Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 and profit-take order at $43.17 are justified from the risk/reward perspective.

On Thursday, crude oil lost 0.58% as an increase in supplies of oil products and a stronger greenback weighed on the price. As a result, light crude hit a fresh multi-month low and slipped to the support area. Will it stop further declines?

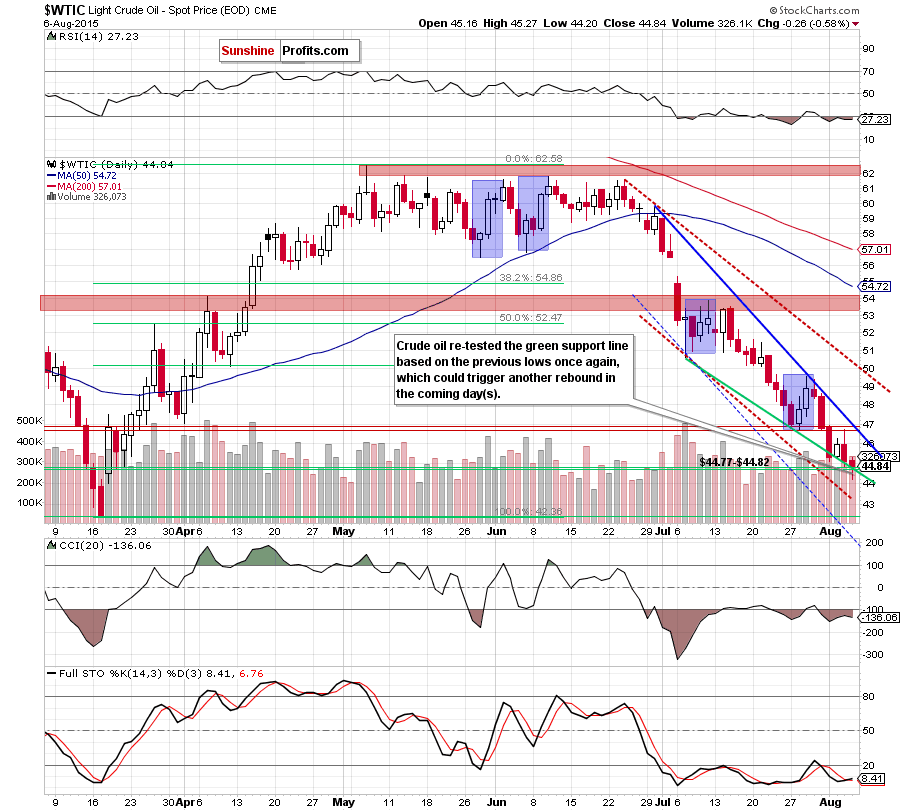

Yesterday, the U.S. Department of Labor showed that the number of initial jobless claims increased by 3,000 last week, compared to analysts’ expectations for a 6,000 rise. These better-than-expected numbers in combination with a rise in supplies of oil products (which overshadowed a larger-than-expected drop in domestic crude inventories) weighed on investors’ sentiment and pushed the commodity to a fresh multi-month low (making our gains on the short position even bigger). With this downswing, light crude reached the support zone, but will it manage to stop oil bears? (charts courtesy of http://stockcharts.com).

Quoting our previous commentary:

(…) Although the commodity rebounded slightly before the session close (…) yesterday’s downswing materialized on sizable volume, which confirms that the downtrend remains in place. On top of that, sell signals generated by the weekly and daily indicators continue to support oil bears. Taking all the above into account, we believe that further deterioration is more likely than not.

From today’s point of view we see that oil bears pushed the commodity lower as we had expected. With this downswing light crude slipped under the support zone (created by the Mar 19, Mar 20 and the green support line based on the previous lows) and hit a fresh multi-month low. Despite this deterioration, crude oil rebounded slightly before the market’s close and invalidated this small breakdown, closing the day only 2 cents above the support area.

Although this is a positive signal, which suggests a rebound, we should keep in mind what we wrote in our Tuesday’s Oil Trading Alert:

(…) as long as crude oil remains below $46.72-$47.05 all upswings would be nothing more than a verification of the breakdown under the previously-broken Apr low and the 78.6% Fibonacci retracement.

Taking the above into account, and combining it with the fact that this resistance area is currently reinforced by the short-term blue declining line, we believe that further deterioration is just a matter of time. Nevertheless, another downward move will be more likely if we see a daily close under the above-mentioned support area (around $44.77-$44-82). In this case, the initial downside target for oil bears would be around $43.25, where the lower border of the red declining trend channel (marked with dashed lines) is.

Summing up, the most important event of yesterday’s session was a fresh multi-month low. Although the commodity rebounded in the following hours, the size of the move was too small to change anything in the very short-term picture. Therefore, we believe that further deterioration and lower values of the commodity are still ahead us. However, it seems that this volatile and very profitable trade’s days may be over soon. Given the sharpness of the decline in the recent days it will likely take only a few extra sessions for crude oil to reach strong support levels - the March low ($42.41) and the January low ($43.58), so we think that it’s a good idea to put exit orders in place for the current trade so that profits are taken automatically off the table, when crude oil moves very close to the above-mentioned levels. It seems that placing a profit-take order at $43.82 is justified from the risk/reward perspective. The plan is to see how crude oil performs at these levels – it will likely correct, which will allow us to re-enter short positions at higher prices, thus increasing the profits once again.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 and profit-take order at $43.17 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts