Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGH22]

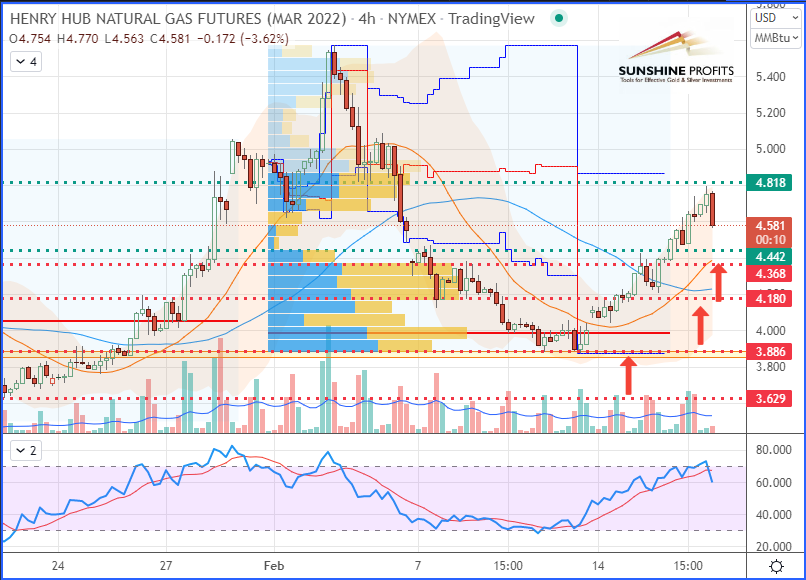

Long around the $ 3.846-3.886 support area (yellow band) with an initial stop at $ 3.629 and targets at $ 4.442 & $ 4.818 – See yesterday’s updates. - RBOB Gasoline [RBH22]

No new position justified on a risk/reward point of view. - WTI Crude Oil [CLH22]

No new position justified on a risk/reward point of view. - Brent Crude Oil [BRNJ22]

No new position justified on a risk/reward point of view.

Henry Hub Natural Gas (NGH22) Futures (March contract, daily chart)

Henry Hub Natural Gas (NGH22) Futures (March contract, 4H chart)

Henry Hub Natural Gas (NGH22) Futures (March contract, 4H chart)

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Did you miss my last article about biofuels to diversify your portfolio? No problem, you can have a look at my selection through the dynamic stock watchlist.

Are you interested in geopolitics? I published an alternative reading of the Ukrainian crisis.

Given that the Henry Hub Natural Gas prices started to revert at $4.793 (just 0.025 below the target), for those who are still riding that trade towards the second target (or any further one), I would just suggest lifting the stop again – at least up to the $4.368 level today, to increase the secured profits so far. Alternatively, bear in mind that by following my risk management guidelines, it would also help you trail your stop to the upper levels, step by step.

Another option would be to place your new stop at the same level as the first target ($4.442), so as you can see, there are various ways of doing it.

That’s all folks for today – happy trading!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist