Briefly: outlook for the stock market is bullish-to-sideways in the short-term (i.e. bullish is more likely than sideways), and then sideways-to-bullish for the following weeks and especially months (i.e. sideways is more likely than bullish).

Welcome to this week's Stock Investment Update.

Refusing to decline or rise intraday, stocks are getting ready for a sizable move - and I think it would be to the upside. But it might not happen without moving lower first, as the flattening $VIX shows. The advance decline line doesn't really bring much short-term clarity to the picture either, but the bullish percent index is solidly in a bull market territory.

And in times as trying the patience as these, that's what hints at what the prudent course of action is. Stepping back, and checking the big picture. Are the bullish premises still valid? Any cracks in the dam emerging?

I still see that the bulls deserve the benefit of the doubt, and the reasons why follow.

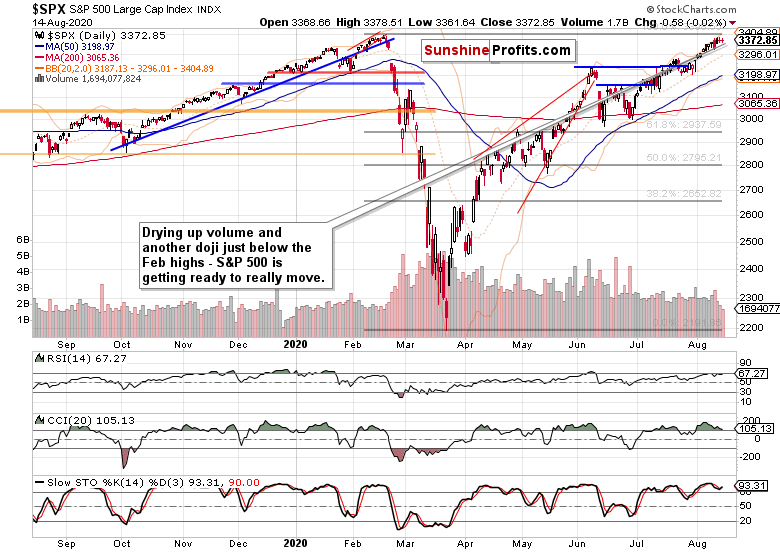

S&P 500 in the Medium- and Short-Run

I'll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

Such were my comments on the weekly chart 7 days ago:

(...) Bullish price action for many recent weeks on volume that isn't yet inviting increasing participation of the sellers. This fact alone bodes well for higher stock prices in the medium-term, but the buyers will meet a set of two key resistances shortly.

It's the Feb all-time highs that are drawing nearer day by day, and the upper border of the rising black trend channel.

The measured move higher continued, and volume decreased again, which doesn't point to the bears' willingness to step in just yet. Given the background of no stimulus deal thus far, and the election uncertainties going beyond taxation, that's actually encouraging.

The daily chart shows the S&P 500 hesitation in short run perfectly. Volume is progressively declining, and a bigger price move is needed to entice market participants to act. And odds are, that it would be in line with the predominant direction, which means higher.

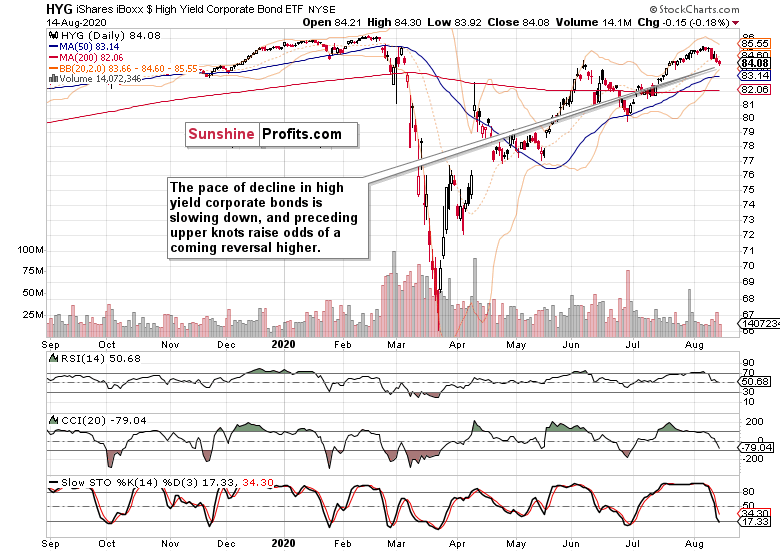

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) can't find a strong bid lately, but the selling pressure appears abating. And so is the pace of daily declines losing steam to a degree.

Does the recent string of lower prices usher in a downtrend? Doesn't seem so just yet. Thus, I view it as a correction within an uptrend. As a consolidation while waiting for the coming Fed move as it comes to weekly balance sheet increases, and more positive economic news.

But the markets are about so much more than the Fed - the central bank is just one player, though with the deepest pockets. This is where other debt instruments come into play, and I mean the high quality ones, especially Treasuries.

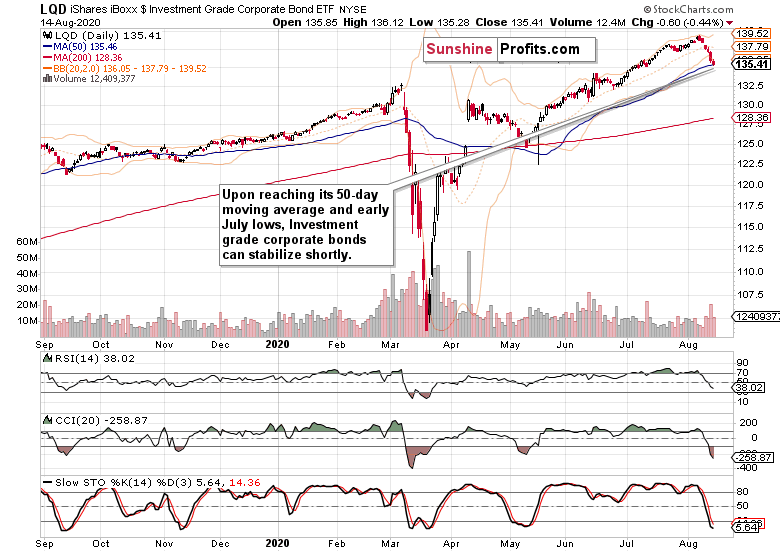

First though, let's take a look at investment grade corporate bonds (LQD ETF) just below.

The investment grade bonds' dynamic is quite similar to their high-yield counterparts - both are declining, yet could see stabilization shortly. And as the 50-day moving average and early July lows have been reached in LQD ETF, the high-quality bonds might lead the way higher.

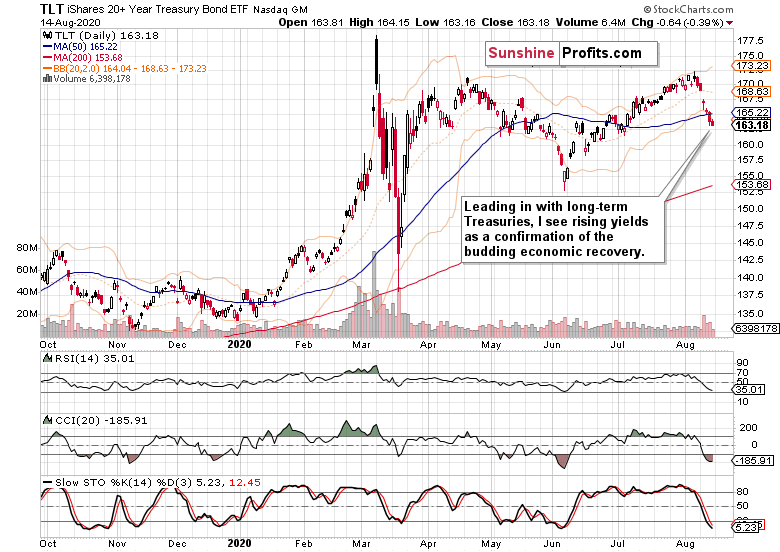

Very long-term Treasuries mirror the deceleration of the plunge. But it's especially within these instruments that I see a confirmation of the real economy recovery story, and the justification of why rising yields will translate into higher stock prices.

Take a good look at early June - Treasuries were plunging in the runup to the surprise non-farm payrolls gain that corresponded with the upside breakout above the rising wedge on the S&P 500 daily chart. This raises the likelihood we'll see an upswing in stocks this time around too.

Smallcaps, Emerging Markets and Other Clues

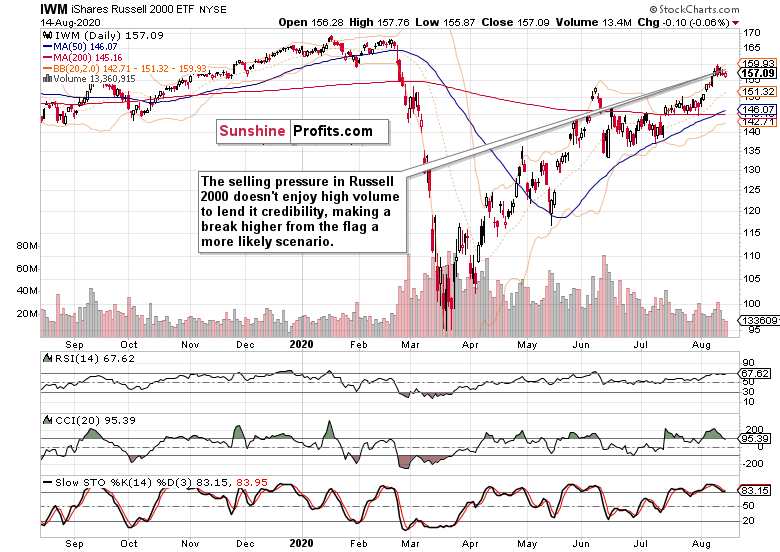

Over the very recent sessions, the Russell 2000 (IWM ETF) was acting weak, but let's not forget that it broke above it early June highs earlier. This makes the currently retreating prices a correction within an uptrend as the smallcaps aren't losing sight of the 500-strong index.

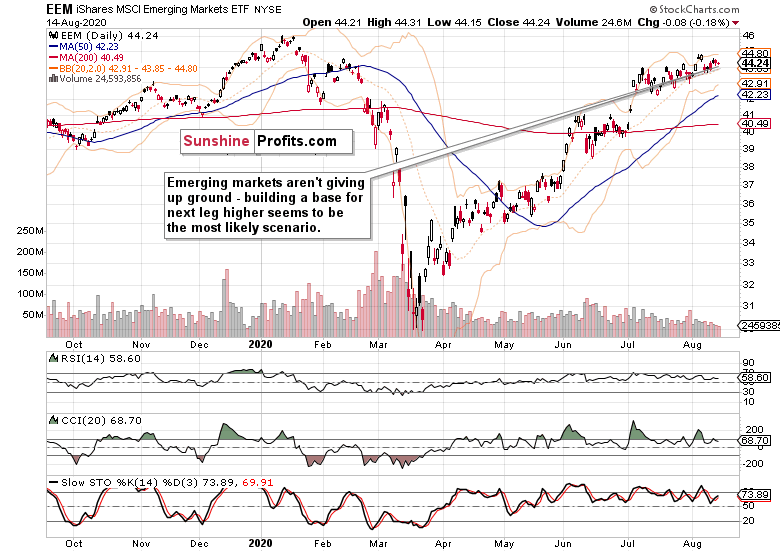

Neither the emerging markets (EEM ETF) are signaling danger - after outperforming since the start of July, they're taking a breather currently. The base they're building, will give way to another upswing (that's the more probable scenario).

Copper keeps consolidating preceding months' sharp gains, and appears less and less likely to decline as time passes by. Should it take on the $3 level successfully, that would be another vote of confidence in the nascent economic recovery.

Let's recall my Friday's observations on the metal with PhD. in economics:

(...) yesterday's lower knot indicates that the bulls have stepped back to a degree. That increases the probability that once trading leaves this flag, they will do so with a break higher.

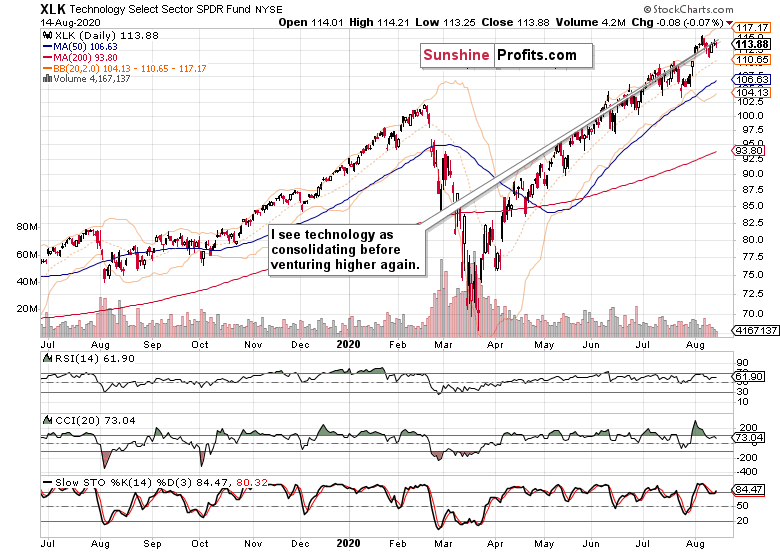

Technology (XLK ETF) keeps consolidating with a bullish bias, and remains the leading S&P 500 sector. Healthcare (XLV ETF) is pausing, while financials (XLF ETF) are showing promising signs of life.

Summary

Summing up, S&P 500 has been going nowhere lately, and the market sentiment can be characterized as one of greed. Encouragingly for the bulls though, the bears are coming back to life as the slowly rising put/call ratio shows - that means the bullish side of the boat got less crowded. The economic recovery story is gaining traction, and stocks are likely to be helped in their upswing once long-dated Treasuries level off, which could help corporate bonds catch a strong bid again.

While the air near the Feb all-time highs is quite thin, the bulls aren't looking to be at the end of their rope.

Very short-term outlook for the stock market (our opinion on the next 2-3 weeks):

Bullish-to-sideways.

Short-term outlook for the stock market (our opinion on the next 2 months): Bullish-to-sideways.

Medium-term outlook for the stock market (our opinion on the period between 2 and 6 months from now): Sideways-to-bullish.

Long-term outlook for the stock market (our opinion on the period between 6 and 24 months from now): Bullish.

Very long-term outlook for the stock market (our opinion on the period starting 2 years from now): Bullish.

As a reminder, Stock Investment Updates are posted approximately once per week. I'm usually posting them on Monday, but I can't promise that it will be the case each week.

Please note that this service does not include daily or intraday follow-ups. If you'd like to receive them, I encourage you to subscribe to my Stock Trading Alerts today.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.