Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Monday, crude oil moved lower once again as a stronger greenback and disappointing Chinese data weighed on the price. As a result, light crude lost 3.14% and hit a fresh multi-month low. What’s next?

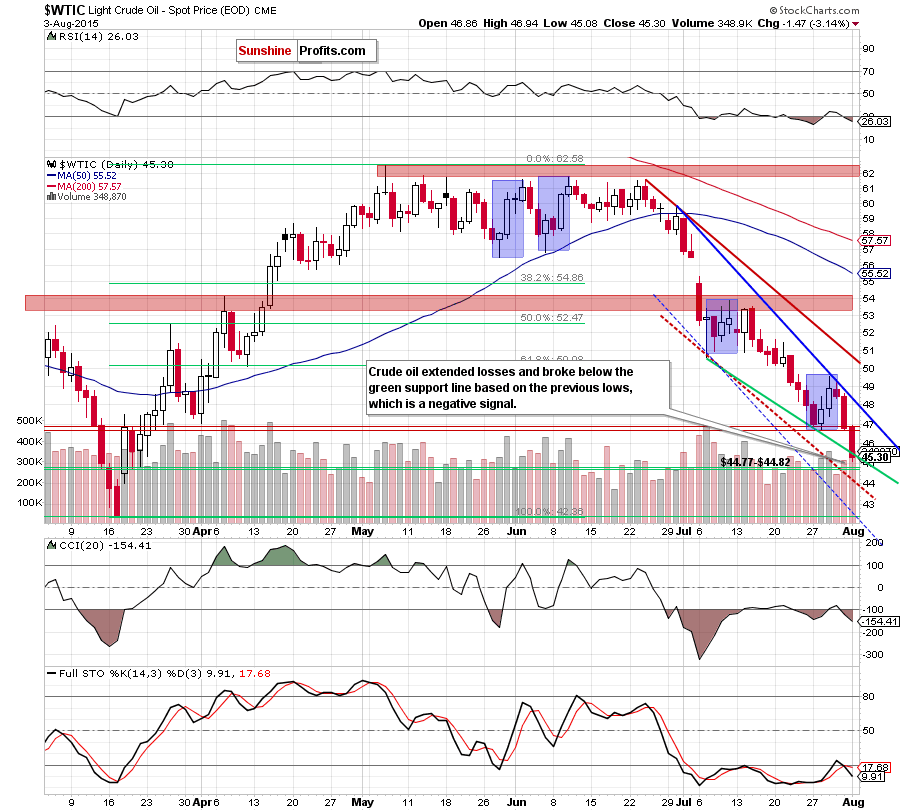

Yesterday’s data showed that China's Caixin manufacturing PMI slipped to 47.8 in July from 48.2 in June, which in combination with a stronger greenback pushed light crude sharply lower. In this way, crude oil slipped under $46 and broke below the short-term support line. Are there any technical factors on the horizon that could encourage oil bulls to act? (charts courtesy of http://stockcharts.com).

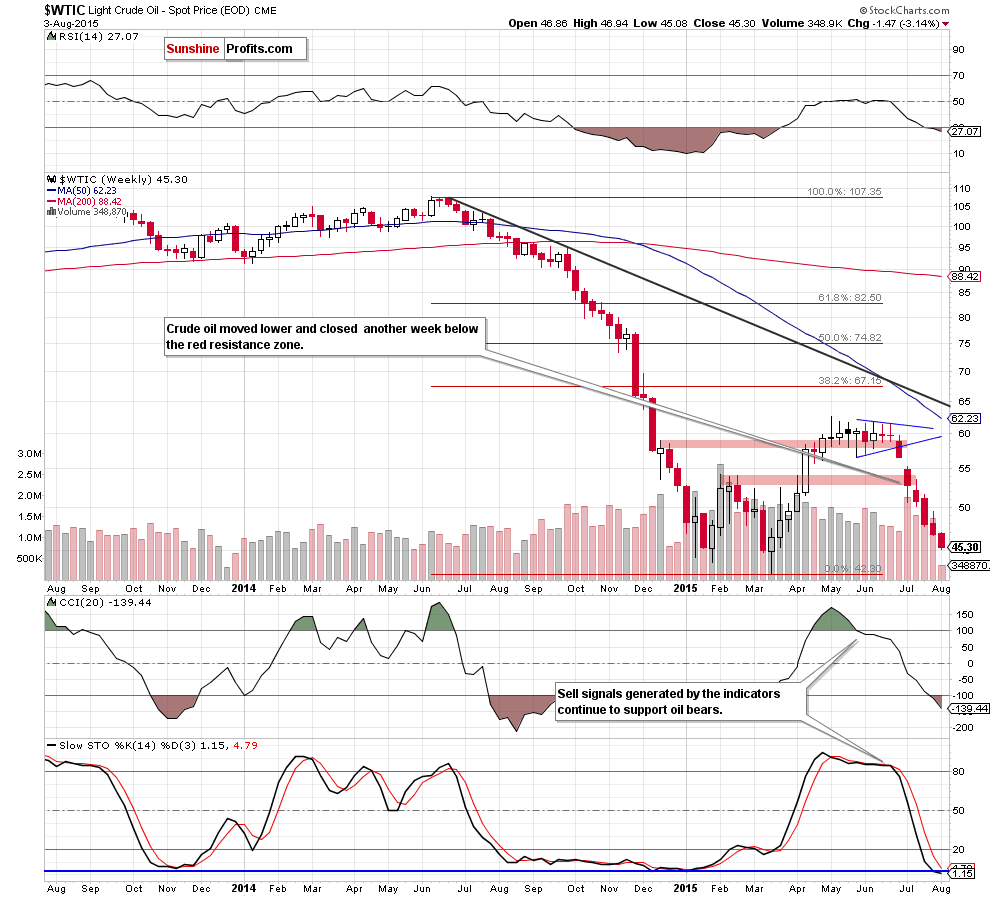

Looking at the weekly chart we see that crude oil extended losses and closed another week lower, which in combination with sell signals generated by the indicators (they continue to support oil bears) suggests lower values of the commodity in the coming week.

Having said that, let’s focus on the very short-term changes.

Quoting our previous alert:

(…) Friday’s downswing materialized on sizable volume and took crude oil below the Apr low and the green support zone (it was also the lowest daily close since Mar 20), which suggests that (…) the next target for oil bears would be (…) the green support zone created by the Mar 19 and Mar 20 lows ($44.77-$44.82).

As you see on the daily chart, oil bears pushed the commodity lower as we had expected. With this downswing light crude broke below the short-term support line based on the previous lows and approached our downside target. Earlier today, this area encouraged oil bulls to act, which resulted in a small rebound (not seen on the above chart yet).

Nevertheless, we believe that as long as crude oil remains below $46.72-$47.05 all upswings would be nothing more than a verification of the breakdown under the previously-broken Apr low and the 78.6% Fibonacci retracement. Therefore, in our opinion, lower values of the commodity are just around the corner (especially when we factor in the rising size of volume in the previous days, which reflects the growing strength of oil bears).

Summing up, crude oil is trading slightly above the multi-month low, but well below the previously-broken Apr low, which means that the downtrend remains in place and suggests that lower values of the commodity are still ahead us.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts