Trading position (short-term; our opinion): Short positions (with a stop-loss order at $39.12 and an initial downside target at $33.66) are justified from the risk/reward perspective.

On Wednesday, crude oil lost 1.34% after bigger-than-expected build in crude oil inventories. As a result, light crude slipped to its first support line and closed another day under $37. Is it enough to encourage oil bears to act?

Yesterday, the U.S. Energy Information Administration reported that crude oil inventories rose by 2.6 million barrels in the week ended December 25. Additionally, gasoline inventories increased by 1.0 million barrels (above expectations for a gain of 0.9 million barrels) and distillate stockpiles rose by 1.8 million barrels. On top of that, inventories at Cushing, Oklahoma, increased by 892,000 barrels last week, also missing analysts’ forecasts. As a result, light crude slipped to its first support line and closed another day under $37. Is it enough to encourage oil bears to act? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

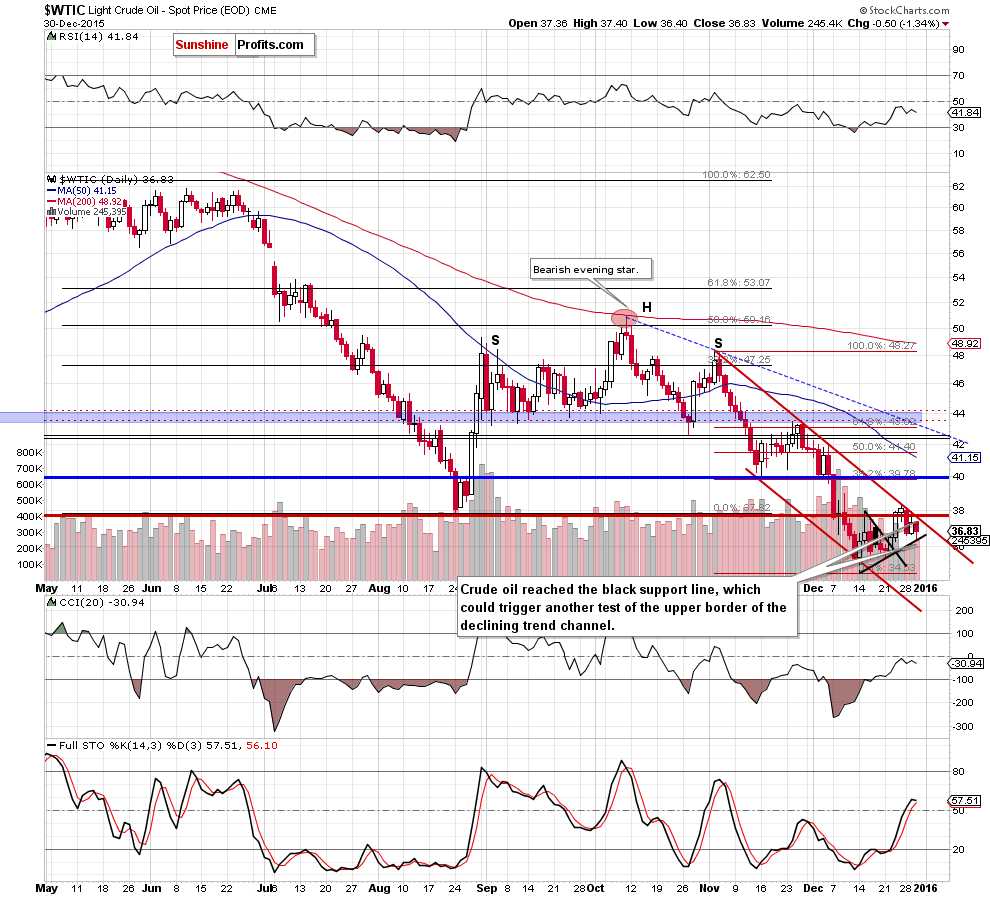

(…) the key resistance area created by the Aug low and the upper line of the red declining trend channel withstood the buying pressure and triggered a pullback. This means that as long as there is no breakout above this zone lower values of the commodity are more likely than not. Therefore, if light crude extends losses from here, we’ll see drop to (at least) the black support line base on the recent lows in the coming days.

As you see on the daily chart, oil bears pushed the commodity lower as we had expected. With this downswing, light crude reached our first downside target, which could trigger a rebound from here and another test of the upper border of the red declining trend channel. Nevertheless, as we mentioned yesterday, as long as there is no breakout above this line lower values of the commodity are more likely than not. Therefore, if the black support line is broken, a way to $35.35 (and then to Dec low) will be open.

Finishing today’s Oil Trading Alert, please keep in mind what we wrote about the relationship between crude oil and gold:

(…) the ratio rebounded in previous weeks, which resulted in an increase to the previously-broken blue line based on the Sept, Oct and Nov lows. (…) this resistance stopped further improvement, triggering a pullback. In our opinion, such price action suggests that the recent upward move could be a verification of earlier breakdown. If this is the case, the ratio will extend declines from here, which will translate to lower values of light crude in the coming week(s).

Summing up, crude oil declined and reached our first downside target. Although the commodity could rebound from here, we believe that the space for gains is limited (by the upper border of the red declining trend channel and the Aug low, which serves as an additional resistance) and lower values of the commodity are just a matter of time. Therefore, short positions (with a stop-loss order at $39.12 and an initial downside target at $33.66) are justified from the risk/reward perspective.

Very short-term outlook: berish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $39.12 and an initial downside target at $33.66) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you and a happy New Year.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts