Trading position (short-term; our opinion): Short position in crude oil is justified from the risk/reward perspective with the binding profit-take level of $43.12 and the stop-loss level of $56.11. Please note that we might decide to close the position even before it reaches these levels.

While the oil had risen in the previous week, the Friday's session was a warning shot across the bow. Looking at today's premarket move lower, what can we say about oil's outlook? And what kind of action should we take?

Let's start with the daily chart examination (charts courtesy of http://stockcharts.com and http://stooq.com ).

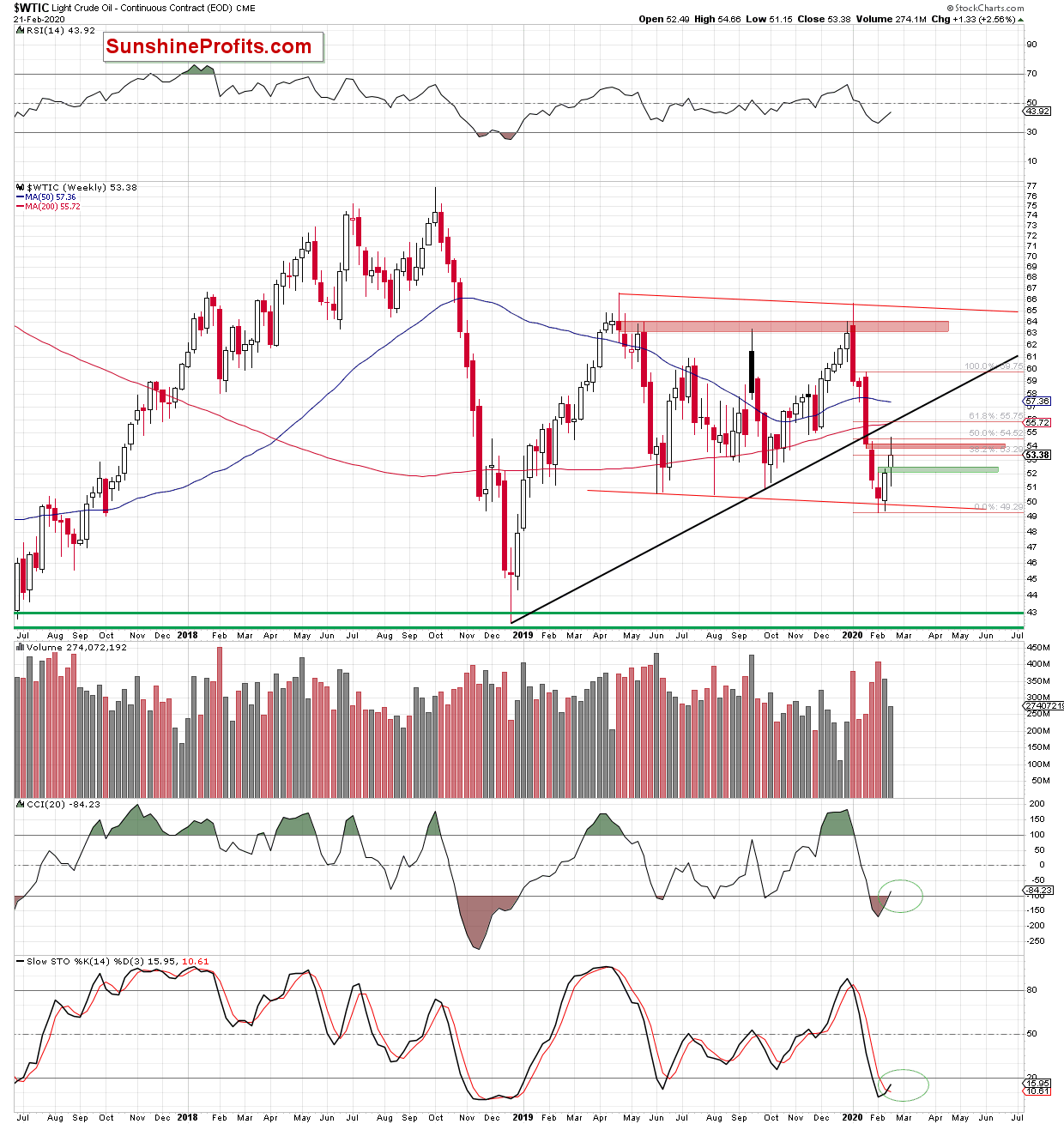

Looking at the medium-term chart, we see that crude oil increased visibly in the previous week. While it has reached the 50% Fibonacci retracement and the red bearish gap created in the previous month, the bulls didn't manage to hold gained ground until the end of Friday's session.

As a result, the commodity pulled back to finish the week below the above-mentioned levels, invalidating the earlier tiny breakouts. Additionally, the volume that accompanied last week's upswing, was visibly smaller than week earlier, which raises further doubts about the bulls' strength.

How did this price action affect the daily chart?

Before we answer to this question, let's recall this quote from our Friday's Alert:

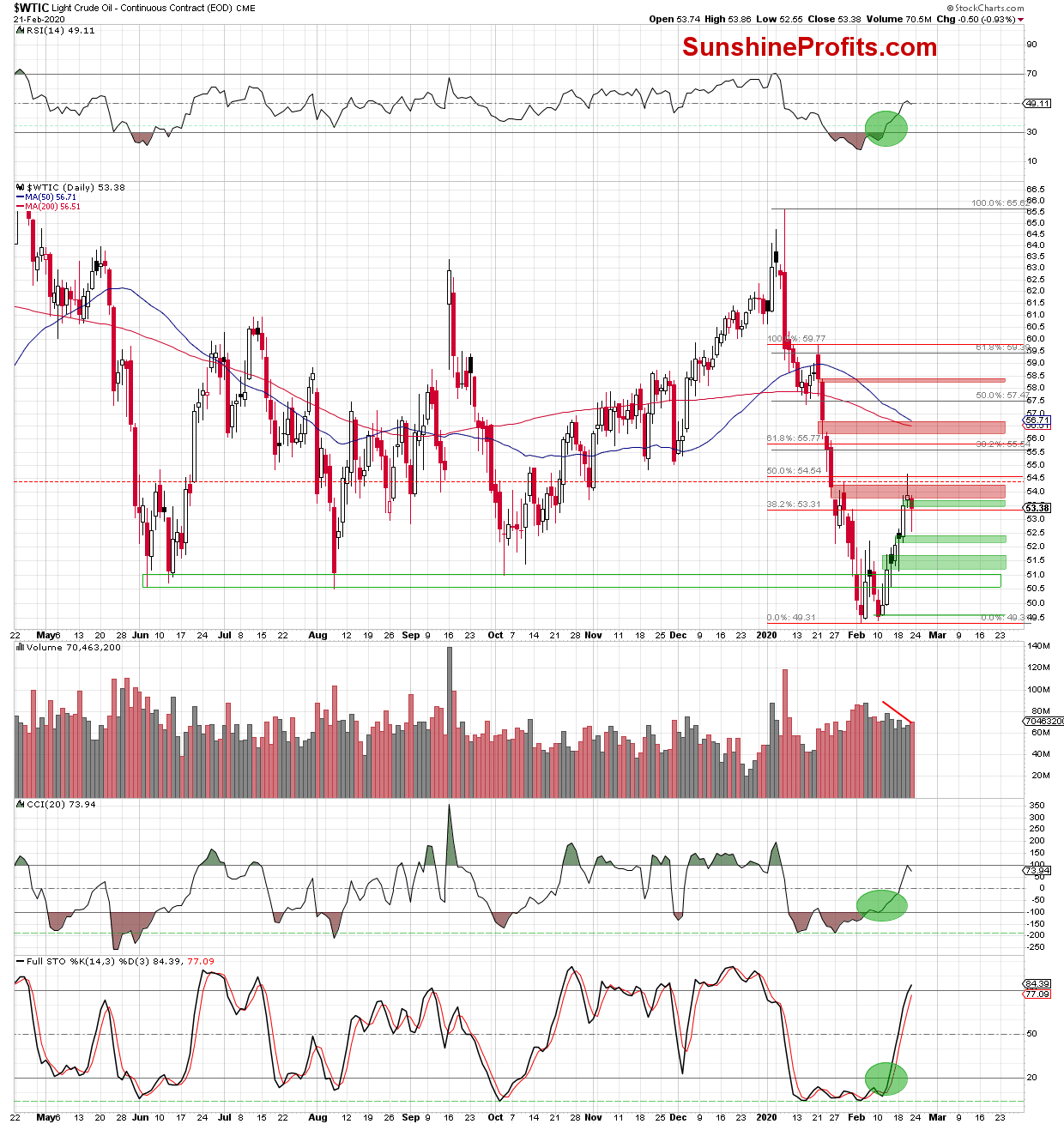

(...) Black gold opened with a bearish gap, which triggered further deterioration in the following hours.

Thanks to this price action, the futures closed yesterday's bullish gap, and slipped below $53, which increases the probability that we'll see a realization of the bearish scenario mentioned in our yesterday's Alert:

(...) should the bulls prove weak and don't keep the upside momentum with the bears closing the gap created earlier today, it appears likely that we could see a bigger pullback and a test of the supportive gaps created at the starts of previous sessions, or even the previously broken upper border of the blue consolidation.

The situation has indeed developed in tune with the above scenario, and crude oil and its futures tested the green gap created on January 18. Although reaching this support resulted in a rebound, black gold with its futures finished Friday's session below the lower border of the green gap created on February 20. In this way, the bears closed this earlier gap, which gave them another reason to act.

What impact did this event have on today's price action?

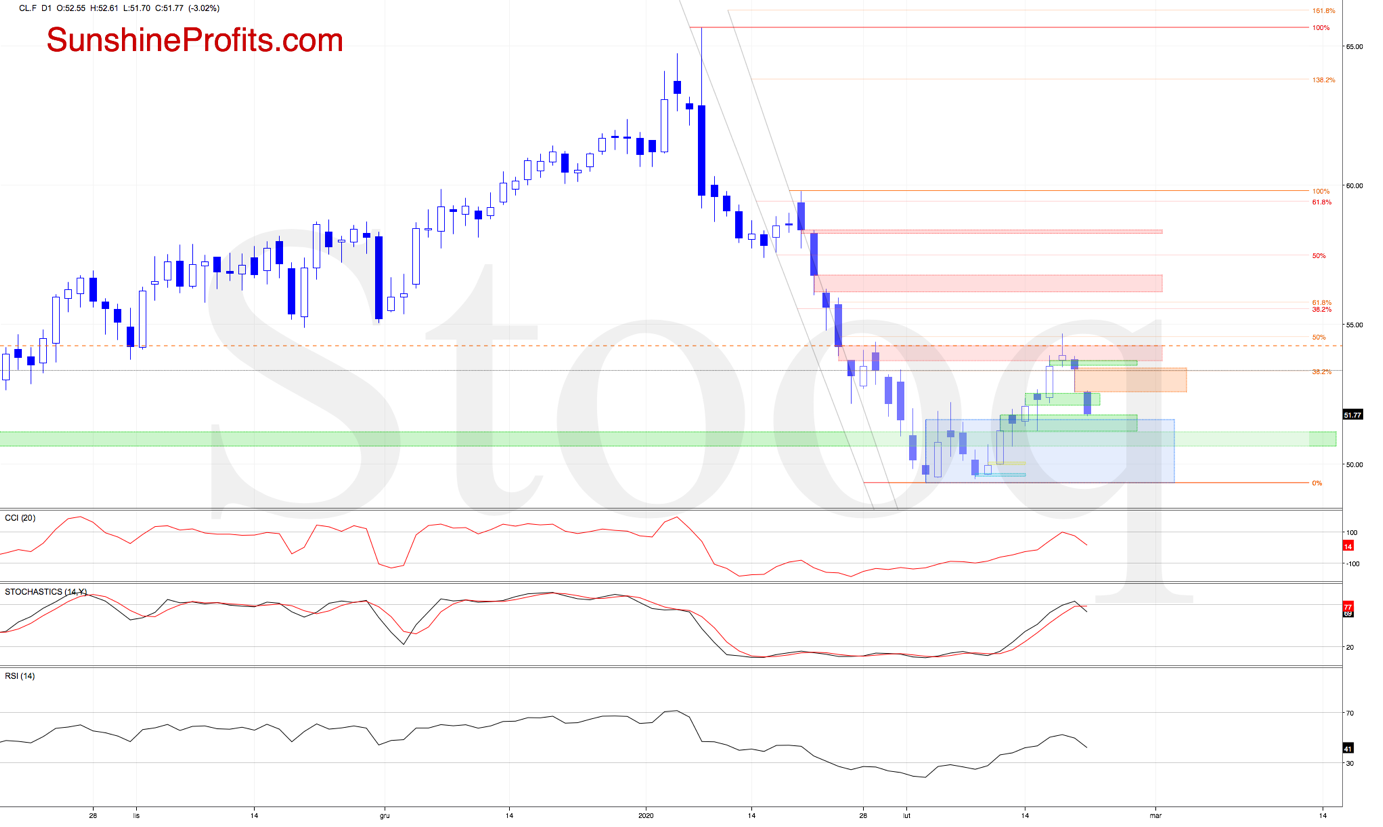

As you can see on the third chart, crude oil futures opened today with an orange bearish gap, which triggered further deterioration in the following hours. As a result, the futures slipped below the lower border of the green gap tested on Friday, prompting the sellers to move even lower.

Thanks to the selling pressure, the futures moved to the supportive gap created on January 13. The prices also approached the previously broken upper border of the blue consolidation.

Will we see further deterioration?

Taking all the above into account and combining it with the sell signals generated by the CCI and the Stochastic Oscillator (in the case of crude oil futures), we think that lower values of the futures and the black gold are just a question of time.

How low could they go?

In our opinion, the first downside target for the sellers will be around $51.39-$51.56. This is where the nearest support area created by the mid-February lows and the 61.8% Fibonacci retracement based on the entire February rebound, is.

However, if this zone is broken, the way to the February lows or even the realization of the bearish scenario about which we wrote in our February 12 Oil Trading Alert, will be likely open:

(...) Additionally, another move to the downside and a fresh 2020 low would be in line with the Elliott Wave Theory.

Summing up, the outlook for the crude oil is bearish, and it seems that the corrective upswing is already over. Consequently, we are entering new trading short position in crude oil.

Trading position (short-term; our opinion): Short position in crude oil is justified from the risk/reward perspective with the binding profit-take level of $43.12 and the stop-loss level of $56.11. Please note that we might decide to close the position even before it reaches these levels.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager