Briefly: In our opinion no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective.

The reasons for which we think the medium-term move is down were covered in Monday’s alert, and if you haven’t had the chance to read it, we encourage you to do so today. Gold rallied yesterday, and it was something that you were prepared for – we emphasized that this rally is likely to take place, but that it’s not likely to be really meaningful. We took profits on the short positions and are planning to re-enter these positions at more favorable – higher – prices. Are we at this point yet? Let’s take a closer look (charts courtesy of http://stockcharts.com.)

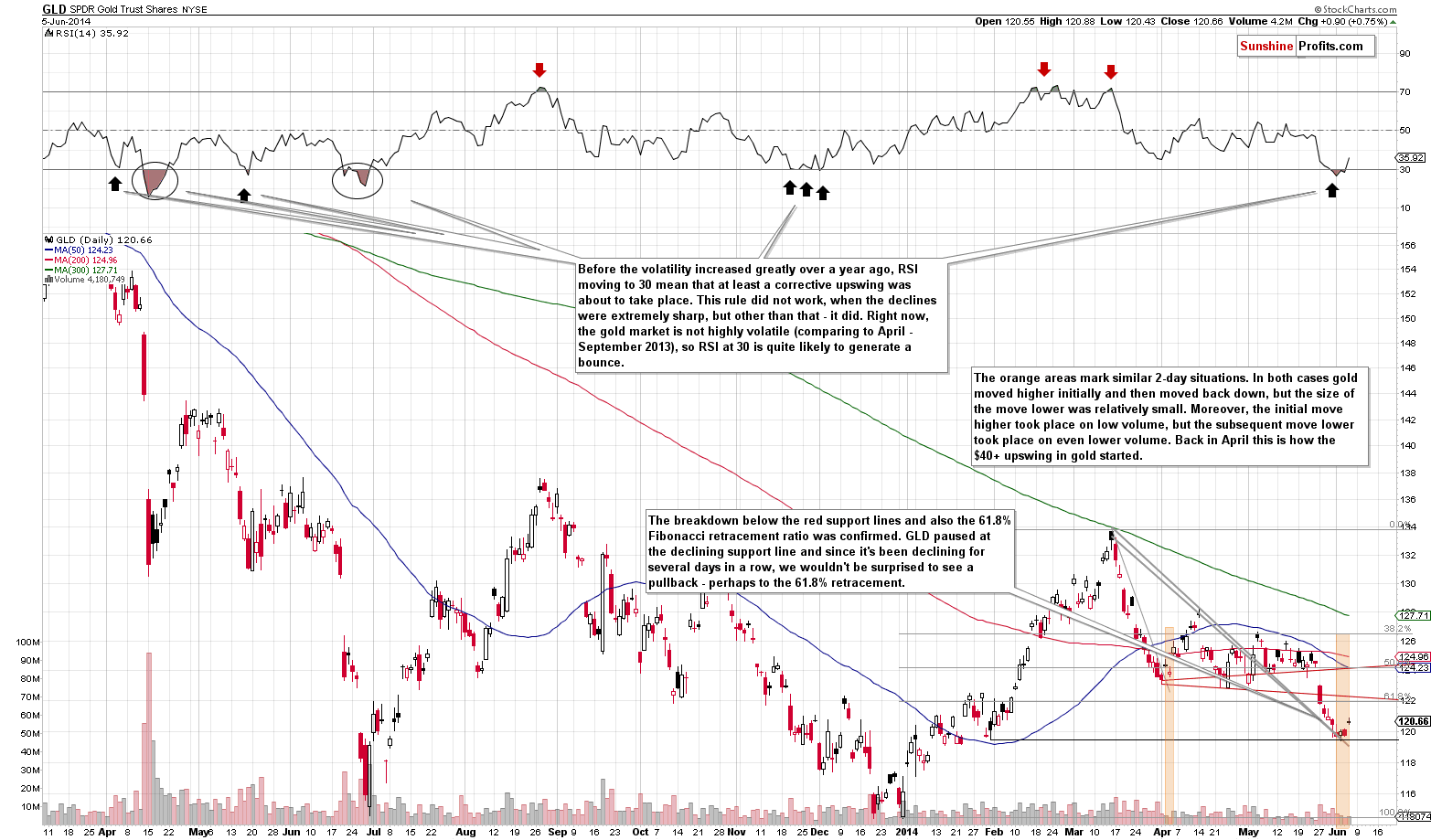

Gold moved higher on volume that was not huge, but still, the move was clearly visible and it stands out when we compare it to the consolidation that we saw in the previous several days. The analogy that we described yesterday worked as expected:

The interesting thing is that the last 2 days are similar to the 2 days that started the previous counter-trend rally. What’s even more interesting, is that the 2 situations occurred right after several-day long declines without any meaningful correction – which makes the situations even more similar. The implications are bullish for the short term and it seems that we will see some kind of short-term rally shortly – especially since the cyclical turning point for the USD Index is here.

How high will gold rally before turning south again? There are no sure bets, but our best guess is that it will correct to the previously broken 61.8% or 50% Fibonacci retracement levels – which means a move to (or very close to) $122 or $124.50 or so in case of the GLD ETF and $1,260 or $1,290 in case of spot gold. We will be looking for bearish confirmations (signals from indicators, ratios, other markets, etc.) around these levels and we’ll probably re-enter short positions once we see them.

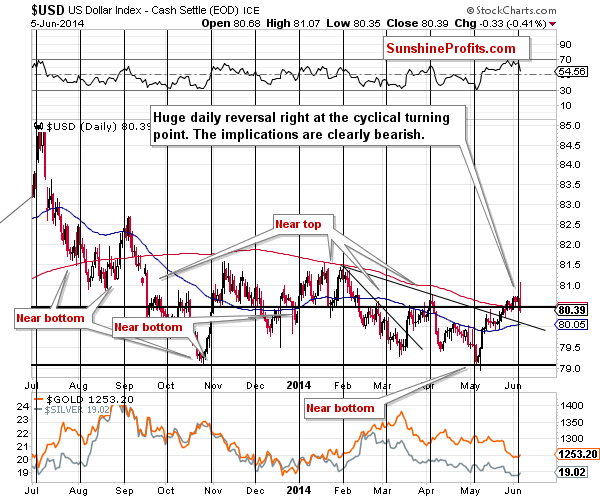

The big deal was the daily intra-day reversal and the subsequent decline in case of the USD Index that followed comments from the ECB. The turnaround was likely to happen based on the cyclical turning point and the ECB simply provided the trigger.

We have previously written the following:

Please note that the dollar’s turning points have often worked for gold and silver even if the reaction in the USD Index was delayed. That was the case in April and May – in both cases metals were the first to react. Perhaps this time we will see the same thing.

We have seen exactly the same thing this time. Gold and silver have bottomed before the USD Index topped, but both happened very close to the turning point.

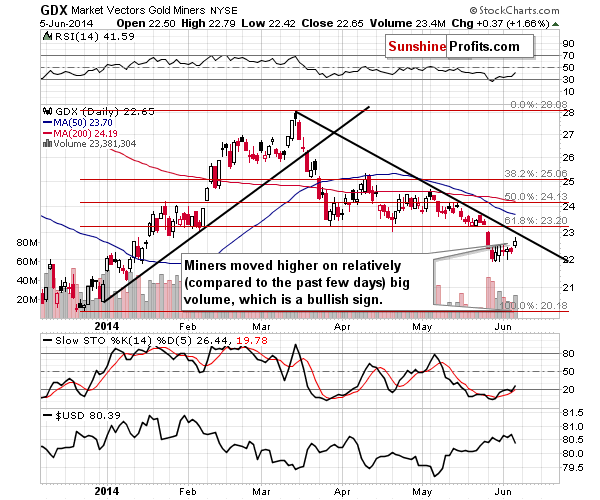

Before summarizing, let’s take a look at the mining stocks.

In case of the GDX ETF, the price targets are relatively close as well. The first one is slightly below the $23 level, at the declining resistance line, and the second one is at the 61.8% Fibonacci retracement. The third one is at the 50% Fibonacci retracement slightly above the $24 level. Either way, the upside is rather limited and we don’t think that the GDX will move and stay above $24 for long – if it gets there, that is.

As it is the case with gold, we will be monitoring the markets for signs of weakness and bearish confirmations to estimate at which of these levels it’s best to re-enter short positions. The situation is much less clear in terms of price targets when it comes to silver, so we will focus on other markets to estimate the time when shorting the silver market seems justified from the risk/reward perspective once again.

Summing up, while the medium-term trend in the precious metals market is down, we are seeing a corrective upswing and it doesn’t seem that it’s over yet. It seems quite likely that the rally will be over relatively soon, perhaps when the USD Index reaches the 80 level.

To summarize:

Trading capital (our opinion): No positions

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts