Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Natural Gas [NGG22]

No new position justified on a risk/reward point of view. - RBOB Gasoline [RBH22]

No new position justified on a risk/reward point of view. - WTI Crude Oil [CLH22]

No new position justified on a risk/reward point of view. - Brent Crude Oil [BRNH22]

No new position justified on a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Did you miss my last article about biofuels to diversify your portfolio? No problem, you can have a look at my selection through the dynamic stock watchlist.

Crude oil prices have been rising again since yesterday, supported by the latest developments in the Ukrainian crisis, which seem to have prevailed in a market already worried about insufficient supply. Since Russia’s exports account for five million barrels a day, anything that might happen – such as sanctions, delivery problems, an exploding oil pipeline or a closing storage terminal – would consequently entail the supply contract. With global black gold supply already tight, the market can not afford to lose any more barrels.

In the Middle East region, the United Arab Emirates, which has been attacked several times in recent days by fire from Houthi rebels in Yemen, and Libya, which still has no date for its elections, which is blocking part of the oil production, are also being scrutinized by the markets.

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

Brent Crude Oil (BRNH22) Futures (March contract, daily chart)

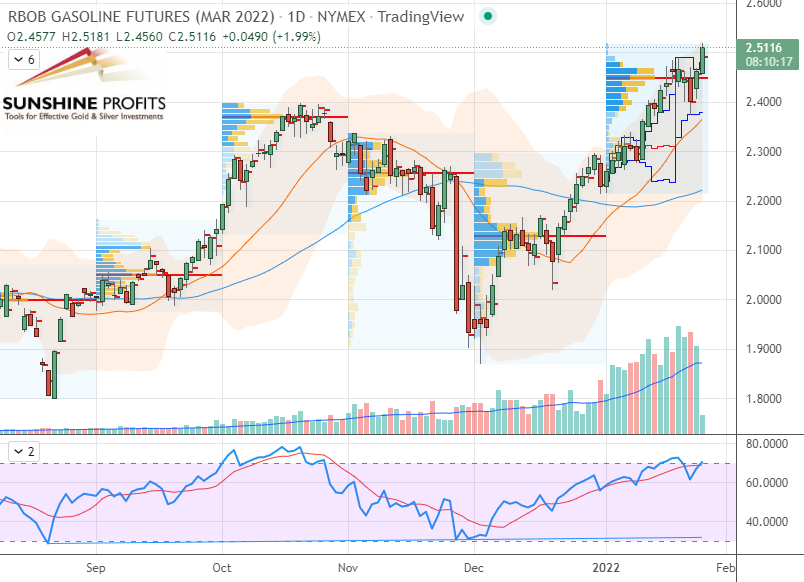

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

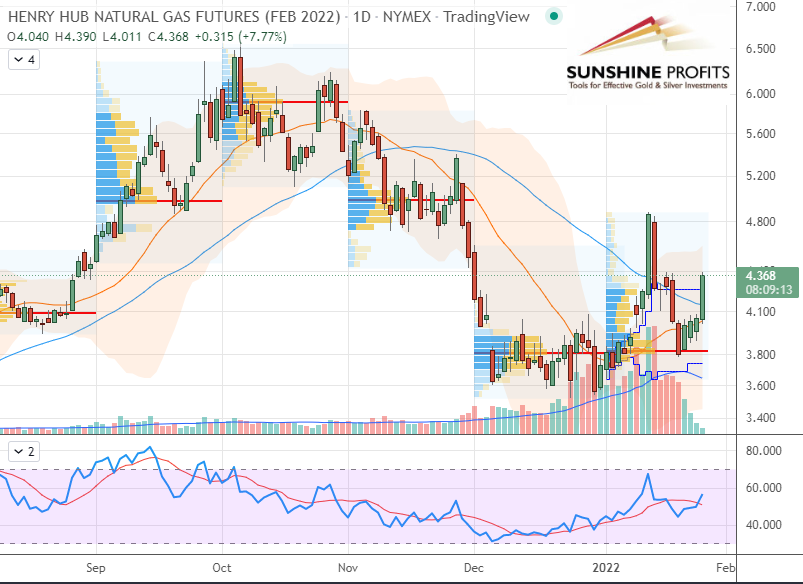

Henry Hub Natural Gas (NGG22) Futures (February contract, daily chart)

CBOE Volatility Index (VIX) “Fear Index” (Daily chart)

In summary, traders will be eying the Federal Reserve’s (Fed) details to be revealed later today on its plans to tighten its monetary policy in order to tackle inflation. This could have an impact on the markets. With the volatility characterized by the VIX Index – aka the “Fear Index” remaining at high levels (well above $26 at the moment) – after the VIX spiked on Monday, we may take a look at it to see how it will evolve in the coming hours. In addition, the US crude oil inventories will be awaited as well.

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist