Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil lost 3.45% as disappointing EIA weekly report continued to weigh on investors’ sentiment. In this environment, light crude broke below Fibonacci retracement and slipped to the support zone. Will it manage to stop oil bears in the coming days?

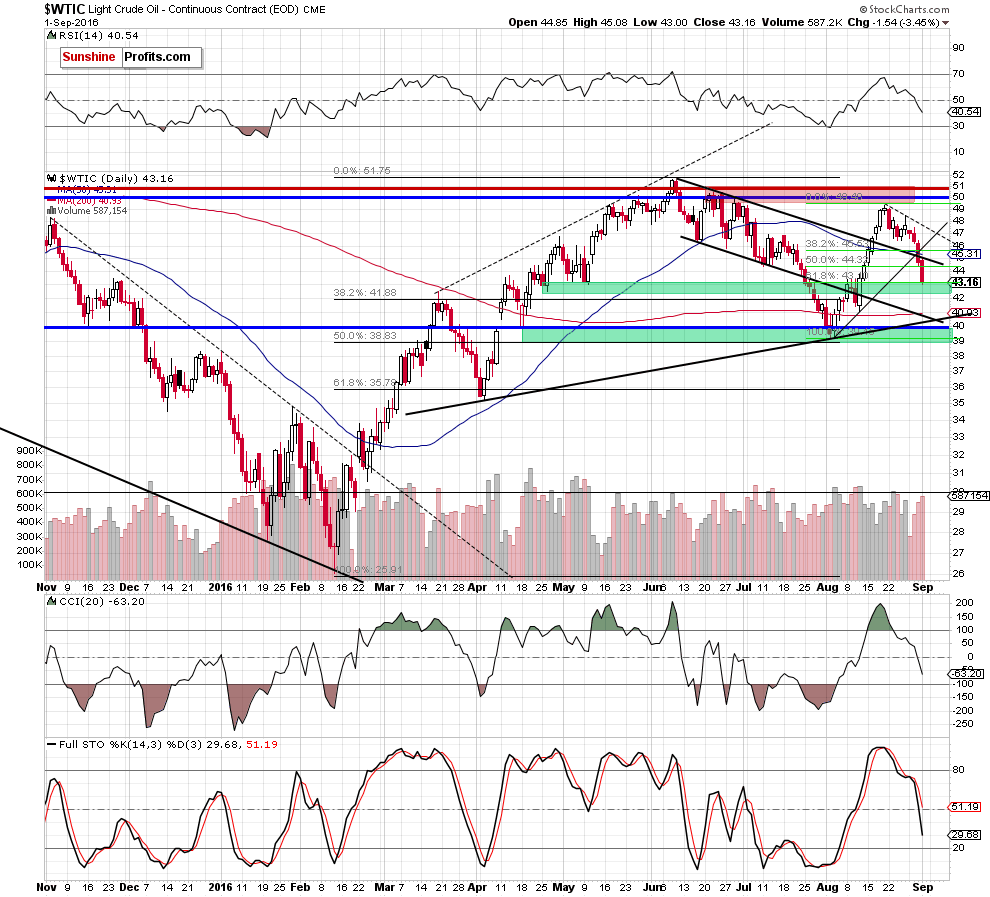

Let’s examine the daily chart and find out what can we infer from it (charts courtesy of http://stockcharts.com).

Quoting our previous alert:

(…) How low can crude oil go? The next support level is provided by the 61.8% Fibonacci retracement level (…)

From today’s point of view, we see that the commodity extended losses and reached our first downside target. What’s next? Although this support area may trigger a rebound (to the previously-broken 50% retracement or even the upper black resistance line around $45), we think that as long as crude oil remains below the upper border of the black declining trend channel and the resistance line based on the previous lows, another attempt to move lower is very likely – especially when we factor in sell signals generated by the indicators.

If this is the case and light crude declines once again, our next downside target from yesterday’s alert would be in play:

(…) given the breakdown and invalidation of breakout above several levels yesterday, it seems that crude oil could slide all the way back to the rising black support line at about $40 - $41.

Summing up, crude oil extended losses and reached the next support zone. Although this area may trigger a rebound, yesterday’s breakdowns and sell signals generated by the indicators suggest lower values of the commodity in the coming week.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts