Trading position (short-term; our opinion): Short positions (with the stop-loss order at $77.23 and the initial target at $71.27) are justified from the risk/reward perspective.

Monday's session started very well for oil bears as the price of black gold dived almost to the level of $73. The next hours of the session, however, were not so pleasant for the sellers, because their rivals decided to fight. What were the consequences and what can we expect in the coming days?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

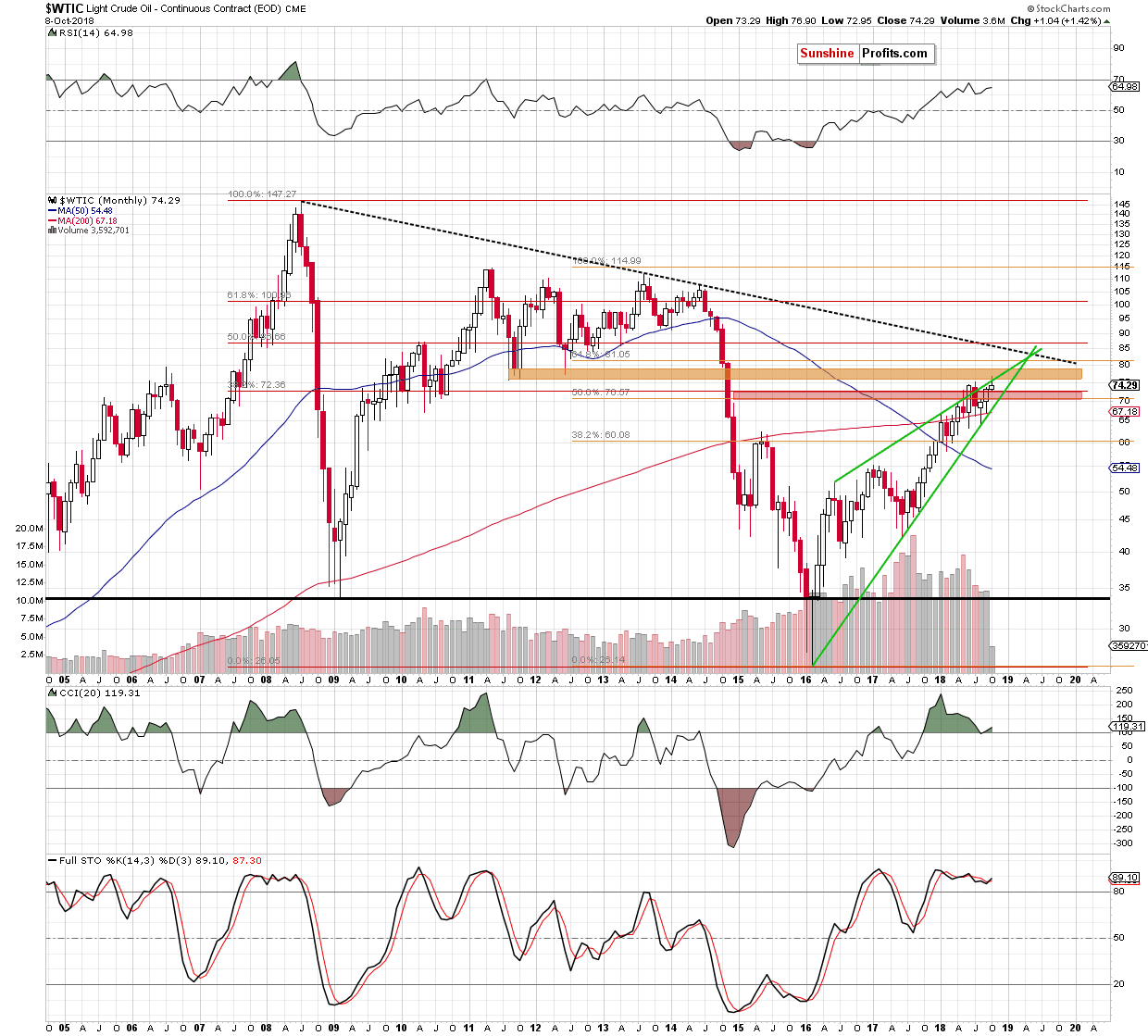

Looking at the long-term chart of crude oil, we see that although the commodity climbed a bit above the upper border of the green rising wedge, the orange resistance zone was strong enough to stop oil bulls once again. As a result, the price returned to the interior of the formation, invalidating the earlier breakout.

When we take a closer look at the monthly chart, we can notice that similar price action took place in July and preceded a decline, which took the black gold to the 200-month moving average.

Taking this fact into account (and other short-term factors about which we write below), we think that another bigger move to the downside is just around the corner.

And what can we infer from the daily chart? Let’s check.

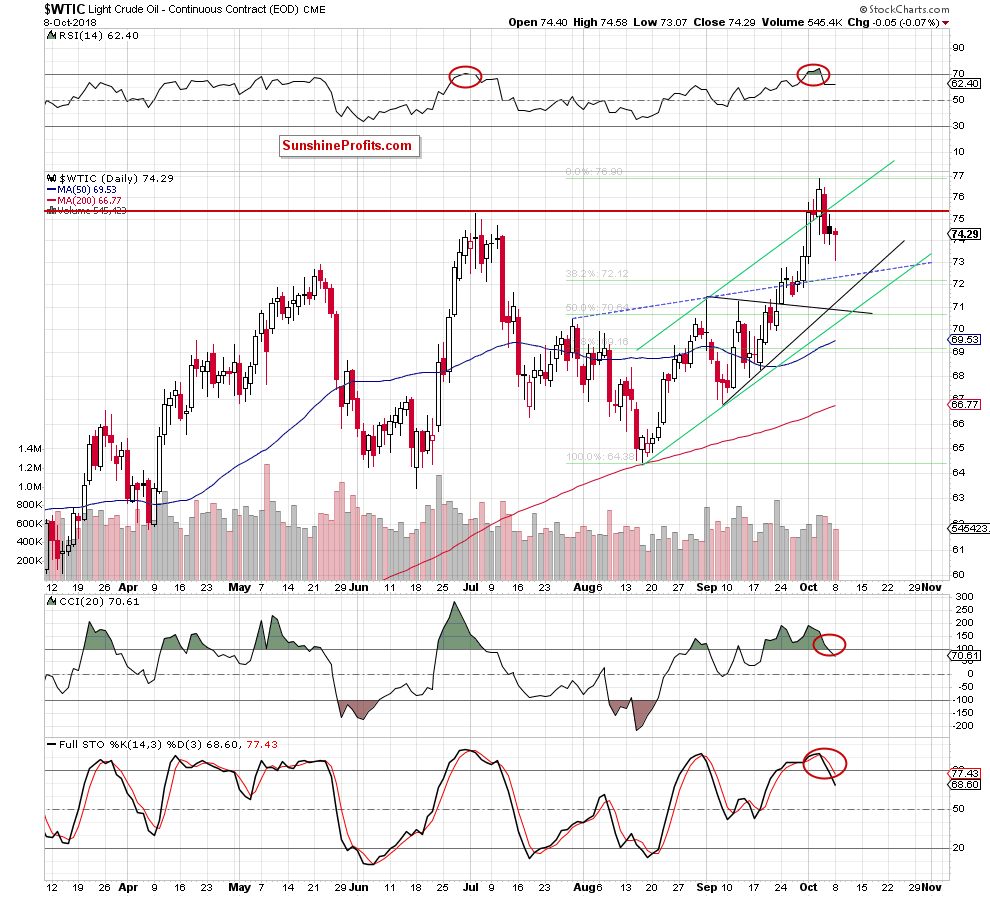

Although the price of black gold moved lower after yesterday’s market open, oil bulls didn’t lose cold blood and triggered a rebound in the following hours. Thanks to their determination the commodity came back to the levels tat we saw at the end of the previous week and finished the day only five cents below Friday’s closure.

The shape of yesterday’s candlestick suggests that oil bulls are active around $73 and probably will defend this level in the following day(s). Nevertheless, the earlier invalidations of the breakouts (above the upper border of the green rising trend channel and the July high) in combination with the sell signals generated by all daily indicators and the long-term picture suggest that further deterioration is more likely than not (even if we see a verification of the breakdown under the July peak or the upper line of the green trend channel first).

Earlier today, crude oil futures moved a bit higher, but we haven’t seen any important technical development, which could change the overall situation. Therefore, our comments on yesterday’s price action remain up-to-date.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $77.23 and the initial target at $71.27) are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts