Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

Although light crude moved sharply higher after EIA weekly report showed that crude oil inventories in the U.S. dropped for the first time in 11 weeks, the commodity reversed and declined below the Aug low once again. Does this show of weakness suggest further deterioration?

Yesterday, the U.S. Energy Information Administration reported that crude oil inventories declined by 3.568 million barrels in the week ended December 4, beating analysts’ forecasts. Additionally, gasoline inventories increased by 0.786 million barrels, missing expectations for a gain of 2.2 million barrels. Despite these positive numbers, the report showed that distillate stockpiles rose by almost 5.0 million barrels. On top of that, supplies at Cushing, Oklahoma increased by 423,000 barrels last week, which encouraged oil bears to act. As a result, the commodity reversed and declined below the Aug low once again. Does this show of weakness suggest further deterioration? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

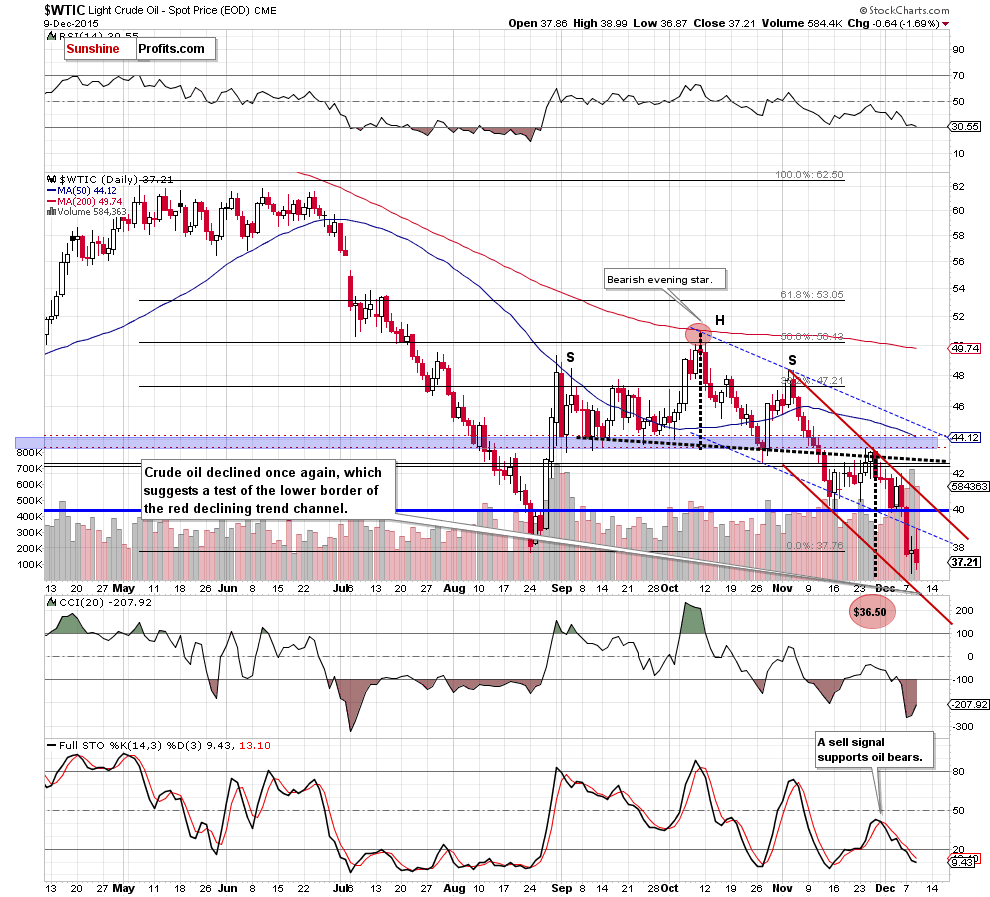

Looking at the daily chart, we see that crude oil verified earlier breakdown under the blue dashed resistance line, which triggered a reversal and another downswing below the Aug low. Additionally, sell signals generated by the indicators (the daily and weekly Stochastic Oscillator) remain in place, supporting oil bears. This means that our Tuesday’s Oil Trading Alertis up-to-date:

(…) a sharp decline (...) took light crude below the Aug low. This is a bearish signal, which suggests that our next downside target (around $36.50, where the size of the downward move will correspond to the height of the head and shoulders formation) would be in play in the coming day(s).

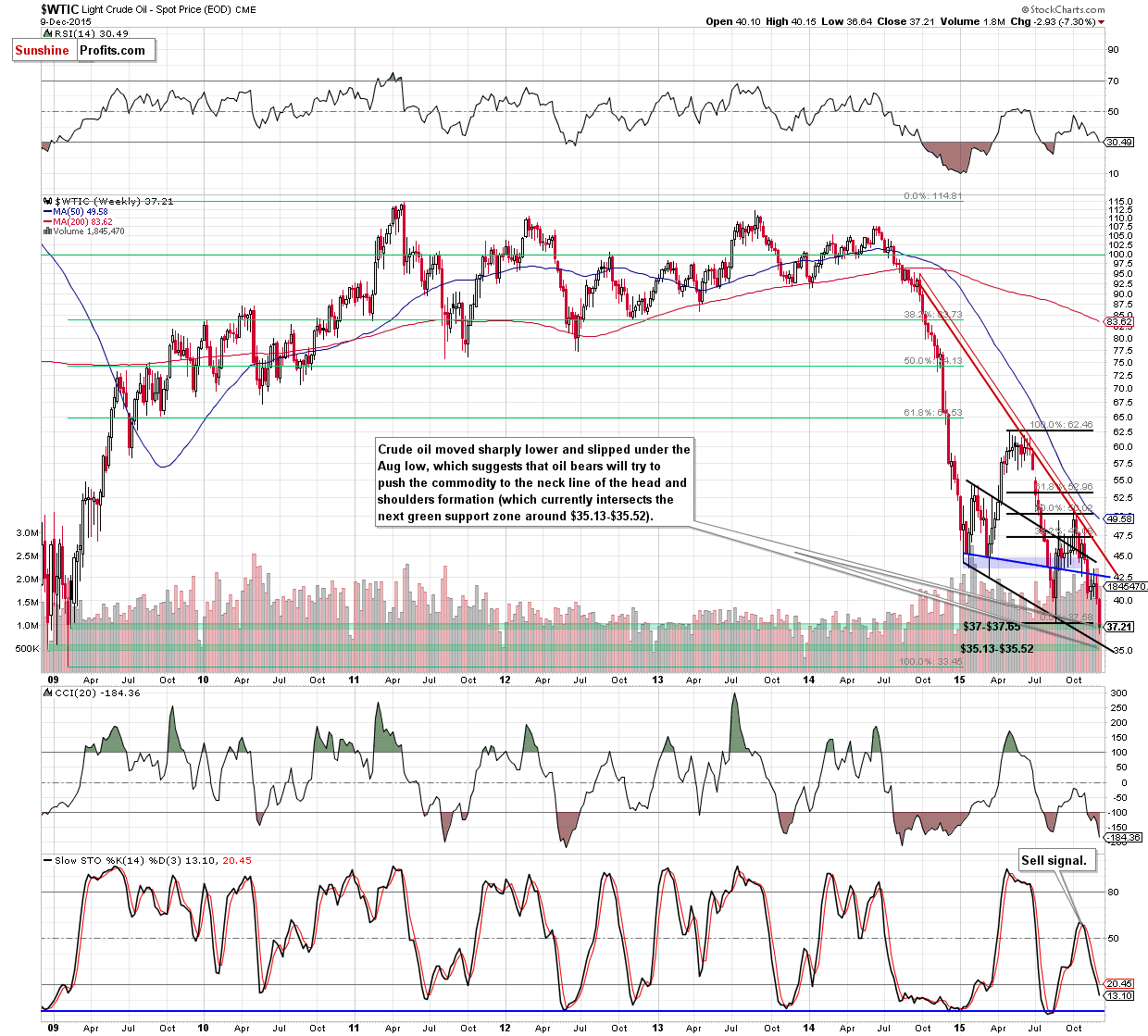

Nevertheless, we should also keep in mind what we wrote analyzing the weekly chart:

(…) Friday’s breakdown under the lower border of the consolidation triggered a sharp decline, which approached the commodity to the upper green support zone marked on the above chart. If it is broken, we’ll see further deterioration and a drop to the lower green zone around $35.13-$35.52. At this point, it is worth noting that in this area is also the neck line of the head and shoulders formation (marked with black), which could encourage oil bulls to act and pause the downward move.

Summing up, crude oil verified anther breakdown and reversed, declining below the Aug low once again, which suggests that further deterioration is more likely than not. Therefore, short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts