Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified on a risk/reward point of view.

- RBOB Gasoline No new position justified on a risk/reward point of view.

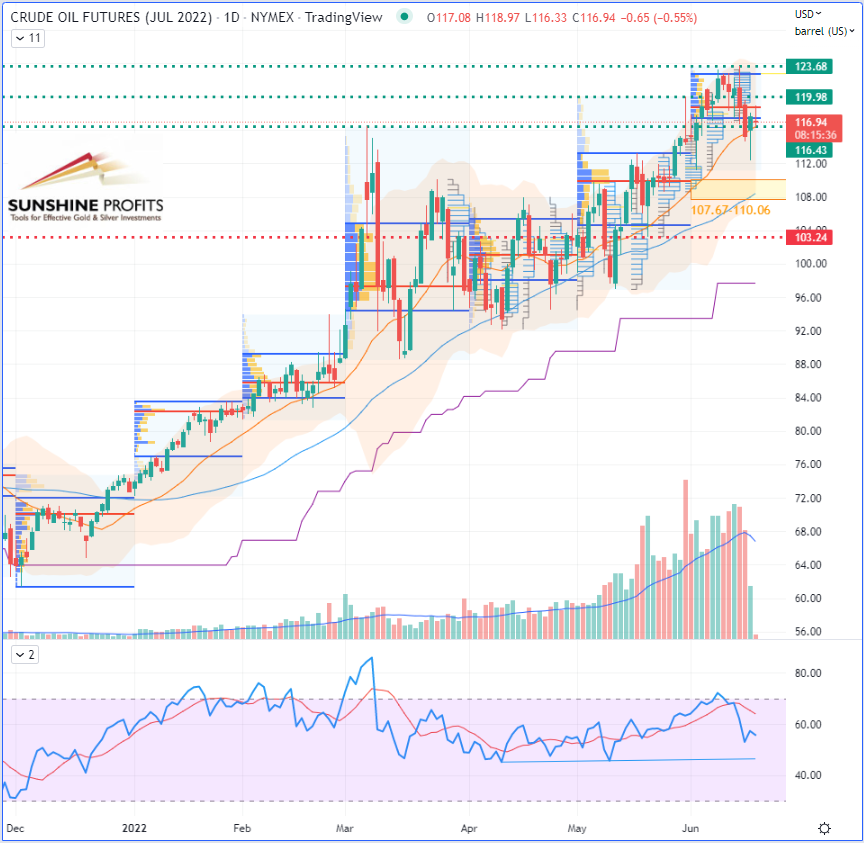

- WTI Crude Oil Long $107.67-110.06 (yellow band) with stop just below $103.24 (red dotted line) and targets at $116.43, 119.98 & 123.68 (green dotted lines).

- Brent Crude Oil $110.47-112.27 (yellow band) with stop just below $106.20 (red dotted line) and targets at $118.43, 120.80 & 124.42 (green dotted lines).

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

WTI Crude Oil (CLN22) Futures (July contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart)

Since most currencies take all their importance from the price of energy and oil, let’s have a look at the other side of the coin: monetary policies.

So, What’s the Story with Central Banks?

Oil prices were choppy on Thursday. They ended up slightly higher in a fearful environment for markets in general, after a Fed rate hike the day before and a sharp fall in the US dollar.

Faced with galloping inflation – after the Federal Reserve (the Fed) announced the largest rate hike since 1994 on Wednesday – the Swiss National Bank (SNB) unexpectedly raised interest rates on Thursday, a rare occurrence that deserves to be noted.

Meanwhile, the Bank of England (BoE) has also promised to act forcefully as it anticipates an inflation rate of 11% in the UK.

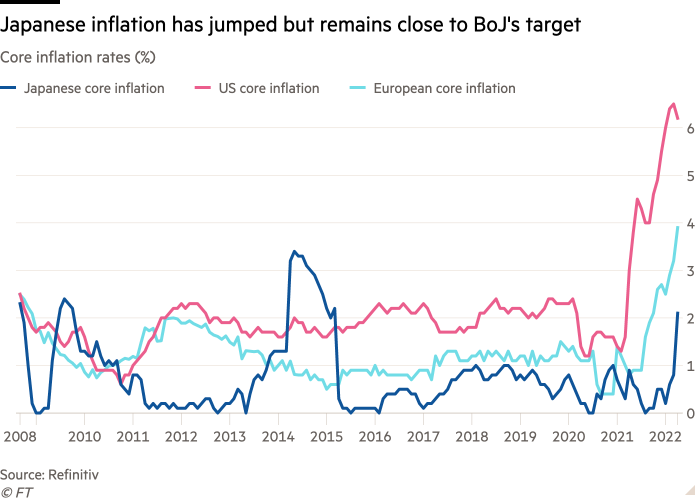

In the Asia-Pacific region, the Bank of Japan (BoJ) sticks to ultra-loose monetary policy, as Governor Haruhiko Kuroda said on Friday that he would not raise interest rates even with a weakening Japanese yen.

Therefore, the latter just hit a 24-year low against the US dollar following the central bank’s decision.

(Source: FT.com)

(Source: FT.com)

According to Deutsche Bank reporting to the Financial Times, “the BoJ has spent $72bn buying bonds just this week, almost what the Fed and ECB were doing in an entire month last year. Adjusted for the different sizes of their respective economies, the pace of Japanese QE this week is more than 20 times the pace of the Fed’s in 2021.” (FT.com)

In short, if all the central banks around the world raised interest rates, the dollar wouldn’t fare any better and commodity prices would likely recoup their losses.

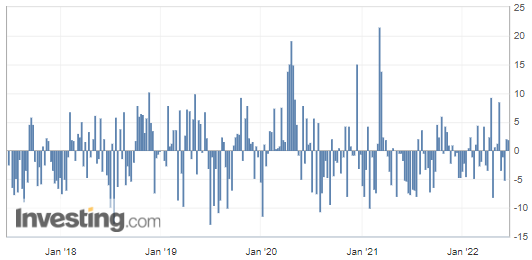

Fundamental Analysis & U.S. Crude Oil Inventories

The weekly crude inventories were released on Wednesday. They confirmed the American Petroleum Institute (API) figures presented in my previous analysis, with an increase of over 1.956M barrels in US oil stocks, while the forecasted figure was expected to be negative (-1.314M barrels).

US crude inventories have increased by over 1.956 million barrels, which confirms slowing demand and is considered a bearish factor for crude oil prices.

Like the API’s release, the difference with the forecasted figure is almost the opposite, so it entails a wide miss from the analysts’ expectations.

Therefore, I still think that the black gold is set for a further corrective wave, possibly back to previous support levels, which I projected for a couple of new trades on both Brent and WTI (see our member section) despite persistent crude supply problems.

(Source: Investing.com)

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

Brent Crude Oil (BRNQ22) Futures (August contract, daily chart)

That’s all for today, folks. Have a nice weekend!

As always, we’ll keep you, our subscribers, well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist