Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

Despite prices finishing higher, the oil bulls took quite a beating yesterday. With most of their intraday gains gone, the candlestick smacks of some downside to come. And certainly, that's what we're seeing right now. But the bigger question is whether the outlook has clarified.

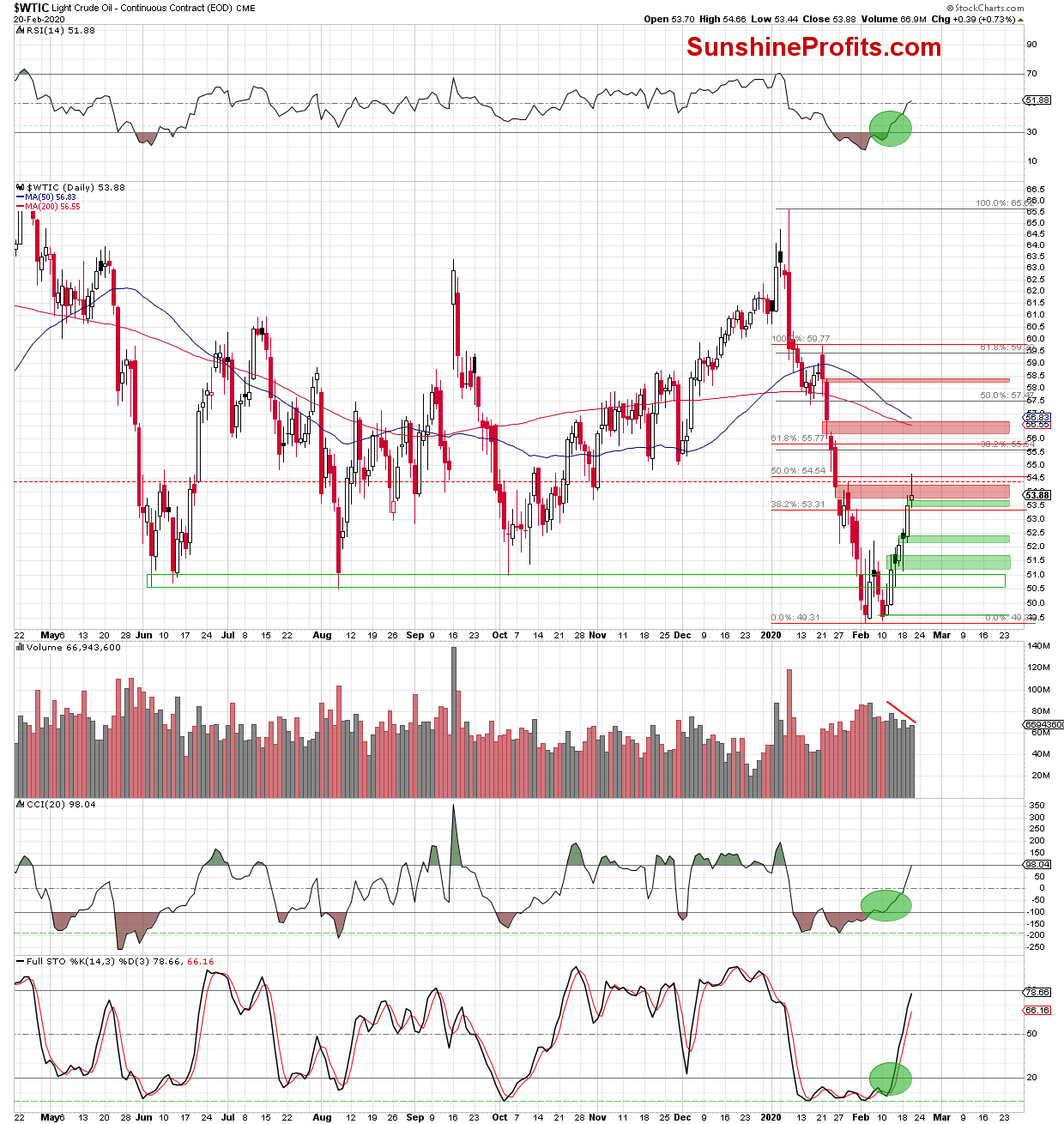

Let's start with the daily chart examination (charts courtesy of http://stockcharts.com and http://stooq.com ).

Let's quote our yesterday's oil commentary. We mentioned that:

(...) crude oil futures opened (...) with another bullish gap and then went on to extend gains a bit. The bulls approached the upper border of the red gap created at the end of the previous month.

Despite this improvement the buyers stumbled and didn't manage to hold gained levels. A small pullback followed, and the futures slipped to the lower border of the gap created at the beginning of the day that is based on yesterday's close at $53.49. At the moment of writing these words, the bulls are making another run higher though.

What's next?

In our opinion, much depends on whether the buyers manage to keep the advantage achieved at the start of Thursday. In other words, whether the gap would remain open when the day is over. If so, we'll likely see another test of the strength of the nearest red gap or even the 50% Fibonacci retracement (at around $54.57) in the very near future . That could even come later today.

As we see, the situation developed in tune with the above scenario and both crude oil and its futures reached our upside targets. Despite this improvement, the bulls gave up their earlier gains and the commodity pulled back. It had closed the day not only below the 50% Fibonacci retracement, but also below the previously broken upper border of the red gap and the January 29 peak.

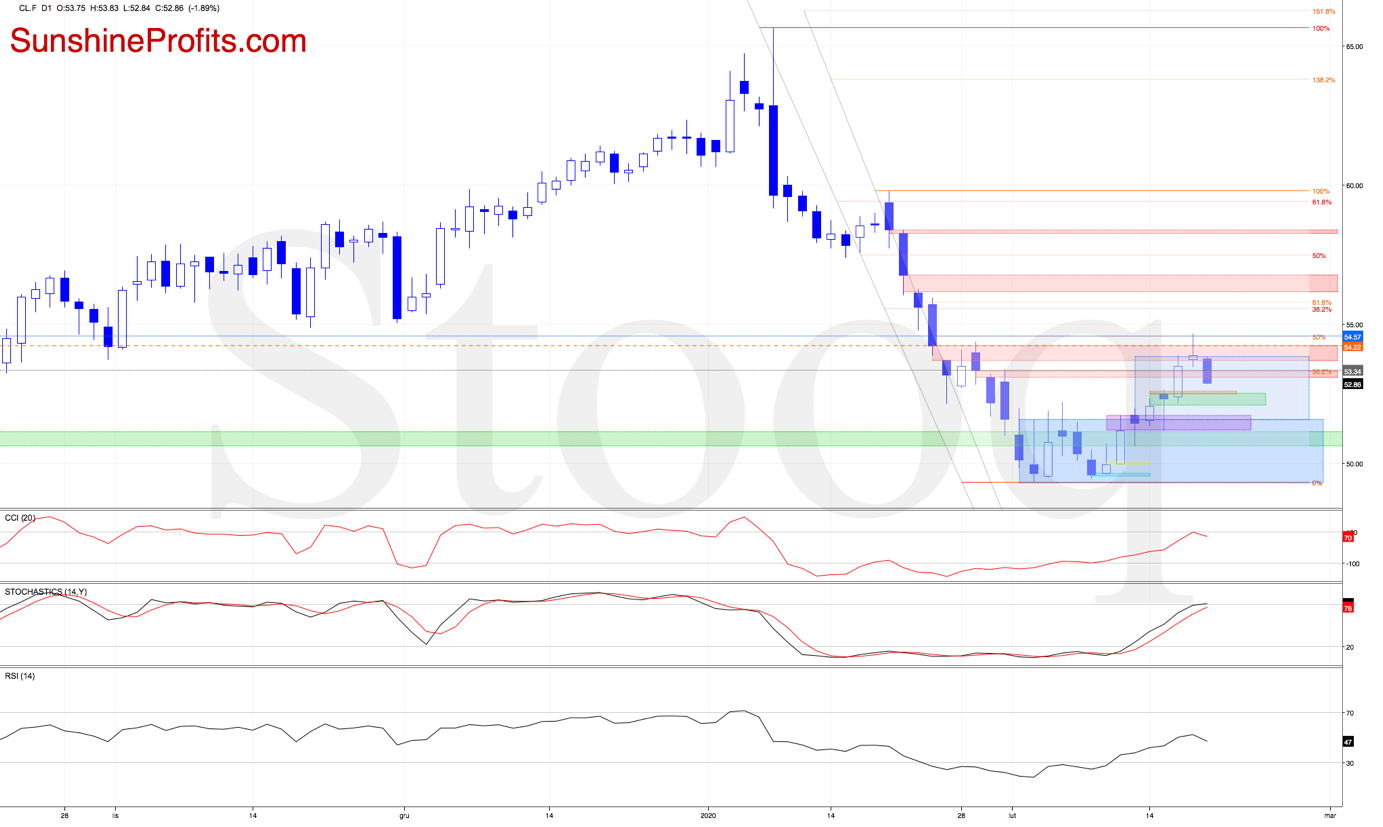

In this way, black gold and its futures invalidated the earlier breakouts. The second chart shows just how it got reflected in investors' moods earlier today. Black gold opened with a bearish gap, which triggered further deterioration in the following hours.

Thanks to this price action, the futures closed yesterday's bullish gap, and slipped below $53, which increases the probability that we'll see a realization of the bearish scenario mentioned in our yesterday's Alert:

(...) today's upswing means that crude oil futures reached the level, where the size of the upward move corresponds to the height of the above-mentioned blue consolidation. This increases the probability that some of the bulls would opt to close their positions, which could translate into a reversal.

(...) should the bulls prove weak and don't keep the upside momentum with the bears closing the gap created earlier today, it appears likely that we could see a bigger pullback and a test of the supportive gaps created at the starts of previous sessions, or even the previously broken upper border of the blue consolidation.

Summing up, the situation in crude oil is still relatively unclear at the moment, but it's quite likely to clarify to some extent soon. When in doubt, stay out is the old Wall Street saying and it fits perfectly to the currently situation.

Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager