Trading position (short-term; our opinion): Short positions (with the stop-loss order at $77.23 and the initial target at $71.27) are justified from the risk/reward perspective.

Yesterday, oil bulls extended Monday’s rebound and approached the previously-broken July peak. Does this comeback mean that oil bears have already lost their will to fight for lower prices of crude oil?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

In our last Oil Trading Alert, we wrote the following:

(…) The shape of yesterday’s candlestick suggests that oil bulls are active around $73 and probably will defend this level in the following day(s). Nevertheless, (…) further deterioration is more likely than not (even if we see a verification of the breakdown under the July peak or the upper line of the green trend channel first).

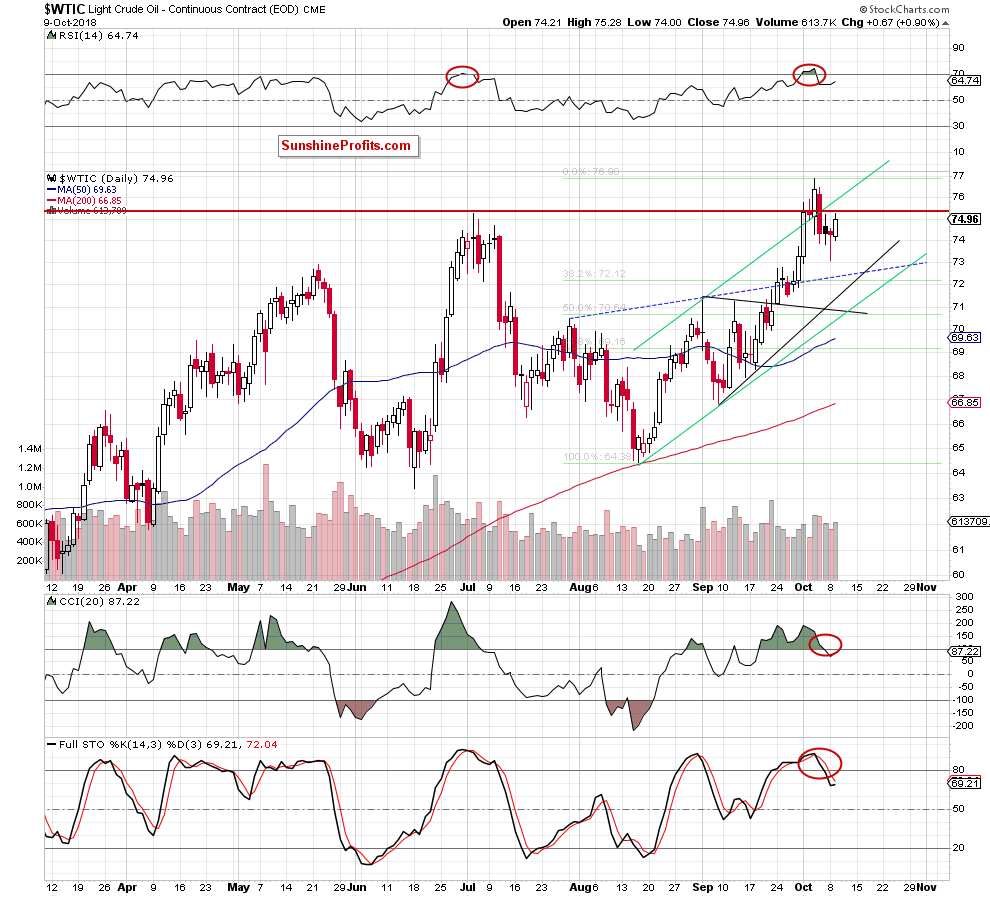

From today’s point of view, we see that the situation developed in line with the above assumptions and crude oil approached the red horizontal resistance line based on the July high during Tuesday’s session.

As we wrote yesterday, such price action looks like a verification of the earlier breakdown and increases the probability of another downswing in the very near future – especially when we factor in the sell signals generated by the indicators and the pro-bearish situation in the long term.

And speaking about it… did this increase change anything in the broader perspective?

Looking at the above chart, we see it didn’t because the price of crude oil is still trading under the previously-broken upper border of the green rising wedge. Therefore, the comments that we made yesterday remain valid:

(…) the price returned to the interior of the formation, invalidating the earlier breakout.

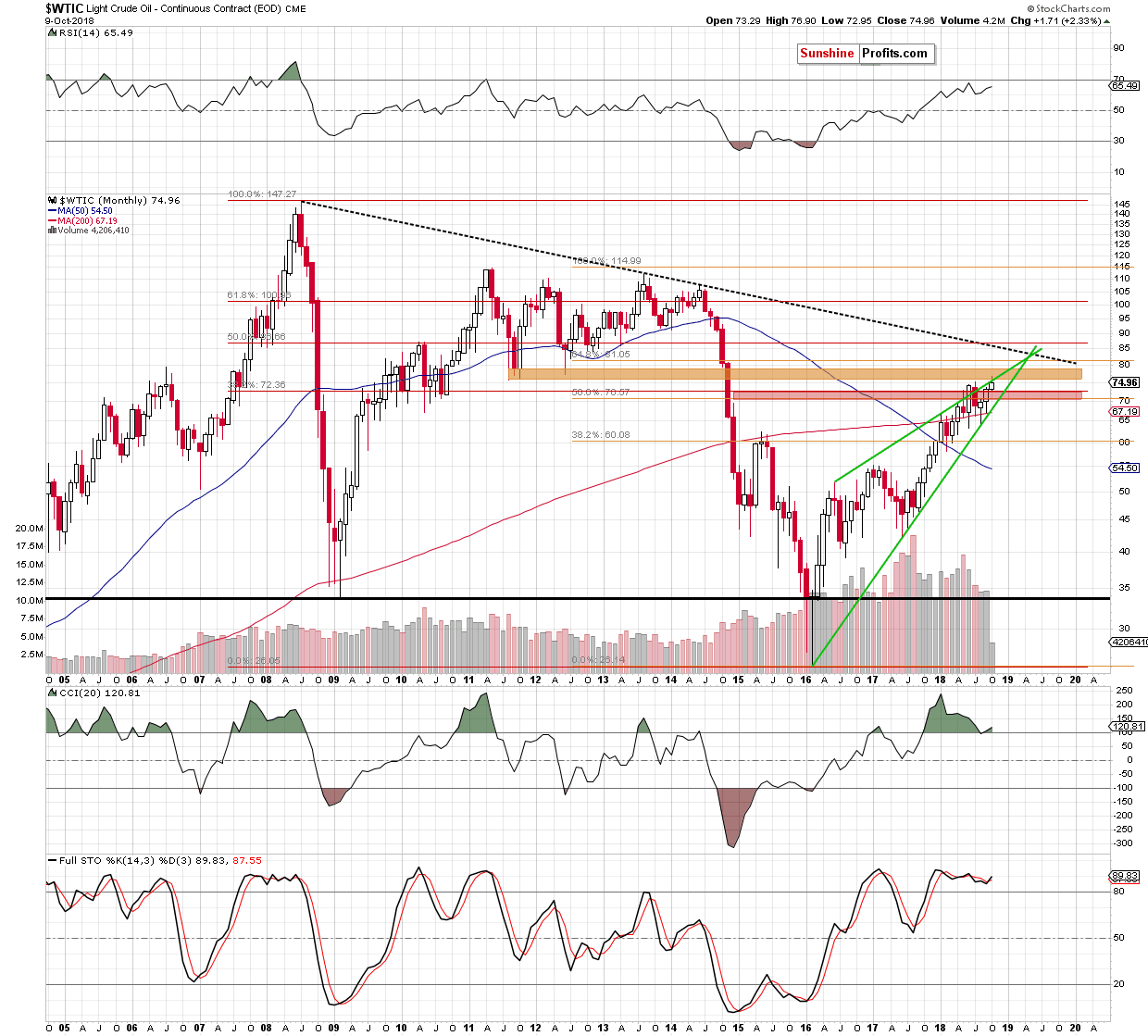

When we take a closer look at the monthly chart, we can notice that similar price action took place in July and preceded a decline, which took the black gold to the 200-month moving average.

Taking this fact into account (and other short-term factors (…)), we think that another bigger move to the downside is just around the corner.

Finishing today’s alert, we would like to add that this week’s move to the upside approached black gold to the upper line of the green wedge, which also looks like a verification of the earlier breakdown and can be read as a negative sign.

Summing up, short positions are justified from the risk/reward perspective as the price of crude oil remains under the previously-broken important resistance levels and the sell signals generated by the indicators continue to support further deterioration.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $77.23 and the initial target at $71.27) are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts