Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 and profit-take order at $43.17 are justified from the risk/reward perspective.

Although EIA showed in its weekly report that crude oil inventories declined once again, the commodity reversed and declined to a fresh multi-month low in the following hours. Does this show of weakness suggest lower values of the commodity?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories dropped by 4.4 million barrels in the week ended July 31. Additionally, supplies at Cushing, Oklahoma, declined by 542,000 barrels last week, beating expectations for a drop of 200,000. Thanks to these bullish numbers, light crude increased to an intraday high of $46.70. Despite this improvement, the commodity reversed and declined after oil investors digested gasoline and distillate inventories data (the report showed that gasoline inventories increased by 0.8 million barrels, while distillate stockpiles rose by 0.7 million barrels). As a result, light crude moved lower, erased all earlier gains (and making our gains on the short position even bigger), hitting a fresh multi-month low. What’s next? (charts courtesy of http://stockcharts.com).

In our Tuesday’s Oil Trading Alert, we wrote the following:

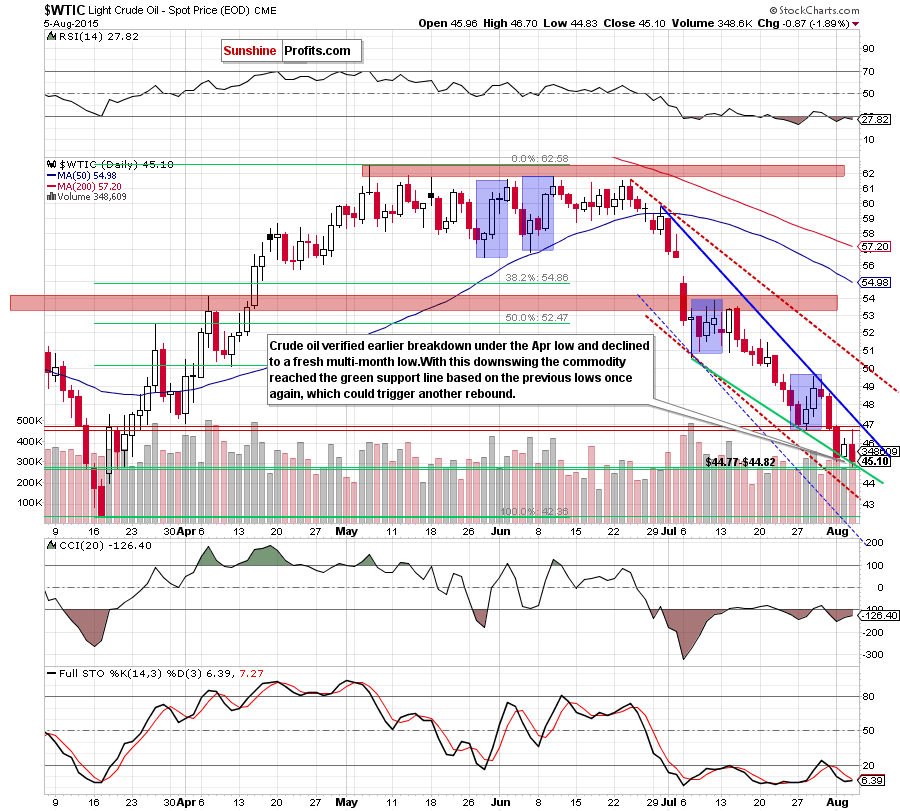

(…) we believe that as long as crude oil remains below $46.72-$47.05 all upswings would be nothing more than a verification of the breakdown under the previously-broken Apr low and the 78.6% Fibonacci retracement. Therefore, in our opinion, lower values of the commodity are just around the corner (especially when we factor in the rising size of volume in the previous days, which reflects the growing strength of oil bears).

Yesterday, we added:

(…) did this move change anything in the short-term picture? Not really. The reason? Firstly, yesterday’s upswing is much smaller than previous upward moves (marked with blue). Secondly, the size of volume that accompanied Tuesday’s increase is much smaller compared to what we saw in recent days. Thirdly, and most importantly, the commodity remains under the previously-broken Apr low and the 78.6% Fibonacci retracement.

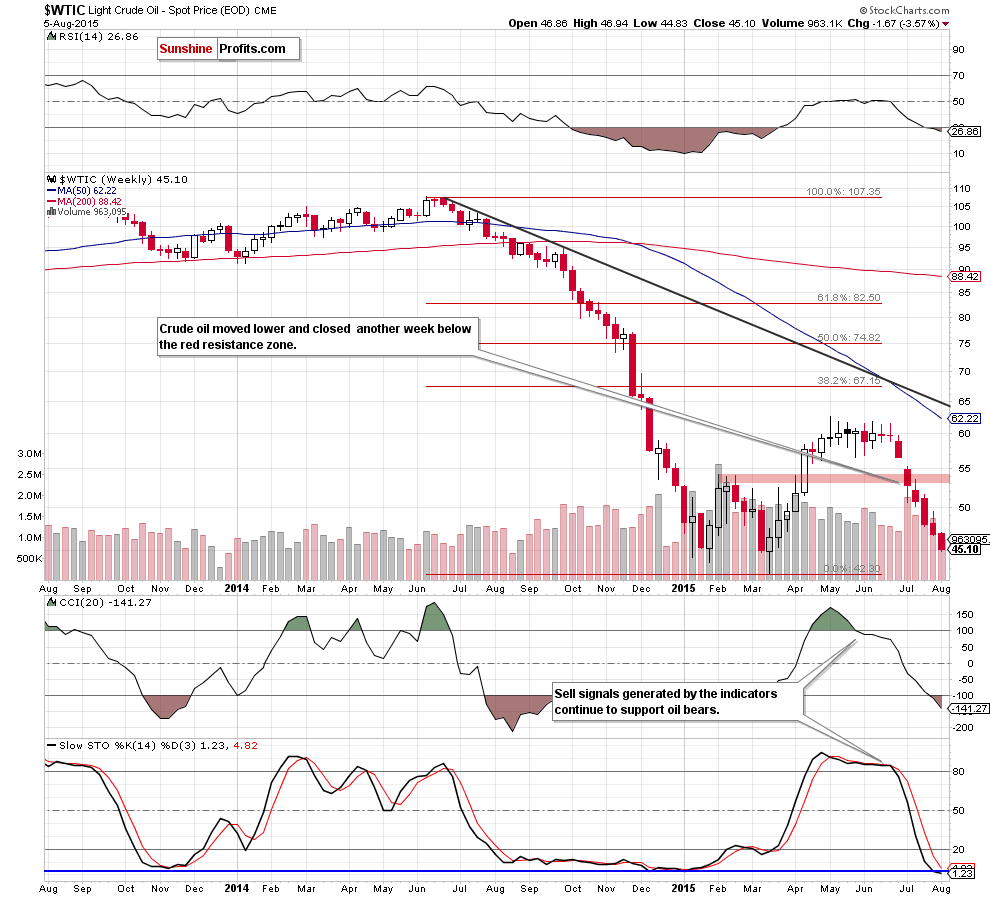

Looking at the daily chart, we see that the situation developed in line with the above scenario and crude oil declined after the verification of the breakdown under the Apr low and the 78.6% Fibonacci retracement. With this downswing light crude slipped under the green support line (based on the previous lows) and hit a fresh multi-month low of $44.83. Although the commodity rebounded slightly before the session close, we should keep in mind that yesterday’s downswing materialized on sizable volume, which confirms that the downtrend remains in place. On top of that, sell signals generated by the weekly and daily indicators continued to support oil bears. Taking all the above into account, we believe that further deterioration is more likely than not.

Summing up, although EIA report showed another drop in crude oil inventories (bullish fundamental factor), light crude reversed and declined, hitting a fresh multi-month low. Taking this fact into account and combining with sizable volume that accompanied yesterday’s decline, we believe that further deterioration and lower values of the commodity are still ahead us. However, it seems that this volatile and very profitable trade’s days may be over soon. Given the sharpness of the decline in the recent days it will likely take only a few extra sessions for crude oil to reach strong support levels - the March low ($42.41) and the January low ($43.58), so we think that it’s a good idea to put exit orders in place for the current trade so that profits are taken automatically off the table, when crude oil moves very close to the above-mentioned levels. It seems that placing a profit-take order at $43.82 is justified from the risk/reward perspective. The plan is to see how crude oil performs at these levels – it will likely correct, which will allow us to re-enter short positions at higher prices, thus increasing the profits once again.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 and profit-take order at $43.17 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts