Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, the price of light crude wavered between small gains and losses, which preliminarily paints the image of the current oil bulls’ condition. Will these assumptions be confirmed in the coming days?

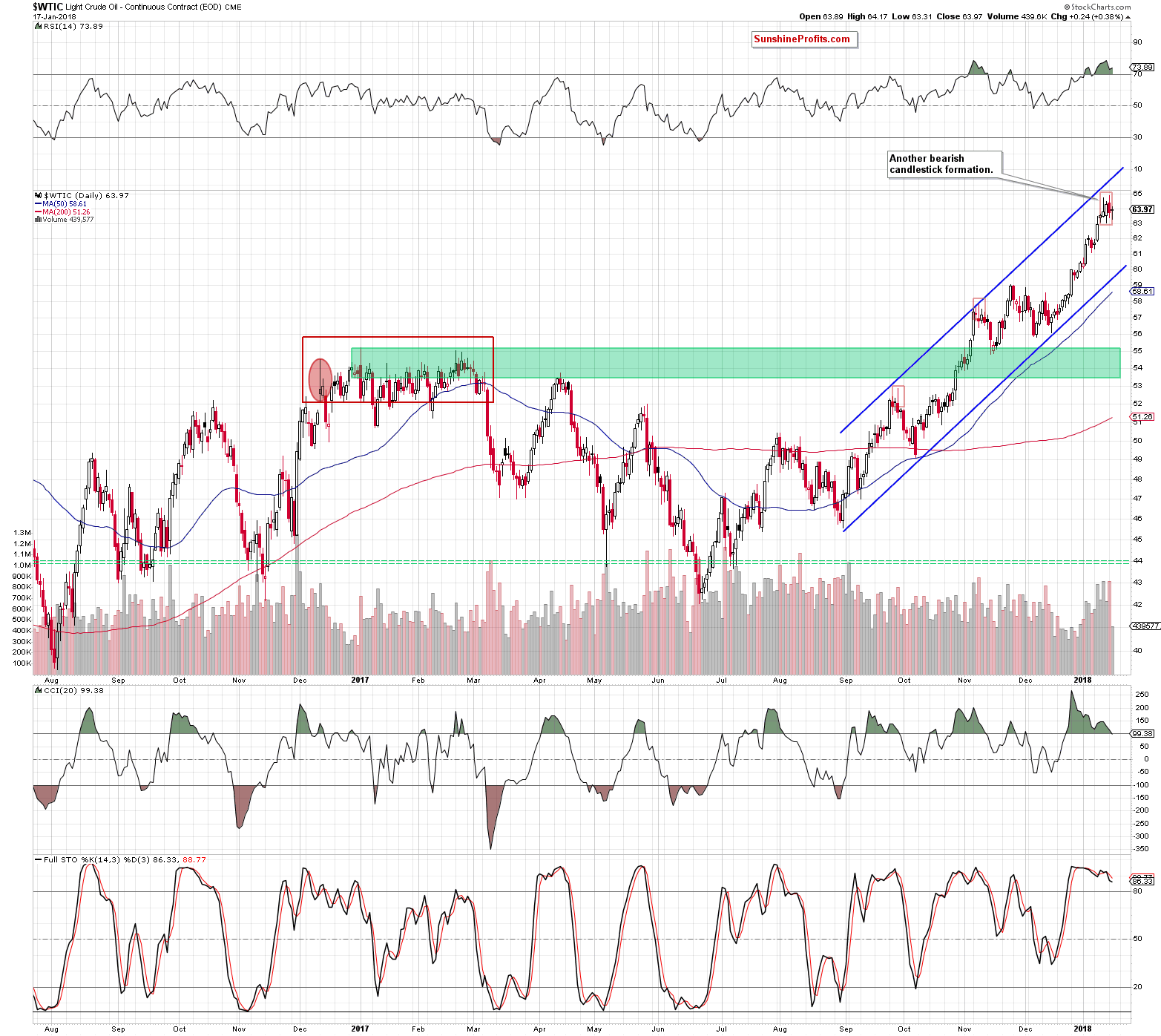

The current situation in the long term remains unchanged (if you haven’t had the chance to read about the broader perspective in our yesterday'a alert, we encourage you to do so today) and we decided to focus on the daily chart (charts courtesy of http://stockcharts.com). What happened and what did not happen yesterday?

Looking at the above chart, we see that yesterday’s battle between bulls and bears resulted in a doji candle, which indicates the lack of decisiveness on the market.

Although neither oil bulls nor oil bears show an advantage yesterday, two bearish candlestick formations remain in the cards, strengthening the resistance zone created by the 200-month moving average at $65.09. Additionally, the CCI joined the Stochastic Oscillator and generated a sale signal, giving oil bears another reason to act.

On top of that, volume was tiny compared to what we saw in the previous days, which confirms oil investors’ indecision regarding the direction of the next move. Therefore, waiting at the sidelines for more clear signals without open positions seems to be the best decision - especially ahead of today's government report, which could show that U.S. crude oil production jumped above the level of 10 million barrels per day.

Taking into account the technical picture of crude oil, we think that oil bears have more arguments on their side to take control on the market. Nevertheless, it seems to us that as long as investors do not see a strong bearish fundamental factor (as the abovementioned increase in output to levels from the 70's for example), the price of black gold will be wavering in a narrow range under the 200-month moving average.

Finishing today’s alert, please note that after yesterday market closure the American Petroleum Institute reported that crude oil inventories fell 5.121 million barrels in the previous week, beating forecasts. Despite this positive news, gasoline inventories rose 1.782 million barrels and distillate stocks rose by 609,000 barrels, which gave oil bears a good reason to push crude oil futures lower earlier today.

Usually, the commodity follows futures, which suggests a drop after the market open. However, the highlight of today’s session will be the EIA report, which could diametrically change the fate of today's session. We will continue to monitor the market later in the day and if we see another reliable show of oil bears strength, we’ll consider opening small short positions.

As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts