Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Crude oil has been declining slowly in the previous days, but that was not the case during yesterday’s session and in today’s pre-market trading. What does it imply for the following days?

In short, the increased volatility by itself, doesn’t change anything, but the fact that crude oil broke below multiple support levels yesterday and was able to close below them – does.

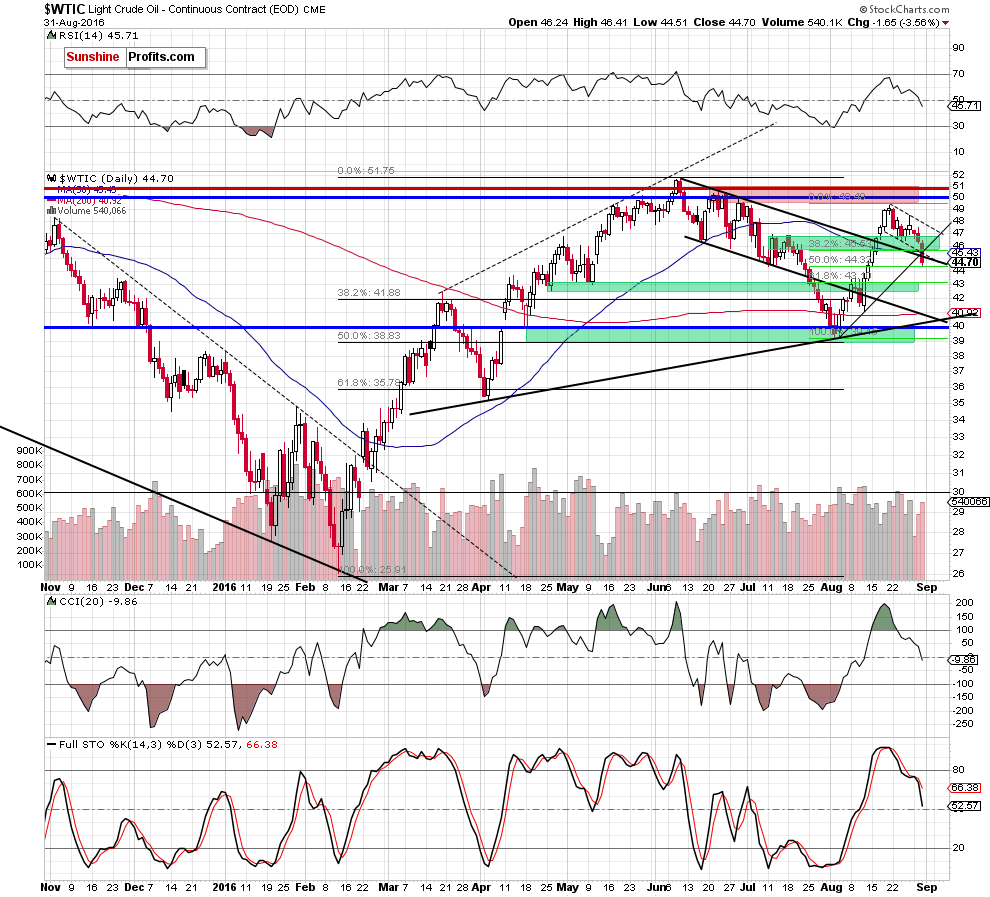

Let’s take a look at the chart for details (charts courtesy of http://stockcharts.com).

Until yesterday’s session, it was very likely that crude oil would reverse shortly and another rally will start right away or almost right away. However, since we are not in math where one set of variables gives us a clear solution to an equation, but in trading, where what is likely is the best kind of certainty that we can get, every now and then, the unlikely thing happens.

That was the case yesterday as crude oil didn’t stop at neither of the support levels:

- the July tops

- the recent August low

- the 38.2% Fibonacci retracement based on the August rally

- the 50-day moving average (it was not too effective as support, though)

- the upper border of the previously broken declining trend channel.

Breakdowns are usually bearish only after they are confirmed, but in case of the move back into the declining trend channel, it was not a breakdown, but an invalidation of the previous breakout. These events tend to trigger reactions much faster as they usually don’t require confirmations. The volume during yesterday’s session was rather significant and yesterday’s downswing is being continued today.

Consequently, yesterday’s bullish outlook is no longer present and, in our opinion, the trading positions should be adjusted accordingly. We will have another opportunity to trade crude oil profitably, but at this time, the risk associated with keeping a long position intact simply doesn’t seem to be worth it.

How low can crude oil go? The next support level is provided by the 61.8% Fibonacci retracement level, but given the breakdown and invalidation of breakout above several levels yesterday, it seems that crude oil could slide all the way back to the rising black support line at about $40 - $41. As always, we’ll keep you – our subscribers – updated.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts