Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGH22]

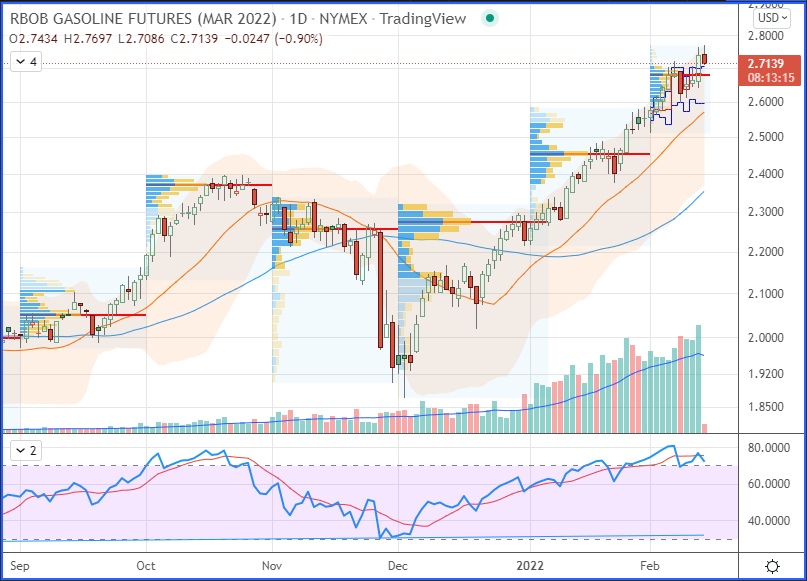

Long around the $ 3.846-3.886 support area (yellow band) with a stop at $ 3.629 and targets at $ 4.442 & $ 4.818 – See Friday’s trade projections. - RBOB Gasoline [RBH22]

No new position justified on a risk/reward point of view. - WTI Crude Oil [CLH22]

No new position justified on a risk/reward point of view. - Brent Crude Oil [BRNJ22]

No new position justified on a risk/reward point of view.

Henry Hub Natural Gas (NGH22) Futures (March contract, daily chart)

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Did you miss my last article about biofuels to diversify your portfolio? No problem, you can have a look at my selection through the dynamic stock watchlist.

Are you interested in geopolitics? I published an alternative reading of the Ukrainian crisis.

With our new entry located around the $3.846-3.886 (yellow band) support, Natgas opened higher at 4.103 today, thus forming a small gap up just above Friday’s high (4.056). This is normally a good indication of a bullish takeover. The market then rallied to form a daily high at 4.169 (0.010 above the mid-way target placed at 4.442).

According to our rules of risk management defined in that article (also mentioned above), we could therefore lift our stop loss to breakeven (at entry ~3.886) to secure this position (see red arrow pointing up). By doing so, we would no longer fear a sudden drop into negative territory.

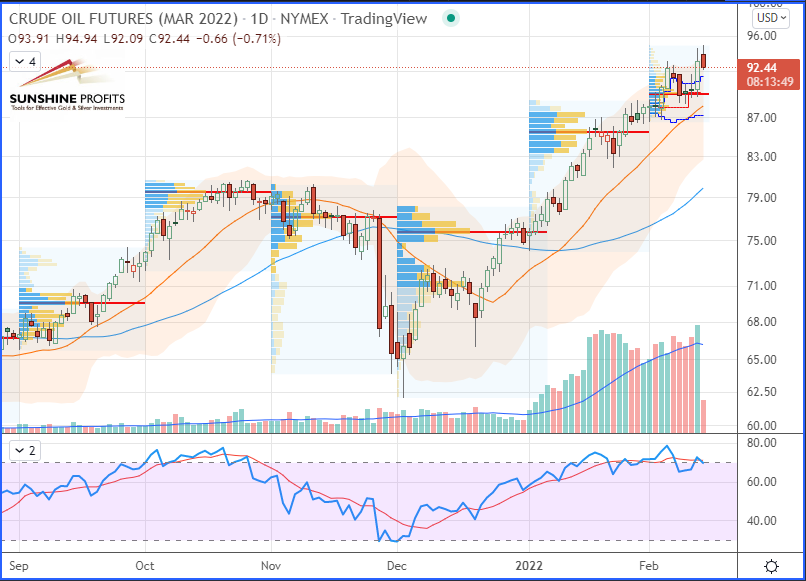

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

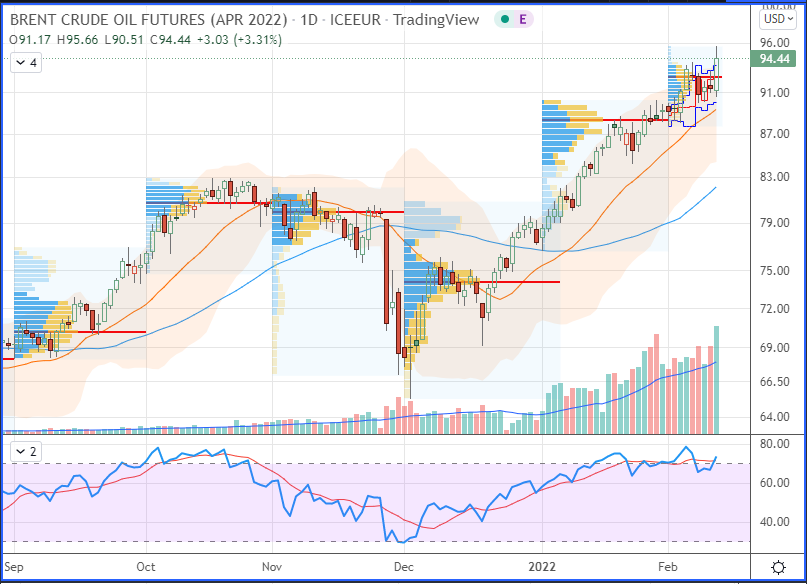

Brent Crude Oil (BRNJ22) Futures (April contract, daily chart)

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

That’s all folks for today – happy trading!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist