Trading position (short-term; our opinion): Short positions (with a stop-loss order at $39.12 and an initial downside target at $33.66) are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open on news that Saudi Arabia cut diplomatic ties with Iran, the commodity reversed and declined in the following hours. As a result, light crude lost 0.51% and invalidated important breakouts. How did this move affect the short-term picture?

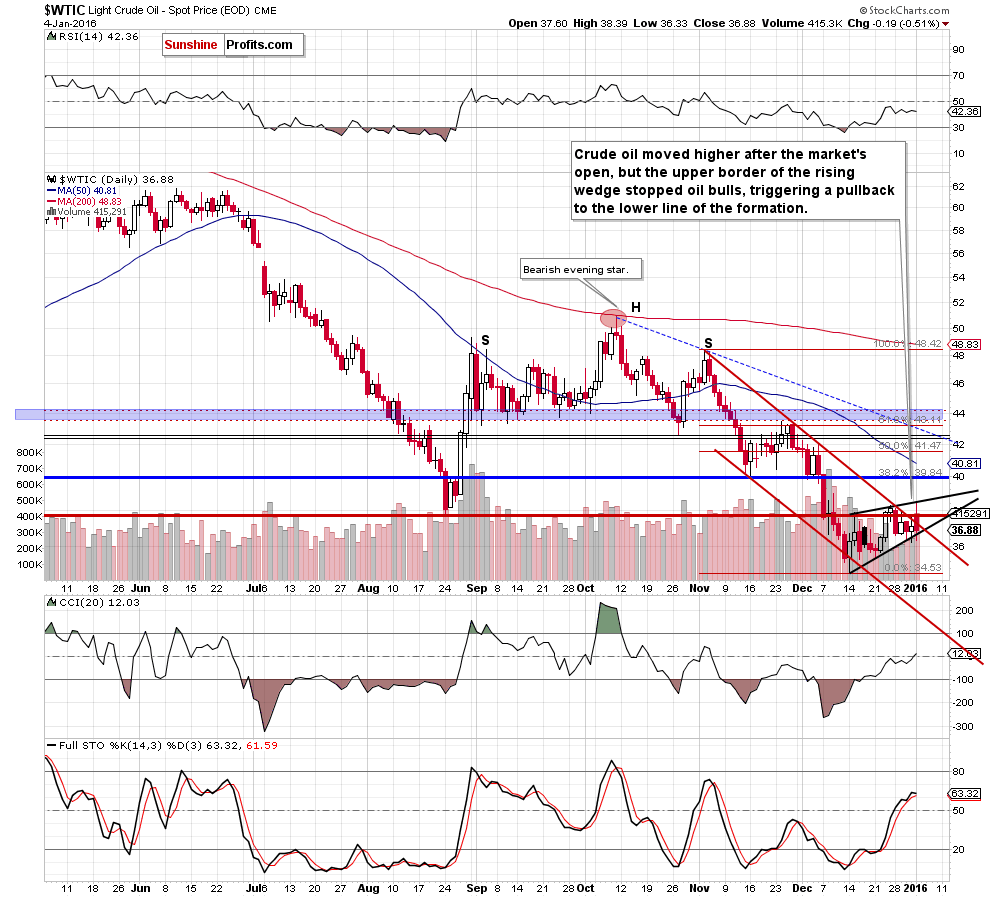

Yesterday, news that Saudi Arabia cut diplomatic ties with Iran fuelled worries that tension between these two countries could escalate Islamic sectarian problems and supported the price of crude oil. Thanks to these circumstances, light crude hit an intraday high of $38.39. Nevertheless, despite this improvement, the commodity reversed and declined in the following hours as investors digested that the effect on oil supplies was limited. As a result, light crude lost 0.51% and invalidated important breakouts. How did this move affect the short-term picture? Let’s examine the daily chart and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) Although the commodity moved little higher on Thursday, the key resistance area created by the Aug low and the upper line of the red declining trend channel stopped further improvement, triggering a small pullback. Earlier today, we saw another unsuccessful attempt to break above the resistance zone, which means that as long as there is no breakout above it lower values of the commodity are more likely than not.

Looking at the daily chart, we see that the situation developed in line with yesterday’s scenario and crude oil declined after another unsuccessful attempt to break above the resistance zone. As you see although crude oil increased after the market’s open, the upper border of the rising wedge stopped oil bulls and triggered a pullback. With this downswing, the commodity invalidated earlier breakout above the upper border of the red declining trend channel, which is a negative signal that suggests further deterioration. On top of that, yesterday’s drop materialized on sizable volume, which increases the probability of another downswing.

At this point, it is worth noting, that yesterday’s move took the commodity to the lower border of the rising wedge (the black support line), which means that a breakdown under this line will likely accelerate further declines. If this is the case, our first downside target from Thursday’s Oil Trading Alert would be in play:

(…) if the black support line is broken, a way to $35.35 (and then to Dec low) will be open.

Summing up, crude oil declined once again and invalidated earlier breakout above the upper border of the red declining trend channel and the Aug low. This is a bearish signal, which suggests that lower values of the commodity are just around the corner. Therefore, short positions (with a stop-loss order at $39.12 and an initial downside target at $33.66) are justified from the risk/reward perspective.

Very short-term outlook: berish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $39.12 and an initial downside target at $33.66) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts