Briefly: outlook for the stock market is bullish-to-sideways in the short-term (i.e. bullish is more likely than sideways), and then sideways-to-bullish for the following weeks and especially months (i.e. sideways is more likely than bullish).

Welcome to this week's Stock Investment Update.

The bears pushed hard also on Friday, but couldn't close near the daily lows. Has the bid returned, and the correction is over now? Given Friday's lower knot and Monday's upswing, it might seem so. How does today's premarket downswing fir in the picture then?

But the key thing is that the bull is alive and well. As long as money will keep being redeployed into other stocks from those that take it on the chin during any correction (such as tech stocks during this one), the bull is far from a top.

That's the power of rotation, as money moves from red hot tech into value plays (with financials perhaps also springing to life at one point - when if not now as yields are rising).

Let's move to the charts.

S&P 500 in the Medium- and Short-Run

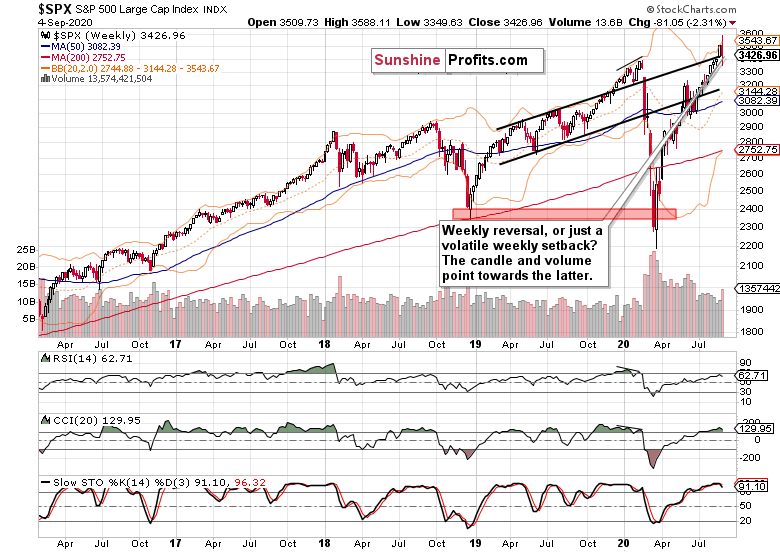

I'll start today's flagship Stock Trading Alert with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

After breaking above the upper border of the rising black trend channel still in August, stock prices retraced that move all the way back. On increasing volume, the bears even pierced this level, but were rebuffed.

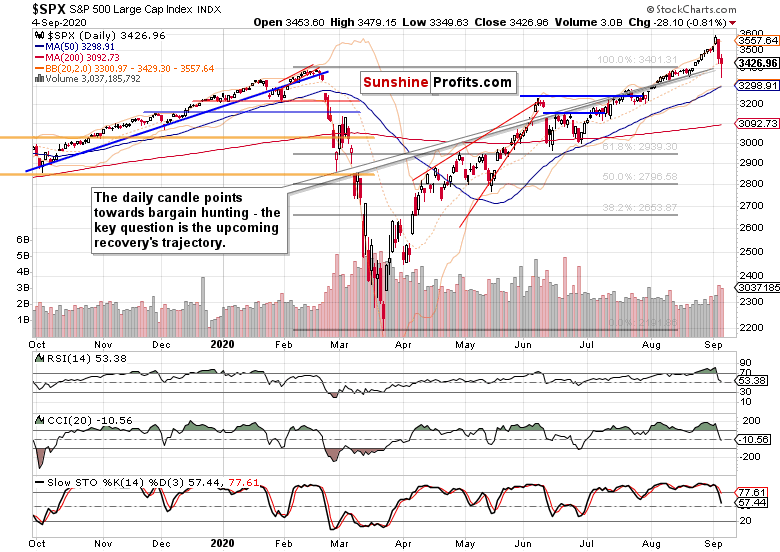

The daily chart appears constructive for the buyers in the short run. On rising volume, much of the downswing was erased, paving the way for the bulls to try their luck next. But I still see the bears as likely to return over the next few session, offering the bulls a better entry point than was the case at the very end of Monday (3440).

Such were my Friday's thoughts on the upswing attempt:

(...) the bulls will have to prove that it wouldn't turn out as a dead cat bounce.

The Credit Markets' Point of View

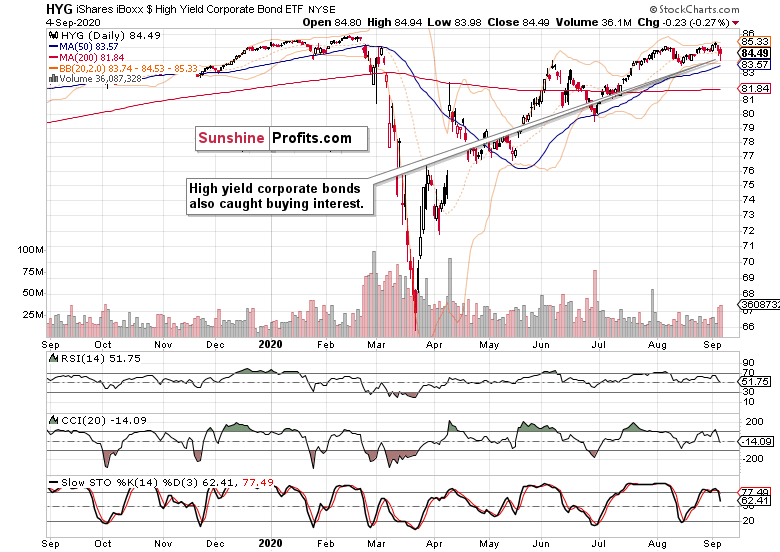

Stocks were not alone in seeing buyers step in - high yield corporate bonds (HYG ETF) did so too. But its lower knot could have been arguably longer, given the S&P 500 performance. Notably, investment grade corporate bonds (LQD ETF) didn't recover during Friday's session at all.

These factors point to a relative indecision in the credit markets as these are unwilling to jump the gun.

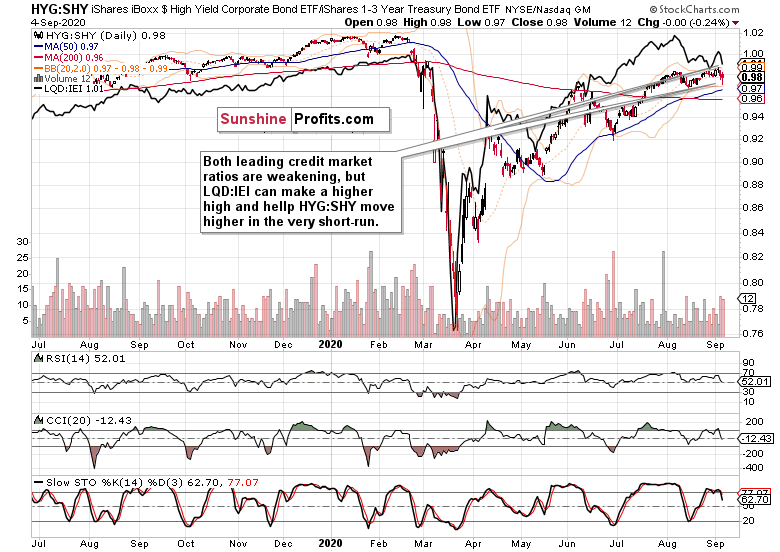

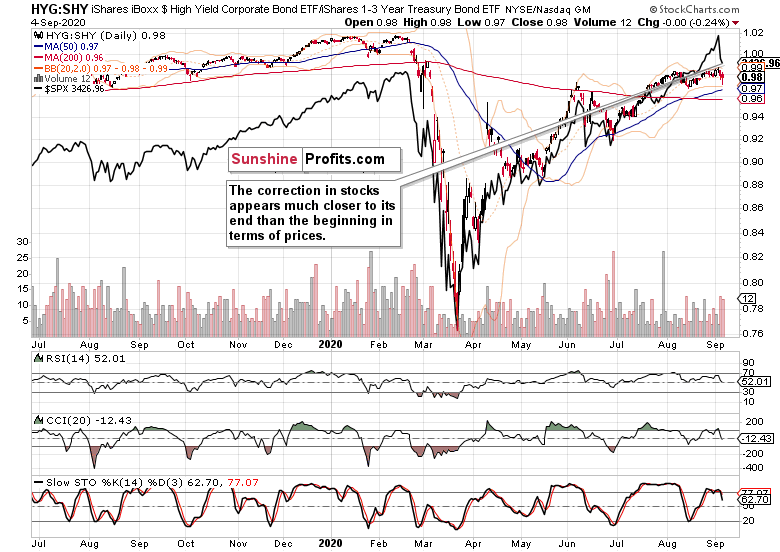

Both leading credit market ratios - the investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) and high yield corporate bonds to short-term Treasuries (HYG:SHY), keep pointing down, but most of their weakness appears to be over for now.

Of course, with the anticipated arrival of the October correction, that will change, but chop with a slightly bullish bias looks as the most probable scenario for September.

Relative to the high yield corporate bonds to short-term Treasuries (HYG:SHY) ratio's daily performance, stocks have reached short-term comparative valuations making them rather attractive vis-a-vis the key credit market ratio.

Smallcaps, Tech and the Metals

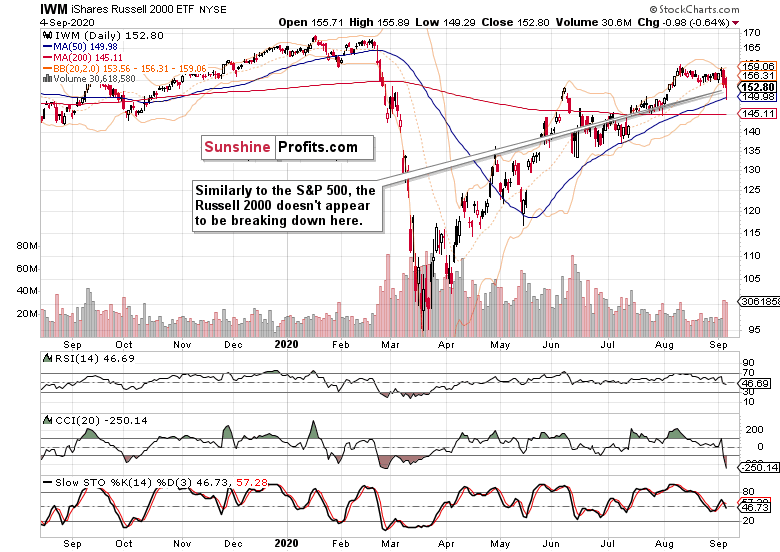

Smallcaps (IWM ETF) mirrored the S&P 500 resiliency, and likewise erased much of the downswing. No sign of distribution here - and while underperforming, the Russell 2000 doesn't disprove the stock bull run.

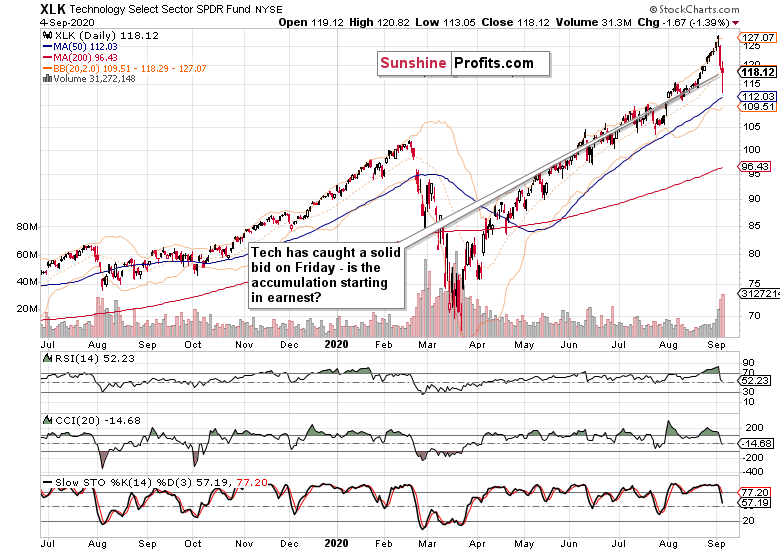

Technology (XLK ETF) strongly rebounded off the deep intraday lows, and the volume shows the extent of the bulls' commitment. The sectoral correction has been healthy, and I expect tech to go on a slow recovery over the coming days and weeks.

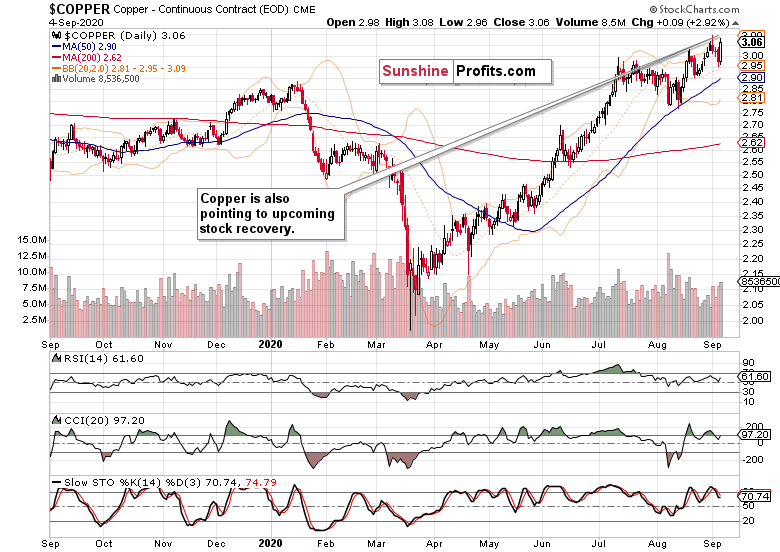

Copper continues its own grind higher, and its chart is bullish. That points to the economy being in a recovery, however slow and uneven that is.

Finally, gold remains in its bullish consolidation, and it's my opinion that it would attempt to extend the early summer gains once the floor in the U.S. dollar probes lower values again. This might take time though, as I look for USDX to spike higher first - quite a few bullish divergences have formed there, and will likely play out over the coming weeks.

Given the weakening oil ($WTIC), that would be little surprising, and actually fitting the October correction hypothesis. No markets go up or down in a straight line, and neither the dollar nor the yellow metal, are an exception.

Summary

Very short-term outlook for the stock market (our opinion on the next 2-3 weeks):

Bullish-to-sideways.

Short-term outlook for the stock market (our opinion on the next 2 months): Sideways-to-bearish.

Medium-term outlook for the stock market (our opinion on the period between 2 and 6 months from now): Sideways-to-bullish.

Long-term outlook for the stock market (our opinion on the period between 6 and 24 months from now): Bullish.

Very long-term outlook for the stock market (our opinion on the period starting 2 years from now): Bullish.

As a reminder, Stock Investment Updates are posted approximately once per week. I'm usually posting them on Monday, but I can't promise that it will be the case each week.

Please note that this service does not include daily or intraday follow-ups. If you'd like to receive them, I encourage you to subscribe to my Stock Trading Alerts today.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.