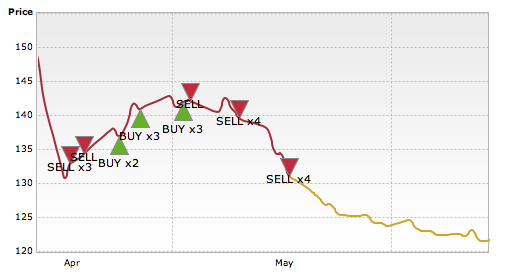

The price/volume action was very bearish on Friday and we are certainly happy with previous decisions to be out of the market with long-term investments and to short gold, silver and mining stocks speculatively.

The particularly bearish signs are:

- breakdown in silver below the April low in terms of weekly closing prices

- today's breakdown in silver below April's intra-day low

- confirmation of breakdown in the HUI Index and breakdown in the XAU Index

USD Index's breakout above its 2012 high

Gold and silver declined today in overnight trading and while gold pulled back, silver is still 50 cents lower. Silver is finally starting to underperform gold more visibly. The process is not extreme enough, though, to confirm that a bottom is in just yet.

We have recently received 2 very interesting questions about self-similarity and we would like to reply to them today.

The first question was if this pullback resembles the 1980 pullback.

First of all, it's an excellent question - thanks for asking it. At first sight the 2011-today price action resembles the 1979-1982 period, because the shape of the price moves is somewhat similar. We saw a major top that was preceded by a parabolic rally. Over 30 years ago, we saw a sharp plunge thereafter, a pullback and then continuation of the decline. In the recent years, we've seen two such pullbacks and only after that did gold move below the previous lows. All in all, the similarity in terms of shape is moderate at best.

Let's speculate on what would it mean if the similarity between these two periods was very significant. The $1,000,000 question is if this would mean that the current bull market is coming to an end. It wouldn't. The reason is that similarity in shape means that the outcome will be - similar in shape, in other words, proportional or self-similar. By that we mean that if there's a move that corrects, say, half of the previous move, then in the second case, we would also see a correction of half of the previous move.

Similarity in shape is one thing, but what if the initial move in the above example was just a $20 rally in gold (in a similar - parabolic fashion) then it would imply only a decline by $10 (half of the rally).

If the size of the moves is not similar, the similarity of shape doesn't have identical implications.

Is the size of the moves in 1980 similar to what we've seen recently? No. Back in 1980 the post-top plunge took gold from about $850 to about $500. A similar decline from $1,900 would mean gold slightly above $1,100 and back in 2011 gold didn't even move below $1,500. It's not close to $1,100 even today.

So, while the similarity in shape is moderate, the similarity in size and range of moves is practically nonexistent. Consequently, our answer to the question is: "No, the current move lower doesn't really resemble the 1980 pullback."

On a side note, the above discussion about self-similarity, what it implies and when are the things that we were pondering on for literally hundreds of hours when we prepared the prototype of the tool that you will soon see - it's probably one of the reasons why we like this question so much.

The second question was if we think there's any significance in the fact that the current gold chart looks similar to one from 1976. Details

Our reply is yes, these two patterns are definitely similar, however we think that they were not plotted on the chart correctly - we would shrink the current price move a bit, so that the April bottom corresponds to the initial 1976 bottom, as we think that aligning major bottoms is more important than aligning the pullback target which was done on the chart. One of the most useful ways to utilize this chart seems to be to compare the size of the pullback and the size of the move below the previous low. Actually, back in 1976, the range of the pullback and the size of the move below the initial bottom were almost identical as they are now.

In April, gold bottomed close to $1,320 and it pulled back to approximately $1,490. The size of the move was $170. Deducting that from $1,320 gives us $1,150 as a target level. If we take a look at closing prices, we have a bottom close to $1,350 and a pullback to about $1,480, which gives us a $130 move and a target of $1,350-$130 = $1,220.

Also, please note that there was a pullback in gold before it moved below the initial low. We could see this type of action shortly. If silver and mining stocks consolidate below their previous lows it will simply serve as a confirmation of the breakdown and an indication of further declines.

The most interesting part of the above is what you don't see on that chart. The point is, this is exactly what our self-similarity tool has been suggesting.

Why is it so exciting? Because our tool didn't take 1976 price moves as an input data - it's price projections are based on less than 10 years of data. This means that the current decline is self-similar to the recent price moves and declines AND to what had happened over 30 years ago! Even though we have analogies based on self-similarity, we have a different set of cases that caused them, which means that these two analogies confirm each other (it's not looking at the same thing from different angles - these are two separate things). 1976 represents a similar stage of the bull market, but looking at it, one might not be certain if the same patterns still exist today - after all, a lot has changed in the last 30 years. Our tool, however, says that they do and that the history does indeed rhyme even though circumstances are different. On the other hand, our tool doesn't "know" what stage the market is in - all it "knows" are the recent price patterns and how similar they are to what we saw in the previous years (but in no more than 10 years from now). Consequently, these two analogies supplement and confirm each other.

Summing up, we believe that betting on lower values of gold, silver and mining stocks is justified from the risk/reward point of view. In other words, we suggest having speculative short positions in gold, silver and mining stocks.

The stop-loss levels are:

- Silver: $25.30

- GDX ETF: $32.2

- HUI Index: 305

We currently think that gold will temporarily move below $1,285, but soon pull back and close the week around this level. How low will gold temporarily go is unclear - perhaps it will form an intra-day bottom close to $1,200 or even $1,100.

Here's the up-to-date version of our trading/investment plan:

- When gold moves to $1,305 close the speculative short position in gold and get back in the market with half of your long-term gold and platinum investments.

- When silver moves to $18.20 close the speculative short position and in silver get back in the market with half of your long-term silver investments.

- When the XAU Index moves to 84, close the speculative short position in mining stocks and get back in the market with half of your long-term mining stock investments.

We will send a separate confirmation to get fully back in.

As far as trading capital is concerned we currently think that placing distant bids is appropriate. They may not get filled, but if we place them too high, we risk being thrown out of the market via stop-loss orders or margin calls if the volatility gets too high (and it's unpredictable how volatile the markets will get as gold is in a reverse parabola right now). If they don't get filled, we plan to get long after gold pulls back significantly on an intra-day basis on huge volume (thus creating a bullish candlestick - probably a "hammer candlestick").

The distant buy price levels are:

- Gold: $1,120 (stop-loss: $970)

- Silver: $16.20 (stop-loss: $14.4)

- $HUI: 155 (stop-loss: 137)

As we wrote, these levels are distant and probably will not be reached, but if they are, they will present a great buying opportunity and also a one that will likely disappear almost immediately - that's why we we think that placing orders in advance is appropriate.

As always, we'll keep you updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) at least until the end of June, 2013 and we will send additional Market Alerts whenever appropriate. We have prolonged the time in which you - our subscribers - will receive Market Alerts daily for another full month.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA