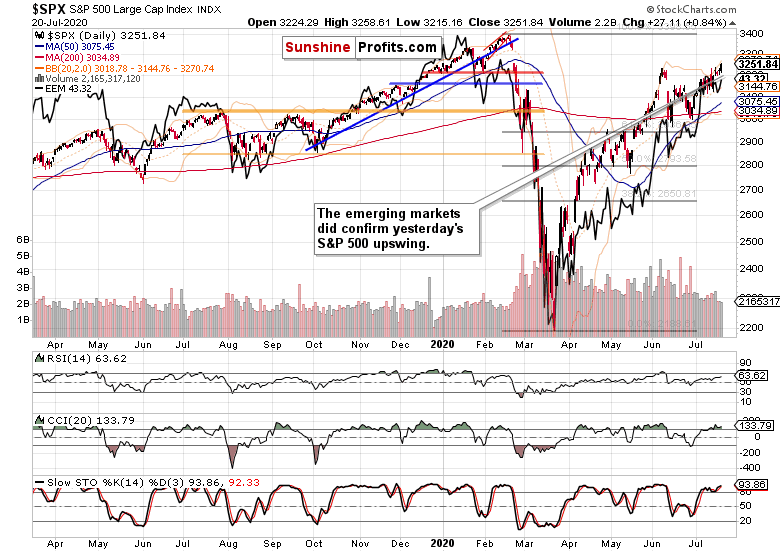

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The daily setback is clearly visible, but was it a game changer? I don't think so - even with new unemployment claims coming in above expectations, and existing ones unsurprisingly stubbornly high, the focus isn't on the harsh economic realities of many real economy sectors, but on the upcoming measures to counter them.

It's all eyes on the stimulus - and that's why the elevated volume is rather a sign of momentary setback and not a full-blown reversal. The late-Feb bearish gap is being put to test, and I expect the bulls to overcome it eventually. Earlier in July, we have also experienced an odd bearish day that brought out the bears from their caves, without really changing the situation on the ground materially.

I expect the same dynamics to play out this time as well, regardless of the headlines touting more stimulus details only next week, or Trump discussing the China phase one trade deal value.

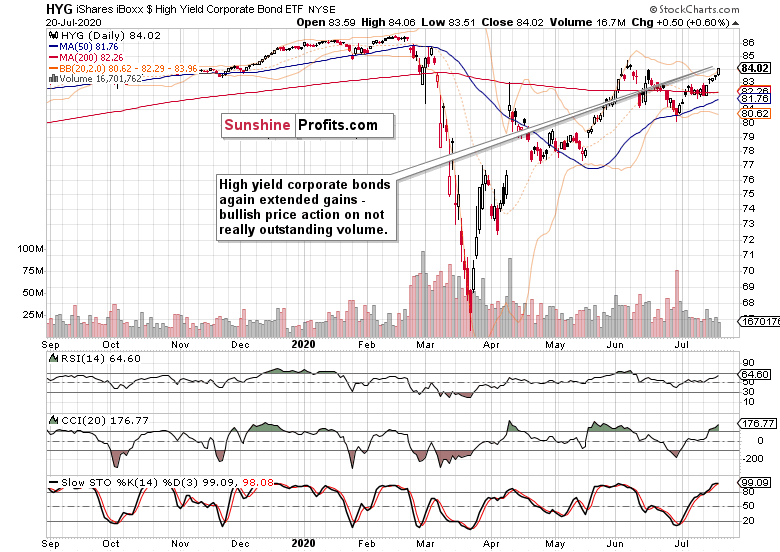

Let's check the credit market clues next, because that's where one of the bullish signs just emerged.

The Credit Markets' Point of View

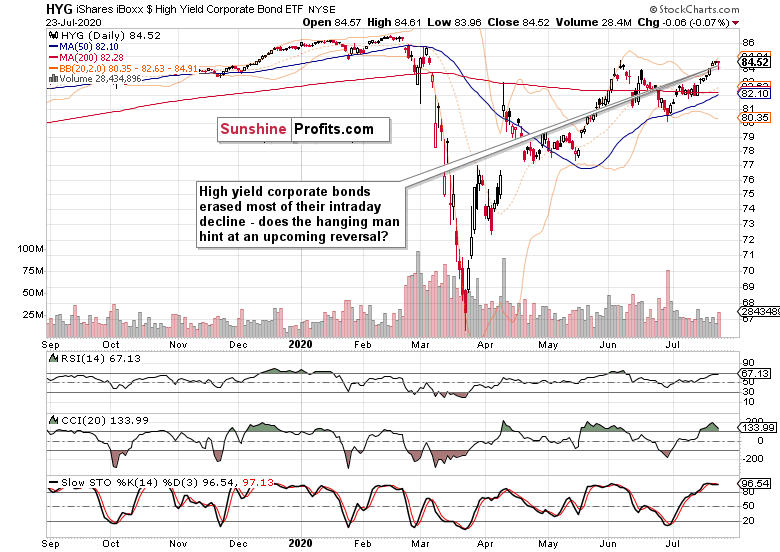

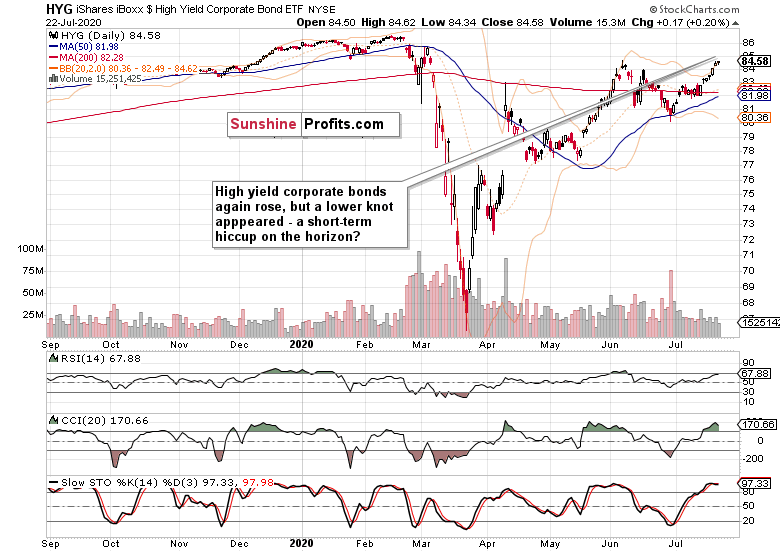

High yield corporate bonds (HYG ETF) ran into headwinds yesterday, and just couldn't extend last days' gains. The bears pushed hard for a reversal, but were repelled well before the closing bell. The result is a hanging man candlestick - while bearish on its own, it's unlikely that it marks more than a fleeting reversal of fortunes.

Remember that the Fed is stepping up to the plate again - Treasuries of whatever duration are salivating at the prospect of more money being thrown at the issues. As we're at the "everyone benefits, no one pays" stage of inflation, there ain't no breaking the stock bull's neck yet.

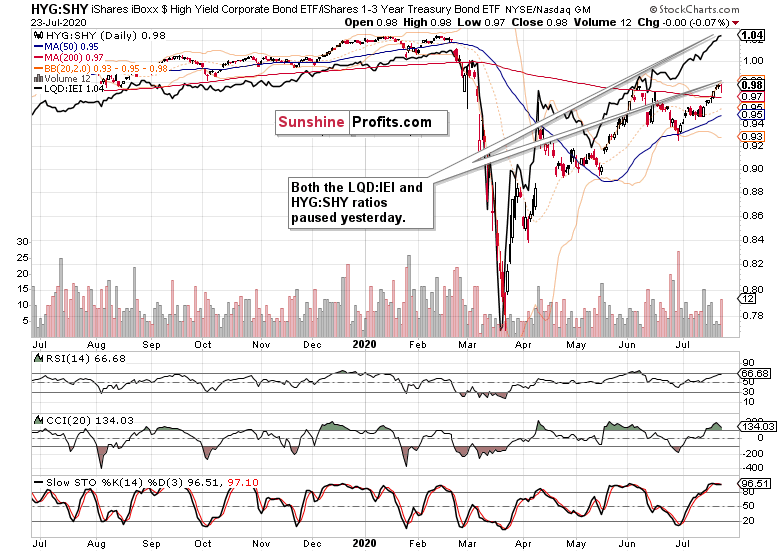

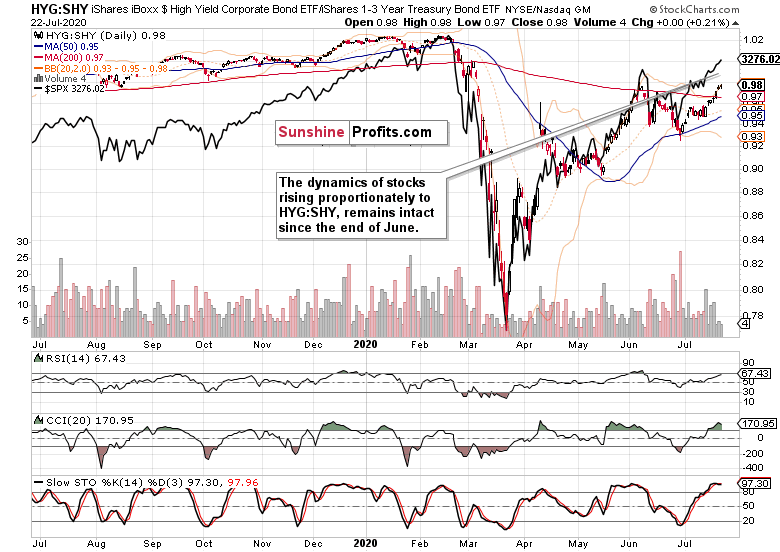

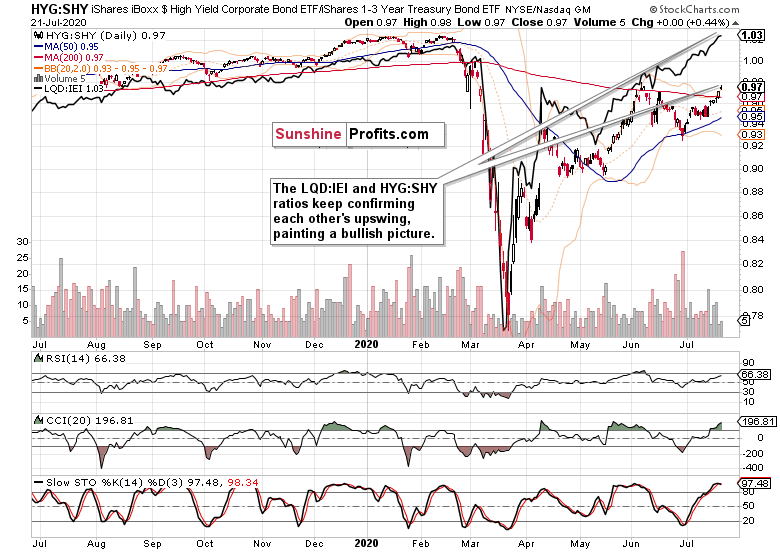

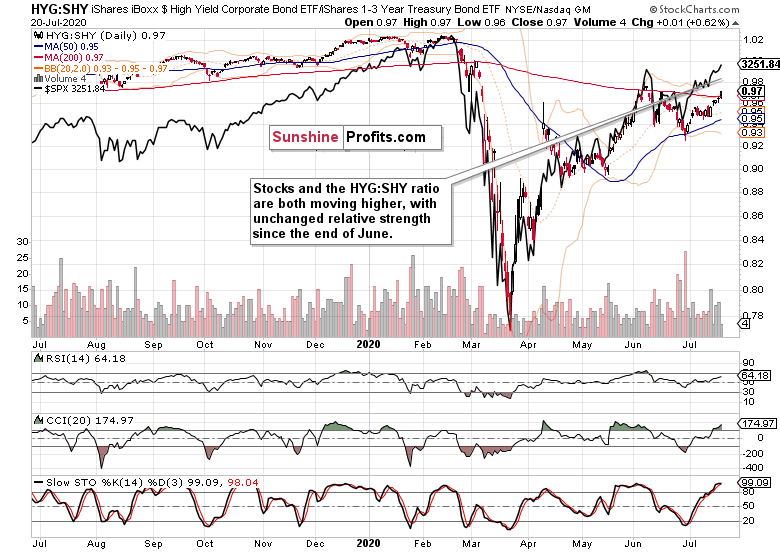

Both the leading credit market ratios - high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) - highlight a daily pause, relatively speaking.

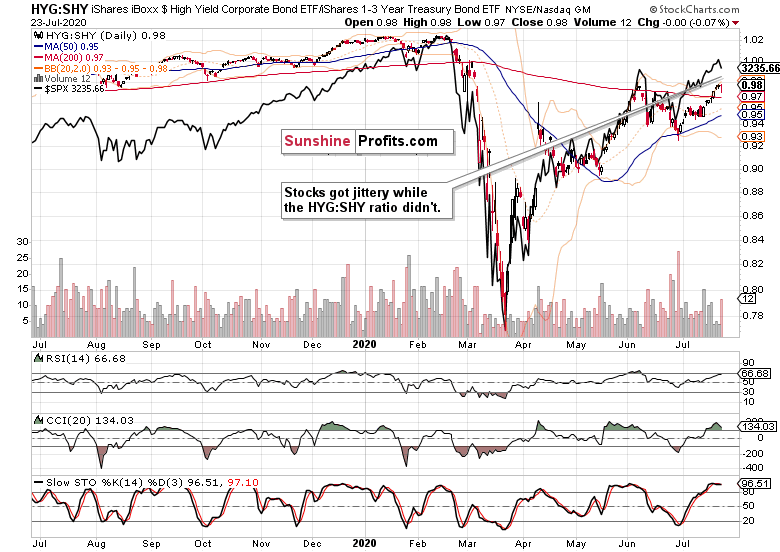

The overlaid S&P 500 closing prices (black line) against the HYG:SHY chart shows just how far have stocks retreated yesterday. That's a telling perspective putting into context my yesterday's conclusion of better to be waiting for short-term mispricing opportunities. One is still staring us in the face currently.

Smallcaps, Emerging Markets and the S&P 500 Internals

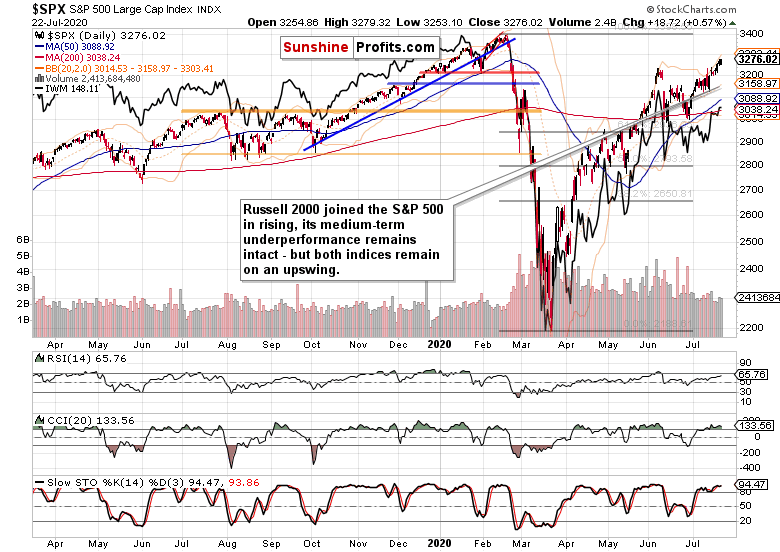

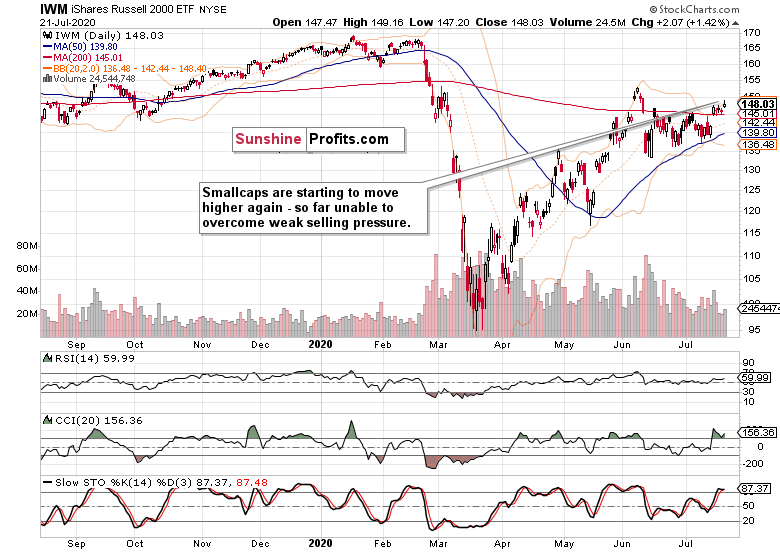

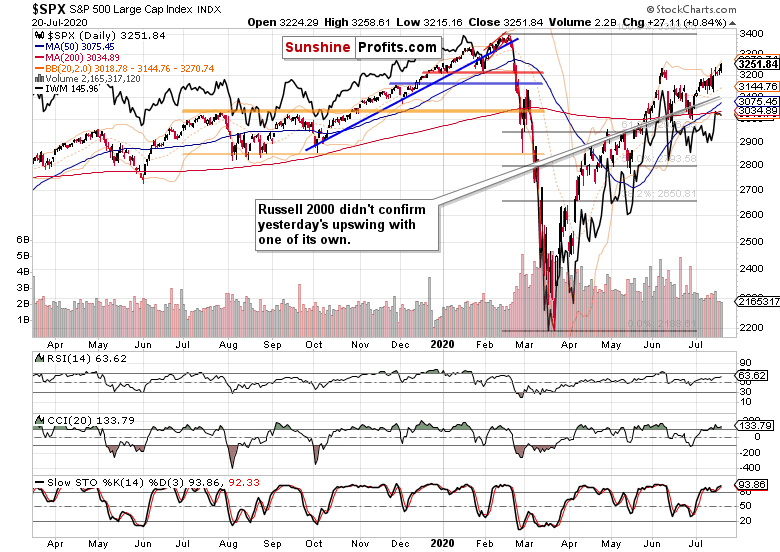

The Russell 2000 (IWM ETF) brings out the second bullish sign - the smallcaps held up much better than the 500-strong index. In place of their rather usual underperformance, that's a bullish sign. Also the IWM ETF volume yesterday points to a run-of-the-mill session, and not an emotionally charged battle.

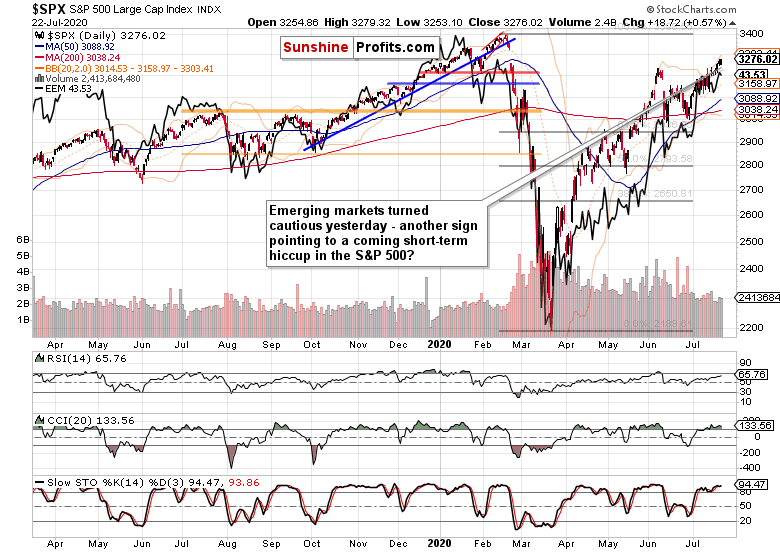

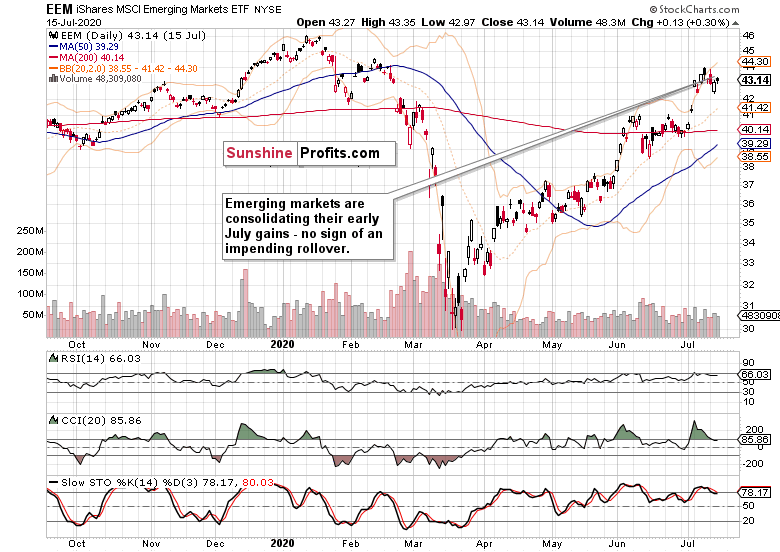

That leaves only the emerging markets (EEM ETF) declining in unison with the S&P 500 yesterday. Should the U.S. - China tensions get ratcheted up a notch or two, that would work to lift the U.S. dollar and send the stock bulls temporarily packing. Remember though that a fallout in relations isn't in the interests of either party - and the weak reaction in both the greenback and stocks reveals the market treating it as a flash in the pan.

Even the daily market breadth didn't dip profoundly into the bearish territory as the advance-decline line shows chiefly. The bullish percent index is still solidly bullish, and that means dips better be bought.

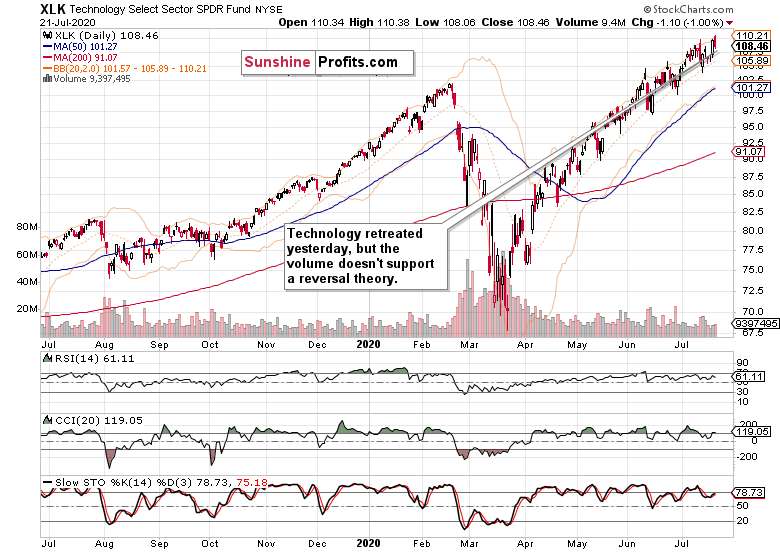

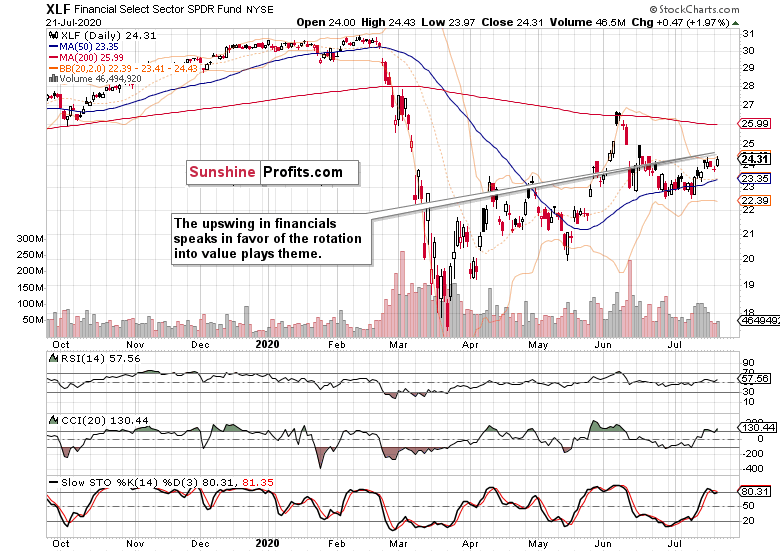

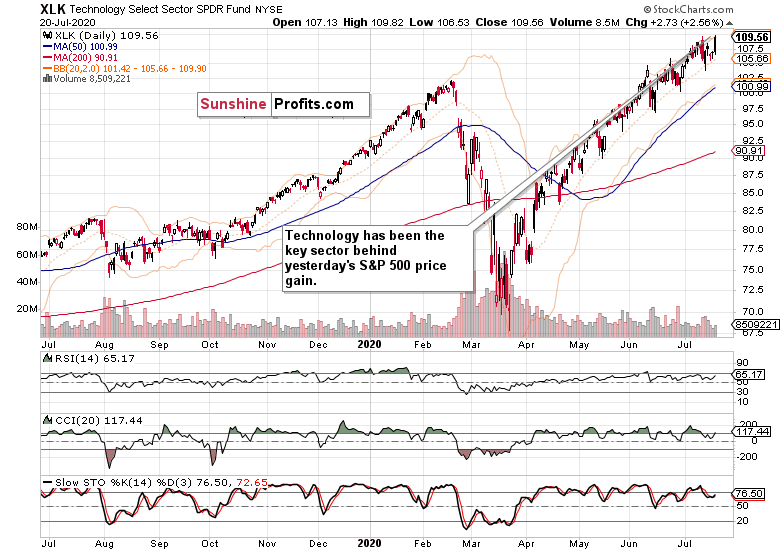

The fact that market breadth didn't take a hit yesterday, shows that the plunge was driven by tech (XLK ETF) with the other sectors more or less refusing to participate broadly. Even semiconductors (XSD ETF) didn't decline as profoundly as technology did. All of these are in your face signs that the stock bull has much farther to run, and all we're seeing, is a healthy consolidation coupled with sectoral rotation.

Summary

Summing up, yesterday's S&P 500 setback hasn't materially changed the optimistic stock outlook, and the bullish signals arising out of Thursday's session support this conclusion. With credit markets not yielding and technology consolidating its meteoric gains, it's time for the beaten-down areas to start catching up, and lift the index. Unless the unexpected happens and stimulus doesn't appear on time to support the real economy and the markets (it will appear), the stock bull run is immune to the temporary shocks of U.S. - China retaliations caliber. With lockdowns thankfully failing to gain much traction not just on the federal level, the risks in stocks remain skewed to the upside.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Upswing Challenge Is Likely, But Won't Derail the Stock Bull Run

July 23, 2020, 9:26 AMThe S&P 500 closed farther from the early June highs than the day before. The bull is telling us it wants to run, now that it's becoming apparent that the bears are out of breath since their mid-July tech ambush.

The month's end is approaching, and so is the window of opportunity to extend the $600 weekly addition to unemployment benefits, and pass the new stimulus into law before the August recess. While continuing unemployment claims under regular state programs are declining, couple that with special pandemic ones, and they're still clinging to their highs.

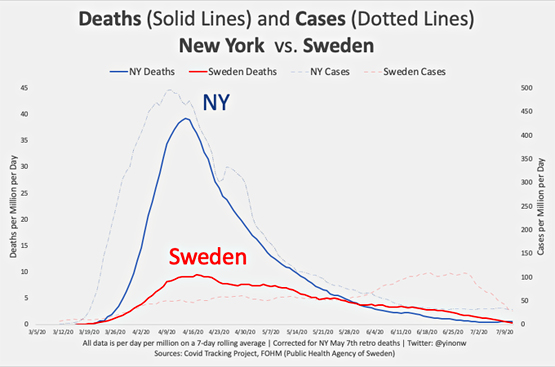

But as strange as it might sound, the stock market isn't about the real economy struggles these weeks. All eyes are on the stimulus and vaccine hopes (whatever one imagines under the latter term), not on the corona case panic and hyped death charts.

Time for another quick reality check.

Have you seen this comparison between New York and no-lockdown Sweden (courtesy of Lew Rockwell and David Stockman)? The markets see through that, and keep their focus on the countermeasures instead. Money printing is in our future, and won't really end until inflation rears its ugly head.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

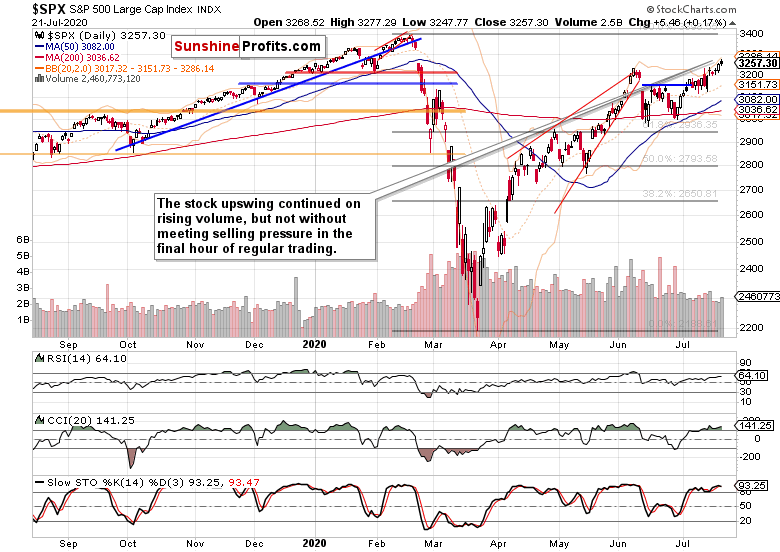

The upper blue line marking the early June highs is getting more distant day-by-day. Volume is picking up, and the price action doesn't exactly show the bulls as relenting. Prices keep cutting into the late-Feb bearish gap without real opposition from the sellers.

Let's check the credit market clues next.

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) again rose yesterday, but not without attempting to decline. The volume though shows the bears weren't really serious about it. Still, the bond ETF paused at its early June highs, and while I wouldn't focus on those highs as a meaningful resistance strong enough to make S&P 500 crash and burn, it can exert a limited and temporary influence.

Better to look for more comprehensive clues such as the leading credit market ratios - and both the high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI), are rising together.

On a daily basis, the HYG:SHY ratio wavered a little, but stocks marched higher as vigorously as in previous days. A short-term noise that needn't have repercussions - the key point is that both are broadly continuing higher.

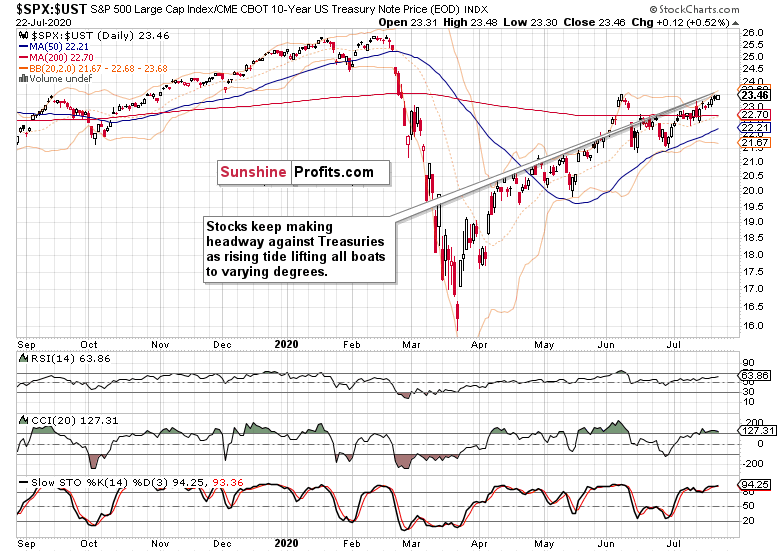

That's the message of the stocks to Treasuries ($SPX:$UST) chart too. The relative valuation of both asset classes continues favoring stocks. Yes, Treasuries remain in a secular bull market and calls for its end earlier this decade have proven premature, but it's stocks (that is companies) that are rising faster here - as they always do when we're in "everyone benefits, no one pays" stage of inflation.

By the way, did you know that inflation used to be about tracking the monetary base increases, and not the symptom of rising real-world prices? Talk of putting the cart before the horse - the latter is a secondary effect of a greater money pool chasing the same amount of goods and services.

Smallcaps, Emerging Markets and the S&P 500 Internals

The Russell 2000 (IWM ETF) took to yesterday's S&P 500 cue. Rising, but the drawn-out underperformance goes on. Little wonder given that smallcaps are more connected to the real economy than the 500-strong index.

While I expect the S&P 500 to challenge and overcome its February highs this year, the Russell 2000 has a tougher ride ahead in doing so. The below emerging markets chart shows these markets having started to outperform already - which the smallcaps clearly haven't.

Overlaid against the S&P 500 chart, emerging markets (EEM ETF) have declined yesterday. While that isn't a sign of a trend change, it still points to short-term caution as the U.S. index is a little exposed here.

The market breadth view confirms that. To see advance-decline line retreating on a stock advance, is never a short-term sign of strength. The rising bullish percent index though points in the direction of dips being better bought as we're firmly in a stock bull market territory.

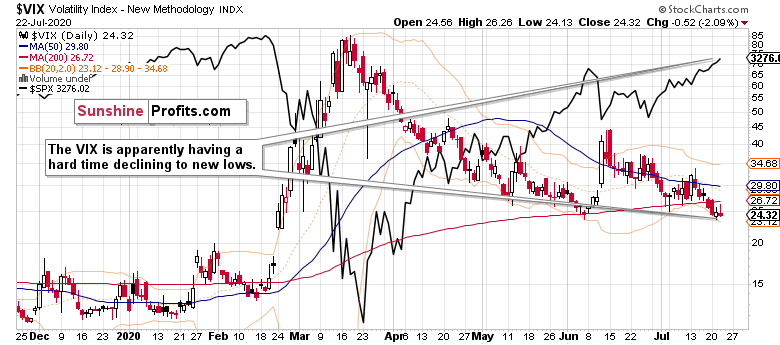

Volatility is also in favor of caution. As it challenges the early June lows, the upper knots are telltale signs of it striving to move higher next. And little wonder as the real world outlook didn't get brighter or calmer over the recent weeks. The coming stimulus will buy us some time, and encouragingly, the Fed is no longer in a week-to-week tightening mode. Obviously though, stocks are banking on more.

Summary

Summing up, the health of the S&P 500 upswing yesterday leaves quite a bit to be desired, and highlights a solid likelihood of upcoming weakness in stocks. Nothing extraordinary in its outlook-changing power though - the stock bull is alive and well, thriving on sensible rotation. What I look for, is a temporary setback that would bring down the rising greed so as to capitalize on short-term mispricing opportunities (or disappearing cautionary signs) within the stock bull run.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

The Slow Grind Higher Above the Early June Stock Highs

July 22, 2020, 9:26 AMThe S&P 500 upswing extended gains, yet retreated before yesterday's closing bell. To a certain degree, the accompanying bullish signals lost their luster too. The air is getting thinner as stock prices cut into the late-Feb bearish gap. Has this been the turning point in the great bull run, or just a modest preview of more fierce battles to be fought?

I'm definitely leaning towards the latter possibility. Far from having thrown cold water on the bull run, it's a gentle test of the bulls' resolve. In today's analysis, I'll lay out quite a few good reasons why, and also discuss the signs pointing towards caution.

S&P 500 in the Short-Run

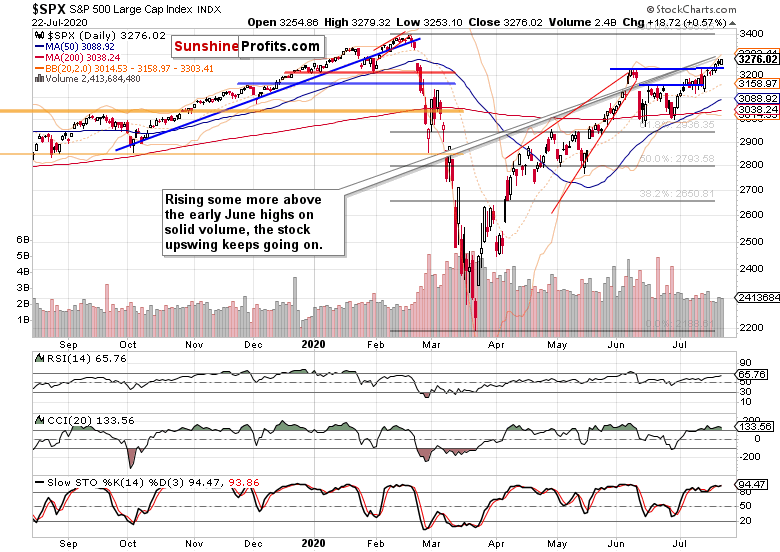

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Stocks have peeked above the early June highs some more yesterday, and the daily volume has risen too. The candle's shape though isn't universally bullish in its interpretation, and that's because of the upper knot.

It means that the bears stepped in, and enjoyed partial success in driving prices lower. Will the selling attempt continue in the short-term? It's possible, but the volume examination doesn't attest to high chances of it to succeed lastingly.

The benefit of the doubt still remains with the bulls - and it's not only because of the credit market action.

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) scored some more gains yesterday, but met with selling pressure before the closing bell too. The modestly rising daily volume shows that no fierce battle has been fought so far.

Both the leading credit market ratios - the high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) support each other's upswing - and that points higher for the S&P 500 as well.

On a daily basis, stocks wavered against the HYG:SHY ratio - wavered as in refused to continue outperforming to the same degree as in recent days. That's a short-term cause for concern merely though.

I consider it to be just a daily fluctuation that lacks further implications for now. The bulls have the initiative to deal with that constructively over time.

Encouragingly, the ratio of high yield corporate bonds to all corporate bonds (PHB:$DJCB) is slowly rebounding - and that points to more risk-on sentiment returning to the market place.

Spotlight on Smallcaps, Emerging Markets and the Dollar

The Russell 2000 (IWM ETF) performance yesterday is in line with the S&P 500 one - and it's as well a sign of selling pressure emerging. Both sides aren't however overly committed to action as the measured rise in volume shows. The bulls still remain in the driver's seat and can overcome yesterday's obstacle if they push just a little harder.

Emerging markets (EEM ETF) continue defending the high ground well. When I look at the below chart of the dollar, this bodes well for stock markets around the world, and also for the currently lagging ones, which are the U.S. ones.

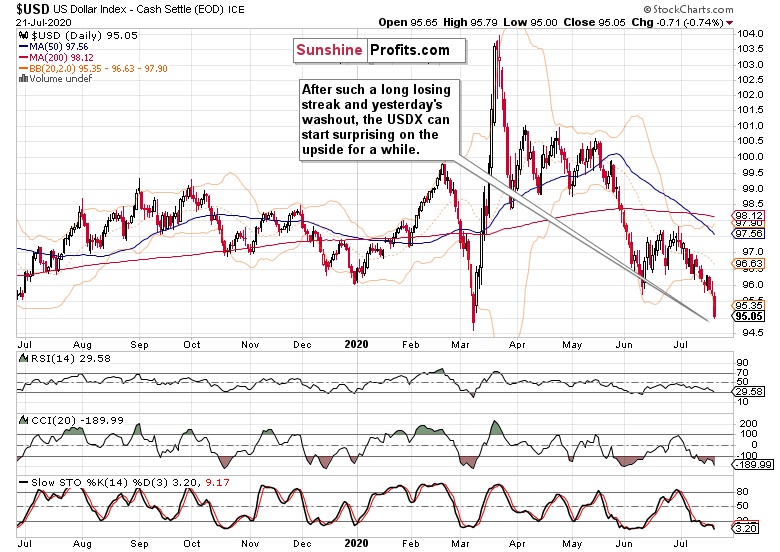

A word of caution regarding the USDX though, as that's arguably the leading sign calling for some caution right now. While I am not calling for one, I wouldn't be too surprised if a short-term consolidation (a reflexive rebound) happened relatively shortly. The quickening pace of recent downswing as the latest long red candle shows, raises such possibility. Remember, no markets move up or down in a straight line.

S&P 500 Sectors in Focus

Technology (XLK ETF) gave up quite some of its Monday's gains, but that's not enough to qualify as a reversal. The volume examination certainly doesn't support that conclusion at the moment.

With healthcare (XLV ETF) retreating from its new 2020 intraday highs yesterday, it was the financials (XLF ETF) that assumed the leadership among the sectoral heavyweights. This would be consisent with the unfolding rotation into undervalued plays after Monday's tech return to shine.

Consumer discretionaries' (XLY ETF) or materials (XLB ETF) didn't see strong moves on a closing basis yesterday, leaving the industrials (XLI ETF) and especially energy (XLE ETF) as the more eye-catching choices. With energy helped by the daily upswing in oil prices on relenting new lockdowns speculation, it leaves us with a tepid but still unfolding rotation into former laggards intact.

And as such rotations mark the health of bull markets, the takeaway is an optimistic one for the current run higher.

Summary

Summing up, the S&P 500 retreat into yesterday's closing bell doesn't appear to be a game changer, making the case for a daily consolidation likely. Not even the U.S. - China tremors have a disproportionate impact on the 500-strong index these days, playing second fiddle to stimulus and vaccine expectations. The summer doldrums' initiative remains with the bulls as the improving daily market breadth shows. Despite the uptick in put/call ratio, greed is making a steady but slow return into the market place, which calls for cautious approach to risk management. I would say that seeking short-term mispricing in order to capitalize on such temporary imbalances is the preferred course of action. In doing so, let's keep in mind that the trend remains up - the slow grind higher rules these days.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

The Prospects of S&P 500 Above the Early June Highs

July 21, 2020, 9:07 AMThe announced S&P 500 upswing is underway, and the early June highs have been overcome on a closing basis. Will the regular trading's final hour sprint carry over into today's session? Are the bulls as strong as the one-sided result of Monday's trading suggests?

That's not a foregone conclusion, because we've seen quite a shift from Friday's sectoral dynamics. In today's analysis, I'll dive into the internals and lay out the case why the bulls still enjoy the benefit of the doubt, regardless of the persisting bearish sentiment and double top talk.

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The extended launching pad above the mid-June tops propelled stocks above the early June highs. The volume of the move has been relatively muted, though. On a standalone basis, that's not an issue, as rising volume can confirm higher prices in the coming days. The white body without a striking upper knot shows that the bulls are in the driver's seat - that's no sign of a reversal.

Are the credit markets in tune with the daily chart's perspective?

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) indeed scored strong gains yesterday, but on really low volume. One day isn't a cause for a full-blown concern, but I would prefer to see it improving over the coming sessions so as to confirm the HYG price direction more convincingly.

The investment grade corporate bonds (LQD ETF) support the HYG upswing to continue - just as the HYG swing structure does.

The high yield corporate bonds to short-term Treasuries (HYG:SHY) ratio is in tune with the overlaid S&P 500 closing prices (black line), and both are moving higher. Stocks are already above the early June highs, while HYG:SHY has a bit more to go still. The current setup is not a screaming divergence, though - the bulls have the initiative to solve that constructively.

Spotlight on Market Breadth, Smallcaps and Emerging Markets

Both the advance-decline line and advance-decline volume have seen better days, and their readings reflect a short-term non-confirmation. Narrowing leadership is not a good omen for the bulls.

The Russell 2000 (IWM ETF) didn't rise yesterday - the smallcaps have paused when they instead could have risen in line with Friday's spirit of rotation into value plays. This is as well concerning on a short-term basis.

Emerging markets (EEM ETF) did confirm yesterday's S&P 500 upswing, which adds weight to the bullish side of the story. It's never a good idea to act solely based on some short-term non-confirmations - instead, it pays to form as comprehensive picture as it gets, and then act on it.

The USD adds more color to the emerging markets story. There is no mad rush into dollars underway, which highlights no deflationary squeeze in the moment.

S&P 500 Sectors in Focus

Technology (XLK ETF) was the driver of yesterday's upswing, and its heavyweight stocks significantly gained ground. Incresing volume also lends credibility to the daily upswing.

Crucially, the semiconductors (XSD ETF) outperformed again, foretelling further tech gains as very likely indeed.

The value plays, the former laggards, disappointed yesterday, but let's discuss the sectors one by one.

Healthcare (XLV ETF) treading water, materials (XLB ETF) declining on inconclusive volume, and consumer discretionaries (XLY ETF) closing at new 2020 highs. The defensive plays (utilities and consumer staples - XLU ETF, XLP ETF respectively) took it on the chin yesterday, but their daily volumes aren't convincing enough to call the moves as reversals - daily consolidations are more probable scenarios.

Summary

Summing up, the S&P 500 made the anticipated move higher, and the bulls can deal with the very short-term non-confirmations accompanying the upswing in the coming sessions. The path of least resistance in stocks still appears to be cautiously higher as the bears aren't putting any real pressure on the bulls to prove what they're made of.

Thank you for reading today's free analysis. If you would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

Free Gold &

Stock Market Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM