Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although oil bears pushed crude oil lower after the Friday market open, their opponents took control and triggered a rebound in the following hours, which resulted in the highest weekly closure since the beginning of December 2014. What does it mean for black gold in the coming week?

Technical Picture of Crude Oil

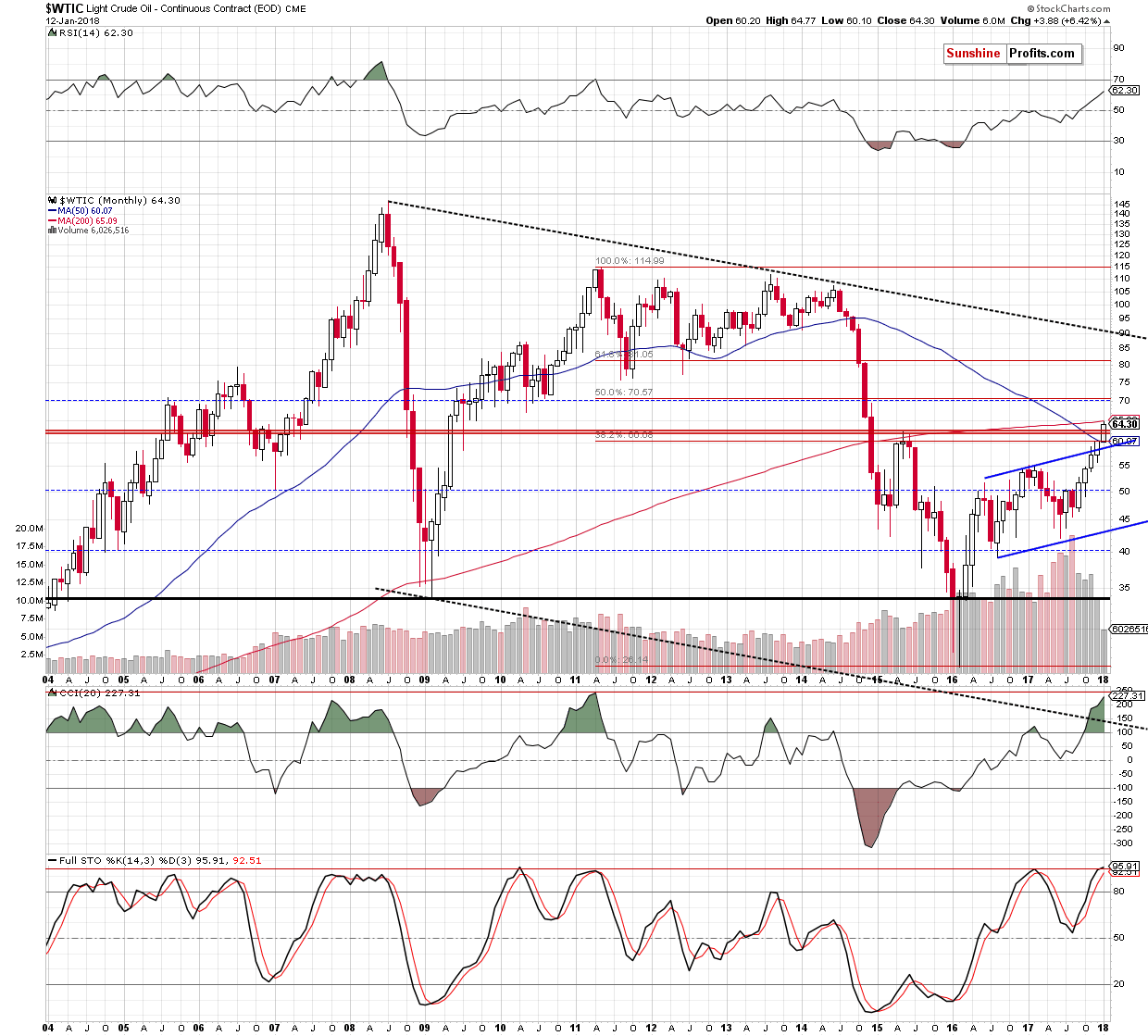

Let’s start today’s alert with the long-term chart of black gold (charts courtesy of http://stockcharts.com).

Looking at the monthly chart, we see that the overall situation in the long term hasn’t changed much. Why? Because despite Friday’s increase, the commodity is still trading under the 200-month moving average, which remains the key resistance at the moment of writing these words.

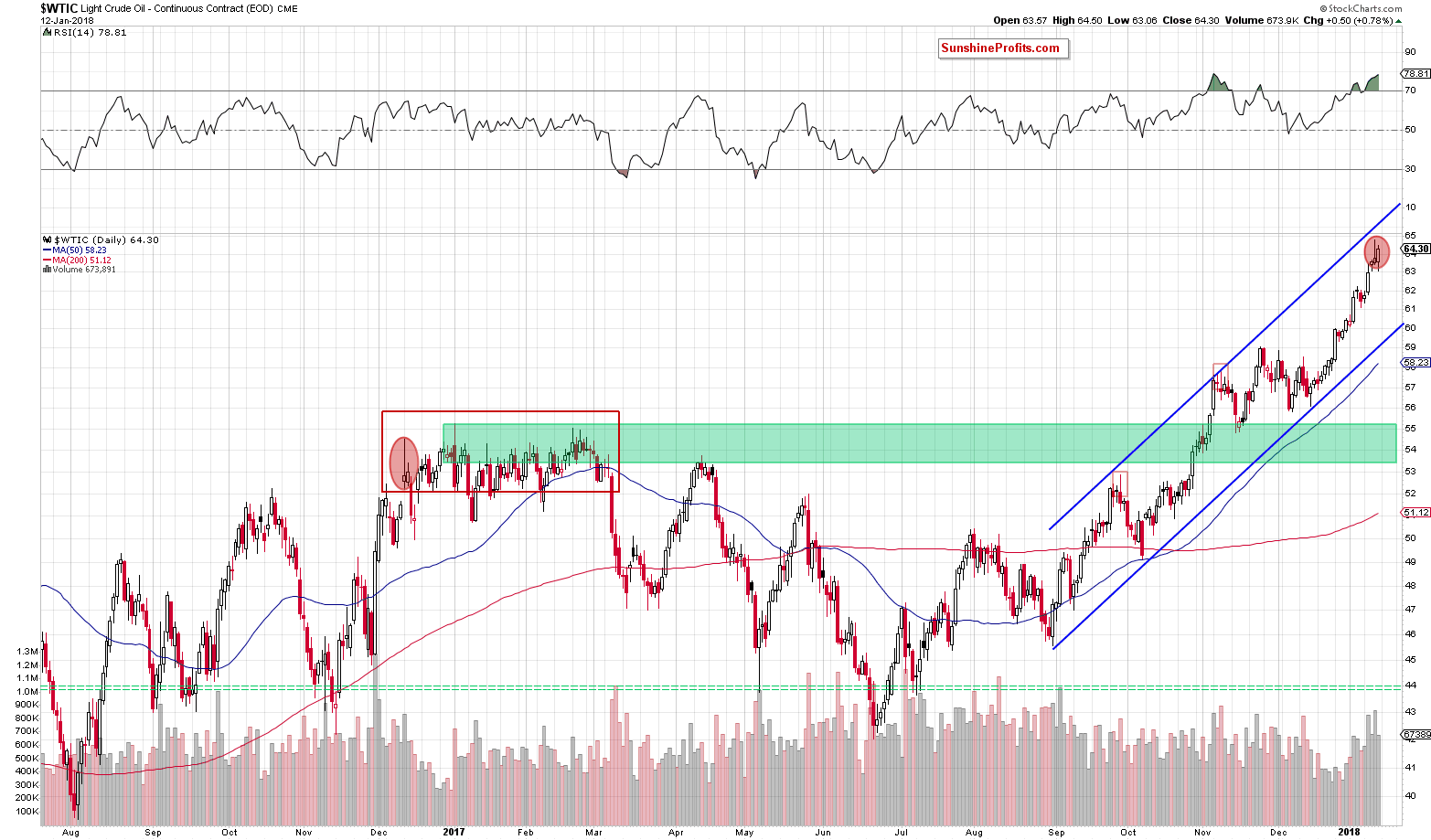

Did Friday upswing change anything in the shorter perspective? Let’s examine the daily chart to find out.

From this perspective, we see that although oil bulls did their best, the pro bearish candlestick formation remains in the cards (more about its parameters and its overtones we wrote in our last Oil Trading Alert).

Additionally, volume, which accompanied Friday’s upswing was visibly lower than day earlier, which raises some doubts about the continuation of the rally (especially when we factor in the current position of the indicators). Nevertheless, we should keep in mind that crude oil futures hit a fresh 2018 high of $64.89 yesterday.

What does it mean for black gold? Taking into account the fact that the commodity usually follows futures’ price action, we think that one more upswing and a test of the above-mentioned 200-month moving average (currently at $65.09) can’t be ruled out. At this point it is also worth noting that if this resistance won’t stop oil bulls, we could even see a move to the upper border of the blue rising trend channel (around $65.80).

Finishng today’s alert lease keep in mind that if we see any reliable show of oil bulls’ weakness, we’ll consider opening small short positions in the following day.

As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts