Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLZ21] – No position currently justified on a risk/reward point of view.

- Natural Gas [NGX21] – Long around $5.268-5.335 support (yellow rectangle) – with stop below $5.070 and target at $5.750 – See yesterday’s update…

Did you miss our last article about the spiciest MLPs to trade? No problem, you can have a look at our selection through our dynamic stock watchlist!

Fundamental Analysis

Oil prices rose again on Tuesday, approaching multi-year highs amid concerns over steadily shrinking US crude reserves.

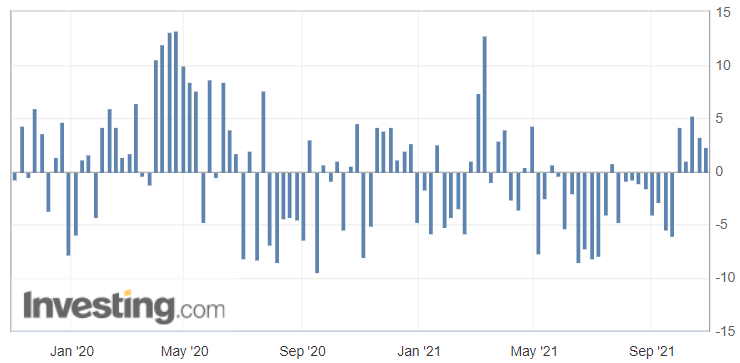

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via Investing

Regarding the API figures published Tuesday, the increase in crude inventories (with 2.318 million barrels versus 1.650 million barrels expected) implies weaker demand and is normally bearish for crude prices. However, we have a strongly bullish context, where the supply is still voluntarily – or not – narrowed by the OPEC+ and the global demand increases. What has to be synthesized from this report are the consecutively decreasing figures week-on-week, which are lifting prices higher.

Today, we have to see whether or not these figures will be confirmed by the weekly Energy Information Administration's (EIA) report… But there is very little doubt that they won’t be, given the current environment in which black gold is progressing.

Geopolitical Context

On the international scene, a meeting between Iran and the European Union is likely to happen fairly quickly since the Iranian deputy minister in charge of the nuclear issue, Ali Bagheri, will meet with an European negotiator Enrique Mora this week in Brussels to discuss a resumption of negotiations in Vienna. There is no need to specify that if the negotiations are successful, the easing of sanctions will lead to the return of a large-volume market of black gold, which is currently under embargo.

Chart

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

To sum up, we now have some context on how the oil market might develop in the forthcoming days, with some events and news to monitor, as they could have a moderated to strong impact on the ongoing lack of supply…

As always, we’ll keep you, our subscribers, well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLZ21] – No position currently justified on a risk/reward point of view.

- Natural Gas [NGX21] – Long around $5.268-5.335 support (yellow rectangle) – with stop below $5.070 and target at $5.750 – See yesterday’s update…

Did you miss our last article about the spiciest MLPs to trade? No problem, you can have a look at our selection through our dynamic stock watchlist!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist