Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil wavered in a narrow range, which resulted in another doji candle. What does it mean for black gold?

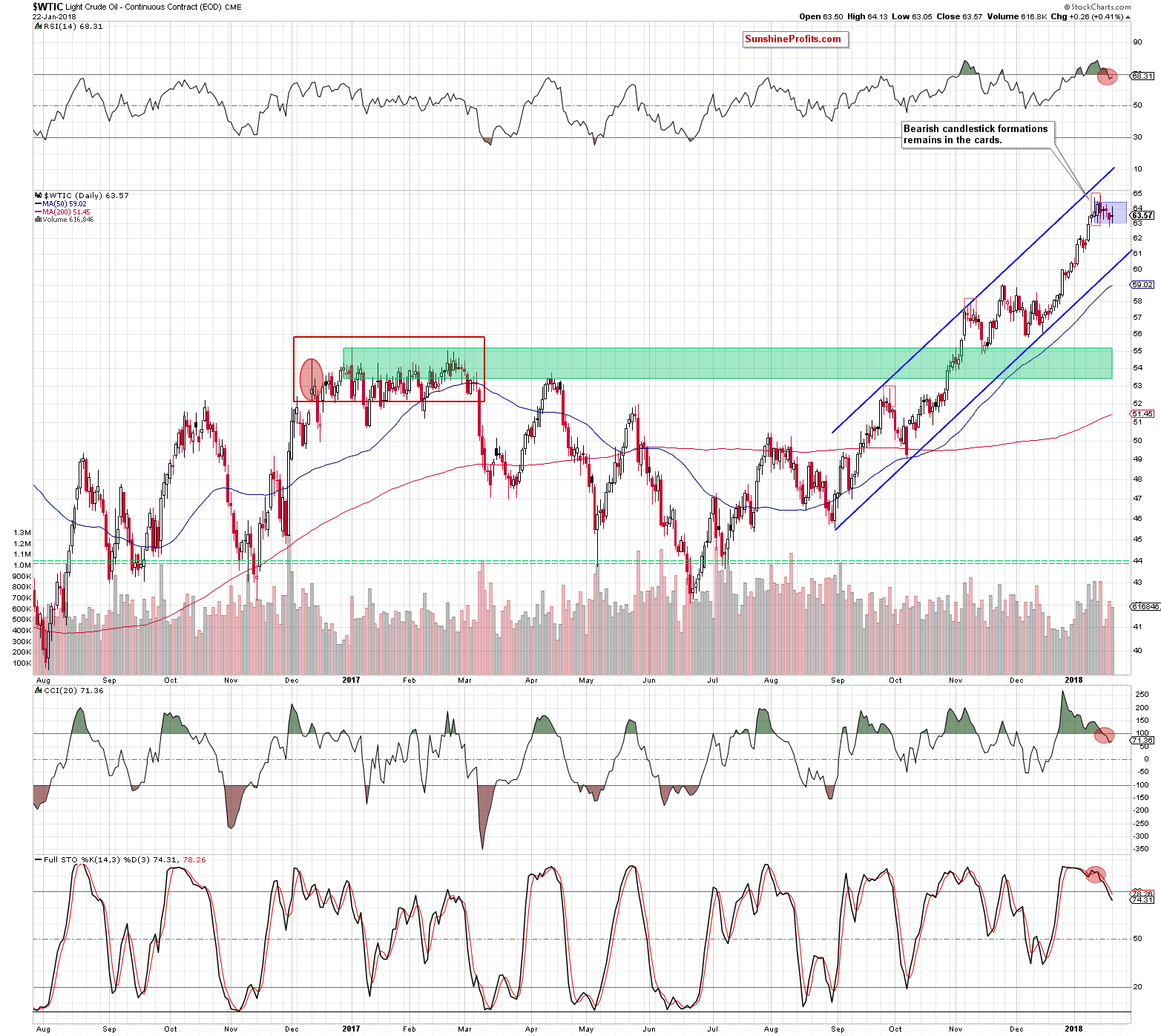

Let’s take a look at the daily chart below chart (charts courtesy of http://stockcharts.com).

Today's alert is going to be even shorter than yesterday's issue, as once again nothing really changed in the technical picture of crude oil and thus everything that we wrote on Thursday and Friday remains up-to-date.

As you see on the daily chart another day passed and neither bulls nor bears gained a clear advantage, which resulted in another doji candle. This is a repeat of what we already saw in the previous days and there are no reliable clues about the direction of the next move, which is in line what we wrote in our Friday’s alert:

(…) This also suggests that we may see short-lived moves in both directions before the release of another government report as investors may want to wait for a significant fundamental factor that would sink the price of black gold before opening big short positions.

Consequently, the comments that we made at the end of the previous week remain up-to-date also today and if you haven’t had the chance to read them, we encourage you to do so today. We will provide you with a bigger update once we see more interesting developments on the crude oil market.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts